skynesher/E+ via Getty Images

Investment Thesis

Placing focus on the dividend income and dividend growth of the companies you invest in helps you to think as a business owner and not as a short-term speculator. By investing in dividend income and dividend growth stocks, you can manage to build up an additional income over the course of your life.

In this article I will show you three companies I have identified that offer a relatively high dividend income in combination with the perspective to provide dividend growth for your long-term investment portfolio. The companies I have selected for you today and which I currently consider to be attractive in terms of risk and reward are the following:

AT&T

There are several factors that contribute to the fact that I currently consider AT&T to be an attractive investment, particularly for dividend income investors: at this moment in time, AT&T pays its shareholders a Dividend Yield [FWD] of 5.78%. This implies a Payout Ratio of 46.96%, indicating that the company has more than enough room for future dividend enhancements. At the current stock price of $18.91, the company shows a P/E [FWD] Ratio of 7.67. This P/E Ratio is currently 56.08% below the sector median (17.47) and 36.54% below its Average P/E [FWD] Ratio over the past 5 years (12.09), thus providing investors with a strong indicator that AT&T is currently undervalued.

At this moment in time, AT&T’s P/E [FWD] Ratio is similar to the one of Verizon (VZ) (P/E [FWD] Ratio of 7.35). Compared to AT&T’s Payout Ratio of 46.96%, Verizon’s is slightly higher (48.63%). Furthermore, AT&T’s EBIT Margin [TTM] of 21.31 is slightly superior to that of Verizon (with an EBIT Margin [TTM] of 19.73), demonstrating the company’s relatively strong competitive position as compared to its competitors.

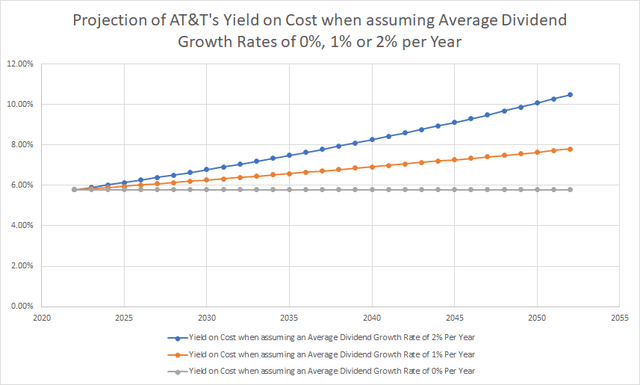

AT&T’s Dividend Growth Rate [CAGR] over the past 10 years is 1.18%. Even though this represents a low Growth Rate, the chart below shows that you can achieve a decent Yield on Cost while having a long-term investment horizon. You can find the projection of AT&T’s Yield on Cost while assuming an Average Dividend Growth Rate of 0%, 1% or 2% per Year for the company over the next 30 years.

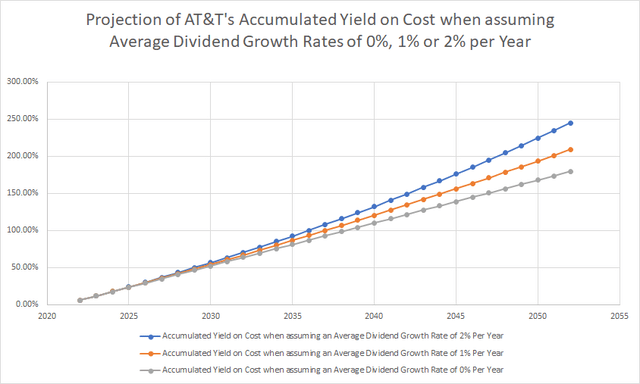

In addition to the graphic above, I will now show you the accumulated Yield on Cost that you can achieve while investing in AT&T with a long-investment horizon. The graphic below demonstrates that, when assuming an Average Dividend Growth Rate of 2% for AT&T for the following 30 years, you could expect an accumulated Yield on Cost of 70.39% by 2032, of 149.14% by 2042 and of 245.13% by 2052. This implies that you can get back 245.13% of your initial investment in the form of dividends by 2052 (Please note that this calculation does not include the withholding tax). Even in the case that AT&T was not able to increase its dividend in the following 30 years, you would still get back your initial investment in the form of dividends by 2039, as shown in the graphic below.

From the details described above, it can be concluded that AT&T is currently an appealing investment for dividend income investors. However, due to the company’s limited growth perspectives, I would recommend that you don’t overweight its stock in your investment portfolio.

JPMorgan

Several figures underscore that JPMorgan is currently very attractive when it comes to risk and reward: the bank has a Payout Ratio of just 33.78%, underlying that there is plenty of room for future dividend increases making the stock an appealing choice for both dividend income and dividend growth investors or for investors seeking an attractive combination between the two.

The fact that JPMorgan shows a Dividend Growth Rate [CAGR] of 13.28% over the last 10 years once again strengthens my belief that the company is an attractive pick for your long-term investment portfolio. In addition to that, JPMorgan’s EPS Diluted Growth Rate [FWD] of 10.22% over the last 5 years suggests that it’s an excellent choice for dividend growth investors.

When it comes to Valuation, it can be highlighted that JPMorgan’s P/E GAAP [FWD] Ratio is 11.71, which is 5.29% above the sector median (11.12) and 6.7% below the company’s Average P/E [FWD] Ratio (12.55). The company’s P/E [FWD] Ratio is similar to the one of Bank of America (BAC), which, at the time of writing, has a P/E [FWD] Ratio of 11.25. In my opinion, due to JPMorgan’s broad diversification and its strong brand image, the bank could be rated with a significant premium as compared to its competitors.

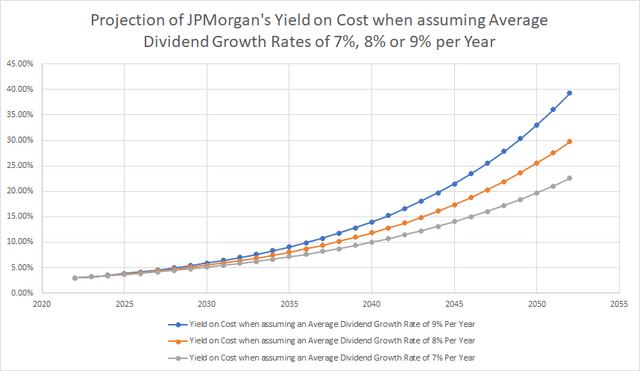

The graphic below illustrates a projection of JPMorgan’s Yield on Cost when assuming that the company would be able to raise its dividend with an Average Dividend Growth Rate of 7%, 8% or 9% per Year. When assuming an Average Dividend Growth Rate of 8% for the company in the following 30 years, you could expect a Yield on Cost of 6.39% by 2032, of 13.79% by 2042 and of 29.78% by 2052.

The graphic underlines that JPMorgan seems to be an appealing prospect for investors that aim to achieve an attractive mix between dividend income and dividend growth. From my point of view, achieving a balanced mix between dividend income and dividend growth is very important when investing with a long-investment horizon and in order to generate an extra income in the form of dividends.

I consider JPMorgan to be a very attractive investment in terms of risk and reward, which is supported by the fact that the company is one of the largest holdings of my own investment portfolio.

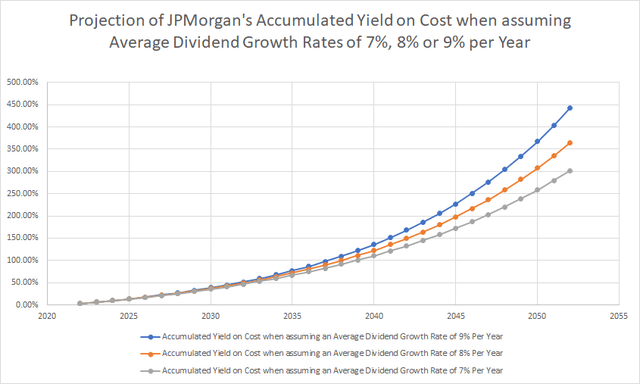

Below you can find a graphic that illustrates the accumulated Yield on Cost when assuming Average Dividend Growth Rates of 7%, 8% or 9% for JPMorgan for the following 30 years. Assuming an Average Dividend Growth Rate of 8% for the company, you could expect an accumulated Yield on Cost of 49.26% by 2032, 149.22% by 2042 and 365.04% by 2052.

The above chart reiterates that JPMorgan is an attractive investment for both dividend income investors and dividend growth investors that aim to invest with a long investment-horizon.

Altria

At the time of writing, Altria shows a Dividend Yield [FWD] of 7.89%. Furthermore, the company’s Payout Ratio is 76.63%. Altria has shown a growing dividend for 52 years in a row, which strengthens my confidence to select the company for a dividend income and dividend growth portfolio. Altria’s Dividend Growth Rate [CAGR] over the past 10 years is 8.1%. The company’s EPS Diluted Growth Rate [FWD] of 7.42% over the last 5 years is an additional indicator that it’s an appealing pick for investors seeking dividend growth.

When it comes to Valuation, it can be highlighted that Altria has a P/E Non-GAAP [FWD] Ratio of 9.89, which is 49.70% below the sector median (19.67), demonstrating that Altria is currently undervalued. In addition to that, Altria’s P/E Ratio is currently 14.01% lower than its Average P/E Ratio over the last 5 years (11.50). Furthermore, the company’s current Valuation is significantly lower than the one of its competitor Philip Morris (NYSE:PM) (P/E Non-GAAP [FWD] of 18.49), demonstrating one more time that Altria is an attractive pick at this moment in time. Altria’s Financial strength is supported by an A3 credit rating by Moody’s.

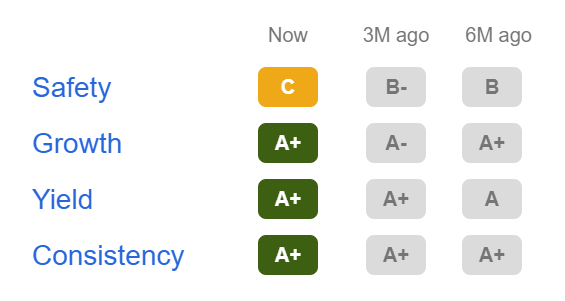

The company’s attractive dividend is underlined by its excellent scoring as according to the Seeking Alpha Dividend Grades. In terms of Dividend Growth, Dividend Yield and Dividend Consistency, Altria is rated with an A+ rating.

Source: Seeking Alpha

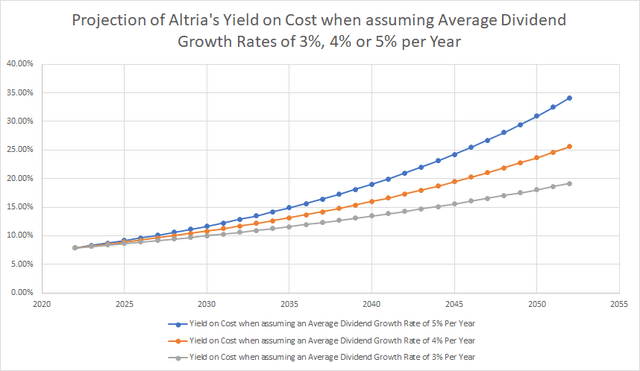

The graphic below shows a projection of Altria’s Yield on Cost when assuming Average Dividend Growth Rates of 3%, 4% or 5% per Year for the next 30 years. Assuming an Average Dividend Growth Rate of 4% for the company, would result in a Yield on Cost of 11.69% in 2032, 17.30% in 2042 and 25.60% in 2052.

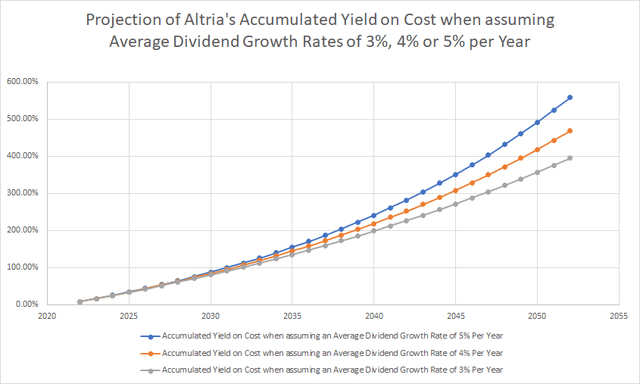

The graphic highlights that Altria is an attractive choice for dividend income investors. Below you can also find a graphic which shows a projection of Altria’s accumulated Yield on Cost when assuming Dividend Growth Rates of 3%, 4% or 5% per Year for the company. Assuming a Dividend Growth Rate of 4% per Year would result in an accumulated Yield on Cost of 106.46% in 2032, 252.37% in 2042, and 468.35% in 2052. These numbers bolster my belief to consider the company as an excellent pick for your investment portfolio.

Conclusion

This article aimed to support you in finding some attractive dividend income stocks, which – at the same time – offer the chance of providing dividend growth for your long-term investment portfolio. At this moment in time, I consider AT&T, JPMorgan and Altria to be excellent picks for dividend income investors with a long investment horizon. Focusing on dividend income and dividend growth when investing allows you to think as a business owner and to gain a relatively secure additional income instead of looking for quick gains while speculating over the short term. For this reason, I recommend that you place your focus on dividend income and dividend growth when investing: you can achieve excellent results when investing with a long investment horizon and when selecting the appropriate companies for your investment portfolio.

Author’s Note: Thank you very much for reading and I would appreciate any feedback on this article!

Be the first to comment