Khosrork/iStock via Getty Images

It is no secret that the US economy is not in a very good place. In all reality, there is not a lot going right at all currently. For starters, we just got the May update showing Inflation is at 8.6%, which is a new 40-year high and this comes after the US economy shrunk by 1.5% in Q1.

On top of that, last week we got a preliminary June report that showed a Consumer Sentiment reading of 50. This was the lowest reading since 1978. It was lower than the peak of the pandemic, the financial crisis, and lower than peak inflation back in 1981. It was low!

Things did not stop there. We have seen reports now, almost on a daily basis of large corporations beginning lay-offs and/or implementing hiring freezes. These have come from the likes of Microsoft (MSFT), Apple (AAPL), and Tesla (TSLA) just to name a few.

Will this lead to a recession or possibly has it already begun? GDP forecasts have fallen from 4.1% GDP growth expected for 2022 back in January, to now forecasting below 2% GDP growth.

All of this will undoubtedly put pressures on not only consumers, but businesses as well. We can unfortunately expect more and more lay-off reports in the near future, in my opinion.

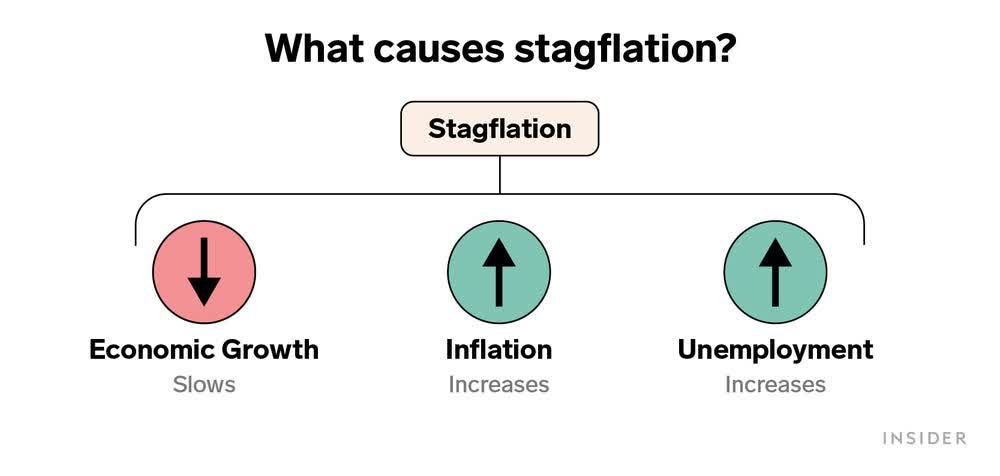

Higher unemployment combined with high inflation will lead to a period of Stagflation, which could last for an extended period.

Business Insider

Based on all this, it is important to prepare your portfolio for this next economic phase. Look for high-quality, cash flowing businesses that will remain strong regardless of an economic backdrop.

As such, today we will discuss 3 Dividend Stocks To Weather Stagflation.

3 Dividend Stocks To Weather Stagflation

Dividend Stock #1 – Johnson & Johnson (JNJ)

The first dividend stock we will discuss is one of the most well-known companies around the world. Johnson & Johnson is a global brand with a very diverse product portfolio.

The company operates within three segments:

- Consumer Health

- Pharmaceuticals

- Medical Device.

You would be surprised at how many Johnson & Johnson products you could find in one’s home. Here are just a few of the JNJ brands:

- Band-Aid

- Tylenol

- Zyrtec

- Johnson’s Baby

- Aveeno

- Motrin

- Benadryl

- Listerine

- Neutrogena

It is wild to think about how many products they actually have. All of the products above are all within the Consumer Health segment, which has been in the news of late.

Johnson & Johnson is in the process of spinning off its consumer health segment into its own separate business. They are doing this for a few reasons. One, the segments have grown so large that they need to be focused on more. The Pharmaceutical and Medical Device segments are much faster growing segments and the spin-off will allow further attention and direction for the company to execute.

Also, the spin-off will also separate the other two segments from the onslaught of ongoing lawsuits currently focused on the consumer health segment.

But this will also allow it to give more attention to its pharmaceutical and medical devices segments, potentially unlocking even more value.

