Nataly Hanin/iStock via Getty Images

Investment Thesis

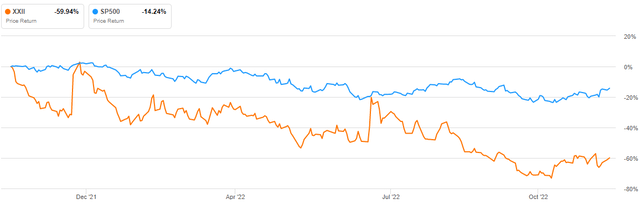

22nd Century Group, Inc. (NASDAQ:XXII) is a major agricultural biotechnology firm that develops low-nicotine tobacco, hemp/cannabis, and hops plant technologies to improve human health. The company operates in the $45B US tobacco industry, the fourth largest in the world behind China, India, and Brazil. Despite operating in one of the world’s largest markets, XXII reported a dismal performance, having been in a downward trajectory since April 2021. Over the past year, the company’s stock price has dropped by more than 59%, significantly underperforming the market by a margin of more than 45% during the same time.

I attribute the poor performance to the company’s low revenues and profit margins. The low profitability is primarily due to the high operating expenses, which sometimes almost surpass the gross revenues.

Although it performed dreadfully for a while now, I stake high on its future given the acquisition of GVB and the transformation of tobacco with VLN. These two initiatives will serve as major game changers, and I am confident that the company will significantly improve its revenues in the coming quarters and turn profitable.

VLN: A Total Reset

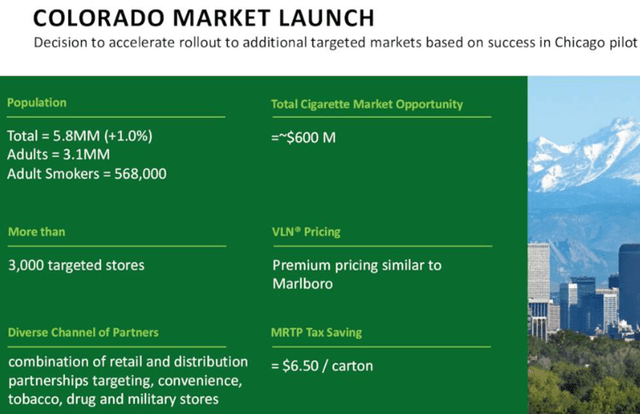

XXII, having been a developer of low-nicotine tobacco, is in an advanced stage of launching what I consider a significant revenue earner for them, the VLN, which is a 95% less nicotine combustible cigarette. The company had a successful pilot in Chicago, where it confirmed high demand for the product, as reported in the Q2 2022 transcript call. Following the successful pilot launch in Chicago, there are plans to extend to the Colorado market, roughly a $600 million market.

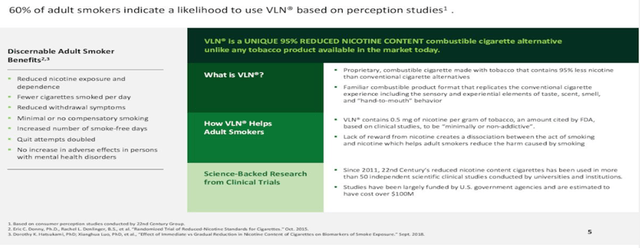

To name a few of the advantages of this one-of-a-kind product dubbed a game changer:

- Very reduced nicotine exposure and dependence

- Reduced withdrawal symptoms

- No increase in adverse effects in persons with mental health disorders.

These are just a few of the many benefits of this outstanding product, as shown below.

Based on the characteristics above, I feel confident that this product is responsible for making tobacco smoking a safe and healthy alternative. An overwhelming majority of adult smokers are interested in trying the product, which is further evidence that it will revolutionize the industry and tap into a massive market. It should be noted that the product is the first cigarette authorized by the FDA to help smokers smoke less, making the policy climate pro-VLN, further affirming my argument of a total reset and the game changer.

During the Q3 ’22 transcript call, the company also stated that the regulatory environment is commendatory for VLN because the FDA is still pushing for its proposed ban on menthol and mandate for less nicotine. The company says that the menthol king cigarette could be the only menthol cigarette that can be lit on the market that is not affected by the menthol ban. This opportunity gives the company a huge share of the market for the product, so it’s not surprising that in the MRQ they reported a 25% increase in VLN production, which included a new product line.

A vast Global Market for VLN: A Reflection Of High Revenues In The Future?

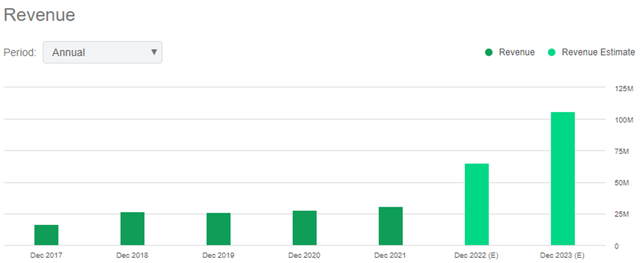

XXII has been registering low revenues, the highest for the last five years being $30.95 million in 2021 FY.

In my view, these low revenues resulted from offering high-nicotine products, which serve an already almost saturated market for such products. Going by the above data, the company has very high revenue estimations for the future, and I believe that is very achievable. I will support my assertion based on the vast market for their unique product, the VLN.

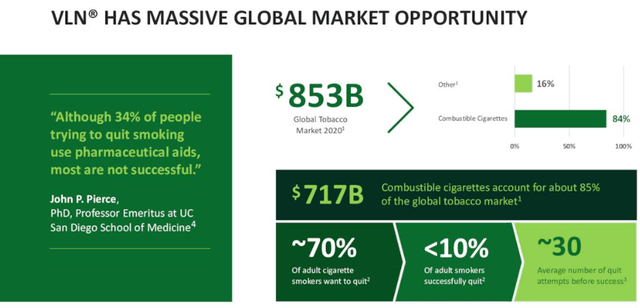

Data from the company’s Q2 2022 transcript call show that the global tobacco market by 2020 was $853B, out of which $717B forms the combustible cigarette market. From the same data set, approximately 70% of adult smokers want to quit though a tiny percentage succeed. The launch of the VLN will offer many healthy alternatives that are less addictive, among other benefits mentioned in this article, which favor this high number of smokers.

In the worst-case scenario, I will assume that only 60% of adult smokers adopt VLN. Working with that percentage, the company would get $430.2B of the total $717B combustible cigarette market. In my opinion, this figure may even go up because they anticipate the entire market will warmly welcome this product, given its health benefits and other economic benefits illustrated in this article, such as reduced daily cigarette intake. To sum it up, this great product will be a significant revenue source for the company, and investors should expect a much improved top line when it is fully commercialized.

The GVB Acquisition

On May 13, 2022, XXII bought GVB Biopharma outright. GVB Biopharma is a world leader in making active ingredients and finished products from hemp for the nutraceutical and pharmaceutical industries. GVB’s competencies complement 22nd Century’s upstream and downstream value chains, which include cannabinoid receptor science with CannaMetrix, plant research and proprietary genetics with KeyGene, breeding expertise with extracts, and cultivation at needle rock farms. The merger creates a global asset to serve the increasing hemp/cannabis ingredient market.

The Hemp Market

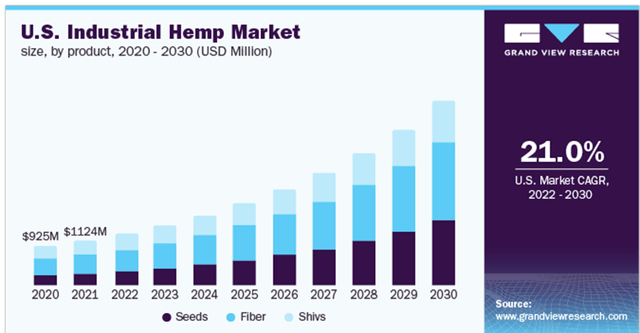

It is estimated that the worldwide industrial hemp market will expand from its 2021 valuation of $4.13 billion at a CAGR (compound annual growth rate) of 16.8 percent (from 2022 to 2030). As a result of the worldwide economic slump induced by the COVID-19 pandemic, manufacturing activity has decreased, leading to limited growth in the global market. Because of this, the market has also taken a significant hit. However, with the rapid pace at which global economies are recovering, the market is anticipated to expand more quickly.

GVB is estimated to have a market share of 15% of the hemp-derived active ingredients market. Using this market share and the 2021 market value of the hemp industry, I would like to estimate the revenues the acquisition will bring to the company assuming the market is static. Computing 15% of $4.13 billion gives $619.5 million. The figure is the revenues the company would raise; other factors held constant. With the market expected to grow, investors should expect a high top line from this acquisition.

One Last Thing: Dismal Profits

Although the company is in good shape to earn good revenues in the coming quarters, investors should know both the VLN cigarette and the GVB acquisition are yet to be fully implemented. Therefore the status quo is worth noting. Having mentioned that, I want to walk investors through the company’s profitability.

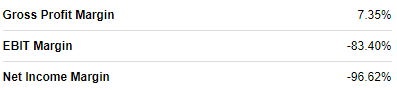

Seeking Alpha

XXII has reported a gross profit margin of 7.35%, an EBIT margin of -83.4%, and a net income margin of -96.62%. I attribute this poor profitability to the company’s low revenues, which sometimes match its operating expenses. Investors should be wary of this trend because it isn’t guaranteed when the company will entirely turn profitable as the game changer initiatives are in the implementation phase.

Conclusion

22nd Century Group, Inc. has been performing poorly for a while, as shown by its declining share prices and poor profits. After that streak of poor performance, I find the company in good shape to turn profitable because of its new product and the GVB acquisition, which will catalyze revenue growth. The company will benefit from the billion markets in the cigarette market and the more than a billion-market share in the hemp industry.

Despite the company’s promising future, investors should be wary of the current dismal profitability of the company since the only options to turn things around are in the implementation phase. For very optimistic investors, I recommend a buy rating now. Still, for the pessimists, I recommend a hold rating until the company turns profitable, which in my view, won’t go beyond mid-2023.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment