atakan/iStock via Getty Images

Insurance Is a Recession-resistant Industry With Great Return Potential

As the backbone of investing titan Warren Buffett’s Berkshire Hathaway (BRK.A), I recently wrote about why the multi-sector company holds a significant insurance stake. Insurance is a service that everyone needs, possesses favorable economics, and the industry is considered relatively recession-proof. Insurance is unlikely to become obsolete, and “sales volume typically increases during economic growth and inflation.”

Market volatility continues to surge as fear of the unknown and unexpected has investors seeking investments that may help mitigate some of the pain of inflation, rate hikes, and market swings. Market volatility can be stressful. If you are feeling stressed and have a high level of investment anxiety, you may want to read my article, 5 Best Investment Strategies For A Volatile Market. Insurance is recession-resilient because as, things get tough, individuals and companies must maintain auto and homeowners insurance coverage, which secures long-term returns for insurers with minimal downside.

Property and Casualty insurance (P&C) protects against property damage and provides liability coverage for claims against insurers for injuries or damage to others’ property. Two of the most common forms of P&C insurance are auto and homeowners. In the current environment, insurance companies are likely to benefit as rates and replacement costs of goods, materials, and labor go up. As home values and replacement costs rise, if homeowners forget to update their policies, insurance companies will not cover the total value of a claim, rather, benefit from old policies that did not include upgrades or appreciated values. Homeowners should consider updating their replacement coverage because consumer oversight can prove costly while beneficial for insurance providers. Another bonus for the insurance provider is rising rental rates. As climbing rental rates sweep the nation, insurance companies should see an influx of renters insurance policies, another stream of P&C income and another reason why we believe insurance stocks are a sound investment.

While there are several benefits to owning insurance stocks, there is also an opportunity cost that I must mention. The investment portfolios that insurance stocks utilize to cover claims tend to use fixed income securities or an asset-liability management approach to match the duration of the portfolio with future expected cash flows from claim payouts. These portfolios generally use longer duration bonds to match those cash flows. It’s crucial to consider this potential risk, but not all insurance stocks are heavily invested in bonds, and overall, we consider our top three P&C picks to be strong buys.

Investing in Property and Casualty Insurance Companies

Insurance companies make money by charging insureds premiums for coverage, whether they use or never use their service. Insurance companies generate quite a profit by collecting policy premiums through the underwriting process, minus expenses and any potential claims, anticipating that those insured are unlikely ever to need their service. This is an added perk for insurance companies as they can invest any excess to generate more for their bottom line. This great business model is why we have selected three top property and casualty stocks to inflation-proof your portfolio.

Top Property & Casualty Stocks to Inflation-Proof Your Portfolio

1. Fairfax Financial Holdings Limited

Fairfax Financial Holdings Limited (OTCPK:FRFHF) has been on an upward trend, reporting its best year ever. Outperforming the S&P 500 YTD and over the last year by more than 15%, this property and casualty (P&C) insurance company has great momentum, as investors are actively buying shares of this stock, driving the price higher.

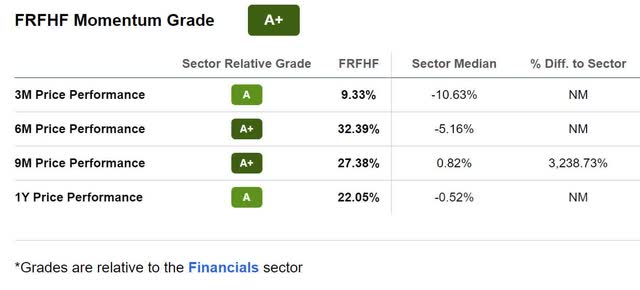

FRFHF Momentum (Seeking Alpha Premium)

As you can see by the above A+ momentum grade, increases to the stock’s quarterly price performance are stellar, outperforming its sector substantially, especially over the five-year average. Although trading above $550/share, the stock comes at a discount with continued price increases.

