z1b

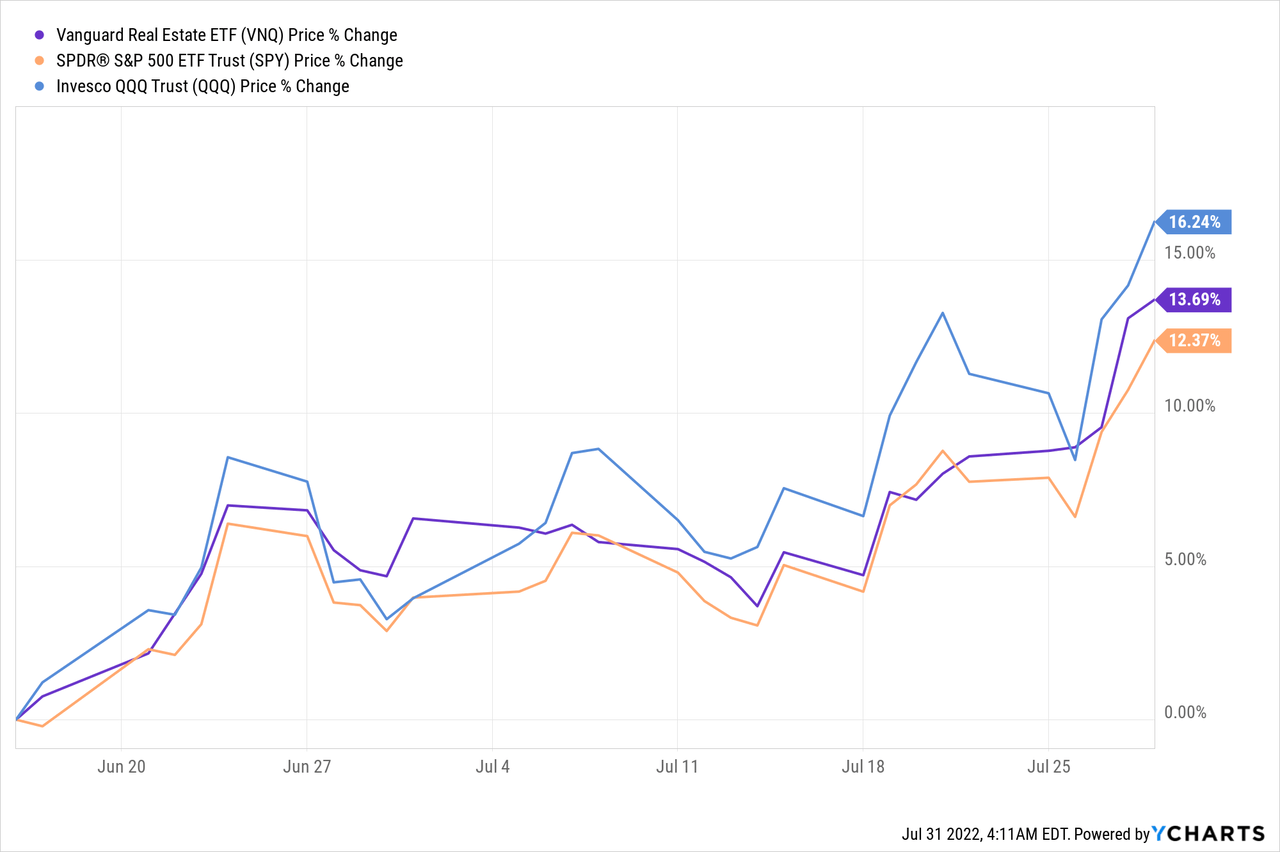

The market has been recovering over the past few days.

The S&P 500 (SPY) is up 12.4% from its lows. REITs (VNQ) are slightly more than that at 13.7% and tech stocks (QQQ) are leading the recovery, up 16.2%:

But despite that, there are still plenty of companies that remain discounted by up to 30% for no good reason.

Such opportunities are particularly abundant in the REIT sector right now.

When interest rates began to rise, the market went into panic mode and sold REITs as if they were going to suffer significant pain for a long time to come.

