RHJ/iStock via Getty Images

When you hear the term “Diamond in the Rough,” what immediately comes to mind?

If you have kiddos at home – or had them at home in the past 30 years – you might recall a repeated line from Disney’s animated movie Aladdin. Or, if you’re one of my younger readers, you might find yourself having a flashback to your own days as a child.

In the film, Jafar, the Sultan’s scheming grand vizier, wants to procure a special lamp from “The Cave of Wonders.” Problem is, it’s a very selective cave with a strict set of rules… starting with this:

“Only one may enter here: one whose worth lies far within. The diamond in the rough.”

That’s more than a little limiting, but Jafar has his methods of figuring out whose who and what’s what. And so, with the help of a talking parrot, he’s able to identify and locate a humble “street rat” named Aladdin.

The kid looks nothing like anyone worthy of entering a mystic, treasure-filled Cave of Wonders shaped like a tiger’s head. He’s a thief whose only friend is a monkey named Abu, and the only other people who know he exists – local merchants, harem girls, and (for some reason), the palace guards – think he’s nothing more than a reprobate.

Yet that unimpressive lowlife goes on to hobnob with royalty, win the heart – and eventual hand – of the princess, and save the kingdom.

It just takes a little time to get from the unimpressive Point A to the man-of-the-century Point B.

“Under The Filth And Fleas”

Now, the story of Aladdin is hardly a Disney original. It’s from Arabian Nights, a collection of Middle Eastern tales from the 8th to 14th centuries… a little while before the era of Mickey Mouse.

At the same time, I’m pretty sure it was Disney that applied the whole “diamond in the rough” angle. And, man, but was it a good one.

Not only is it extremely engaging – because, hey, who doesn’t like stories about an underdog? – but it’s also a great reminder not to be fooled by appearance. While, yes, many (maybe even most) things that look like junk are, in fact, junk.

There are exceptions to the rule.

We get another noteworthy reminder of this in the Broadway version of Aladdin. One of its original songs is flat-out titled “Diamond in the Rough” where Jafar tries to convince the hero to play along with his plans.

Here’s part of it:

“Under the filth and the fleas, there are gifts that you’ve been neglecting.

And truth be told, you are not quite the guy that we were expecting.

And though you might need finesse and perhaps some… disinfecting,

You’ll be the one who succeeds when the lamp [out there] needs collecting.”

Admittedly, Jafar was only in it for himself, with every intention of killing Aladdin and keeping the treasure to himself. But I never said the story was a perfect fit for the real estate investment trusts (REITs) you’re waiting for me to reveal.

I do, however, think it serves as a compelling introduction with some valuable reminders.

More “Unpolished REIT Gems” To Reveal

On May 26, I wrote about “2 Small-Cap Unpolished REIT Gems,” clearly working off the same theme I’m today. The two stocks it listed were:

- City Office REIT (CIO), the spinoff from Realty Income (O) and Vereit’s merger

- NewLake Capital (OTCQX:NLCP), a much smaller competitor of Innovative Industrial Properties (IIPR).

As I concluded:

“I’ve been a REIT analyst for over a decade now, and there’s a lot I love about what I do. But one of my favorite things is spotting needles in the haystack.

“And I think I’m pretty good at it considering how well iREIT on Alpha’s Small-Cap Portfolio has done.

“It takes a lot of work, and I’m often subjected to criticism in the process. However, it all pays off eventually as these unpolished gems turn out to be spectacular finds in the end.

“As I explained earlier, ‘Emeralds in their natural state aren’t automatically gorgeous. They need to be verified by an expert, cut, and polished before they’re ready to grace someone’s ears or neck or fingers.’”

I know it’s only been a few weeks since I uncovered such possibilities. Typically, I try to space them out a bit more than this.

But sometimes when inspiration kicks in, I have to go with it regardless of the optics.

I also know this market isn’t exactly one that inspires people to take chances. Investors are running further and further away from speculative positions and further and further into value plays.

Fortunately, though, you don’t have to stray too far away from the latter to get where I’m taking us today. The REITs below still have class… just not as much cash as they probably will someday soon enough.

Small Cap Pick #1

Sachem Capital (SACH) is a commercial mREIT that specializes in originating short-term, high-yielding real estate loans, historically targeting the “fix-and-flip” and real estate development markets.

All loans secured by first lien mortgages with conservative maximum 70% loan-to-value ratio; all loans require personal guarantee by the principals of the borrowers.

One key differentiator for SACH its approach to origination, it can close a loan in as quickly as five days, whereas the competitors can take 3-6+ months. Due diligence is more centered around the value of the collateral rather than the property cash flows or borrower’s credit.

The company continues to diversify holdings, including larger loans with established developers, and it’s also expanding lending operations across the U.S. with a presence in 14 states, with a strong core focus along the Eastern seaboard.

In Q1-22, SACH generated approximately $10.3 million in revenue compared to approximately $5.7 million for Q1-21, an increase of approximately $4.6 million, or 80.3%. The increase in revenue was primarily attributable to an increase in lending operations.

Net income in Q1-22 was approximately $3.4 million, or $0.10 per share, compared to approximately $2.2 million, or $0.10 per share for Q1-21. Adjusted earnings were approximately $4.5 million, or $0.13 per share, compared to approximately $2.2 million, or $0.10 per share for Q1-21.

At $.13 per share, SACH was able to sustain the $.12 per share dividend and have a little left over. Keep in mind that most mREITs payout out 100% of their core earnings, this we consider SACH’s ~11% dividend yield safe, all things considered.

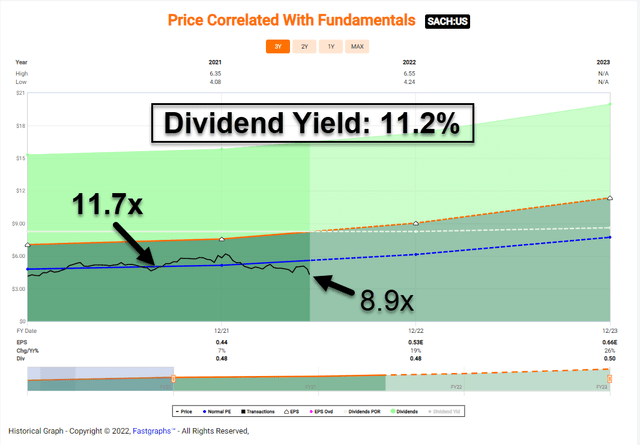

Fast Graphs

Keep in mind, SACH is a small cap ($185 million market cap) so this pick is much more susceptible to mood swings. There are also just four analysts tracking the name, but even with this small sample size, the consensus growth estimates are very attractive: +19% in 2022 and 25% in 2023.

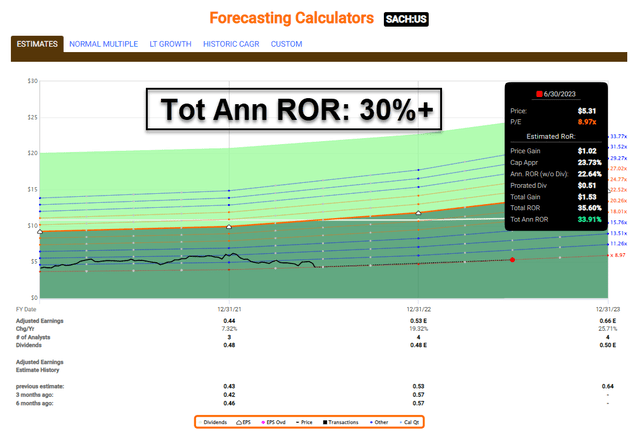

Our conservative model for SACH has the company returning 30% over the next 12 months. We’re happy to own a healthy slice of SACH in our Small Cap portfolio, recognizing this portfolio is designed for higher risk profiles.

Fast Graphs

Small Cap Pick #2

City Office (CIO) is a small cap ($575 million market cap) REIT that owns high-quality office properties in 18-hour cities in the Southern and Western United States. The portfolio is spread across these markets: Orlando (8%), Tampa (13%), Raleigh (18%), Dallas (15%), Denver (9%), Phoenix (23%), Sane Diego (5%), Portland (4%) and Seattle (5%).

We like the CIO model because most properties are located in low or no state taxed markets that drive a diverse employment base with national and international employers.

COVID-19 served as a catalyst for CIO as the company has focused on value-enhanced leasing, rent collection and growing property cash flow. The company targets properties valued between $25 million and $100 million and the top 5 tenants are:

- Seattle Genetics (3.5%)

- WeWork (3.0%)

- United Healthcare (2.9%)

- Ally Financial (2.7%)

- HF Management (2.6%)

- H. Lee Moffitt Cancer Center (2.6%)

CIO’s Q1-22 net operating income was $28.4 million, which was $3.3 million higher than the amount reported in Q4-21 (primarily a result of the acquisitions completed in Q4-21). CIO reported a core FFO of $17.6 million or $0.40 per share, which was $1.8 million higher than Q4-21 and also represents the highest core FFO per share in the company’s history.