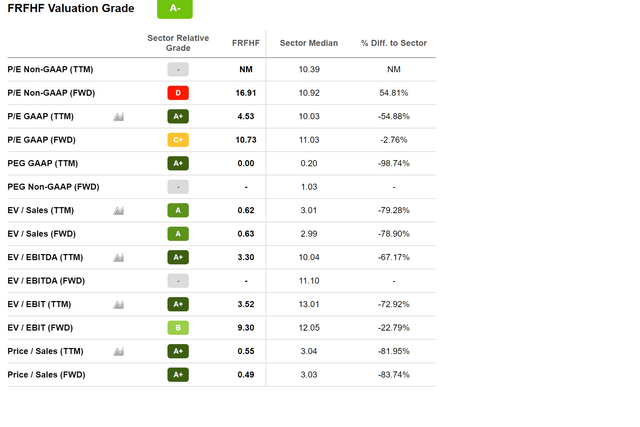

FRFHF Valuation

FRFHF has a great valuation. With an A- overall grade and a current P/E ratio of 4.53x, the stock is trading more than 50% below its sector average while also maintaining an excellent PEG ratio, a near 100% difference to the sector. With this degree of discount, investors also want to ensure Fairfax’s growth and profitability prospects, so next, we’ll dive into those metrics.

FRFHF Valuation (Seeking Alpha Premium)

FRFHF Growth & Profitability

After crushing its Q4 results, with record earnings of $3.4B compared to $2B as a prior high in 2019, Fairfax declared a $10 dividend, showcasing its excellent growth prospects and strength in its income stream. With an A+ dividend safety rating which indicates the company’s ability to pay its dividend consistently, FRFHF is a strong pick for those seeking a solid yield and consistent income. Seeking Alpha’s Quant Team launched dividend grades in 2020 to show investors which stocks have the strongest dividends and those most susceptible to dividend cuts. From 2010, using our dividend safety as a metric, 98% of dividend cuts would have been averted with stocks possessing a Dividend Safety Grade of A+ through B-.

FRFHF Dividend Grades (Seeking Alpha Premium)

When we look at Fairfax’s dividend grades above, the overall picture is great, and we believe they will continue to pay a solid dividend going forward. But with any stock, there are risks. For property and casualty, potential risks include underwriting losses. As Seeking Alpha author Discount Fountain writes, “Fairfax has seen an overall underwriting loss earlier in the financial year as a result of catastrophic losses. However, the company’s exposure is limited,” and we continue to believe FRFHF’s growth and profitability will remain solid.

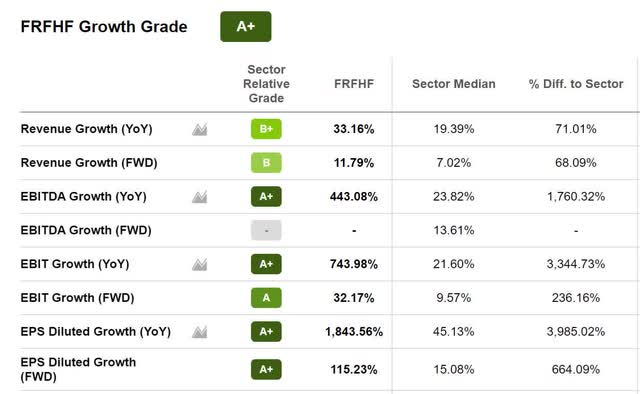

FRFHF Growth Grade (Seeking Alpha Premium)

In addition, revenue growth and EBITDA growth, as evidenced by the figures above, are promising. Insurance and reinsurance are rapidly growing across the globe, and FRFHF wrote $23.8B in gross premiums in 2021, a $4.8B increase from 2020. Despite several high catastrophe claim losses, premiums saw a rise of 25% in 2021 and a more than 30% increase in Q4, and its profits continue to be on an upward trend.

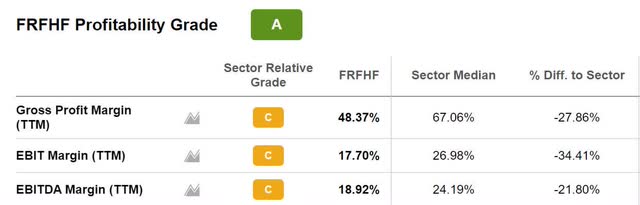

FRFHF Profitability

FRFHF maintains 75% of its business in P&C lines and 25% in reinsurance premiums and accounts for its A profitability grade. Adjusted for its $10/share dividend, Fairfax’s book value per share grew 34%, with a record of underwriting profits that exceeded $800M plus investment performance. In addition, the company is well-positioned in its investment portfolio, having restructured to take advantage of the changing environment.