We think that this is a generational opportunity and expect a rapid recovery because the market is overlooking a few important things:

- Firstly, REIT balance sheets are today the strongest ever with low leverage and long debt maturities, and therefore, the impact won’t be significant.

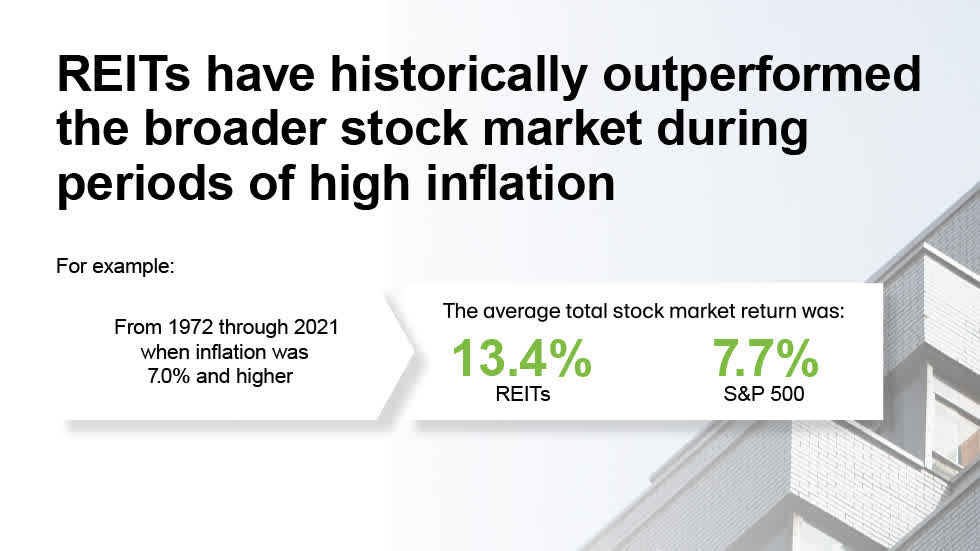

- Secondly, interest rates have been rising because of the high inflation, which benefits REITs by growing their rents and property values all while also inflating away their debt.

- Finally, the positive impact of inflation is far greater than the negative impact of rising rates because it impacts 100% of the balance sheet, and not just the debt, which is typically just around 30% of it.

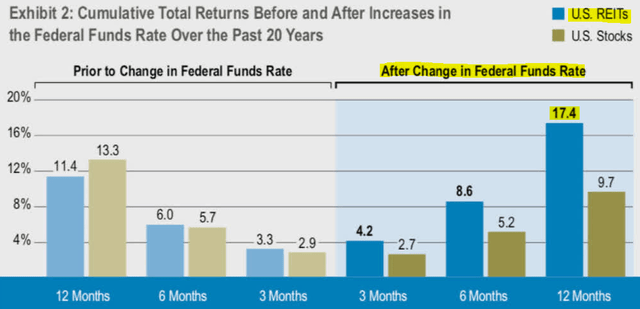

This explains why REITs have historically outperformed during times of rising interest rates, and especially so when inflation was high:

Of course, it is impossible to predict exactly when REITs will recover and our crystal ball isn’t any better than yours, but we are confident that a recovery will come as soon as the narrative shifts from:

“Avoid REITs due to rising interest rates”

to:

“Buy REITs to gain inflation protection and recession resilience.”

But what are the best REITs to buy today?

At High Yield Landlord, we have identified a list of 24 REITs that we are accumulating aggressively and these REITs typically share the following characteristics:

- They own assets that benefit from inflation.

- They generate cash flow that’s resilient to recessions.

- They have strong balance sheets with well-laddered debt maturities.

- They have great track records of shareholder value creation.

- They pay a dividend that’s expected to grow, regardless of a recession.

Put simply, they are what you would describe as blue chips in terms of quality, but they are temporarily discounted, and expected to bounce back rapidly as investors regain confidence in REITs.

In what follows, we highlight two such opportunities to buy before the market recovers:

STAG Industrial (STAG)

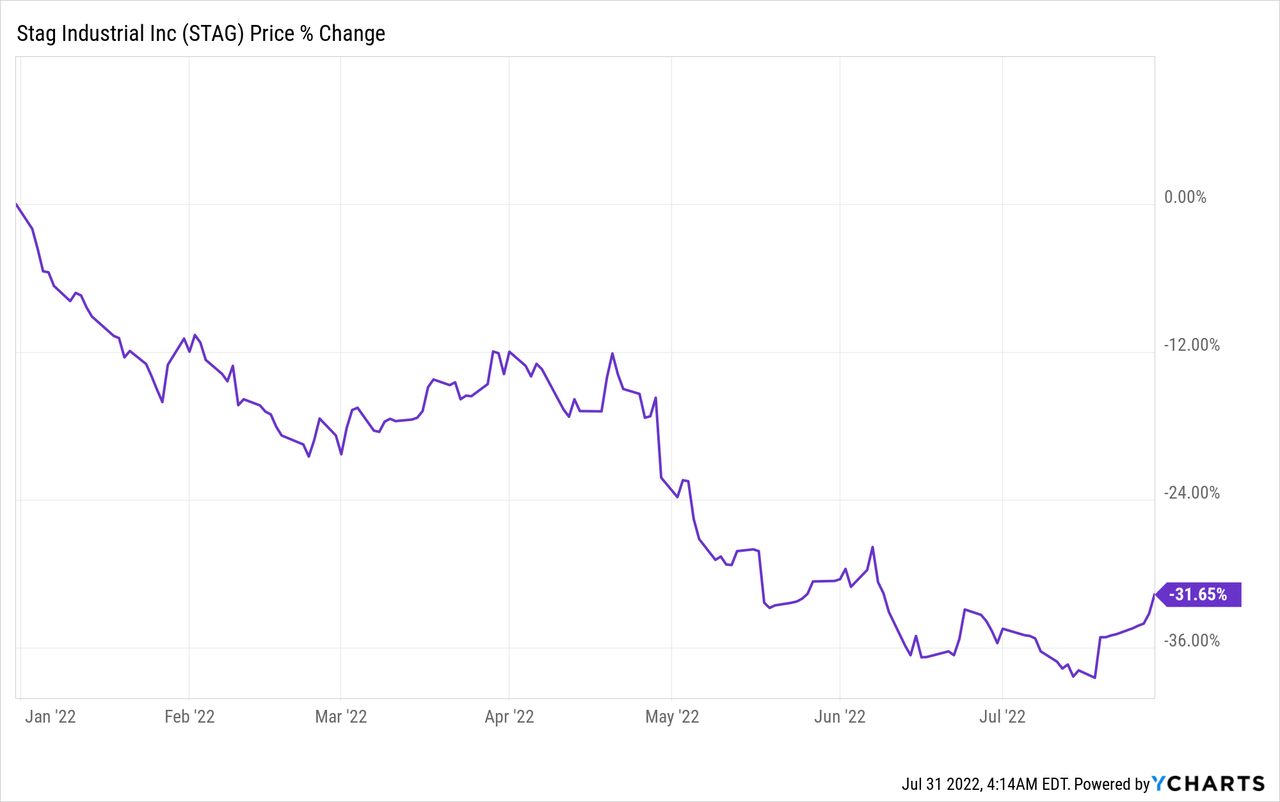

STAG is currently our Top Pick among industrial REITs. We like it so much because it is down over 30% year-to-date and that’s despite enjoying improving fundamentals over this same time period:

The management is quite literally telling us that their business is doing better than ever. They expect 2022 to be a record year in terms of organic growth as they are able to release vacated space with a ~15% rent hike. Here’s what the CEO noted on the recent earnings call. Emphasis added:

“The positive industrial backdrop coupled with our team’s operational excellence resulted in another strong quarter. Our portfolio is in great position to take advantage of the macro tailwinds for our sector, leading to record internal growth guidance for 2022.” said President and CEO Bill Crooker.” [emphasis added]

The industrial sector is doing so well right now because of three main reasons:

- The growth of e-commerce greatly accelerated during the pandemic and it absorbed a huge amount of industrial space.

- Increasingly many companies are now bringing back larger portions of their supply chains into the US because the pandemic and the war in Ukraine have shown them that being too heavily reliant on foreign countries, especially dictatorships like China and Russia, has downsides.

- To this day, the demand for new space outpaces the new deliveries as we are simply not building enough, in part because of supply chain issues, high construction costs, and rising interest rates.

STAG Industrial

One quarter ago, STAG’s occupancy rate was 96.9%. Now, it is 98.1%, which is a new record for STAG. It clearly shows you that there are more companies wanting to lease space than there are companies downsizing, despite all the negative headlines that you may read.

With occupancy rates now at near 100%, and STAG’s rents still below market, it is in a particularly strong position to keep hiking rents on expiring leases, and this is why the CEO is so bullish.

How do you then justify the 1/3 drop in its share price?

Is STAG overleveraged? No, it has a strong investment grade rated balance sheet with low leverage and high liquidity.

Was it overvalued? No, even at its peak, it traded at a large discount to peers, and since then, its internal growth has accelerated.

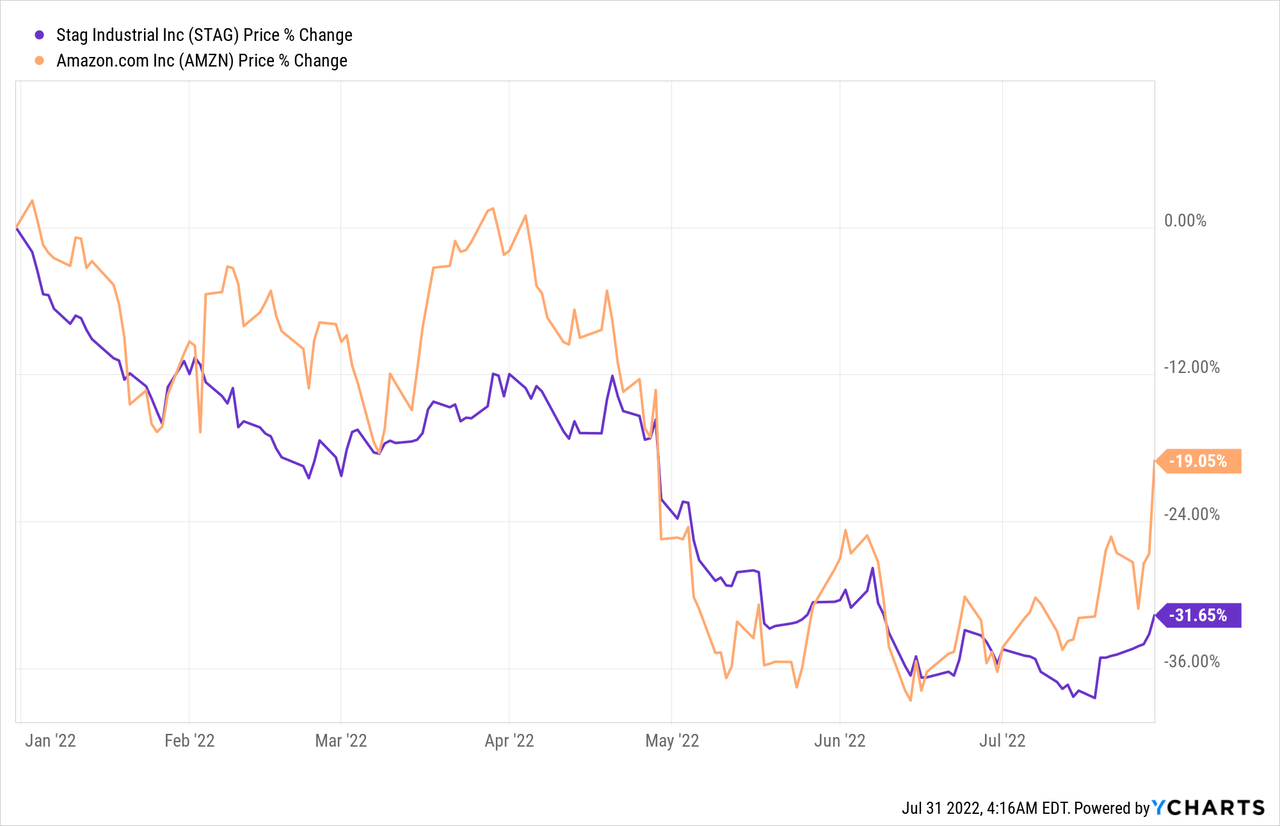

Could it just be a market overreaction? We believe so. STAG sold off particularly heavily due to reports that Amazon (AMZN) was scaling back its growth projects and expected to lease less space in the near future. Interestingly, STAG appears to have dropped almost in a straight line with Amazon as if their businesses were greatly correlated:

In reality, STAG’s business is well diversified and a few years of slower e-commerce growth is unlikely to have a material impact on its business.

As we have noted earlier, STAG’s rents are growing the fastest in the company’s history right now, which isn’t exactly what you would expect from a REIT that just lose 1/3 of its value.

As the market realizes that STAG’s business is doing so well, we expect a quick recovery to its previous highs, unlocking ~50% upside to shareholders and while you wait, you earn a near-5% dividend yield.

Federal Realty Investment Trust (FRT)

