Khosrork

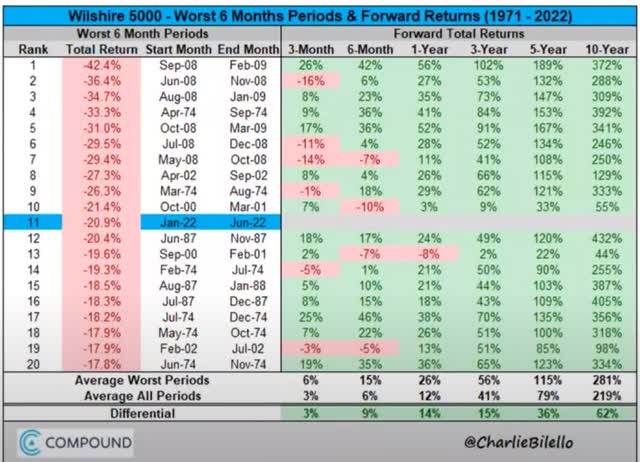

You’re not alone if you’re confused and frustrated by this market’s wild gyrations. The world’s most accurate blue-chip economist firms can’t agree on what the stock market will do next.

- JPMorgan (JPM) thinks inflation will come down quickly, the Fed will pivot, and stocks will be at record highs by the end of the year

- Morgan Stanley (MS) is telling clients to go to cash because a 30% sell-off is likely this year

- Goldman Sachs (GS) thinks stocks are still a 25% plunge away from their final bottom

Each blue-chip firm has a reasonable argument for why we’re likely in for stock market hell or heaven, so here’s what smart long-term investors should do.

Remember that in the short-term stock returns are almost all luck. In fact, over 1-year luck is 33X as powerful as fundamentals.

But over the long-term, 30+ years, fundamentals are 33X as powerful as luck.

In the short-term, returns are a crap shoot; in the long run, they are fundamentals-driven destiny.

Will stocks rise or fall in the next year? No one really knows. What will they do in the next 3 years? The next 10 years? The answer is almost certainly go up…a lot.

Whether or not we get a recession in 2023 or stocks fall another 30% or have already bottomed doesn’t matter. Because 10 years from now, anyone buying blue-chip bargains today will feel like a stock market genius that bought the bottom.

So let me show you why Allianz (OTCPK:ALIZY) and Cummins (CMI) are two world-beater blue-chips that have minted millionaires for over a century and could be your ticket to retiring in safety and splendor in the coming years and decades.

Allianz: The World’s Best Insurance Company

Full Deep Dive On Taiwan Allianz: Growth Prospects, Investment Thesis, Risk Profile, Valuation Profile, and Long-Term Total Return Potential

- 26.375% dividend tax withholding

- you need to own it in a taxable account to get the tax credit and recoup the withholding

Great insurance companies make investors rich through managing risk well, and according to rating agencies, Allianz, the world’s largest insurance company, is the best risk manager in its industry.

ALIZY Credit Ratings

|

Rating Agency |

Credit Rating |

30-Year Default/Bankruptcy Risk |

Chance of Losing 100% Of Your Investment 1 In |

|

S&P |

AA Stable Outlook |

0.51% |

196.1 |

|

Fitch |

AA- Stable Outlook |

0.55% |

181.8 |

|

Moody’s |

A+ (A+ equivalent) Stable Outlook |

0.60% |

166.7 |

|

AMBest |

Aa3 (AA- equivalent) Stable |

0.55% |

181.8 |

|

Consensus |

AA- Stable Outlook |

0.55% |

181.0 |

(Source: S&P, Fitch, AMBest, Moody’s)

And it’s not just credit ratings showing ALIZY’s risk management power.

ALIZY Long-Term Risk-Management Consensus

|

Rating Agency |

Industry Percentile |

Rating Agency Classification |

|

MSCI 37 Metric Model |

100.0% |

AAA Industry Leader, Stable Trend |

|

Morningstar/Sustainalytics 20 Metric Model |

91.6% |

16.7/100 Low-Risk |

|

Reuters’/Refinitiv 500+ Metric Model |

99.4% |

Excellent |

|

S&P 1,000+ Metric Model |

89.0% |

Excellent, Stable Trend |

|

FactSet |

50.0% |

Average, Negative Trend |

|

Morningstar Global Percentile (All 15,000 Rated Companies) |

86.2% |

Very Good |

|

Consensus |

86.0% |

Low-Risk, Very Good Risk-Management, Stable Trend |

(Sources: MSCI, Morningstar, FactSet, S&P, Reuters)

The most recent fallout from the Alpha Fund scandal has lowered ALIZY’s risk-management consensus from 87% to 86%, which is still very good. How good?

ALIZY’s Long-Term Risk Management Is The 21st Best In The Master List (96th Percentile)

|

Classification |

Average Consensus LT Risk-Management Industry Percentile |

Risk-Management Rating |

|

S&P Global (SPGI) #1 Risk Management In The Master List |

94 |

Exceptional |

|

Allianz |

86 |

Very Good |

|

Strong ESG Stocks |

78 |

Good – Bordering On Very Good |

|

Foreign Dividend Stocks |

75 |

Good |

|

Ultra SWANs |

71 |

Good |

|

Low Volatility Stocks |

68 |

Above-Average |

|

Dividend Aristocrats |

67 |

Above-Average |

|

Dividend Kings |

63 |

Above-Average |

|

Master List average |

62 |

Above-Average |

|

Hyper-Growth stocks |

61 |

Above-Average |

|

Monthly Dividend Stocks |

60 |

Above-Average |

|

Dividend Champions |

57 |

Average bordering on above-average |

(Source: DK Research Terminal)

ALIZY’s risk-management consensus is in the top 4% of the world’s highest quality companies and similar to that of such other blue-chips as

-

Colgate-Palmolive (CL) – dividend king Ultra SWAN

-

Ecolab (ECL) – dividend aristocrat Super SWAN

-

W. W. Grainger (GWW) – dividend king Ultra SWAN

-

AbbVie (ABBV) – dividend king Ultra SWAN

-

Lowe’s (LOW) – dividend king Ultra SWAN

-

Microsoft (MSFT) – Ultra SWAN

-

Prologis (PLD) – Super SWAN

-

Equinix (EQIX) – Ultra SWAN

-

BlackRock (BLK) – Ultra SWAN

-

Adobe (ADBE) – Ultra SWAN

This is truly a world-beater insurance titan you can trust with your hard-earned money, just as you can its risk-management peers.

Reasons To Potentially Buy Allianz Today

| Metric | Allianz |

| Quality | 92% 12/13 Super SWAN |

| Risk Rating | Very Low |

| DK Master List Quality Ranking (Out Of 500 Companies) | 51 |

| Quality Percentile | 90% |

| Dividend Growth Streak (Years) | 2 |

| Dividend Yield | 6.60% |

| Dividend Safety Score | 92% Very Safe |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.25% |

| S&P Credit Rating | AA Stable |

| 30-Year Bankruptcy Risk | 0.51% |

| Consensus LT Risk-Management Industry Percentile |

86% Very Good, Risk-Management |

| Fair Value | $22.28 |

| Current Price | $17.20 |

| Discount To Fair Value | 23% |

| DK Rating |

Potentially Strong Buy |

| Price To Book Value | 1.1 Vs. 1.36 historical fair value |

| LT Growth Consensus/Management Guidance | 6.0% |

| 5-year consensus total return potential |

19% to 23% CAGR |

|

Base Case 5-year consensus return potential |

20% CAGR (4X the S&P 500) |

| Consensus 12-month total return forecast | 63% |

| Fundamentally Justified 12-Month Return Potential | 36% |

| LT Consensus Total Return Potential | 12.6% |

| Inflation-Adjusted Consensus LT Return Potential | 10.4% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.68 |

| LT Risk-Adjusted Expected Return | 8.78% |

| LT Risk-And Inflation-Adjusted Return Potential | 6.56% |

| Conservative Years To Double | 10.98 |

(Source: Dividend Kings Zen Research Terminal)

Analysts expect ALIZY to deliver 63% total returns in the next year, and up to 36% would be justified by its growth, dividends, and a return to historical fair value.

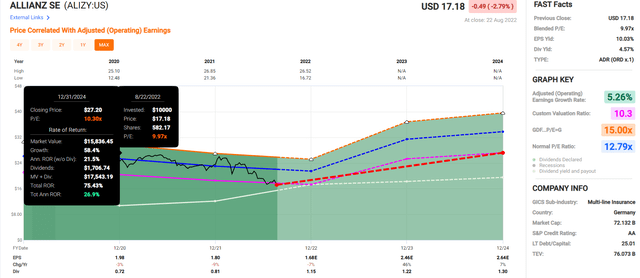

Allianz 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research Terminal)

If ALIZY grows as expected and returns to historical fair value (10.3X earnings and 1.3X book value), investors will earn 75% total returns or 27% annually.

- literally Buffett-like return potential from the world’s best insurance company

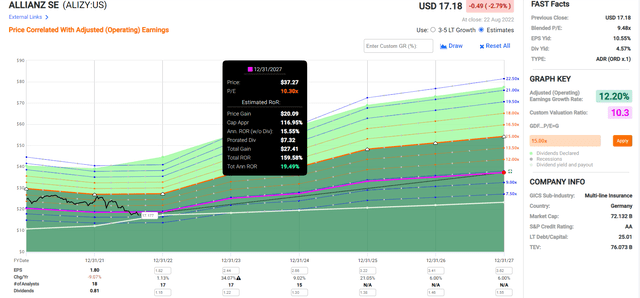

Allianz 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research Terminal)

Management and analysts expect ALIZY to deliver very strong 12% annual growth through 2027, which could translate into 160% total returns or almost 20% annually.

- Buffett-like return potential for the next five years

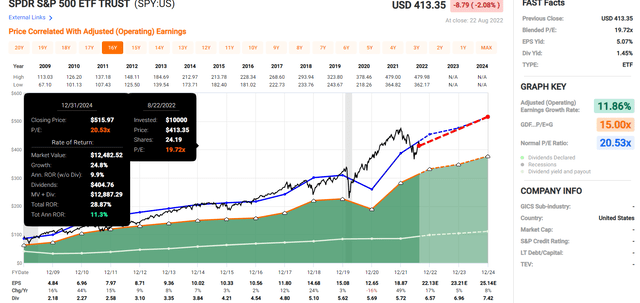

Now compare that to S&P 500.

S&P 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research Terminal)

Analysts expect solid 11% annual returns from stocks through 2024.

S&P 500 2027 Consensus Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

| 2027 | 45.94% | 7.85% | 5.89% | 3.62% |

(Source: DK S&P 500 Valuation And Total Return Tool)

But just 8% annual return through 2027.

- ALIZY offers over 3X the return potential of the S&P through 2024

- and 4X better return potential over the next five years

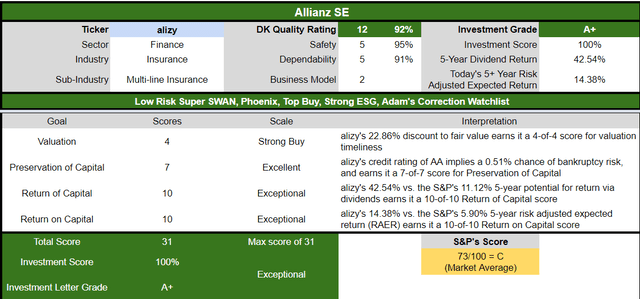

ALIZY Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

ALIZY is as close to a perfect high-yield Ultra SWAN as exists on Wall Street for anyone comfortable with its risk profile.

- 23% discount vs. 6% market premium = 27% better valuation

- 6.6% yield vs. 1.6% yield (4X higher and safer)

- 22% better consensus long-term return potential

- 3X better risk-adjusted expected return over the next five years

- 4X higher 5-year income potential than the S&P 500

Cummins: The Global Engine Master Is Learning New Tricks

Full Deep Dive On Cummins: Growth Prospects, Investment Thesis, Risk Profile, Valuation Profile, and Long-Term Total Return Potential

What makes Cummins a world-beater?

We think Cummins will continue to be the top supplier of truck engines and components, despite increasing emissions regulation from government authorities. For over a century, the company has been the pre-eminent manufacturer of diesel engines, which has led to its place as one of the best heavy- and medium-duty engine brands. Cummins’ strong brand is underpinned by its high-performing and extremely durable engines. Customers also value Cummins’ ability to enhance the value of their trucks, leading to product differentiation.” – Morningstar

Cummins has spent over 100 years earning a reputation for quality and helping companies meet ever stricter emissions requirements.

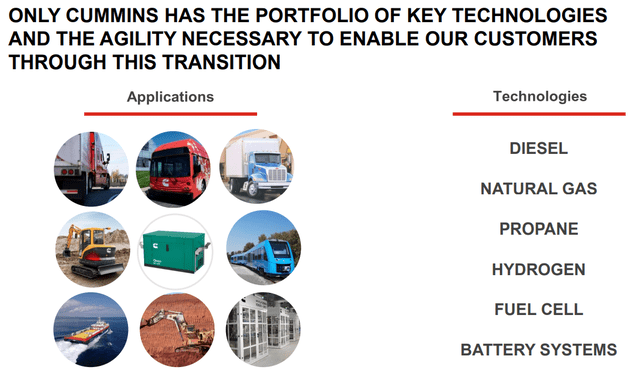

How can I be recommending a diesel engine maker when the world is shifting to electric vehicles and green energy?

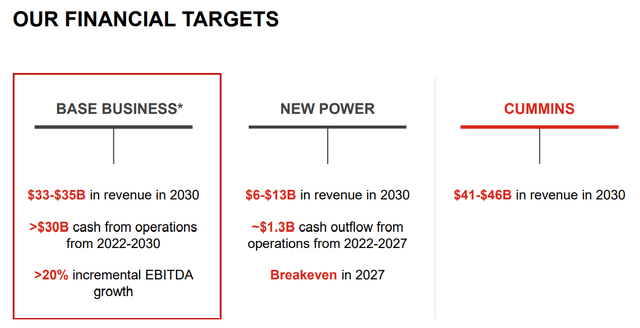

(Source: investor presentation)

Because Cummins is throwing its proven R&D skills and heft behind the green technology of the future.

(Source: investor presentation)

It’s an industry leader in hydrogen production, and McKinsey estimates it could be a $3.5 trillion global market by 2030.

It’s working on fuel cells and battery systems so it can help its customers electrify everything, including buses, trucks, trains, and construction equipment.

(Source: investor presentation)

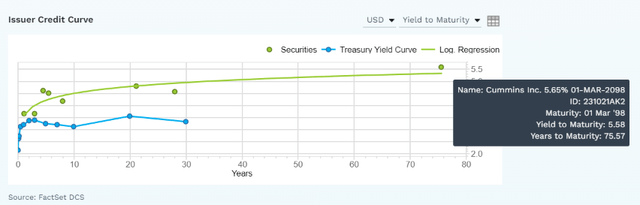

Credit rating agencies rate CMI A+ stable. This means a 0.6% 30-year bankruptcy risk, agreeing with management and the 24 analysts that cover CMI on Wall Street, that CMI will successfully pivot to a green energy future that involves no diesel engines.

Do you know who else agrees that CMI has a bright future?

The bond market is the “smart money” on Wall Street, 100% focused on preservation of capital and risk management. The bond market is so confident in CMI’s future that they are willing to lend it money out to 2098, 76 years, at a reasonable 5.7% interest rate.

Or, to put it another way, the most risk-averse investors in the world are willing to bet millions that CMI will outlive us all.

Do you know who else agrees that CMI can handle all the challenges ahead of it? Six rating agencies we use to measure long-term risk management.

