The Good Brigade

Article Thesis

Equity markets are in trouble today, but with inflation running high and fixed income not offering any inflation protection, retirees and other income investors still will flock toward income-paying equities. In this report, we’ll show three income stocks that could be suitable for a retirement portfolio thanks to their combination of yield, recession resilience, and income growth potential.

1: Enterprise Products Partners

Enterprise Products Partners (EPD) is an energy midstream company with a vast asset base in North America. Its pipelines are used to transport a range of energy commodities, such as natural gas and different liquids. As one of the largest players in its industry, it is a well-diversified player that is not overly reliant on a single asset, such as one specific pipeline. In times of heightened political and regulatory risks, that’s a positive fact. Without midstream infrastructure such as the assets that Enterprise Products provides, energy commodities can’t be moved to the markets where they are refined and/or sold. This means that EPD’s infrastructure, and that of its peers, is highly important for the functioning of society and for our daily lives.

Enterprise Products does not benefit much from high oil and natural gas prices, as most of its contracts are fee-based. Nevertheless, when energy prices are high and energy producers, such as E&P firms and refiners, are highly profitable, EPD’s counter-party risk shrinks, as its customers are able to strengthen their balance sheets further. From a risk-reduction perspective, the current energy price environment is thus advantageous for Enterprise Products Partners.

Enterprise Product Partners has raised its dividend for 23 years in a row. That means that the company is not a Dividend Aristocrat yet, but it nevertheless has proven its ability to pay a growing income stream during past crises, including the pandemic, the oil price crash in 2014, the Great Recession, the bursting of the dot.com bubble, and so on. Investors thus don’t have to worry about a dividend cut from the company. At current prices, EPD offers a dividend yield of 7.9%, which is very attractive relative to the yield the broad market offers, and relative to what one can get from treasuries. With fee-based contracts that allow for rising revenue over time, EPD is positioned to grow its cash flows in the future, which should result in ongoing dividend growth. Recession resilience, a high yield, and income growth potential make this a compelling pick for income investors and retirees.

2: Medical Properties Trust

Medical Properties Trust (MPW) is a hospital REIT that has seen its shares come under pressure in recent months, which made its already solid yield explode upwards. At current prices, Medical Properties Trust offers a dividend yield of 7.5%, which is highly attractive. The payout ratio based on this year’s expected funds from operations is 63%, which isn’t very high for a REIT.

Medical Properties Trust’s assets, hospitals, are a recession-resistant property class. After all, people that require care do so no matter whether the economy is strong or not. Medical Properties Trust has long-term contracts with its tenants, and occupancy rates are very high, which is why there is little variance in the company’s cash flow over time. Medical Properties Trust has made huge investments in new assets in recent years, which led to a steep increase in the company’s funds from operations. Even on a per-share basis, which accounts for share issuance that was used to pay for some of those acquisitions, MPW generated compelling growth. But at current valuations, not a lot of growth is needed for Medical Properties Trust to be a good investment.

In fact, one can argue that the current dividend yield alone provides very solid returns already. Since shares are trading for just above 8x this year’s expected funds from operations today, multiple expansion in the foreseeable future would not be a huge surprise. In that case, returns would be higher than the dividend yield of 7.5%, even before factoring organic and inorganic FFO growth.

Since Medical Properties Trust does not pay out all of its profits to shareholders, and since management has guided the company to compelling growth in the past, it seems reasonable to assume that reinvestment of the portion of MPW’s profits that is not paid out to shareholders should result in at least some FFO growth in the long run. Thanks to the high yield, even a low-single-digit FFO growth rate of 2%-3% would allow for annual returns in the 10% range, before factoring in potential tailwinds from multiple expansion. Relative to the past FFO per share growth rate of around 7%, a low-single-digit future FFO per share growth estimate is quite conservative.

Medical Properties Trust has raised its dividend for nine years in a row, and I do believe that investors will continue to receive regular dividend increases in the coming years.

3: Simon Property Group

Simon Property Group (SPG) is a mall REIT. That doesn’t sound great when we consider that the “death of malls” has been proclaimed for years, even before the pandemic. But when we consider SPG’s strong asset quality, the company nevertheless seems like a solid investment at current ultra-low valuations.

Not all malls are created equal. Malls in smaller markets where average income isn’t very high are struggling, and have been struggling for years — even before the pandemic. Retailers are not too inclined to open up new stores in these malls, and rent proceeds are thus falling or stagnant. But SPG’s malls are not located in small markets with low average income. Instead, Simon Property Group’s malls belong to the best assets in this industry — most of them are located in densely-populated large markets where consumers have a lot of disposable income. This makes these malls attractive for high-value tenants such as Apple (AAPL) or Tesla (TSLA). Rents are thus strong for SPG, and the company’s strong balance sheet and ample surplus cash flows (after dividends have been paid) allow the company to invest in making its malls even more attractive. Upgrades may add office space, hotel space, or even apartments to its properties, thereby adding additional income streams over time.

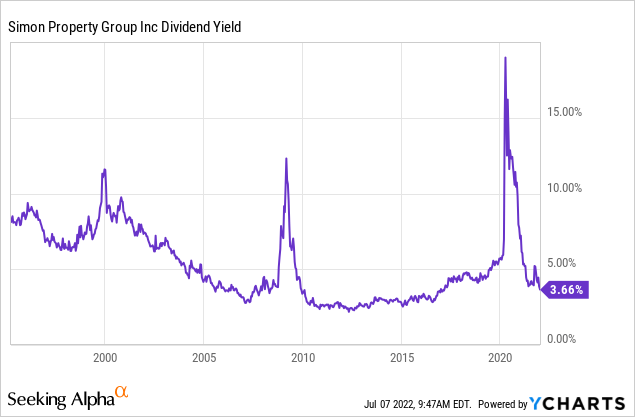

Simon Property Group has forecasted that it will earn a little less than $12 this year, but shares are trading at only $97 today. Based on expected funds from operations, Simon Property is trading at an earnings multiple of just above 8.0. The company offers a dividend yield of 7.0% at current prices, which is well above average compared to the yield SPG offered in the past:

Prior to the current year, being able to buy Simon Property Group at a yield of around 7% was a rare opportunity. During the Great Recession its yield was higher, and during the COVID panic it was higher as well. But oftentimes, Simon Property Group was trading with a yield of well below 5%, at least over the last 15 years or so. Compared to that, the current yield is quite attractive.

With the dividend standing at $1.70 per quarter right now, the payout ratio for the current year is just 58%. This is why I believe that the risk of a dividend cut is pretty small for now. With the company having a lot of cash left over after paying its dividend, it can invest organically, can acquire other attractive assets, and can buy back shares under its current $2 billion program. That covers more than 5% of the REIT’s share count and should be highly accretive at the current valuation. All in all, Simon Property Group looks like an attractive pick right here, offering a nice yield and avenues for business and shareholder value growth.

Takeaway

Interest rates have been rising, but buying treasuries with a yield of a little less than 3% while inflation is running at 8% or more still doesn’t seem like a good deal. There are income stocks that have pulled back considerably in recent months and that are now offering juicy dividend yields while also offering income growth potential at the same time. EPD, MPW, and SPG are such stocks, and they offer better inflation protection than treasuries and other fixed-income investments at the same time. I welcome all readers to share their favorite income/retirement picks in the comment section.

Be the first to comment