imaginima

Enbridge (NYSE:ENB) is a leading blue chip midstream company that boasts a broadly diversified portfolio of pipelines and related midstream assets, including leading crude oil and natural gas transmission pipeline networks along with the top position as a North American natural gas distributor.

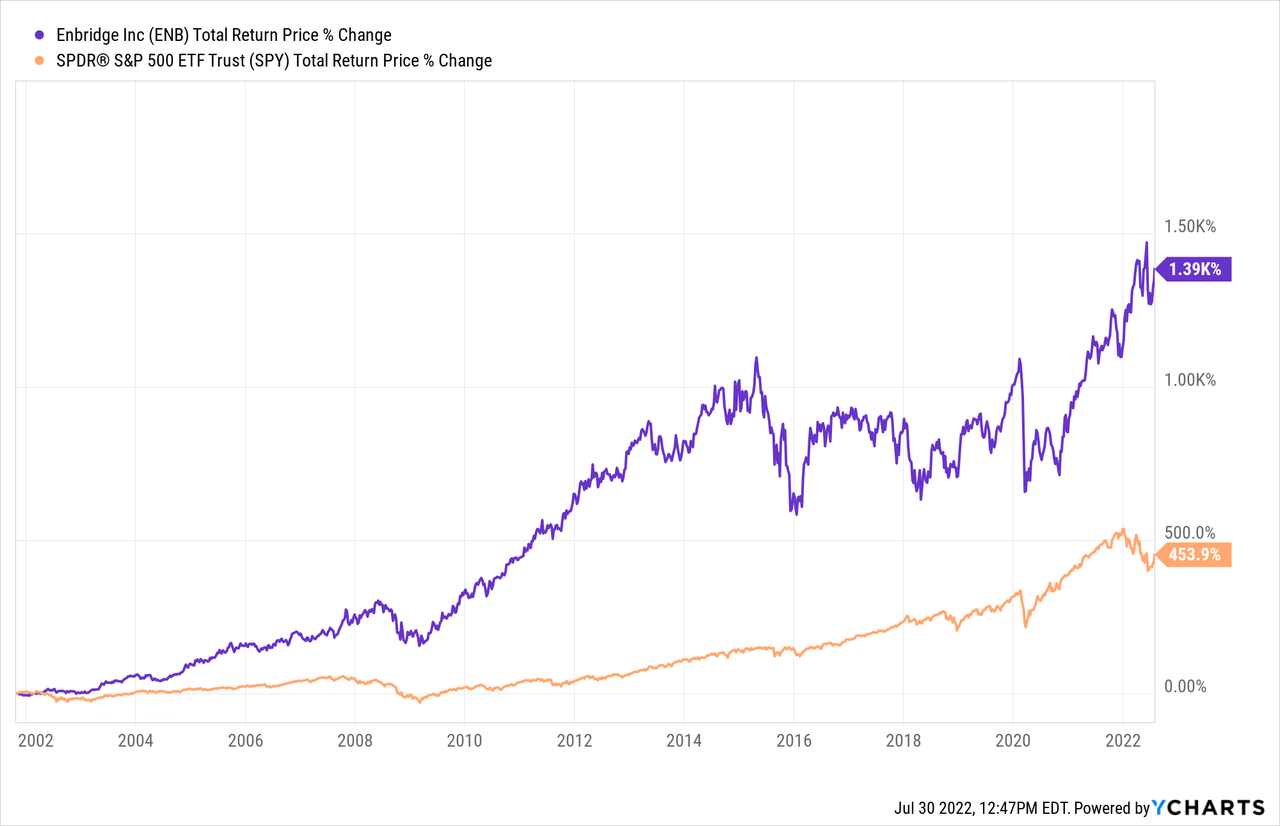

The company also has a fantastic track record for growing dividends regularly, with a growth streak that now spans 27 years, helping it to deliver market-crushing returns since going public:

In this article, we will discuss three important takeaways from ENB’s Q2 results and provide our updated outlook on the stock.

#1. ENB Stock Remains One Of The Best Ways To Bet On The Reality Of The Energy Transition

While ENB is undoubtedly heavily overweight hydrocarbons like crude oil and natural gas, it is making a much more deliberate effort to invest in and grow its renewable energy business as well. As a result, it offers investors a one-stop shop for exposure to the reality of the energy transition.

At the moment, hydrocarbons continue to play an outsized role in meeting the energy needs of the public, and likely will continue to do so for the next decade or two. In particular, natural gas is expected to play an increasingly prominent role. However, over the long-term, renewable energy sources are expected to rapidly grow their market share of the total energy industry.

As a result, ENB is prudently investing all of its growth capital into renewables and natural gas-related assets and businesses, while letting its existing and competitively advantaged oil business continue to cash flow.

ENB announced on its Q2 earnings call that it expects to invest $5-$6 billion per year moving forward, with ~ $4.5 billion of that invested in natural gas and liquids assets and ~$1 billion invested in renewable power assets like European offshore wind, onshore behind the meter, and onshore front of the meter projects. This may also include asset-level acquisitions. This investment profile reflects ENB’s natural competitive strengths as well as the growthiest areas of the energy industry.

#2. ENB Stock Is In Excellent Shape To Weather A Recession

The U.S. GDP has now declined for two quarters in a row and inflation continues to rage. With a meaningful recession all but a foregone conclusion in the coming quarters, ENB is one of the best high yield vehicles for facing it. Between its BBB+ credit rating, leverage at the low end of management’s target range, exceptionally well-laddered debt maturity ladder, and significant liquidity, ENB has little risk of experiencing financial distress and in fact should be able to respond opportunistically to market dislocations.

Its cash flows also remain highly defensive, often being described by management as being utility-like. As of the end of Q2, 98% of EBITDA is contracted and 95% of its counterparties have an investment grade rating. On top of that, roughly 80% of its EBITDA has inflation protections built into its contracts. As a result, ENB’s cash flows are highly resistant to inflation, recession, and commodity price volatility.

#3. ENB’s Growth Profile Remains Robust

On top of its very safe and attractive 6% dividend yield, recession-resistant cash flows, and strategic investments in the future of the energy industry in order to ensure the company’s durability for decades to come, ENB has a strong near-term growth profile.

As management announced on the earnings call:

Through 2024, our secured capital program drives a highly visible 5% to 7% DCF per share CAGR. This growth builds off a solid base in 2021, and we expect to continue to deliver 1% to 2% per year of growth from contractual revenue escalators and productivity enhancements. Our secured capital program will deliver another 4% to 6%, and all of this cash flow will be under low-risk commercial framework…With the recent additions to our secured capital and the additional opportunities we’re advancing, our capital program provides good visibility for longer-term growth.

Investor Takeaway

ENB put up another quality, low-drama quarter in Q2. Distributable cash flow per share grew by 9.7% year-over-year in Canadian Dollar terms and full-year guidance was confirmed, which implies high single-digit year-over-year distributable cash flow per share growth.

The company’s balance sheet is as solid as ever, the cash flows are highly recession resistant, and its growth pipeline is robust. Meanwhile, its current dividend yield remains very attractive at ~6%. As a result, there is a clear line of sight to double-digit annualized total returns over the next 3 years at least. This stems from a combination of growth and the dividend yield, even assuming no multiple expansion over that span. When combined with the low risk of financial distress and resistance to recessions and commodity price volatility, the risk-adjusted profile looks quite attractive here. As a result, we view ENB as a Buy.

While it issues a 1099 tax form, which makes it more convenient for many investors who dread the K1 tax form issued by many of its midstream peers, it is important to remember that it is a Canadian company, which brings its own set of tax implications for investors to consider.

Be the first to comment