CMI’s Long-Term Risk Management Is The 61st Best In The Master List (88th Percentile)

| Classification | Average Consensus LT Risk-Management Industry Percentile |

Risk-Management Rating |

| S&P Global (SPGI) #1 Risk Management In The Master List | 94 | Exceptional |

| Cummins | 82 |

Very Good |

| Strong ESG Stocks | 78 |

Good – Bordering On Very Good |

| Foreign Dividend Stocks | 75 | Good |

| Ultra SWANs | 71 | Good |

| Low Volatility Stocks | 68 | Above-Average |

| Dividend Aristocrats | 67 | Above-Average |

| Dividend Kings | 63 | Above-Average |

| Master List average | 62 | Above-Average |

| Hyper-Growth stocks | 61 | Above-Average |

| Monthly Dividend Stocks | 60 | Above-Average |

| Dividend Champions | 57 | Average bordering on above-average |

(Source: DK Research Terminal)

CMI’s risk-management consensus is in the top 12% of the world’s highest quality companies and similar to that of such other blue-chips as

- AbbVie: Ultra SWAN dividend king

- PepsiCo (PEP): Ultra SWAN dividend king

- W. W. Grainger: Ultra SWAN dividend king

- Bank of Montreal (BMO): Ultra SWAN

- Adobe: Ultra SWAN

- Microsoft: Ultra SWAN

How We Monitor CMI’s Risk Profile

- 24 analysts

- 2 credit rating agencies

- 7 total risk rating agencies

- 31 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk analysis

If CMI falters in its pivot to a green energy future, our 31 expert consensus panel will let us know. But for now, the future looks bright for this undervalued Ultra SWAN quality dividend growth blue-chip.

Reasons To Potentially Buy Cummins Today

| Metric | Cummins |

| Quality | 91% 13/13 Ultra SWAN |

| Risk Rating | Very Low |

| DK Master List Quality Ranking (Out Of 500 Companies) | 68 |

| Quality Percentile | 87% |

| Dividend Growth Streak (Years) | 17 |

| Dividend Yield | 2.80% |

| Dividend Safety Score | 92% Very Safe |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.4% |

| S&P Credit Rating | A+ Stable |

| 30-Year Bankruptcy Risk | 0.60% |

| Consensus LT Risk-Management Industry Percentile |

82% Very Good, Risk-Management |

| Fair Value | $268.53 |

| Current Price | $227.22 |

| Discount To Fair Value | 15% |

| DK Rating |

Potentially Strong Buy |

| PE Ratio | 12.8 |

| Cash-Adjusted PE | 8.3 Anti-bubble blue-chip |

| Growth Priced In | -0.4% CAGR |

| Historical PE Range | 14 to 15 |

| LT Growth Consensus/Management Guidance | 9.2% |

| PEG Ratio | 90.22 |

| 5-year consensus total return potential |

10% to 16% CAGR |

|

Base Case 5-year consensus return potential |

13% CAGR Vs. 8% S&P 500 |

| Consensus 12-month total return forecast | 10% |

| Fundamentally Justified 12-Month Return Potential | 21% |

| LT Consensus Total Return Potential | 12.0% Vs. 10% S&P and 11% Dividend Aristocrats |

| Inflation-Adjusted Consensus LT Return Potential | 9.8% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.54 |

| LT Risk-Adjusted Expected Return | 8.35% |

| LT Risk-And Inflation-Adjusted Return Potential | 6.13% |

| Conservative Years To Double | 11.75 |

(Source: Dividend Kings Zen Research Terminal)

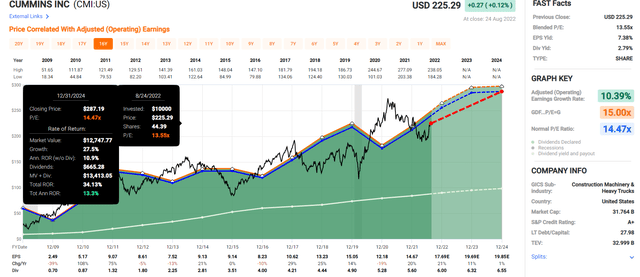

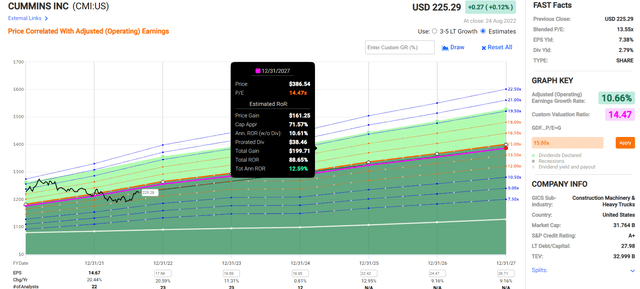

CMI 2024 Consensus Total Return Potential

(Source: Fast Graphs, FactSet Research)

CMI 2027 Consensus Total Return Potential

(Source: Fast Graphs, FactSet Research)

If CMI grows as expected and returns to historical market-determined fair value, investors could see 13% annual returns not just through 2024 but also almost double their money in the next five years.

- 25% better annual return potential than the S&P through 2024

- 2X better return potential over the next five years

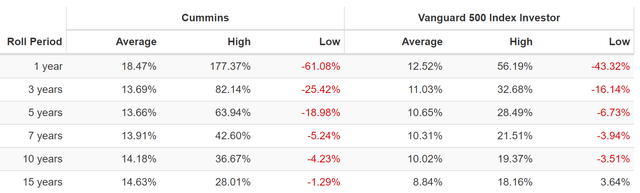

In fact, analysts think CMI could deliver 12% long-term returns for decades to come, similar to the 14% returns it’s been delivering consistently for the last 37 years.

CMI Rolling Returns Since 1985

(Source: Portfolio Visualizer Premium)

That means CMI delivered 21X inflation-adjusted returns over the last 37 years, and in the next 30 years, analysts expect 16.5X inflation-adjusted returns.

This wonderful company at a wonderful price, 8.3X cash-adjusted earnings, could change your life and help you retire in safety and splendor.

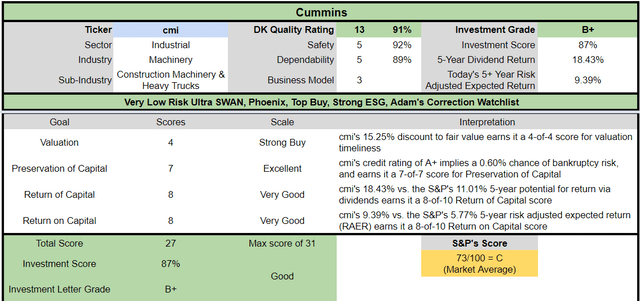

CMI Investment Decision Score

DK (Source: Dividend Kings Zen Research Terminal)

CMI is a reasonable and prudent anti-bubble Ultra SWAN choice for anyone comfortable with its risk profile.

- 15% discount vs. 7% market premium = 22% better valuation

- 2.8% yield vs. 1.6% yield (and much safer)

- 20% better consensus long-term return potential

- 2X better risk-adjusted expected return over the next five years

- 70% higher 5-year income potential than the S&P 500

Bottom Line: World-Beater Blue-Chip Bargains Are Your Easiest Road To A Rich Retirement

If you want to gamble and try to score a quick 10% to 20% in the stock market, then CNBC and Jim Cramer are for you, in my opinion.

If you want to retire rich and get steadily richer in retirement, turn off Bloomberg and focus on world-beater blue-chips at attractive valuations.

Allianz and Cummins are two global leaders in their respective industries that offer very safe and steadily growing dividends.

They are A-rated or even AA-rated risk-management experts with battle-tested management teams that have proven they can adapt and overcome any and all challenges they are likely to face in the future.

The only guarantee about stock returns in the short-term is that the market will move up, down, or sideways. But if you’re collecting very safe and steadily growing income, you’re being paid to wait out this current economic turmoil.

More importantly, you’re being paid to wait for two of the best risk-management teams in their industries to work hard for you, so that one day you won’t have to.

If you’re tired of praying for luck on Wall Street, turn off Cramer, stop gambling in speculative long-shots, and focus on world-beater blue-chips like ALIZY and CMI.

This is how you can take charge of your financial destiny, make your own luck on Wall Street, and retire in safety and splendor.

Be the first to comment