Charday Penn/E+ via Getty Images

Let no one say Brad Thomas isn’t a man of his word.

On September 14, I published “If I Were to Own Just 5 REITs, Here’s What They’d Be.” To know what those five were, you’ll just have to read it.

I’m only mentioning it here because of how it ended:

Once more, I’ll stress that I am not advocating to own just these five REITs [real estate investment trusts]. And while I provided you with a list of some fan favorites, there are others that we recommend at iREIT on Alpha that provide sound risk management guardrails.

Believe me, I’ve seen plenty of one-hit wonders… the funny thing is that everyone likes to talk about the winners, but not so much the losers.

So, in a few days, I promise to write an article on my losers. And the most important lesson to learn is that I hold far more winners.

Over the years, I have learned that transparency is critical to the trust-building process… that’s why showing you the good, the bad, and the ugly is what life is all about.

I have nothing to hide when it comes to my stock market strategy and how well it works. Because it works very, very well.

If it didn’t, I wouldn’t be on here touting it day in and day out (with more followers than anyone on Seeking Alpha). I genuinely want to see you succeed, which is why I tell you about all my success stories.

And why I’m sharing the opposite as well.

I Try to Make My Mistakes Count

Here’s the thing about mistakes: Everyone makes them. And anyone who claims otherwise is selling something. Namely snakeskin oil.

Moreover, we start out making mistakes young. Asking stupid questions. Believing silly answers. Doing foolish things.

I did it. My kids did it. And my grandson – and whatever other grandchildren are down the road – will do the same.

Hopefully though, we learn from our mistakes. We grow. We figure out better ways to live life.

A seemingly silly example is something I shared earlier this year about playing Monopoly with my dad back when I was a kid. I loved the game and I loved being with him, but man was he brutal – beating me time and time again.

It took me a number of losses before I realized how he reigned so supreme over that street name-filled board. But in the end, I got it nonetheless.

The key is diversification – the same principle as that first line I quoted before: the advice not “to own just these five REITs.” I was always leaving the railroads and utilities alone, letting Dad snatch them up instead.

Admittedly, I should have then known better as I built my “big kid” commercial real estate development business two decades later. If I had better diversified there (and invested more than I spent), I would have come out of the housing market bubble bursting in a much healthier state.

I guess some lessons some people have to learn more than once. Call us thick-skulled if you want, but I think we’ve all been there and done that before.

Again, it’s part of being human.

History Might Not Repeat, but It’s Worth Studying Anyway

Of course, if we can make being human easier on ourselves, all the better. That’s why, along with trying, failing, and learning, it’s great to study other people.

What they did right.

What they did wrong.

What they did afterward.

History doesn’t repeat itself, we all know. But, as someone said somewhere (apparently it might not have been Mark Twain as I’ve always believed)…

History does rhyme.

So the more of the previously established pattern we can study, the better we’ll be able to figure out what comes next.

Admittedly, sometimes things just happen out of the blue. Those are called black swans – negative occurrences that just couldn’t be predicted.

The 2020 shutdowns were one such set of unfortunate circumstances. Yet even then, I was able to navigate them.

I don’t say that to brag. I say it to encourage.

I very well remember telling everyone that, contrary to what I’d previously believed… early 2020 actually was different. And since it was different, I paused my buying activity and used that time to assess the situation instead.

Once I’d gotten what I thought to be a good grasp of the situation, I started moving forward cautiously. I recommended this REIT here. That REIT there. Until slowly, I built my readers and the portfolios they love back up to speed.

Because even in those unprecedented times, I remembered how well keeping my cool had worked for me before.

I just wish I’d thought so clearly with the three memorable stock market mistakes I made as detailed down below.

My Worst Performers Year-to-Date

As a portfolio manager, it’s critical to always carefully evaluate each holding in the portfolio to determine whether the position is enhancing or destroying value.

One of the reasons that I’ve been able to rebuild my net worth over the last decade is to never fall in love with any stock and to always focus on underlying fundamentals.

It’s imperative to examine your portfolio with a truly unbiased perspective in order to conduct proper due diligence, as Howard Marks pointed out,

Risk assessment is an essential element in the investment process.

Marks went on to say,

Great investing requires both generating returns and controlling risk. And recognizing risk is an absolute prerequisite for controlling it.

Today I want to take a closer look at my worst REIT performers and determine whether to make changes, once gain citing Marks,

Skillful risk control is the mark of the superior investor.

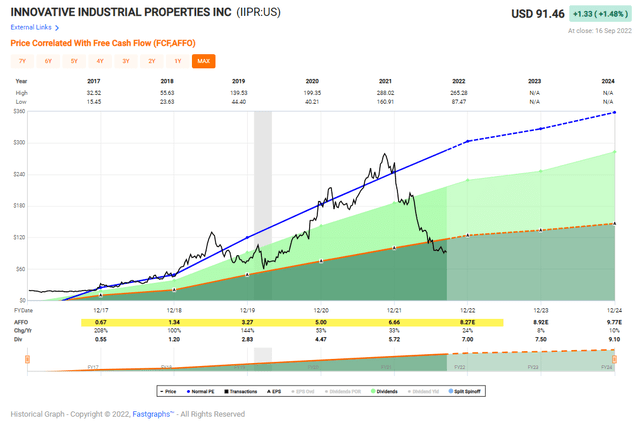

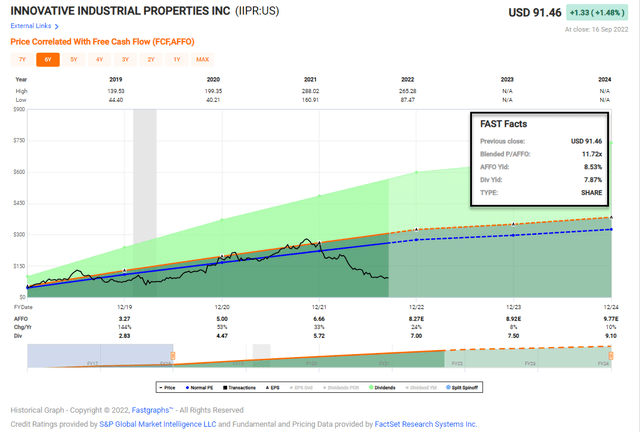

My worst performer YTD is Innovative Industrial Properties (IIPR), down over 60%. Since my first purchase in December 2020, shares have returned an average of -36% annually.

It has certainly been hard to stomach that much red ink, especially when the company has maintained relatively strong fundamentals.

Over the last five years the company has generated average earnings (AFFO per share) growth of 70%, although it has slowed substantially (estimated at 24% growth in 2022).

The balance sheet is pristine with a debt to gross asset ratio of just 12%, consisting solely of unsecured debt with no maturities in 2022 or 2023 and $300 million of that debt not maturing until 2026. IIPR has a debt service coverage ratio of 15.7x and the targeted dividend payout ratio is 75% to 85% of AFFO on a stabilized portfolio basis.

For Q2, that payout ratio was 82% and recently the company announced a 2.9% dividend increase, from $1.75 per share to $1.80.

Last summer the company disclosed one of its top tenants, Kings Garden, had stopped paying rent, and in an article, I explained that “on July 25, 2022 IIPR filed a Breach of Contract Complaint versus Kings Garden, Inc., IIPR’s 4th largest tenant.”

Last week an 8K was filed by IIP explaining that “on September 11, 2022, the parties to the Lawsuit entered into a confidential, conditional settlement agreement pertaining to matters related to the Lawsuit.”

That’s a good sign, and of course there’s no indication as to whether rent will commence soon, but the fact that IIPR settled the lawsuit in a quick time (~45 days) demonstrated the aggressive stance of the cannabis REIT.

