DutchScenery

Year to date the market has performed very poorly with the majority of stocks down significantly. Today I will take a look at a company that has been relatively stable throughout the market turmoil. The company that I am talking about is Ahold Delhaize (OTCQX:ADRNY) (OTCQX:AHODF) an operator of grocery stores in both the United States and Europe. In this article, I will give you 3 reasons why you should consider adding Ahold Delhaize to your portfolio.

Inflation resistant

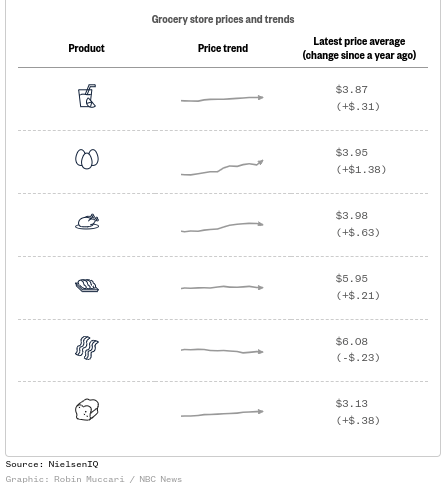

The first reason you should consider adding Ahold Delhaize to your portfolio is that the company is relatively inflation resistant. The company is able to hike prices if its suppliers hike the prices, as customers will still need to buy their groceries. This makes the demand for the products of Ahold Delhaize relatively inelastic. Besides the price hikes that were due to inflation, critics also claim that restaurants and grocery stores have hiked prices more than necessary. According to an article in the New York Times, many food companies have rapidly increased their prices by a larger amount than necessary, with for example a bag of chips costing $6.05 vs approximately $5.05 a year ago.

This comes after a few years in which both food companies, restaurants, and grocery stores only hiked prices in small steps in order not to frighten the customer. According to executives of companies in the food industry, as well as some other sectors, customers have been tolerating these increases as there is enough money available to households, leading to higher corporate profits. Ahold Delhaize is no exception as comparable growth in the US was at 8.6% and 7.4% in Europe. What this means is that the current environment is actually boosting the company’s profit, which is beneficial for shareholders.

Food price inflation (NielsenIQ / NBC News)

Strong US Dollar

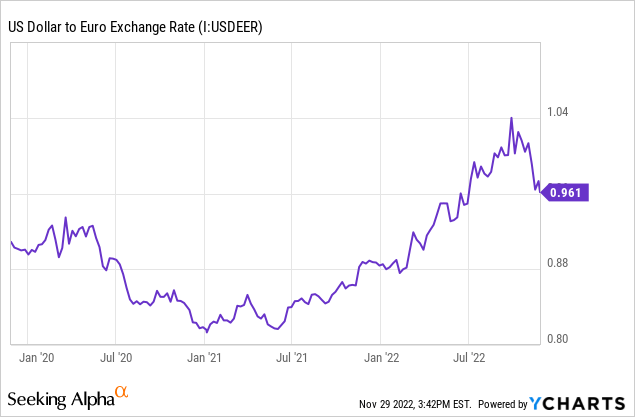

The second reason why the company should be on your radar is the strong US Dollar. A strong Dollar has two advantages. First of all, the company reports all of its profits in Euros but gets more than 60% of its revenues from the United States. This means that the company’s profits are currently boosted by the strong US Dollar.

The second advantage of a strong US Dollar is that investors in the US can buy the company at a lower price than would have been the case at the average exchange rate over the past few years. Investors should take this into account especially if they believe that the USD will remain strong in the coming years.

Personally, I expect that the US Dollar will remain relatively strong in the coming years as it is a lot harder for the European Central Bank to fight inflation than it is for the Fed. The ECB has to take into account the economy of 19 countries, which are all very different. For example, the best thing for Western European countries such as the Netherlands, and Germany would be to hike the rates in order to fight inflation. But if the ECB hikes the rates too fast or too high some of the Southern European countries like Italy and Greece might default on their debt, something that Greece already did in the aftermath of the great financial crisis in 2009. For this reason, I expect the USD to remain stronger than the EUR in the foreseeable future.

Dividend growth

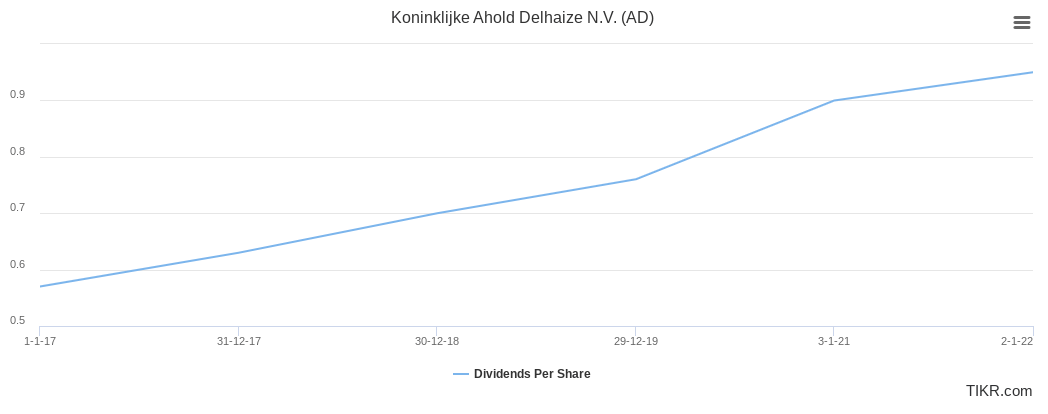

The final reason that I think that Ahold Delhaize could be a good addition to your portfolio is that the company has steadily grown its dividend over the past few years. A dividend growth streak is calculated in a slightly different way for most European companies. For companies that pay a dividend once a year, it is pretty straightforward. However, many companies that pay twice a year pay an interim dividend and a final payment. The interim dividends are paid in for example 2022, while the final payment for 2022 is paid in 2023. The division between the final and interim might change a bit per year and thus it might look like the company didn’t grow the dividend, while in reality, they did grow their dividends. Nevertheless, if you combine the payments for one year (interim + final for that year) the dividend shows growth. For Ahold Delhaize, this hasn’t been a problem yet, but it is something to watch for when investing in European stocks.

The payout ratio of Ahold Delhaize is currently not too extreme at 38.1%. This gives the company some room to grow their dividends in the future, while it also doesn’t have to cut the dividend in times of economic turmoil.

What I also like to look at when buying dividend growth stocks is the chowder ratio. The chowder ratio combines the company’s current yield and its dividend growth over the past 1/3/5/10 years. I prefer to use the 5-year one and like to own companies that have a chowder rule of 12%, or 8% for high-yielding stocks. Ahold Delhaize grew its dividend from 0.57 for 2016 (adjusted for merger and special dividend) to 0.95 for 2021. This gives a CAGR of approximately 11.2%. The current dividend yield is 3.5%, meaning that the chowder rule for Ahold Delhaize is 14.7%, beating my threshold of 12%.

Ahold Delhaize dividend growth (Tikr.com)

Valuation

To value the company, I like to use multiple methods. First of all, I like to use a DCF with 2 exit prices. One is based on the EV/EBITDA multiple, while the other one is based on the growth rate in perpetuity. When making a DCF valuation the majority of the value comes from the final value and thus making reasonable estimations is very important. Besides this, I also like to use a multiple valuation, in the case of Ahold Delhaize I decided on the EV/Revenue, PE and dividend yield multiple because they all use different inputs.

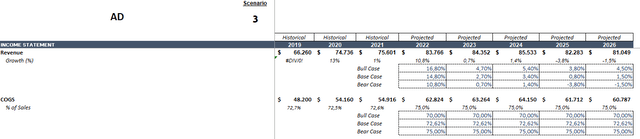

Let’s start with the DCF. In my assumptions, I always use 3 scenarios, a base case, a bull case, and a bear case. The assumptions are based on analyst forecasts and my own expectations. For Ahold Delhaize I used the following revenue and COGS assumptions:

revenue and COGS assumptions DCF (Author)

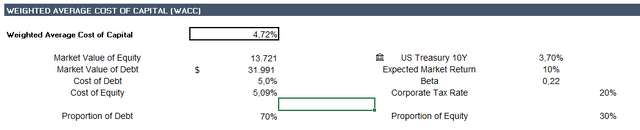

I use the weighted average cost of capital method because I think it is more accurate than the adjusted present value method, which makes you calculate a tax shield. The inputs that I use are the company’s beta, cost of debt (I use a slightly higher number to reflect the higher interest rates), my minimum required rate of return, the treasury rate, and the tax rate. For Ahold Delhaize this leads to the following WACC:

Ahold Delhaize WACC (Author, Yahoo Finance)

The estimated growth rate in perpetuity is put at 2% to reflect the long-term inflation target. We assume that the company buys back approximately 40 million shares a year and that it will have a dividend payout ratio of 55%. This gives a price target of approximately €44.25 based on the perpetuity growth method and €43.88 based on an EV/EBITDA multiple of 7, which is slightly below its 5-year average, to reflect the worsened market conditions.

All of the multiple valuations that I use are based on the company’s multiples reverting to the mean. The company’s 5-year LTM PE multiple is 12.7, I will lower this to 12 to reflect the current market conditions and this leads to a price target of approximately €26.40. The company’s 5-year LTM EV/Revenue multiple is 0.5, which we also adjust downward to 0.4, leading to a price target of €16.24. The company’s dividend yield over the past 5 years was approximately 3.5%, given that the company’s payout is safe at the current payout but that market conditions aren’t great, leading to a lower price and a higher yield we use a dividend yield of 3.75%. This gives a price target of €25.33. If we combine all of these methods we have a price target of €31.22, which gives an upside of slightly over 10% over the current price.

Risks/things to take into account

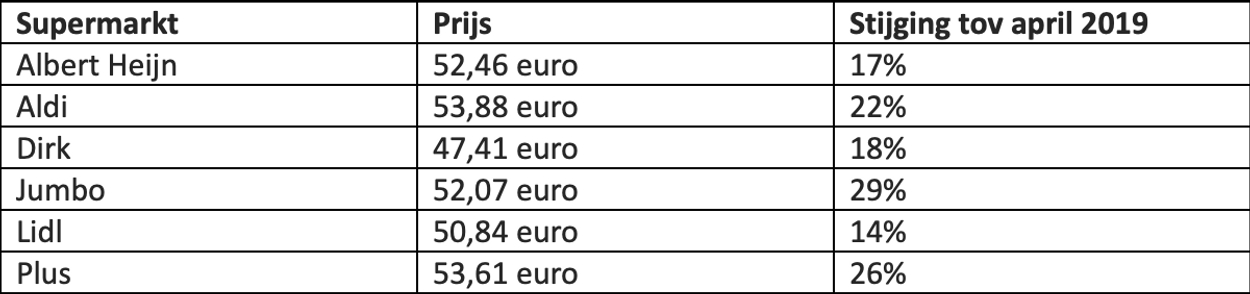

As with any investment, there are also risks and things to take into account when you want to start a position in Ahold Delhaize. First of all the company is not the cheapest grocery store around, German Discount grocers like Lidl and Aldi (although Aldi isn’t always cheaper, in an experiment done in the Netherlands it was one of the more expensive ones) are in general cheaper than Ahold. Ahold’s stores tend to be more premium compared to discount stores and it sets itself apart by offering a better service than them. Nevertheless, people with a lower disposable income will care less about this service.

Prices of grocery stores in the Netherlands for a set basket of goods. Aldi has become more expensive than Ahold owned Albert Heijn. Supermarkt = supermarket, prijs = price, stijging tov 2019 = increase compared to 2019 (Kassa)

Besides the main risk, there are two things that investors should take into account when starting a position in Ahold Delhaize. First of all, due to the fact that the company is traded in Euros investors will be exposed to FX risk. As I mentioned before I believe that the USD will remain relatively strong compared to the Euro in the coming years. If the USD starts to appreciate again, the stock will be worth less in USD. This can have a significant impact on the returns that an investor will make.

Another thing to take into account when starting a position in Ahold Delhaize is that the company is headquartered in the Netherlands. The Netherlands has a dividend withholding tax of 15%. Under the tax treaty between the Netherlands and the US, the withholding tax remains the same. Investors should contact their tax advisors if they want to know more and how to handle this in, for example, IRA accounts.

Conclusion

Ahold Delhaize is a strong company that has a relatively safe business model. The company is able to hike its prices to cover its inflation costs and earn some additional profits. Ahold also profits from the fact that over 60% of its revenue comes from the US, whose currency has outperformed the reporting currency. In addition to this, the company also pays out a growing dividend and reaches my threshold for the chowder number.

On the other hand, an investment in Ahold Delhaize does not come without risk. The company operates a more premium brand and if the economic situation worsens, customers will have a lower disposable income which might make them opt for cheaper options. In addition to this investors also have to deal with the foreign exchange risk and a 15% withholding tax, which might make the investment less interesting.

Nevertheless, at the current valuation, the company is approximately 10% undervalued according to the calculations that I made. Therefore, I would argue that investors should at least do their due diligence on the company.

Be the first to comment