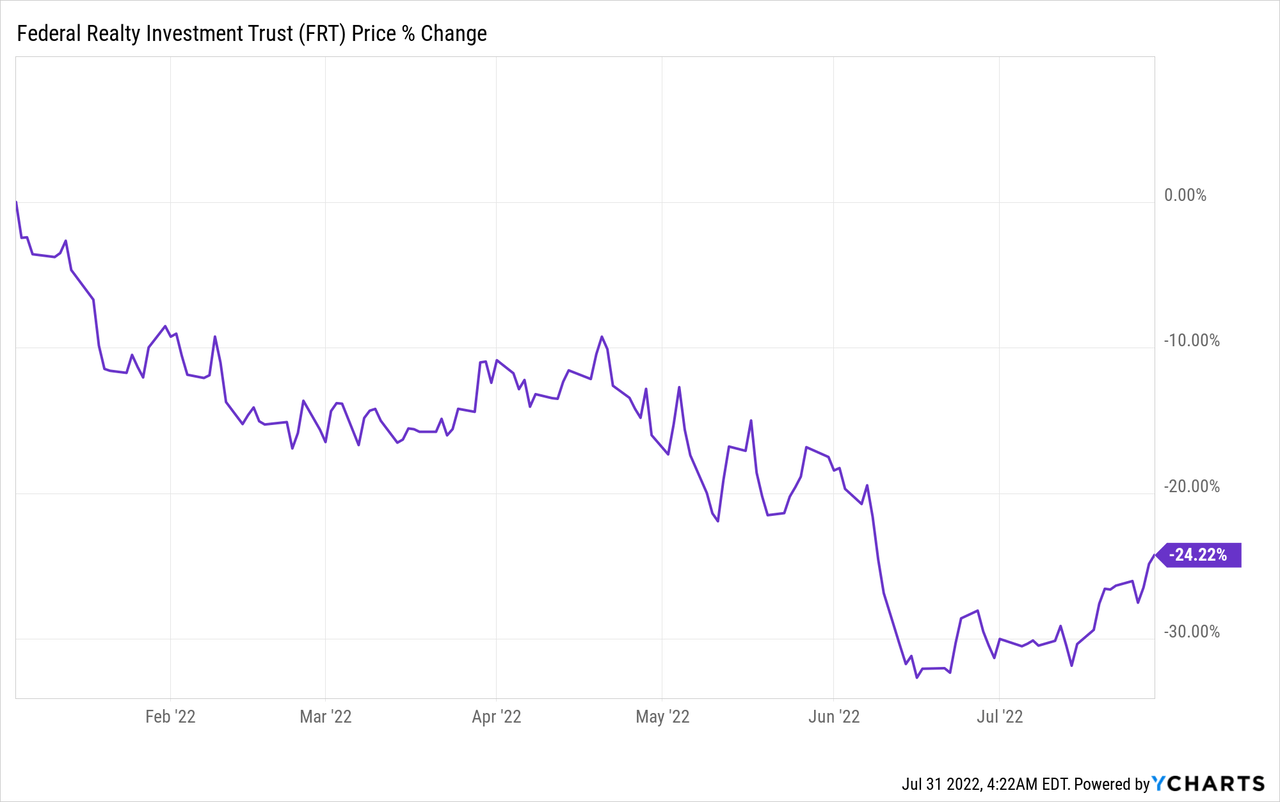

FRT has historically been perceived to be one of the highest-quality REITs of all time, and yet, it is down ~25% year-to-date:

Our analyst, R. Paul Drake, explained recently in his monthly portfolio recap that he has been accumulating more shares of FRT and I understand why.

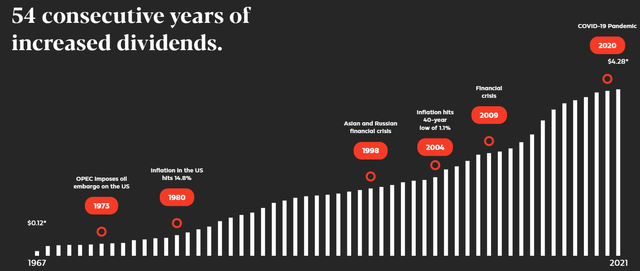

FRT is one of the most resilient REITs against recessions, rising rates, and inflation. It owns some of the best real estate on earth, has a fortress BBB+ rated balance sheet (Just shy of an A rating), and it has the longest dividend growth streak of all REITs at 54 years.

Yet, it is down heavily because many investors have miscategorized it as a “mall REIT”. Even Jim Cramer from CNBC has mistakenly referred to it as a mall REIT in previous interviews:

Since investors fear a recession and malls are cyclical, they have sold FRT in anticipation of that.

But in reality, FRT isn’t a mall REIT, and beyond that, they fail to recognize that not all retail real estate is created equal.

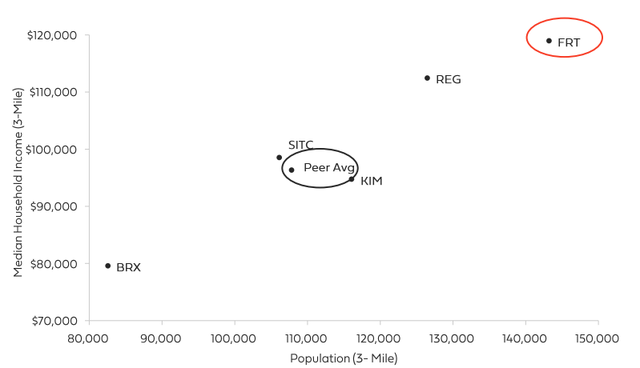

FRT owns quite literally the most sought-after retail real estate in the country. These are mainly mixed-use open-air retail properties that are located in the 1st Ring suburbs of premier cities with superior demographics and high-barrier to entry.

Most of these properties are anchored by grocery stores, which bring consistent daily traffic regardless of economic conditions, a lot of experiential uses like gyms as well as essential services, and even apartments, which generate 11% of FRT’s revenue.

Federal Realty Trust Federal Realty Trust

The diverse and resilient uses as well as the open-air, flexible format makes these retail properties much more defensive than regular malls.

And where FRT really stands out is its property locations. Its demographics are literally in a class of its own:

This matters a lot because higher-income households are less impacted by inflation and recessions. If you make $200k a year, your lifestyle likely won’t change as much as someone who makes $70k for instance.

Moreover, since these locations are densely populated, there are high barriers to entry and new supply is very limited. It results in healthier supply/demand dynamics that reduce the cyclicality of rents and property values.

It also explains how FRT has been able to grow its dividend for 54 years in a row, despite numerous crises that were far worse than a regular recession:

Real estate is all about “location, location, location…” and when you own resilient real estate in some of the very best locations of premier cities, you enjoy stronger bargaining and pricing power with your tenants since there is a long line of other tenants willing to take up space in case of vacancy.