More good news, as reported at iREIT on Alpha, is that IIPR’s founder and Chairman, Alan Gold, has been buying shares. More recently he purchased shares on August 10th and August 12th (around $200,000 total).

In addition, it appears IIPR is back on the offense, recently announcing a closing on 104,000 square foot facility leased to Curaleaf Holdings (CURA) for $21.5 million ($207 per square foot).

These are all good signs, yet IIPR and most all cannabis-related stocks are experiencing a massive sell-off.

Meanwhile, more and more states are opening up to cannabis, while the SAFE Laws (interstate) have caused investors angst, recognizing that eventually the playing field will become more competitive.

Analysts are also cautious, as IIPR is expected to grow by just 8% in 2023 and 10% in 2024. That’s still above average in REIT-dom, but certainly not the average 70% growth I described above.

So IIPR is now trading at $91.46 per share with a P/AFFO multiple of 11.7x, a far cry from the average P/AFFO multiple of 36.7x. I’m certain the 30+ multiple days are over for cannabis landlords, but it seems reasonable to compare the company to Industrial REITs like STAG (STAG) and Plymouth (PLYM).

- IIPR: 11.7x

- STAG: 16.6x

- PLYM: 14.3x

I’ve visited a few IIPR properties, and I consider the quality of these properties comparable to STAG and PLYM buildings, with the exception that IIPR’s buildout for their properties are much more complex.

These buildings are highly specialized, and they require a license to operate, which also makes them valuable, especially the limited license states.

And this brings me back to Kings Garden and the lawsuit that was settled.

Depending on the resolution, I suspect that there could be a spike to IIPR’s price if the outcome is positive. The last thing an investor wants is for a building to sit idle, and if IIPR’s management team can deliver good news (Q3 earnings) the market should react accordingly.

So, I will be sitting tight, waiting to seek how things are resolved, and there’s a possibility that I will add more shares, depending on my overall portfolio allocation. I’m also reinvesting dividends, so my underweight position is growing.

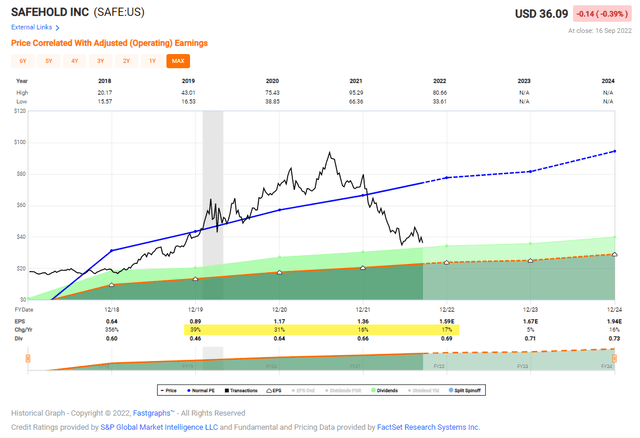

My second worse pick YTD is Safehold (SAFE), down 55% this year, a pure play ground lease landlord that owns ~$3.9 billion in assets with a portfolio that includes over 350 investments across 8 asset classes, with a weighted average life of 18 years.

The argument for a REIT like SAFE is above-market inflation-protected cash flows from attractive lease deals that are fundamentally protected by the land involved.

The company targets a 3% initial yield with 2% annual rent bumps based on 10-year CPI lookbacks and targets a 3% annual raise in today’s environment.

Also SAFE has a decent capital structure.

It has $3.4B worth of debt with a weighted average maturity of 23 years, which comes to debt at an equity market cap level of 0.9x. An effective interest rate of 3.6% and an annualized yield of 5.1% gives us an effective spread of 152 bps or 1.52%.

SAFE is BBB+ rated by Fitch and Baa1 by Moody’s confirming just how safe the market thinks this business model is.

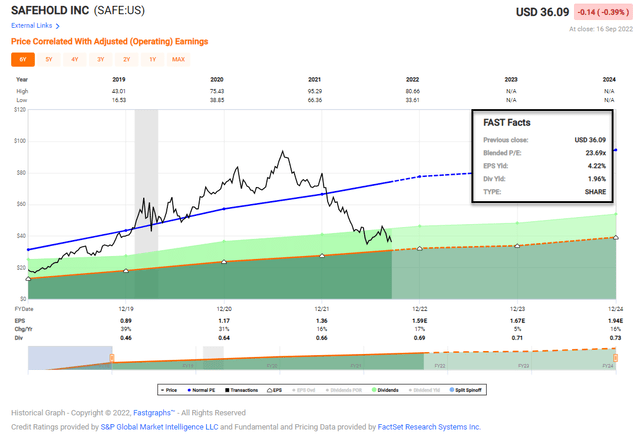

More recently, as I pointed out in an article, “STAR announced that it had filed an amended 13D, disclosing that a special committee of the Board of Directors of STAR and a special committee of the Board of Directors of SAFE are in advanced discussions with respect to a potential strategic corporate transaction and that they are proceeding to negotiate definitive agreements.”

This is no surprise to us, as we have been suggesting for months that STAR and SAFE should merge, and now that STAR has sold its net lease portfolio, the bulk of the remaining STAR assets are non-core legacy assets ($414 million) and loans ($204 million).

Also, as I pointed out, “MSD Partners (Michael Dell’s family office) will purchase 5.4M shares of SAFE from STAR, which STAR will use to pay down debt. MSD will also buy 100,000 units of Carat from SAFE for a total of $20M ($200/unit) – more on Carat later.”

The stock deal (5.4 million shares) was at $37.00 per share which translates into a $200 million price, validated by Michael Dell’s family office.

MSD purchased the shares from STAR and while this transaction may seem unusual, keep in mind that Dell has a track record for investing in founder-led businesses like SAFE (run by Jay Sugarman).

Also, included in the internalization of the external manager, SAFE will become a more “investable” stock with a broader set of investors. As viewed below, the transaction will more than double SAFE’s free float and diversifies its shareholder base.

One big positive for SAFE is that the company will no longer be clouded by the complexity of its external manager STAR; however, there’s execution risk to consider, and of course that’s currently reflected in the cheap share price.

Similar to IIPR, SAFE was once a best-former based on earnings (per share). As seen below, the company grew EPS by an average of 26% over the last four years.

However, much like IIPR, SAFE has cooled off, as analysts are forecasting growth of 5% in 2023 and 16% in 2024 (the average growth over 4 years is 26%).

Shares are now trading at $36.09 with a P/E of 23.7x, compared with the average multiple of 49x. There are no direct peers (at least for public REITs) and the dividend yield of just under 2% appears rock solid.

Catalysts?

I mentioned simplification already.

The key is growth and while SAFE has a solid pipeline, the real trick is going to be generating above average ROE that leads to solid shareholder returns. As for me, I’ve already participated in a healthy dollar cost averaging program by investing in shares in late June at $37.94.

I’m maintain limits here though, maintaining my rules of no more than 1% of capital to speculative holdings like IIPR and SAFE.

Closing Thoughts

It took some guts to tell the world about two of my biggest losers, but I can comfortably disclose these picks because I fully grasp the power of diversification.

I really don’t want to be a one-hit-wonder here on Seeking Alpha.

Instead, I prefer to be a voice of reason, always attempting to help you navigate REIT-dom with sensible investment picks.

The good news is that I loaded up on shares in VICI Properties (VICI) and Hannon Armstrong (HASI) in 2022. Not just speculative allocations, but “big boy” doses, that has results in excellent portfolio returns.

In addition, Medical Properties (MPW) – another loser YTD worth mentioning – has become a larger part of my portfolio. As Howard Marks explains,

Outstanding investors, in my opinion, are distinguished at least as much for their ability to control risk as they are for generating return.

The key to investing is to own more winners than losers, and most importantly, to stay humble.

Humility will open more doors than arrogance ever will. – ZIG ZIGLAR

Be the first to comment