jmalov/E+ via Getty Images

Co-produced with Treading Softly

Have you ever taken the time to read Nathaniel Hawthorne’s Twice-Told Tales? One of my favorites from that collection is the story of the Great Carbuncle. It’s said that a rare gem that emitted a brilliant light was hidden among the mountains.

Many went looking for this gem for selfish reasons.

Yet when a newlywed couple found it, they left it where it was to aid another seeker who was blinded by its light.

The story illustrates virtues of humanity that Hawthorne saw as important – like humility, self-sacrifice, and kindness. The characters with selfish ambitions met negative ends in their tales, while the newlyweds did not.

It can be easy to be distracted by some tale of glory or mythical success and miss perfectly outstanding opportunities sitting right in front of you. For investors, this means giving up the idle hopes of finding “the next big thing”. Steady, reliable, and recurring returns will provide more success, stability, and less stress.

The market should not be a “get rich quick” scheme. If you think you will take $1,000 and turn it into $1 million, you will find yourself taking excessive risks and likely having nothing to show for it. The market is best used as a place for slow and steady wealth growth over the long term. Impatience is a great enemy to investors.

Today, I want to highlight two REITs that should be irresistible gems in your portfolio, but are overlooked by many for not being flashy or exciting enough. Enjoy the income. It will be reliable, steady, and recurring – just what retirees need.

Pick #1: EPR – Yield 7.5%

The weather is heating up, and people who curtailed their entertainment for the past couple of years due to COVID are eager to get back to enjoying the pleasures of life. EPR Properties (EPR) is a REIT focused on owning experience-based properties – the types of places you go to do things.

A romantic trip for two to The Springs Resort in Pagosa, Colorado, hanging out with Yogi Bear at Jellystone Park in Warren, Wisconsin, delving into history at the Titanic Museum in Branson, Missouri, catching the latest movie, or meeting up with some HDO members at a Top Golf facility. There is a lot of fun to be had at EPR’s properties. It is hard to think of a more exciting company to do “due diligence” on.

Since the theme of EPR’s investments is properties where people “go out”, EPR was hit especially hard by the COVID pandemic as everything was shut down, and these types of properties were among the last to open. EPR’s management did the right thing, maintaining the balance sheet and weathering the storm.

EPR spent much of the pandemic ensuring that it improved its balance sheet. EPR reduced interest expense by issuing bonds at 3.6% to pay off the debt that was at 5.25%, resulting in immediate interest savings.

Even though at one point 60% of EPR’s tenants stopped paying rent, EPR made it through the crisis without taking on new debt and slightly reduced its share count by buying back shares at rock-bottom prices in March/April 2020. EPR exited the pandemic as a stronger company.

Now the focus is on growth. EPR has the capital on hand to deploy $1-$1.5 billion in new acquisitions. EPR recently announced the acquisition of two properties in Canada, Village Vacances Valcartier resort and hotel in Quebec City, Quebec, and the Calypso Waterpark in Ottawa, Ontario.

EPR is back to growing, and that growth will be done with cash on hand, meaning that shareholders will see the benefits of that growth on the bottom line without dilution. While we wait for that growth, EPR is paying a $0.275/month dividend, which we expect will be raised as EPR buys more properties.

Pick #2: MPW – Yield 7.7%

Medical Properties Trust (MPW) has had several negative articles written about it in publications like the Wall Street Journal. These articles were light on facts and heavy on innuendo. MPW responded at its Q1 earnings the best way possible: using facts, numbers, and increased transparency. MPW released numbers with more transparency than any of its peers.

AFFO (adjusted funds from operations) for the quarter was at $0.37, up 8.8% from $0.34 last year. For us, AFFO has always been the most important metric because it best represents cash flow and is, therefore, the best metric that MPW provides, representing dividend-paying potential. The current $0.29 quarterly dividend represents a payout ratio of 78% – a very healthy AFFO payout ratio for a REIT growing like MPW is.

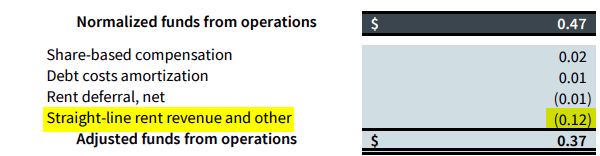

The best part is that MPW’s AFFO growth is embedded in its existing investments. MPW’s “normalized FFO” was $0.47/share. Below is the reconciliation from Normalized FFO to AFFO. (Source: Q1 2022 Supplemental)

Q1 2022 Supplemental

By far, the largest adjustment is removing “straight-line rent revenue”. When a rent contract has raises built into it, GAAP requires REITs to report revenues as if they were flat and received equally throughout the entire term. So in the first half of the lease, the rental income will be overreported, and it will be underreported in the second half of the lease.

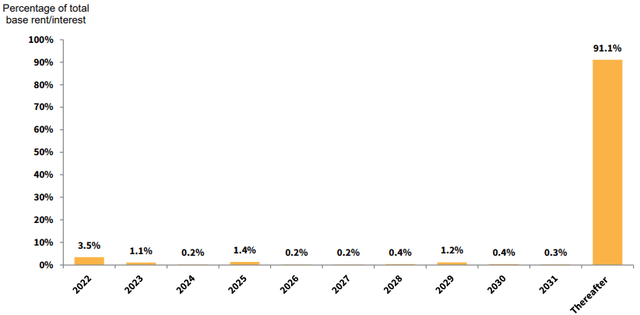

MPW has been on an acquisition spree, and it has been creating new leases as it acquires properties. As a result, it has a lot of brand new, very long-term leases. Over 91% of its leases don’t expire until after 2031!

If MPW does nothing, AFFO will rise to catch up with normalized FFO just through lease escalators alone. In the second half of the leases, AFFO will be higher than NFFO. Of course, we don’t expect MPW to sit around doing nothing for the next decade. Though, it is nice to know that the growth will come even if they do! Right now, the priority for MPW is to digest its recent acquisitions and reduce its leverage. MPW received a “positive” outlook from Moody’s for a rating upgrade, which would make MPW an “investment grade” rated company. MPW has a very good opportunity to hit the goal posts that Moody’s set this year. If MPW can achieve that goal, future growth will occur at a lower cost of capital and returns will be improved over the long term.

The bottom line is that MPW is growing like a weed. They’ve invested billions in new properties over the past few years. 2022 is a year of pulling in the horns a bit and digesting what was bought with expectations of acquiring “only” $1-$3 billion in properties. Clearly, MPW is gunning for an increase in their credit rating now that Steward will be below 20% of total rent, the target Moody’s set. If MPW’s credit rating is increased, that has powerful implications for their future cost of capital and would materially improve the fundamental outlook for the company.

We are happy to be paid while we wait for the market to recognize the strong earnings growth that MPW has.

Shutterstock

Conclusion

EPR and MPW have survived the hardest conditions the economy could throw at them. Today, they are stronger than ever and ready to continue to reward their shareholders richly.

Both have detractors who are looking at the past or focusing on the minor issues that are not presently causing problems. MPW has proven its naysayers wrong simply by showing strong earnings and has already remedied the issues others are trying to highlight. EPR has moved from the defensive to the offensive by moving its cash pile back into work and generating more income and returns than before.

As income investors and retirees, these REITs are gems that should adorn our income portfolios to provide us with regular, recurring, and reliable dividends. Collect the income, see a movie or visit your doctor while knowing you’ll be collecting money from the thousands of others doing just that.

That is the heart of income investing. It takes everyday life occurrences and turns them into income-generating opportunities.

Capitalize on all the opportunities you can.

Be the first to comment