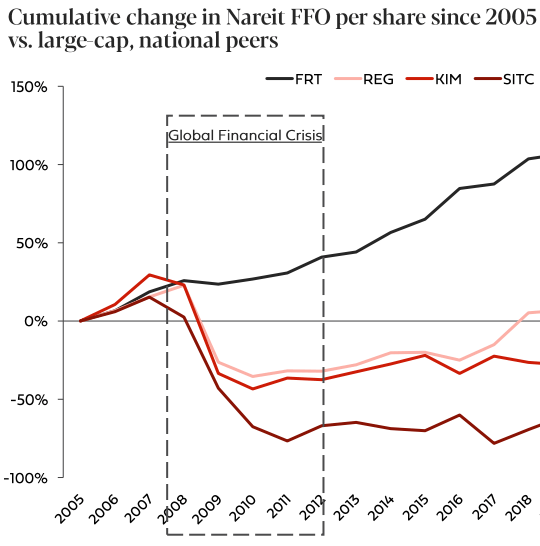

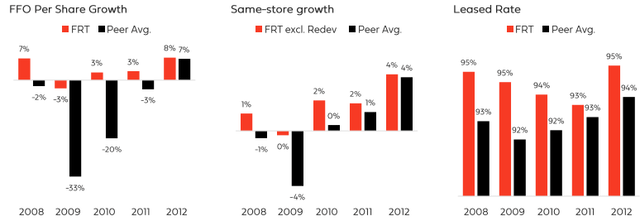

Diving deeper into FRT’s historical performance, we find that its cash flow barely dipped in 2008 and it resumed its growth in 2009 already. Here is a comparison to other large-cap shopping center REITs:

Federal Realty Trust

Here’s more data on FRT’s performance versus peers during the great financial crisis:

Today, FRT’s portfolio is even stronger and better diversified than it was back then, which speaks highly of its resilience if and when we hit a recession.

In fact, FRT actually increased its growth guidance for 2022 earlier this year. It expects its FFO per share to grow by ~7% and it could grow even faster if it decided to add more debt on its balance sheet to acquire additional properties.

In any case, it is hard to justify the recent 30% drop, unless you mistakenly perceive FRT as a mall REIT that’s headed into a recession.

This misperception of others is an opportunity for us. The company is now priced at a very reasonable 16x FFO and a 25% discount to NAV according to the consensus NAV estimates of analysts who follow the company.

Getting a 25% discount on some of the highest-quality real estate that’s conservatively financed and exceptionally well-managed is a great deal and for this reason, we recently bought more shares of the company.

We think that it has an easy 30-50% upside from here, and while we wait, we earn a 4.4% dividend yield. Even ignoring any upside from repricing, FRT should be able to deliver double-digit total returns from its yield and growth alone.

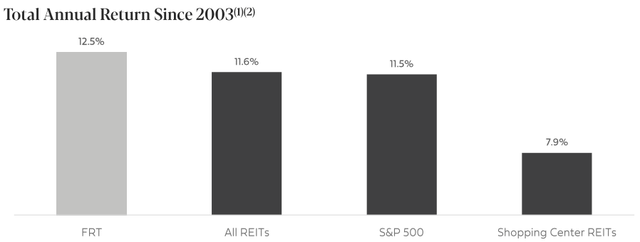

Historically, FRT has consistently provided above-average returns with below-average risk throughout the cycles, and that’s what active investing is all about:

Bottom Line

In a weird way, we expect certain types of REITs like STAG and FRT to actually benefit from a recession.

It will cool off the inflationary pressures and cause interest rates to fall back down, removing the primary concern of investors.