When the spin-off takes place in 2023, investors will get shares in both companies. Owning both certainly has its benefits. JNJ is so diverse that they should perform well regardless of the economic backdrop.

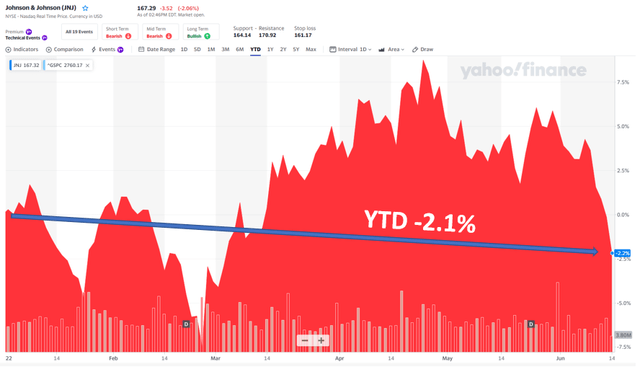

Shares of JNJ currently trade at a per share price below $170. Analysts are expecting JNJ to obtain earnings per share (‘EPS’) of $10.92 in 2023. Based on those estimates, shares of JNJ are trading at a forward P/E multiple of 15.4x.

Shares had been performing in the green over the past few months, but the intense selling we have seen as of late has pushed shares of JNJ back into the red on the year. Year to date, shares of JNJ are down just over 2%.

Dividend Stock #2 – Prologis Inc. (PLD)

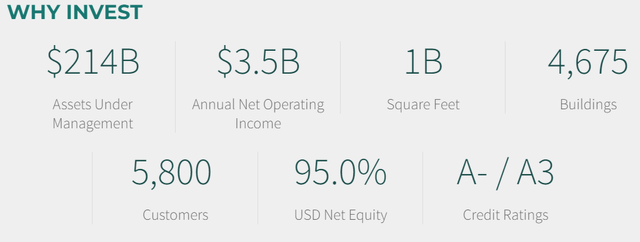

Now we will move over to the REIT sector to find our next stock to invest in during times of stagflation, and that is Prologis Inc. Prologis happens to be the second largest REIT by Market Cap at a value of roughly $88 billion, trailing only American Tower (AMT).

Prologis operates in the industrial sector, with 4,675 properties across the globe that are leased out to 5,800 customers. PLD is one of the highest quality REITs on the market today and they are backed by their A- rated balance sheet.

The company posted FFO of $1.09 during Q1, beating consensus estimates by $0.02/share. Sales for the quarter came in at $1.22 billion, which also beat analyst estimates. Sales for the quarter grew over 6% on the back of continued strong demand in the sector.

Occupancy at the end of the quarter was 97.4%, up 110bps from the same quarter last year.

PLD was in the news this week as they entered into an agreement to acquire Duke Realty (DRE) in an all-stock transaction valued at $26 billion.

The company likes the appeal of DRE as it boosts its portfolio in key geographic areas and management sees the transaction as creating immediate accretion of $310 to $370 million in G&A cost savings among other areas. In the future, management sees the acquisition creating synergies that will generate $375 to $400 million in annual earnings and value creation.

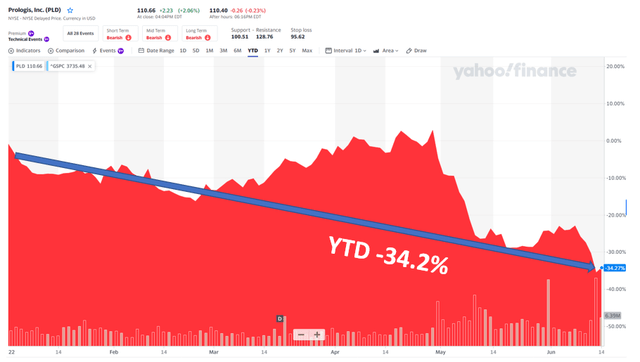

Prior to the acquisition news, shares of PLD have been under pressure. The company reached a new 52-week high of $174.54 on April 28th, but since then, in less than two months, shares have fallen ~37%.

What happened in such a short time period? A couple of things. First, the valuation was running extremely hot for PLD after the run the shares had, we saw shares of PLD trading at an FFO multiple close to 40x, which is wild for a REIT.

The high valuation left very little room for error or any negative news. Well, shortly after hitting the new 52-week high, Amazon (AMZN), which is PLD’s largest tenant, made a comment in their quarterly earnings call stating that the company had more warehouse space than it needed.

This sent shockwaves through the industrial REIT sector, hitting other logistic and warehouse REITs as well. On top of that, Prologis had ruffled investor’s feathers on their own by talks of acquiring Duke Realty, which we see now was recently made official. The initial offer in early May was rejected by DRE, and the thought of making an acquisition while heading into a recession led to investors becoming fearful.

Nonetheless, Prologis is a best of breed industrial REIT with strong cash flows and a very well-run business. Demand is still plenty strong and the company continues to diversify to limit its exposure to Amazon. As of Q1, AMZN accounted for 4.8% of total annual rent.

Analysts are still expecting FFO of $5.15 in 2022, which equates to a P/FFO multiple of 21.5x, down big from the highs we saw at the end of April. Over the past five years, PLD shares have traded at an average P/FFO of 24.2x, suggesting shares appear to be a good value at current levels.

The company also sports a dividend yield of 2.9% with a 5-year dividend growth rate close to 10%.

Dividend Stock #3 – CubeSmart (CUBE)

The last stock we will cover today is another REIT that has the ability to outperform even in times of stagflation. CubeSmart hails from the self-storage REIT sector.

Recessions and even stagflation are all part of the economic cycle. A true recession, not brought on by a global pandemic, is something many new investors are not familiar with. After all, the last recession like that was the financial crisis back in 2008/2009.

If there is one business out there that can excel in any economic environment, it has to be self-storage. In times of strong economic activity, especially here in the U.S., Americans love to accumulate things, but they only have so much run, thus the need for self-storage.

In times of slower economic activity, we see times of hardship brought on by financial stress. This could lead to divorce, downsizing, relocation, you name it. Although all these things are very tough to watch, it is the reality we live in. Regardless, these lead back to the need for self-storage.

Did you know that for nearly 30 years now, self-storage has been the single top-performing REIT sector? You can look back to the last recession to see how well self-storage REITs performed.

Three of the largest self-storage REITs include: Public Storage (PSA), Extra Space Storage (EXR), and CubeSmart.

Now let’s look at the valuation for each based on forward P/AFFO:

- Public Storage: 21.2x

- Extra Space: 20.2x

- CubeSmart: 16.9x

Public Storage is undoubtedly the leader of the sector and a name I like very much and hold. However, the appeal of CubeSmart is undeniable. The company has a great business plus it has a great technology aspect where facilities can be rented right from the company’s app.

CUBE has a dividend yield nearly double that of PSA and they also have a much stronger dividend growth track record, which I really like. Over the past five years, CUBE has increased the dividend at an average annual rate of nearly 10%. Not only is the growth rate strong, they have consistently increased the dividend for 12 consecutive years and counting.

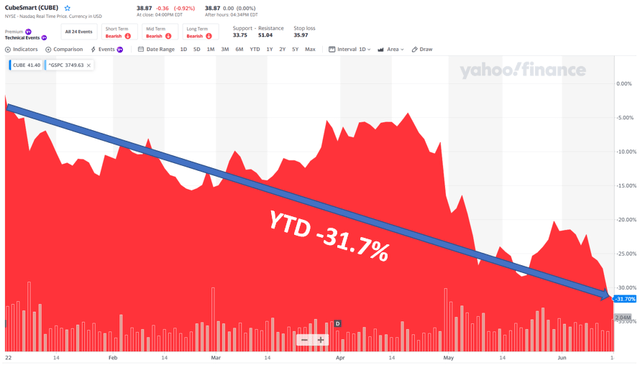

Based on these things and the industry, I have been adding to shares of CUBE on the recent pullback.

Investor Takeaway

Knowing where the US economy is headed, take this time to improve and strengthen your portfolio with high-quality businesses like the ones we have discussed today.

Waiting out a recession is a must, but doing so with high-quality businesses allow you to limit your losses in other areas and even outperform the broader market.

Be the first to comment