That was driven by the sale of the life science portfolio in Q4 and the recycling of that capital into the three acquisitions completed in December. AFFO was $8.3 million or $0.19 cents per share.

Also in Q1-22, Same Store cash NOI was in line with expectations at negative 4.7% (or $1 million lower compared to Q1-21).

Same Store cash NOI was impacted by lower occupancy year-over-year, contributing $500,000 or half of that decrease when BB&T vacated their space at Park Tower to accommodate a new 73,000 square foot tenant. That new tenant lease commences on May 1, 2022, but will not begin paying cash rent until February 2023.

CIO has total debt of $662 million and the net debt (including restricted cash) to EBITDA, was 6.0x. There are no debt maturities in 2022 and two small maturities in the fall of 2023.

CIO was one of our best picks in 2021 and while we sold most of the shares at the peak, we’re now gobbling up shares again due to the pullback.

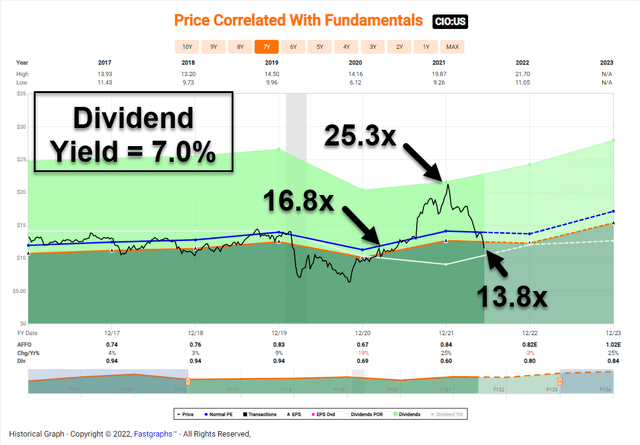

Fast Graphs

We like the margin of safety, as CIO is now trading at $11.46 per share with a P/AFFO of 13.8x (average multiple is 16.8x). More importantly the growth is impressive, analysts estimate 25% AFFO per share growth in 2025 which means the dividend should be well-covered at 82%.

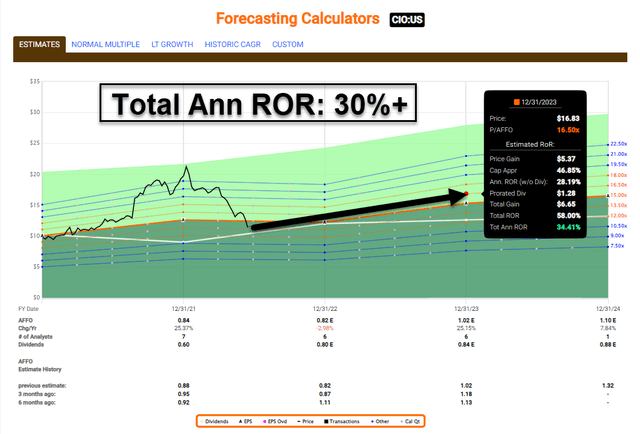

As viewed below, we’re modeling CIO to return at least 30% over the next 12 months, while collecting a 7% dividend yield for just waiting.

Fast Graphs

In Closing…

Our small cap picking skills are getting better by the day, as our team is always laser-focused on mining these so-called “diamonds in the rough”. It does take a certain degree of TLC (tender loving care) to vet these REITs, but it’s well worth it when we see the results paying off.

Earlier today, I spent an hour or so with the management team of Strawberry Fields REIT that filed a registration to go public as a skilled nursing REIT.

The company owns 78 properties leased to Skilled Nursing Facilities (SNFs), Long Term Acute Care Hospitals (LTACHs) and Assisted Living Facilities (ALFs) located across nine states: Arkansas, Illinois, Indiana, Kentucky, Michigan, Ohio, Oklahoma, Tennessee and Texas.

This is just one example as to how we will begin to dissect the business, even before listing (on Nasdaq) in an attempt to deliver alpha for our members. We will not turn over every rock, recognizing that there could be a diamond in the rough, or to use another analogy, “a needle in the haystack”. Better yet,

“Let’s go make some hay while the sun is shining!”

Be the first to comment