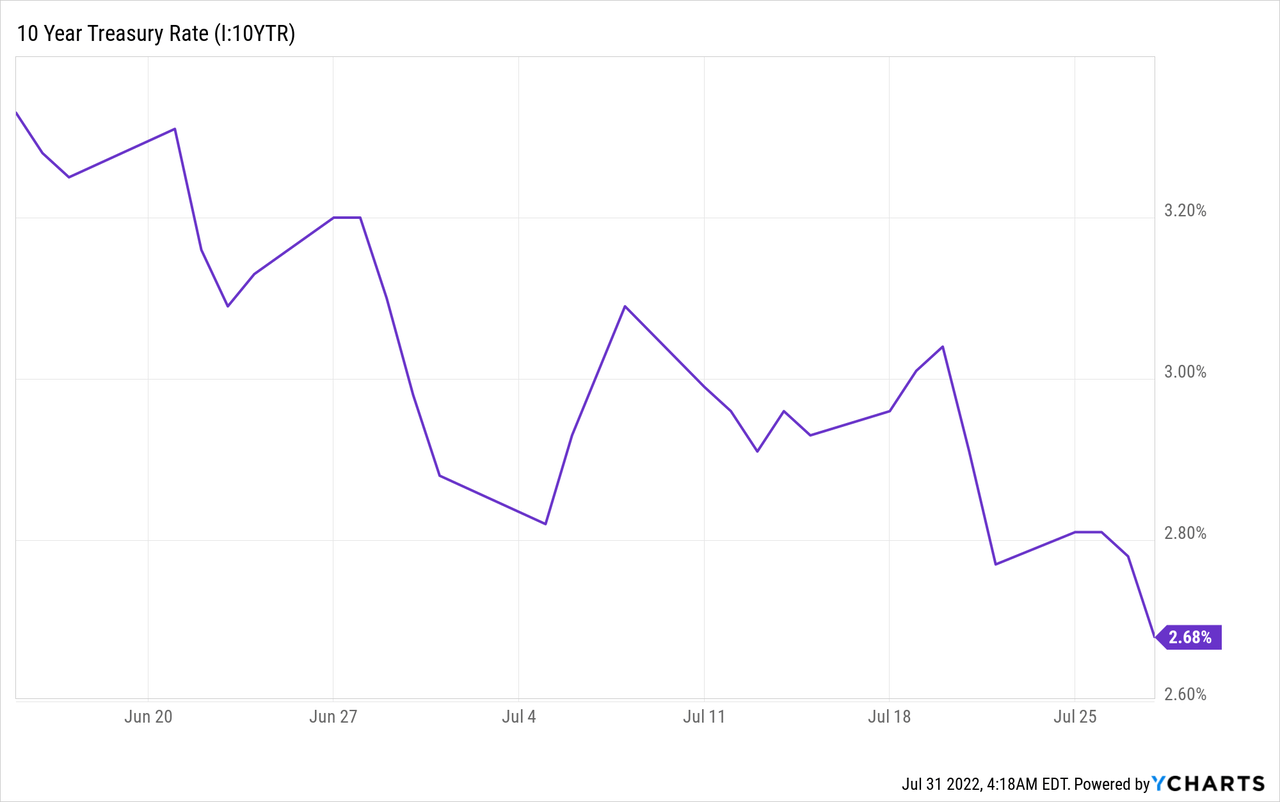

In fact, this appears to be slowly unfolding at the moment.

The 10-year treasury peaked recently and it has been dropping for a month. At the same time, the yield curve recently inverted, which is a clear sign that a recession is coming, which also means that inflation will likely cool off:

I think that this will ultimately cause a shift in narrative and result in a rapid recovery in REIT share prices.

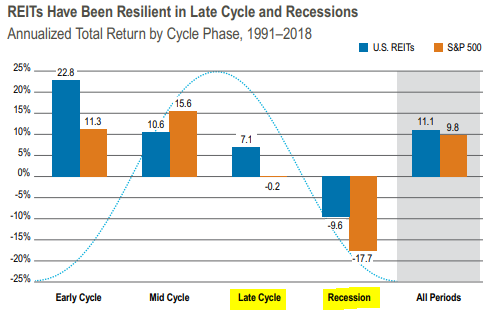

Typically, REITs drop by 9% on average during a recession and outperform other stocks because their businesses are quite resilient to recessions.

Cohen & Steers

Yet, today, we have many REITs like STAG and FRT that are already discounted by 30%, and the reasoning for this discount does not make sense.

We are loading up on these opportunities while they last. You may want to do that too.

Be the first to comment