FRFHF Profitability Grade (Seeking Alpha Premium)

As Seeking Alpha author Deep Insight writes, “The insurance industry has long suffered under low rates since their portfolios typically have a sizable allocation to bonds to cover claims. But in a prescient move, Fairfax has kept its portfolio short in duration by keeping about 50% of its USD $43B of invested assets in cash and short term instruments. Meaning that as rates rise, its portfolio will be more resilient to mark-to-market changes since longer term fixed income instruments are discounted against better priced ones.” Cash flush with $6.64B cash from operations, this stock along with our next stock pick is primed for growth as we look to the future.

2. Markel Corporation

Markel (NYSE:MKL) is a specialty insurer that has been likened to a smaller version of Berkshire Hathaway (BRK.B), given its diverse holdings and investment strategy. With nearly one-third of its invested assets held in publicly traded stocks, Markel has a unique portfolio that makes a great profit from underwriting specialty insurance products while also placing great emphasis on its private equity segment. Independent investor, financial journalist, and Seeking Alpha contributor Mike Thomas, highlights the company’s revenues and profits growth in his article titled, Markel Has Turned A Corner. Mike highlights, “Markel is one of the best capital allocators in America. Over the last twenty years, management has grown revenue and profits at staggering levels. Yet, the company’s share price has gone sideways since 2018. The dramatic improvements in the company’s underlying business have simply not been recognized by the market and now, at a time when the model is doing better than ever and the signs are that the company is about to enter a period when operating results are superior to any point in the company’s history, Markel remains undervalued.” Markel Ventures’ private equity segment is driving their growth and profits, as evidenced by its below growth grade and profitability metrics.

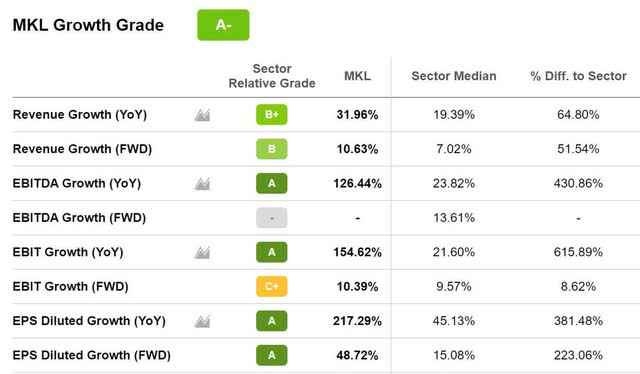

MKL Growth Grade (Seeking Alpha Premium)

Despite a less than ideal C+ valuation, MKL is still trading at a discount, but our focus is on MKL’s growth and profitability. Year-over-year growth and YoY EBITDA growth are strong. With emphasis on insurance, investments, and Markel Ventures’ holdings, Q4 total revenues were $12.8B. Underwriting produced $8.5B in written premiums versus $7.2B in 2020, and with a Q4 EPS of $17.01 beating by $0.91 revenue of $3.76 for the same period beating by $959.31M, the FY1 revisions are great with three up and zero down in the last 90 days.

MKL Momentum Grade (Seeking Alpha Premium)

Profitability is the executive’s focus in 2022 with emphasis on reinsurance “to grow and optimize our profitability within the core casualty, professional liability, and specialty reinsurance lines, seeking to attain at least a 90% combined ratio on those product lines longer term,” said Richie Whitt, Markel Co-CEO. Its focus on quality products, reinsurance, and continued growth is paving the way for continued momentum. Year-to-date, the company has seen an increase +20% in share price, gradual quarterly increases in its price performance as evidenced in the momentum grade above, and over the last five years, the stock is +52%. We believe this stock will continue its momentum and remain as a strong stock pick.

3. Chubb

Global leader in the insurance industry with nearly $90B market cap, Chubb’s (NYSE:CB) strong profitability and increasing free cash flow make this stock attractive, with an excellent dividend. Although the company’s D valuation indicates its trading at a premium, we believe the stock is still worth consideration, given its consistent earnings in underwriting profits and global penetration that should benefit in the current environment. Notably, the stock possesses a forward PEG ratio (PE Ratio divided by EPS long-term growth) of 0.72 compared to the sector at 1.03, and this earns a Seeking Alpha Quant B grade for this all important multiple versus the sector.

