YakobchukOlena/iStock via Getty Images

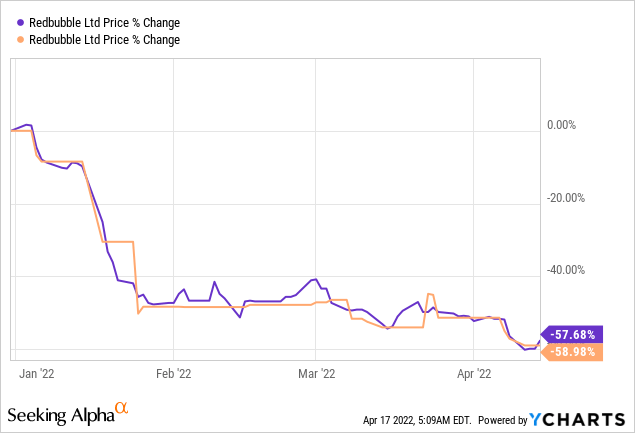

Since my previous article on Redbubble (OTCPK:RDBBF) (OTCPK:RDBBY), the company’s share price has continued to dip and is down almost 60% YTD, to a level similar to that of its 2019 pre-pandemic price. This provides a rare opportunity for investors to buy a fundamentally strong growth company at extremely depressed valuations.

In this article, I will conduct a comprehensive valuation of Redbubble using relative valuation and discounted cash flow, along with sensitivity analysis. A blended average of these valuation methods show that Redbubble is currently undervalued by 93%. Finally, I will assess the growing risk of prolonged inflation and the possibility of a recession on Redbubble’s business and why I believe it is still a good time to start a position in this company.

As this article will focus on the valuation of Redbubble, I will quickly summarize on my three theses for Redbubble.

#1: Unique Value Proposition Will Return Strong Growth Trajectory In Artists And Customers

Redbubble has a strong value proposition to both consumers and artists and has a considerable lead over POD rivals in terms of catalogue size, artist pool and GMV. This puts them in a prime position to capture the growing POD and e-commerce market.

#2: Strong Marketing & Asset-Light Model Facilitates Expansion In Current And New Markets

Redbubble has low marketing spend to its competitors and superior growth, suggesting efficient marketing strategies which will facilitate expansions into new markets. At the same time, its asset-light model will also enable it to be quick and nimble to respond to growing customer demand in new markets as it just needs to establish partnerships with quality fulfilment centers when expanding operations.

#3: Catalogue Expansion Serves As A Strong Growth Driver Due To High Customer Stickiness

High customer desirability for Redbubble’s products coupled with a large runway for catalogue expansion provides a strong growth driver for Redbubble.

All of these theses remain valid today and if you would like to read more, you can click my previous article as follows: Redbubble Stock: A Rare Value And Growth Gem

Downward Outlook Revisions Put Further Pressure On Stock Prices

However, one key assumption that has changed within this time period is that following Redbubble’s 1H22 report, management has guided for FY22 underlying revenue to be slightly lower than FY21, down from the flat underlying revenue growth expected. This poor forecast has likely accelerated the huge sell-off of the stock. However, after updating my financial projections to reflect this decline, it is evident that the market has significantly overestimated the long-term impact of this revenue decline.

Financial Projections

Revenue Model

Before touching on the revenue model, the following are some key industry growth figures:

- Global Print-On-Demand market size is expected to grow at a CAGR of 32% from 2021 to 2025 – Orbis Research

- United States E-commerce market size is forecasted to grow from $0.933tn in 2021 to $1.648tn in 2025, representing a 15% CAGR – Smart Insights

- United Kingdom E-commerce revenue is expected to pose a CAGR of 13% from 2022 to 2025, reaching a projected market volume of $285.60bn by 2025 – Statista

- Australia E-commerce market is slated to grow from $46.7bn in 2021 to $70bn in 2025, representing a 11% CAGR – CMO

Given that it is difficult to find country-specific growth rates for the POD market, I will use the e-commerce growth of individual countries as a proxy and add a premium to it to reflect the faster-growing POD sub-segment, as well as Redbubble’s strong market position which will allow it to capture greater growth.

FY22 Revenue

Given that FY22 is slated to experience a revenue drop, I have forecasted a flat 15% decline for all regions (and overall) as it is difficult to pinpoint which region will currently experience a larger fall than the other. A FY22 projected revenue of AU$558.7 is obtained.

As a sense check, given that a 1H22 revenue (I will count total revenue as marketplace + artist revenue in my calculations) of AU$342mn was recorded, and the traditional revenue split for 1H and 2H is 60% to 40%, this extrapolates to AU$570 million for FY22. Since my projection is close to and slightly below this figure, I believe that it has sufficiently baked in some margin of safety too.

Long Term Revenue Projections

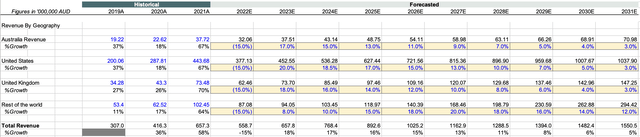

Redbubble Revenue Model and Projections (Author’s estimates)

For long-term projections, I expect revenue growth to resume from FY23 onwards and this is supported by the strong company fundamentals as discussed in my previous article. Growth will eventually taper down over time for Australia, UK and US markets while the rest of the world growth will spike in FY25 through FY27 due to internationalization strategies which are expected to commence in FY24.

In the projections, I used FY25 as a reference point. With the forecasted e-commerce growth rates of each country, I have added a 2% premium in FY25, meaning that Australia, US and UK will see 13%, 17% and 15% growth rates respectively in FY25. The preceding and following years will have their growth rates altered between 2 to 2.5% to reflect a tapering down of growth rates over the decade.

Generally speaking, these numbers are very conservative, something that aligns with my investing principle. Given that the POD market is rapidly growing, a premium larger than 2% could easily be added. FY23’s growth rate is also low when compared to average pre-COVID growth rates which were in the middle twenties percent. Finally, this model also assumes that growth rates will dip to inflation levels by FY31, meaning that Redbubble will be considered a “mature” company by this stage. I view this as unlikely, as Redbubble still has a huge runway for growth and the company itself has estimated a TAM of $400bn by 2024. However, I am one who prefers to minimize downside loss potential hence I have taken these conservative assumptions. A more conservative approach also allows for unexpected events (e.g., economic slowdown) to occur over the next ten years without significantly affecting the intrinsic value of the company. In another perspective, should Redbubble pose a much stronger recovery and remain a growth company in FY31, the upside potential for investors would be enormous.

Cost Projections

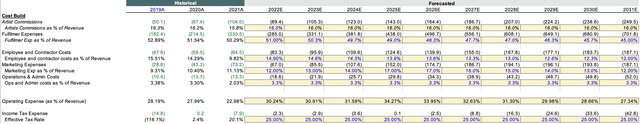

Cost Projections For Redbubble (Author’s estimates)

Cost projections are done as a percentage of revenue. The key assumptions are as follows:

- Artist commission as a % of revenue to remain stable at 16% as per management guidance & assurance not to reduce artists’ margins

- Fulfiller expense as a % of revenue tapers down to 45% by FY31 due to economies of scale

- Employee cost as a % of revenue tapers down 290bp by FY31 due to scale

- Marketing expense as a % of revenue will gradually increase and spike in FY25 as Redbubble expands to foreign markets. Greater marketing expense will likely be required to attract new customers. This will taper back down to 12% in FY31

- A flat income tax rate of 25% is used for simplicity

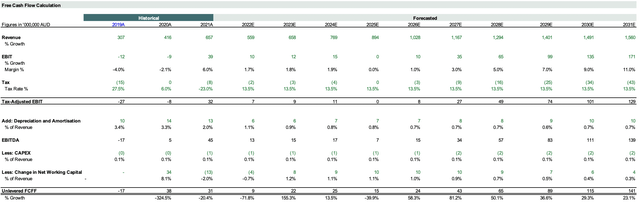

Discounted Cash Flow Model

After considering all these projections, the following represents the DCF model for Redbubble. From the model, we can see that FCFF will fall from FY21 numbers back to a normalized level and increase steadily over the years. As Redbubble starts to reap economies of scale, FCFF growth will be much greater in the later years. More importantly, as a growth company, Redbubble is FCF positive and not burning cash to survive or expand.

Redbubble Discounted Cash Flow (DCF) Model (Author’s estimates)

Discounted Cash Flow Valuation

To obtain an intrinsic value for Redbubble, Exit Multiple and Terminal Growth methods are used. The following are more assumptions:

- Shares outstanding of 277.46 million used.

- Flat discount rate of 15% used. This is a personal preference and rate of return desired for growth companies. A higher discount rate also better protects the investor from increases in risk-free rate which we are experiencing now.

- Discount rate solely includes cost of equity as Redbubble currently does not carry any debt.

- EV/EBITDA multiple of 15.9 is used, corresponding to 25th percentile of its peer group (more in RV section). While this is arguably low, I prefer using a lower number to account for a potential reduction in multiples for tech-growth stocks in the long run.

- Terminal growth rate of 2% is used.

| AU$ million unless otherwise stated | Exit Multiple | Perpetual Growth |

| Present Value of Cumulative FCFF | 209 | 209 |

| Present Value of Terminal Value | 555 | 285 |

| Implied Enterprise Value | 764 | 494 |

| Add: Net Cash | 99 | 99 |

| Implied Equity Value | 863 | 593 |

| Implied Share Price (AU$) | 3.16 | 2.14 |

Relative Valuation

For RV, EV/EBITDA and P/S are used as Redbubble and the majority of its peers are still growth companies that do not have a steady income stream.

As there are no direct POD competitors, comparable companies chosen are retail e-commerce businesses largely operating in US and Europe, similar to that of Redbubble. I have obtained a ten-year history of their multiples (or whatever is available for younger companies) and taken the average.

| Company/10 Yr Average | P/S | EV/EBITDA |

| Etsy | 7.8 | 49.9 |

| eBay | 4.0 | 10.9 |

| Wayfair | 1.4 | N/A |

| ASOS | 2.0 | 37.7 |

| 15.1 | 30.9 | |

| Qurate | 0.7 | 7.9 |

| BooHoo | 3.3 | 32.8 |

These multiples are broken down into their various percentiles and an intrinsic value is calculated.

| Percentile | P/S |

| 25th Percentile | 1.7 |

| 50th Percentile | 3.3 |

| 75th Percentile | 5.9 |

| 90th Percentile | 10.7 |

| FY22 Est Revenue/Share | AU$2.0 |

| Intrinsic Value (Using 25th Percentile) | AU$3.42 |

| Percentile | EV/EBITDA |

| 25th Percentile | 15.9 |

| 50th Percentile | 31.9 |

| 75th Percentile | 36.5 |

| 90th Percentile | 43.8 |

| FY22 Est EBITDA/Share | AU$0.2 |

| Intrinsic Value (Using 50th Percentile & Adding Net Cash/Share) | AU$1.86 |

Note that 25th percentile was used for P/S to be conservative, similar to DCF exit multiple. However, 50th percentile EV/EBITDA is used as I believe that given the greater investments of Redbubble in the near term, their forward EBITDA will be depressed hence a higher multiple is justified. This differs with the DCF exit multiple which uses the 25th percentile, but this is because the model is over a period of 10 years, hence I opted for a lower multiple as it represents a normalized long-term multiple.

Blended Valuation

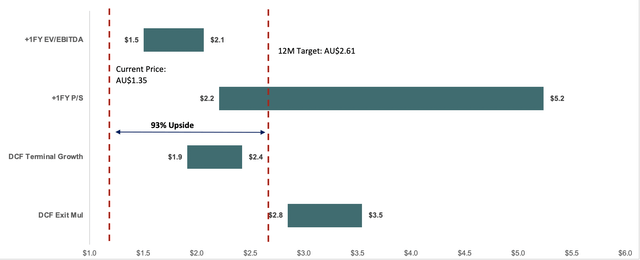

Finally, a blended calculation of these four valuation methods is conducted, with a higher weightage assigned to DCF methods as Redbubble is a young company, hence future cash flow projections is a better predictor of company value. A blended average intrinsic value of AU$2.61 is obtained, representing a 93% upside.

| Method | AU$ | Weightage | Weighted Value |

| DCF Exit Multiple | 3.16 | 40% | 1.27 |

| DCF Terminal Growth | 2.14 | 40% | 0.85 |

| P/S | 3.42 | 10% | 0.34 |

| EV/EBITDA | 1.50 | 10% | 0.15 |

| Blended Share Price | 2.61 |

The football field analysis of the various valuation methodologies also suggests a huge upside potential.

Football field valuation for Redbubble (Author’s calculations)

Sensitivity Analysis

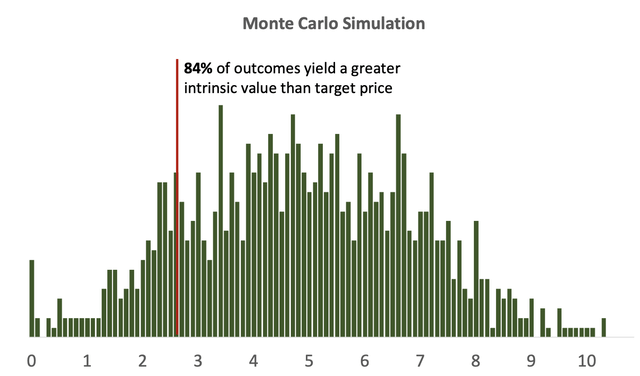

Finally, I will conduct a Monte Carlo sensitivity analysis of the terminal growth DCF method. For revenue growth, I have taken into account the possibility of an economic slowdown over the next few years. Hence, I have varied revenue growth rates as follows:

- FY23: -5% to 23%

- FY24: 0% to 22%

- All other years given a +-5% range to the growth rate used in my DCF

Other key variables which I have varied are fulfiller and marketing expense as a percentage of revenue. These are chosen as they will have the largest potential impact on FCFF and due to the fact that some of these costs might be beyond the control of Redbubble, e.g., a spike in oil prices hence freight costs, favourable macroeconomic environment in a particular year hence management decides to rapidly expand and an increase in marketing expense for that year. Both are varied in a +- 5% range from the percentage used in the DCF.

From the Monte Carlo analysis, over 84% of obtained values yield an intrinsic value about the target price, reflecting a positive risk-reward asymmetry.

Monte Carlo Analysis For Redbubble (Author’s calculations)

Hence, after accounting for a variety of scenarios, Redbubble is still evidently severely undervalued by the market.

My Take On Inflationary Risks

Over the past year, inflation rates have quickly run up, reaching 8.5% as of March 2022 – a level that has not been seen in over a decade. Prolonged periods of high inflation erode consumer spending power and this could lead to a depressed economy if left unchecked. Many investors are worried, and rightfully so. As a consumer discretionary stock by nature, any adverse economical outcome would be detrimental to Redbubble, as lower consumer spending would mean fewer purchases of clothes and accessories.

Cushioning Effects

While this will inevitably hurt Redbubble, there are some factors which would cushion a potential blow. First, among all consumer categories, big-ticket items like vehicles and electronics tend to be the products which consumers cut down spending on the most during recessions. Second, for Redbubble’s products which can be classified as “treats” in the HBR framework, companies can capitalize on low consumer sentiments and market these products as “small indulgences” in a period of doom and gloom. Additionally, value-for-money products will be a key focus, and given Redbubble’s high quality, this should be an area they can stand out. Third, brands which have a strong emotional connection & brand loyalty with customers will be able to retain most of their customers in recessionary periods. Given Redbubble’s strong track record of repeat customers, this shows that Redbubble is viewed favorably by consumers.

Strong Recovery

However, it is best to look beyond any potential recession. No one can predict the future and I do not claim to know if a recession will happen, or when it might end should it happen. What we can do is to take a look at companies that will bounce back the strongest post-recession. According to Deloitte, these are the qualities of companies that will recover the quickest following an economic downturn:

- Low debt-to-market cap ratio

- High reinvestment rates during the recession

- Quick to embrace technology

Redbubble has no debt, and a high cash stockpile hence they are well capitalised to benefit from the first two points. As an online platform, Redbubble will certainly be able to leverage on key technological trends to further improve their business. Therefore, should a recession hit, Redbubble will be in a very strong position to recover and post superior growth rates in the long run.

Conclusion: High Margin Of Safety With Long Term Growth

As the future is unknown, my philosophy is to include a huge margin of safety in whatever I do. All valuation methods conducted have taken conservative assumptions and multiples, and sensitivity analysis has accounted for the possibility of an economic slowdown and unexpected fluctuations in key cost drivers over the next decade.

After an extensive valuation, we can see that Redbubble remains extremely undervalued, even if we price in a variety of adverse events. This shows that the market has heavily underappreciated the strong fundamentals of Redbubble, and overestimated the potential headwinds to the business. While it is likely that Redbubble’s share price could continue to fall given a poor market sentiment toward consumer discretionary stocks in today’s economic climate, I believe that today’s price gives investors a great opportunity to start a position in Redbubble. It would be unwise to time the market as given that Redbubble is so undervalued, there could also be an equal chance of institutions recognizing its potential and adding on more shares, before a further dip is even experienced.

Therefore, if you would like to own a small, fundamentally strong growth company that is severely undervalued, Redbubble would definitely be a great pick!

Be the first to comment