Big-Dividend Preferred Stocks Drew Angerer

As Jerome Powell and the US fed utterly wreck the US stock market in their efforts to stop inflation, some investors take solace knowing interest rates on savings accounts have finally ticked up from 0% to over 1% in some situations.

However, when you factor in sky-high inflation (CPI is 8.5% year-over-year) you’re still losing a lot of buying power!

For those willing to move further out on the income-investment spectrum, preferred stocks can offer a compelling combination of higher income and lower price volatility (as compared to common stocks). In this report, share data on over 200 big-dividend preferred stocks and then review 2 in particular that are attractive and worth considering if you are an income-focused investor.

Market Environment

Before getting into the specific preferred stocks, it’s worth considering the current market environment, including interest rates, inflation, monetary policy, risks factors and a few high-level comments on the mechanics of preferred stocks in general.

Regarding interest rates, yes, they are still very low. For example, the 10-year US treasury rate is up but still only around 3% (versus over 15% in the early 1980’s). And when you factor in inflation (which is still near a 40-year) high, current interest rates are absurd (i.e. your bank may pay you 1% on your savings, but your buying power is still down more than 7% after factoring in high inflation—yuck!).

Current high inflation was caused mainly by the government response to the pandemic, including lowering interest rates, mailing out stimulus checks (and other easy money) and the supply chain challenges that were caused by lockdowns.

Arguably, the good news is that inflation is somewhat transitory, meaning the rate of year-over-year consumer price increases will likely slow (as supply chain issues are increasingly resolved, and as the delayed effects of the Fed’s latest interest rate hikes eventually slow the rate of inflation–knock on wood). The bad news is that prices aren’t likely to go back down to the levels they were before the pandemic (to a large extent, higher prices are here to stay, in our opinion). Nonetheless, as the rate of inflation slows, the buying power of your money will deteriorate at a slower rate.

There are many ways to deal with inflation through investments, but one strategy that can help is adding an allocation to preferred stocks to your investment portfolio. This can help boost your income and reduce the amount of price volatility (as compared to high-yield common stocks—which unfortunately are often just slowly dying companies that haven’t yet cut their dividend payments–unless you pick them right!).

Briefly, preferred stocks are a stock-bond hybrid, in that they have characteristics of both stocks and of bonds, often including a par value (technically a redemption price, usually at $25) like a bond, which can help keep share prices less volatile (but also expose them to bond-like interest rate risks) and they represent ownership in a company (similar to a common stock) but with priority over common stock in the capital structure). We’ll explain more with two specific examples later in this report.

In a nutshell, preferred stocks can offer attractive big-dividend payments and often with less share price volatility than a common stock. And depending on your goals, preferred stocks can be a worthwhile addition to a prudently diversified portfolio.

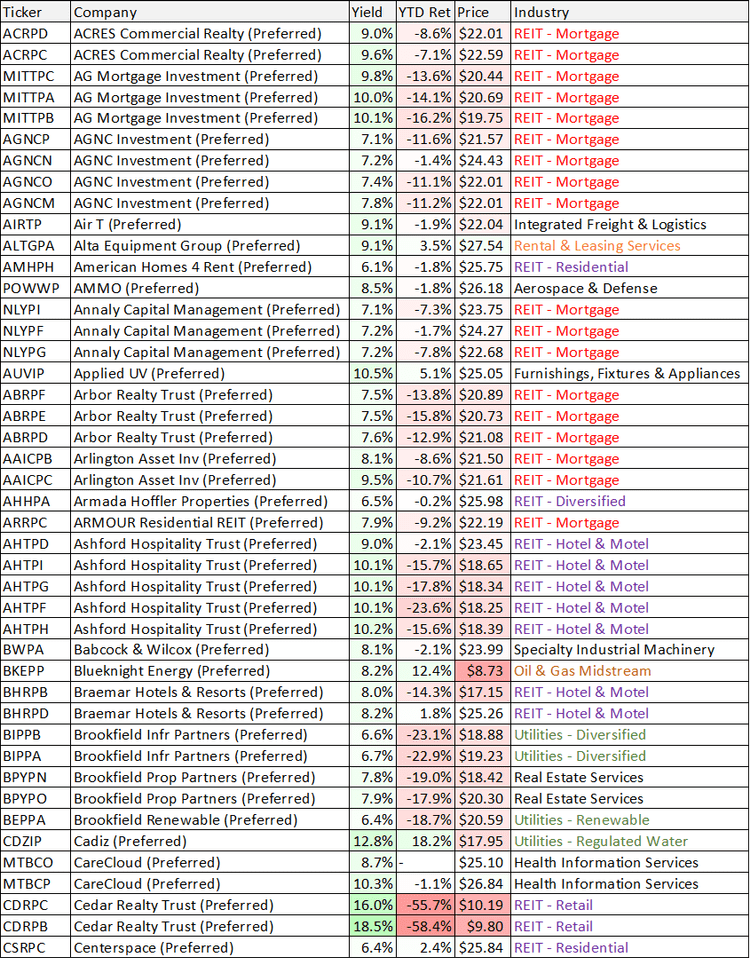

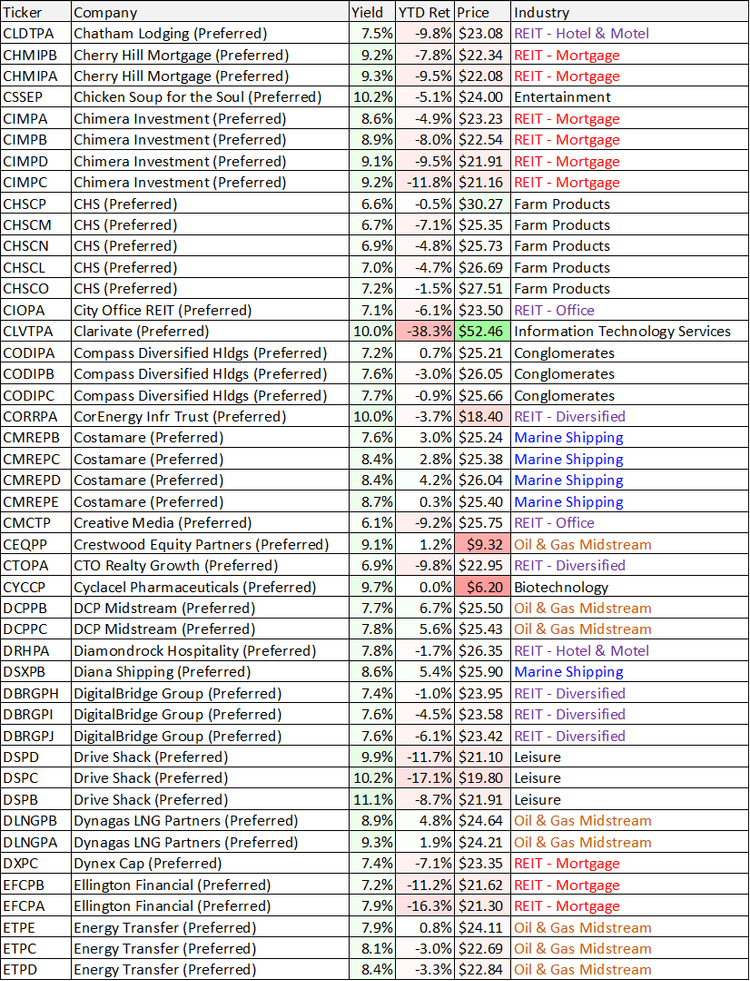

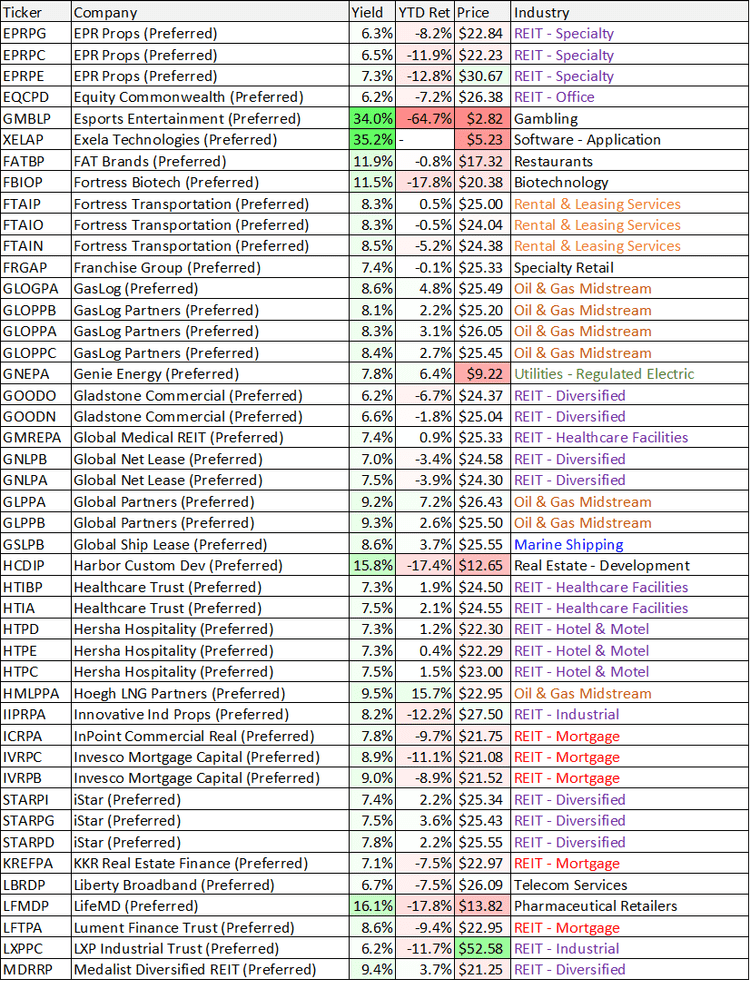

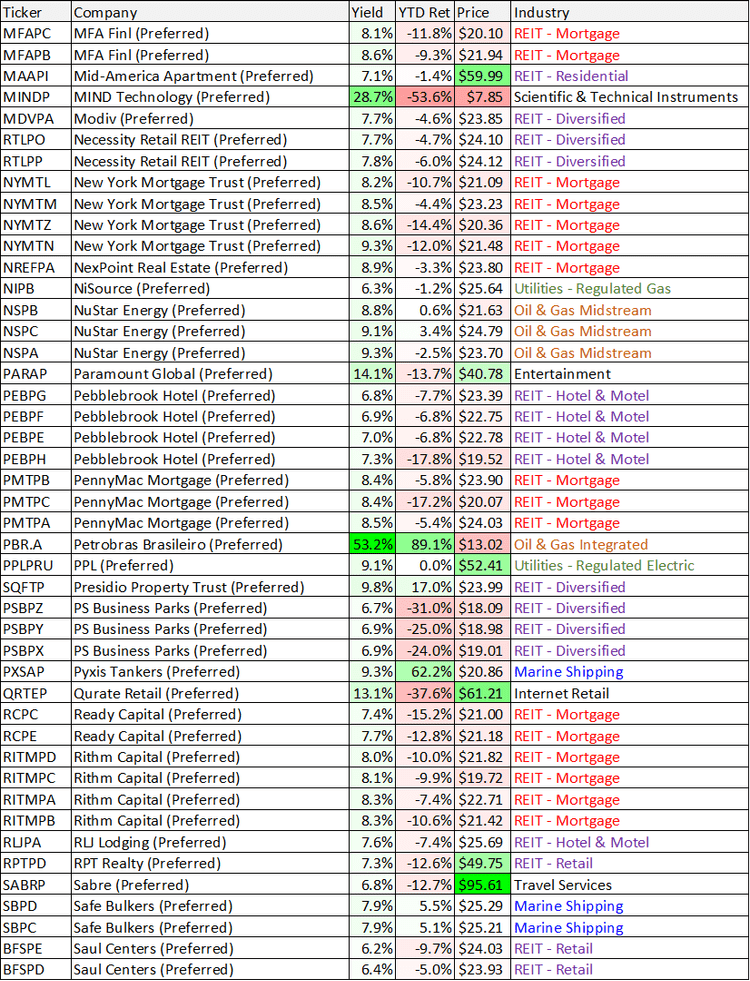

200 Big-Dividend Preferred Stocks

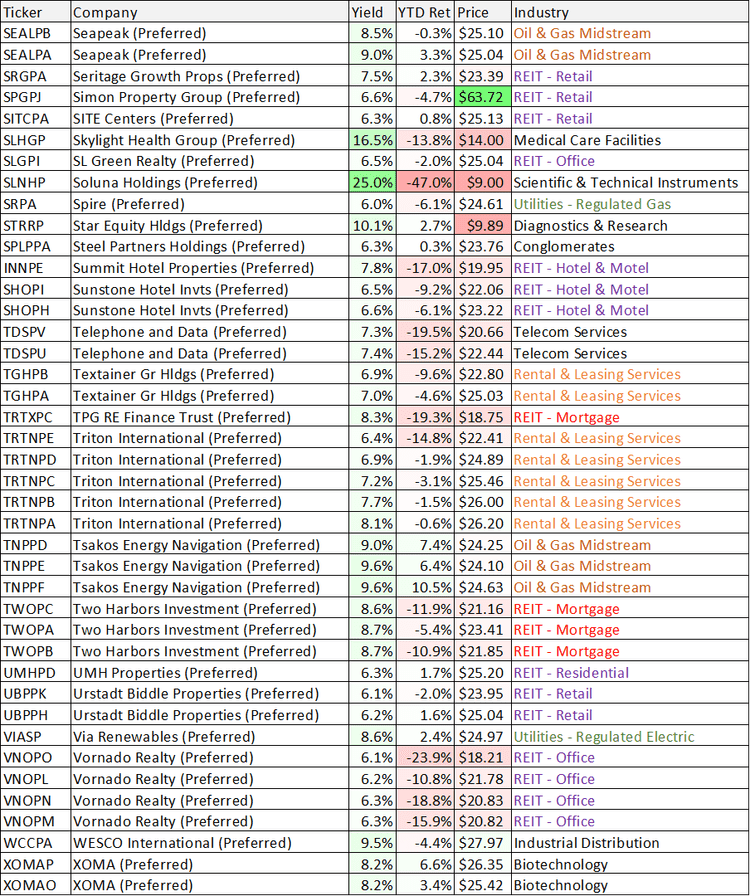

For your reference, and to provide a little more color on preferred stocks currently, here is a list of metrics (including yields, prices, industries and more) for 200 big-dividend preferred stocks (i.e. those with yields over 6%) sorted alphabetically.

Stock Rover Stock Rover Stock Rover Stock Rover Stock Rover

Source: Stock Rover (data as of 25-Aug-22). Note: Yield is calculated as the percentage of price per share a company pays out to its shareholders as dividends annually, calculated by dividing the forecasted 12-month dividend payout by the current price.

Two Preferred Stocks Worth Considering:

With that backdrop in mind, let’s review two specific preferred stocks that are attractive and worth considering if you are an income-focused investor.

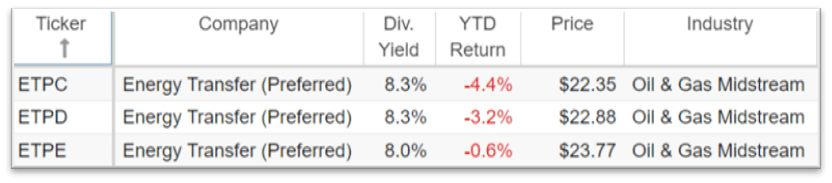

Energy Transfer (ET) (ET.PD), Yield: 8.4%

Energy Transfer

Energy Transfer is one of the largest and most diversified midstream energy companies in North America. It has approximately 120,000 miles of pipelines and associated energy infrastructure across 41 states (it transports the essential oil and gas products that basically make our lifestyles possible).

Energy Transfer website

And while many investors prefer the 6.2% yield currently offered by the common units, others are attracted to the higher yielding preferred units, which also tend to have significantly less price volatility than the common.

Stock Rover

Energy Transfer announced very strong earnings earlier this month, and the business remains very attractive for a variety of reasons, including its high quality earnings (it has strong cash flows and predominantly fee-based earnings that provide stability and limit its sensitivity to commodity prices), diversified portfolio (it has complementary natural gas, crude oil and natural gas liquids franchises that offer a wide range of services), nationwide footprint (it has assets located in every major supply basin in the U.S. with access to all major demand markets in the U.S., as well as exports), and significant inside ownership (management and insiders own ~19% of Energy Transfer’s total common units outstanding, and they’ve been buying).

One big caveat (for some investors) with the preferred (and common) units of Energy Transfer is that it operates as a master limited partnership and issues a K-1 statement at tax time. For some investors, this is no problem at all, but for others it creates challenges because some brokers won’t allow you to own the units in a tax-exempt retirement account, and it may also generate unexpected tax and reporting requirements related to unrelated business taxable income.

If you can handle the K-1, then Energy Transfer common units are very attractive for income-focused investors (in light of its high income and healthy financials). And if you prefer higher income and less price volatility, the preferred shares may be an even better option for you.

Digital Realty (DLR) (DLR.PJ), Yield: 5.8%

Digital Realty website

The preferred stock of Digital Realty does not offer the highest yield in the world (it didn’t even quite make our list of 200 because the yield is just below 6.0%), but it does offer one of the safest. Backed by a very financially strong and healthy data center business, DLR preferred shares currently yield ~5.8% and they trade at an attractively discounted price (i.e. below $25).

As a data center REIT, Digital Realty has recently been shifting more towards connection and co-location services, thereby giving it access to attractive cloud-services growth. It also has an advantage over competitors that are more narrowly-focused geographically. Further, demand for data centers will continue to grow as the digital revolution and massive cloud migration will continue for many years.

One of the reasons we like the preferred shares (over the common) is because the preferreds are less impacted by potential risks (because they’re higher in the capital structure) such as the risk of competition (such as Equifax) and the risk that technology is enabling tenants to do more with less space (thereby reducing their data center needs).

Overall, data center needs will continue to grow. And while the common shares have sold off a bit (thereby making them more attractive as compared to their long-term value), the preferred shares are even more compelling for some income-focused investors that prefer less volatility.

Conclusion:

Preferred stocks can present attractive opportunities for income-focused investors. For example, of the hundreds of big-dividend preferred stocks in the market, the two we reviewed in this article were ranked ninth and eighth in our recent report Top 10 Big-Dividend Preferred Stocks because of their high income, strong businesses and attractive prices (including relative price stability, especially as compared to common stocks). However, at the end of the day, you need to select investments that are right for you, based on your own situation, goals, and tolerance for risks.

Be the first to comment