CB Profitability and Growth

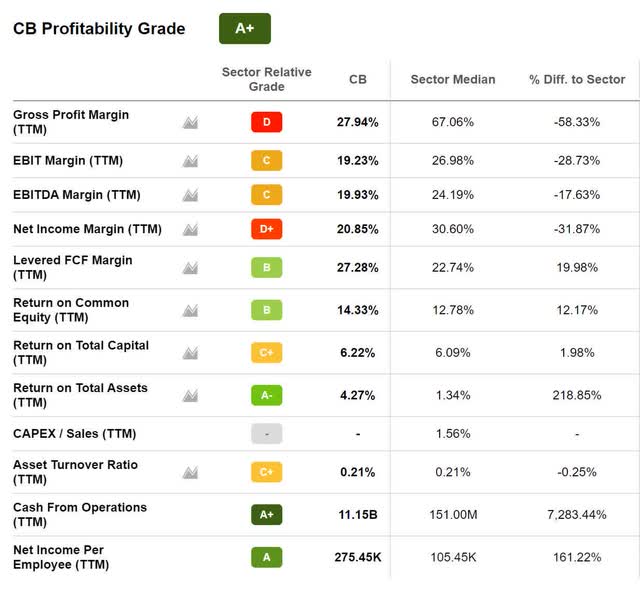

Chubb has been on a longer-term upward trend, outperforming the S&P 500 by more than 20% over the last year, and has excellent momentum. As we look at the A+ profitability grade, although gross profit margins are not ideal, the company is cash flush with $11.15B on the books and stellar underwriting profits that outperform its peers.

CB Profitability Grade (Seeking Alpha Premium)

“Among the capital-related actions in the quarter, we returned $1.2 billion to shareholders, including $905 million in share repurchases and $342 million in dividends. For the year, we returned over $6 billion to shareholders, equaling 112% of our core earnings. This included $4.9 billion in share repurchases or 6.5% of our outstanding shares and dividends of $1.4 billion. As of December 31, $2.6 billion of the share repurchase authorization remains,” said Peter Enns, Chubb CFO during the Q4 earnings call. Q4 returned great results with an EPS of $3.81 beating by $0.53 and revenue of $8.52B beating by nearly 10% year over year.

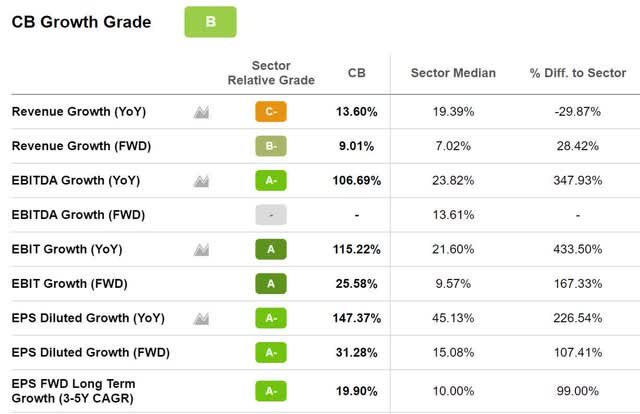

CB Growth Grade (Seeking Alpha Premium)

As the world’s largest publicly traded P&C insurer, operating in more than 54 nations, Chubb’s $200B in total assets continues to grow, and as one of the largest insurance carriers in the world, whose diversification creates a business moat and protections that many other stocks do not possess. Financial journalist Mike Thomas wrote in his article, Chubb Is A Global Leader In An Industry Poised To Outperform The Market, “The company has consistently earned excellent underwriting profits, with its combined ratio topping that of its peers…Chubb has shown strong profitability and an ability to generate large and growing free cash flows, which it has used to increase its dividends for each of the last 28 years.”

CB’s forward revenue growth projections of 9% are solid, and as one of the few insurers with a global footprint sought after by corporations, Chubb should continue to benefit via its commercial portfolio and international retail. Commercial P&C premiums increased 15% with international retail business seeing a 13% increase in Q4 with property +8%, financial lines up 30% and casualty up 7%. We’ve chosen to focus on Insurance stocks because they are recession-resilient and provide protections that many other sectors do not. Consider adding our top three best P&C insurance stocks to your portfolio.

Conclusion – Financial Stocks Are Strong Buys if You Pick the Right Ones

In times of market volatility, investors seek investments that will perform well when markets fall or rise. By purchasing high-yield stocks with excellent dividend safety ratings like FRFHF, MKL, and CB, investors get increased exposure to financials in the insurance industry as a potential inflationary hedge. Our three stock picks have solid valuation, growth, and profitability grades and help shield from declines in income caused by the Fed tightening.

Check out the Grades on your stocks, or we have many Top Dividend Stocks. Our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions. Finding knowledgeable investment resources is also a great way to be a successful investor in volatile or rallying markets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment