MicroStockHub

By Hyun Kang

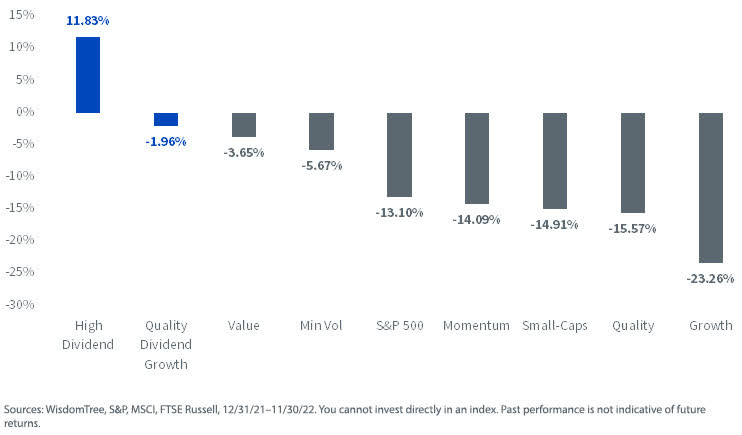

As the year wraps up, dividend strategies finished a banner 12 months of outperformance compared to their broad-market counterparts.

The main driver of this outperformance was the resilience of dividend payers amid the washout in more speculative growth stocks in the face of rising interest rates.

The WisdomTree U.S. High Dividend Index (WTHYE) outperformed the S&P 500 by almost 25% year-to-date.

The WisdomTree U.S. Quality Dividend Growth Index (WTDGI), which measures the performance of dividend-paying companies with growth characteristics, outperformed the market by more than 11%.

These two dividend benchmarks significantly outperformed other factor benchmarks, such as standard minimum volatility and standard value indexes, as well.

Year-to-Date Performance, Select WisdomTree Dividend Indexes vs. Factor Benchmarks

WisdomTree U.S. Dividend Indexes

WisdomTree rebalances its U.S. Dividend Index (WTDI) each December with data as of the end of November.

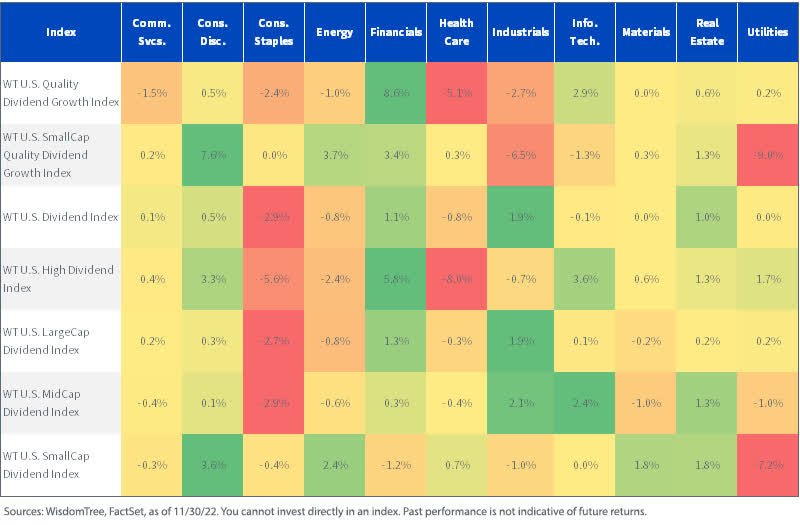

At this year’s rebalance, the WisdomTree U.S. dividend Indexes saw notable changes in sector weight allocations.

All Indexes but the WisdomTree U.S. SmallCap Quality Dividend Growth Index (WTSDG) dropped allocations from Consumer Staples due to prices outpacing dividend growth for that sector compared to others.

Most Indexes also shed some allocations from the Health Care sector, with the WisdomTree U.S. High Dividend Index dropping more than 8% weight from the sector. At the same time, most Indexes increased allocations to the Consumer Discretionary and Financials sectors.

The rebalance tilted most portfolios away from defensive sectors and toward cyclical sectors, with the Financials sector seeing the greatest gross increase in allocations.

Rebalance Sector Changes

Looking at Index fundamentals, dividend yields improved for six of the seven Indexes, and the WisdomTree U.S. SmallCap Dividend Index (WTSDI) saw the largest increase, from 3.1% to 3.4%.

Most Indexes improved return on assets and return on equity. The WisdomTree U.S. Quality Dividend Growth Index’s return on assets increased from 4.6% to 8.5%, and its return on equity improved more modestly, from 27.5% to 30.1%.

Rebalance Changes, Fundamentals

Another result of the rebalance is that the Indexes are trading at discounts to their respective benchmarks, as can be seen in the table below.

Including the below Indexes, all rebalanced U.S. dividend Indexes (with the exception of the WisdomTree U.S. Dividend Index) currently trade at discounts to the S&P 500 Index.

Select WisdomTree Dividend Index Valuations

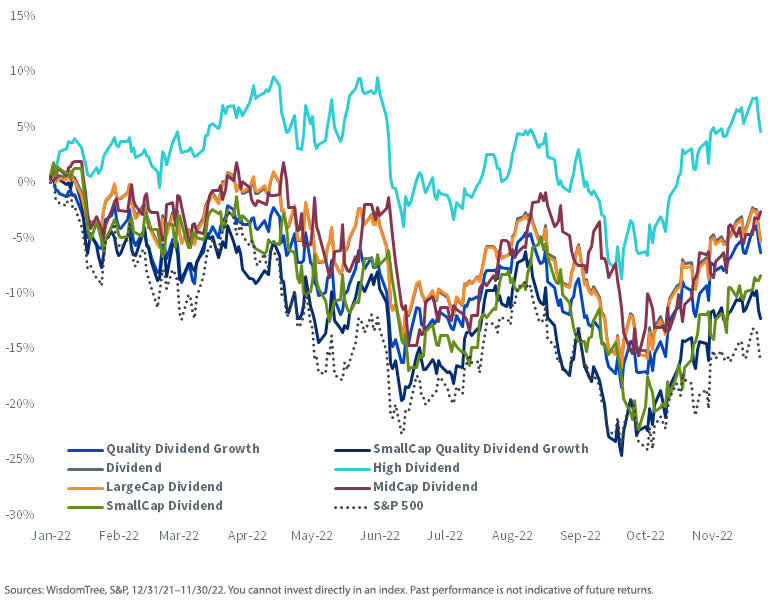

Notably, every WisdomTree U.S. dividend Index outperformed the S&P 500 year-to-date.

Year-to-Date Performance, WisdomTree Dividend Indexes vs. S&P 500

The market landscape is rife with fears of lingering inflation, higher interest rates and the possibility of a recession in 2023. These conditions are causing more investors to consider dividend strategies, which have acted much more defensively with rising volatility. We think the macro environment should still reward a focus on dividend-paying stocks in 2023 as the focus for the market turns to the sustainability of earnings estimates.

WisdomTree U.S. Dividend Index Top 20 Holdings

Hyun Kang, Research Analyst

Hyun Kang joined WisdomTree in July 2022 as a Research Analyst. As a part of the Index team, he assists with the creation and maintenance of the firm’s indexes and supports the group’s research initiatives across various strategies. Hyun graduated from Carnegie Mellon University, with a B.S. in Business Administration and an additional major in Statistics and Machine Learning.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment