SARINYAPINNGAM

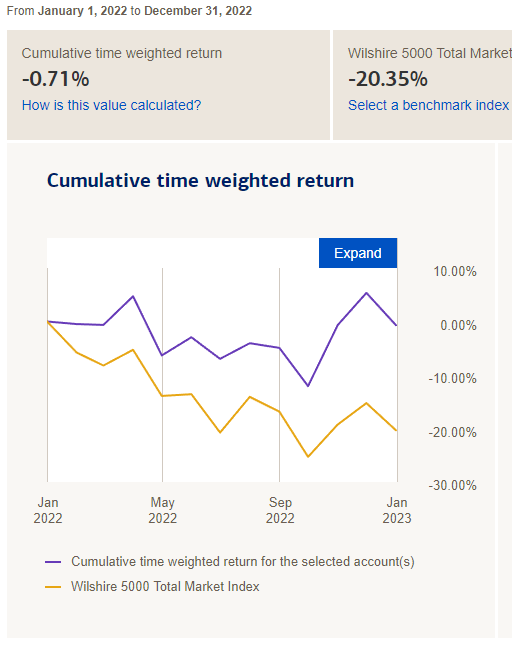

With 2022 now behind us, I’m doing my third annual performance review. I like to keep myself honest by publicly tracking what’s in my portfolio and how I’ve performed. After trailing the market slightly in 2020 and 2021, I noted in last year’s review that my portfolio was constructed to be resilient to a bear market – but that’s much easier said than done, and until a downturn actually happened, it was anyone’s guess how it would hold up. 2022 saw the interest rate regime shift away from ZIRP and with it, an extended bear market that we are still currently living in.

Fortunately, my portfolio held up extremely well, ending the year nearly flat in comparison to a ~20% downturn in the broader markets.

Merrill Edge

I am especially happy with this performance since my portfolio is long-only and usually near 100% invested in equities. I do very little trading and am not overly exposed to the energy sector, which was the notable outperformer in 2022.

With three years of results in the books, I can review the CAGR of my portfolio relative to my chosen benchmark, the Wilshire 5000 (one of the broadest US total-market indexes available).

| (Total returns) | 2020 Return | 2021 Return | 2022 Return | 3-year CAGR |

| My portfolio | 14.20% | 23.53% | (0.71%) | 11.89% |

| Wilshire 5000 | 18.41% | 24.96% | (20.35%) | 5.63% |

3 years isn’t that much data all things considered, but it is nice to have caught up to the market return this year.

Below is the composition of my portfolio as of 1/26/23. I assign each stock a confidence rating of ‘high’, ‘medium’, or ‘low’, which helps to determines the position sizing. In general, I try to keep the allocation to low-confidence positions below 7.5%, medium-confidence below 22.5%, and high-confidence above 70% of the total portfolio.

| Ticker | % of portfolio | 2021 confidence | 2022 confidence | Notes |

| TTWO | 22.67% | High | High | Position split between shares and Jan ’25 LEAPs (approx 2.5:1). |

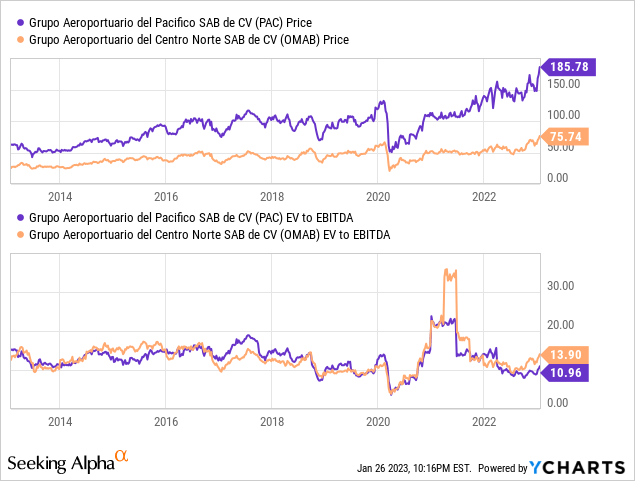

| PAC | 12.98% | High | High | PAC and OMAB are both Mexican airport operators. The combined weighting is 22.67%. |

| OMAB | 9.69% | High | High | |

| RNR | 16.90% | High | High | |

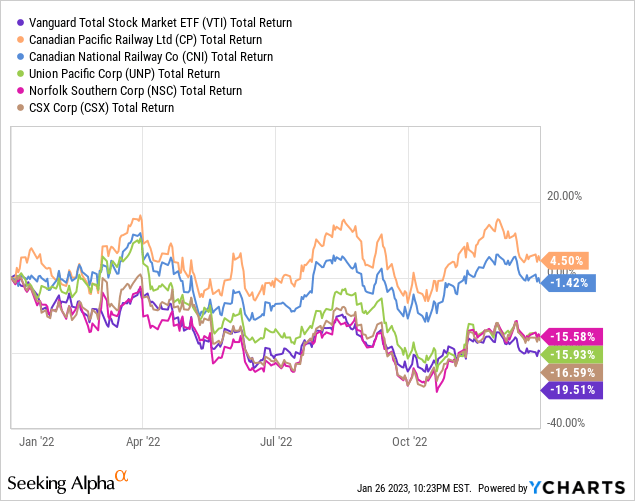

| CP | 13.99% | High | High | |

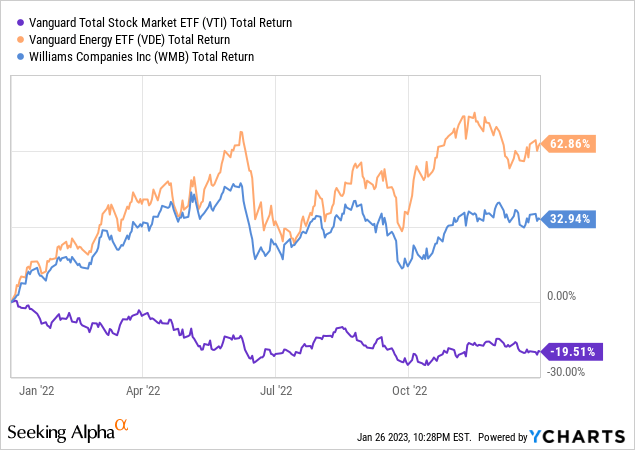

| WMB | 7.75% | High | Medium | Rating downgraded in Mar 2022. |

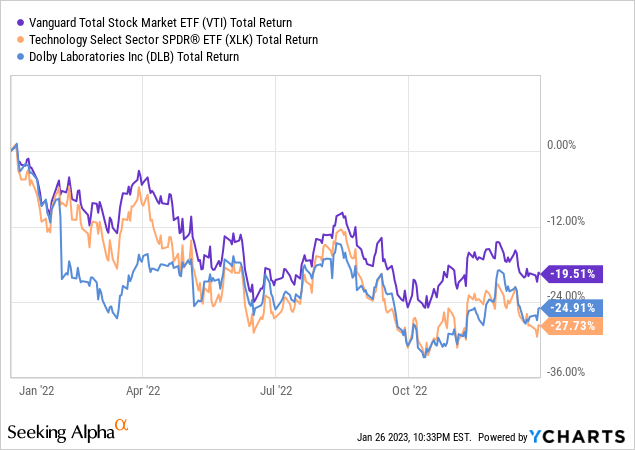

| DLB | 7.27% | Low | Medium | Rating upgraded in Jun 2022. |

| ISDR | 2.52% | Low | Low | |

| DOCS | 2.20% | — | Low | Position initiated in Sep 2022. |

| AVLR | — | — | — | Position initiated in Jun 2022 at medium confidence, closed in Sep 2022 after acquisition. |

| Cash | 4.03% |

In 2022 I fully exited Ingredion (INGR) and Matterport (MTTR). Ingredion struggled with inflation early in the year and I lost confidence that I understood how well its commodity offerings would hold up in a downturn, so I moved on in June. Matterport was a tiny speculative position (below half a percent of the portfolio) which I exited in June, as the company continued to burn cash with no sign of expanding into new verticals or reaching profitability.

High-Confidence Positions

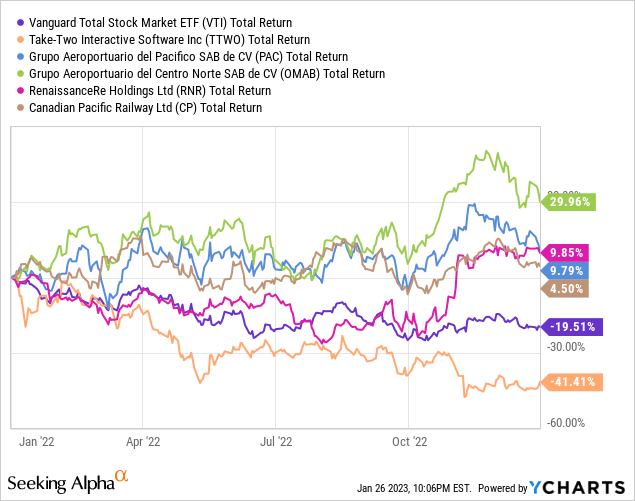

My current high-confidence positions are Take-Two Interactive (TTWO), two Mexican airport operators (PAC) (OMAB), RenaissanceRe (RNR), and Canadian Pacific (CP). Collectively, these positions currently represent just over 75% of my portfolio.

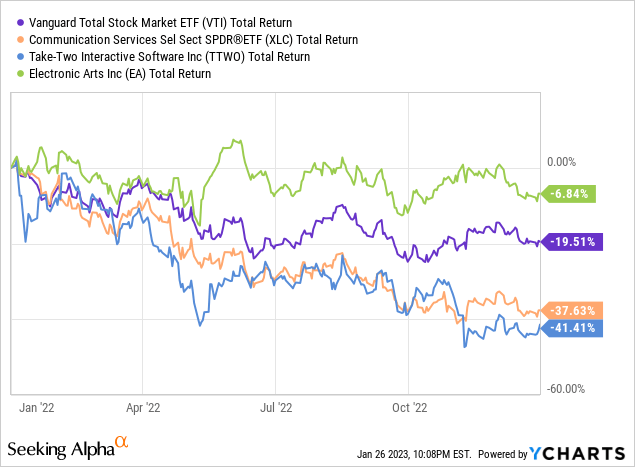

Take-Two is my largest and worst performing position. The communications sector was the worst major sector performer on the year, and video game publishers like Take-Two and EA (EA) were particularly hard hit.

I have now held Take-Two for three years and increased both my confidence and position size in each year despite consecutive years of underperformance. It’s dangerous to get attached to a stock, but my thesis on Take-Two has always had the success of the Grand Theft Auto franchise at its center, which I believe is being significantly undervalued by the market. A successful release of Grand Theft Auto 6 is an obvious potential catalyst for a revaluation, and I am currently projecting that to come between holiday season of 2024 and holiday season of 2025. As a result, I rotated a portion of my position into January 2025 LEAP calls when they came out in September, and plan to add January 2026 calls as well when they are made available.

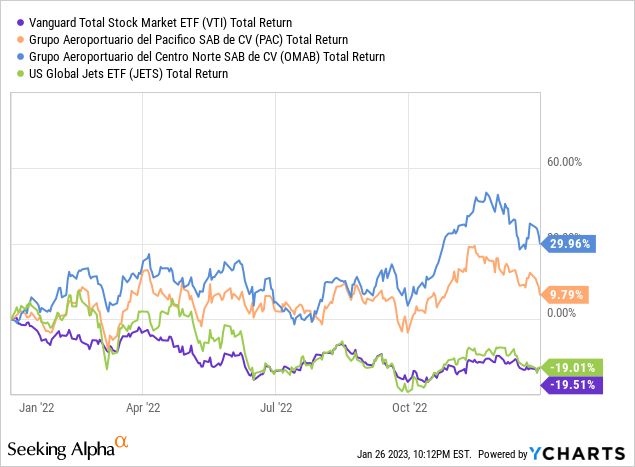

My most successful overall position continues to be my investment in the Mexican airport operators PAC and OMAB. I am attracted to Mexican infrastructure as a way to play the nearshoring of supply chains that was accelerated by COVID. As Mexican industry and US-Mexico trade continues to be built up, the Mexican middle class will continue to grow, and air travel for both business and personal reasons should take increasing market share from ground travel. The Mexican airport operators stand to benefit.

While both companies are currently at all-time highs, neither is trading at an unusually high EV/EBITDA valuation when looking at the past 10 years. EBITDA has drastically increased as the operators maintained cost discipline after the pandemic and the Mexican government approved significant toll increases. PAC recently forecasted 10-12% EBITDA growth in 2023, a growth rate which could easily sustain a multiple closer to 20x.

I hold Canadian Pacific (by way of Kansas City Southern) as another way to play the nearshoring theme. The north-south rail routes from Mexico’s industrial heartland to Canada’s wheat belt stand to benefit greatly from a revitalized USMCA trade relationship.

Disappointingly, the merger between Canadian Pacific and Kansas City Southern failed to close in 2022, as the STB is still finalizing the environmental review process. Current projections are for an approval to come in March. Getting over this final hurdle will finally allow the anticipated merger synergies to begin to materialize.

Finally is my position in the catastrophe reinsurer RenaissanceRe, which I have just covered here.

Medium-Confidence Positions

I have two medium-confidence positions in Williams (WMB) and Dolby (DLB), making up about 15% of my portfolio.

I continue to like Williams, an American midstream company, as a pure-play on natural gas infrastructure. Williams has an extensive network of interstate transmission pipelines which will play a crucial part in any clean energy transition.

That said, my preference is for the stable transmission assets over the more volatile gathering and processing (G&P) midstream sector, and I wanted to see the company maintain capital discipline. I downgraded Williams from high confidence to medium confidence in 2022 after it spent several billion dollars acquiring some lower-quality G&P assets. Valuations on these deals aren’t crazy, but I would prefer the company to focus on its more stable interstate transmission portfolio. Assuming the composition of EBITDA doesn’t shift, I am happy to continue to hold on to Williams.

Next is Dolby, a technology company focused on developing advanced audio-visual processing firmware.

I like Dolby for its technological leadership and established industry position, with a number of industry standard codecs across television, radio and cinema. This creates a predictable and extremely high-margin licensing income stream, but it’s not a growth engine and this income is dependent on device sales, which can fluctuate with the macro situation. More exciting are the cutting edge Dolby Atmos, which is being introduced into more and more high-end devices, and the dolby.io API offering which offers a new pathway to monetizing the company’s technology.

Low-Confidence Positions

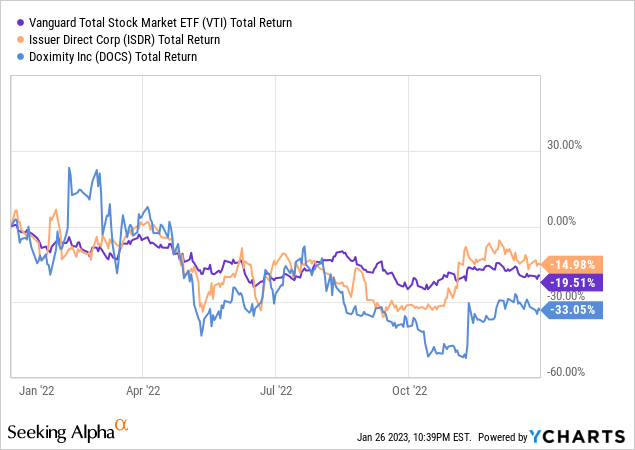

My low-confidence holdings are Issuer Direct (ISDR) and Doximity (DOCS), making up about 5% of my portfolio.

Issuer Direct is a micro-cap company offering a platform for newswire, shareholder communication, and compliance services, primarily targeting small public and private companies. The company recently closed the transformative acquisition of Newswire, another micro-cap competitor, and the first quarterly results for the integrated company are upcoming. If the companies can integrate their offerings and gain a stronger foothold on the lower end of the market, this combination conceivably could pay significant dividends.

Finally, I initiated a position in Doximity in the back half of the year. The basic pitch for Doximity is “LinkedIn for doctors”. It’s a professional social network that allows doctors to connect with each other and keep up to date with recent medical research and professional certifications, as well as offering a number of ancillary professional tools. The primary revenue stream comes from pharmaceutical and medical device companies who are eager to advertise directly to relevant specialists on the platform. I am intrigued by companies like Doximity that are very “one of one” and don’t have any true competitors. The exposure to a resilient pharmaceutical advertising market is good, but in my mind the optionality provided by a platform that boasts the membership of 80+% of American doctors is particularly interesting. Doximity is already trying to explore additional avenues of monetization with a telehealth offering and the recent acquisition of a nurse staffing company, and I think that the successful launch of any such new revenue streams could provide a foothold for extremely strong future returns.

Looking Forward

As the bear market kicked off at the beginning of the year, I was comfortable with a portfolio that I felt was relatively defensively positioned. As the year went on and valuations in growth sectors contracted, I took steps to rotate toward a more aggressive positioning, decreasing my allocation to consumer staples (Ingredion) and energy (Williams) and increasing my allocation to the technology sector (Avalara, Dolby and Doximity). With an uncertain economic future in 2023, I aim to continue to take advantage of opportunities in growth sectors when they become apparent. Best of luck to anyone following in 2023!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment