JamesBrey/iStock via Getty Images

Inflation has soared to four-decade highs and shows no signs of slowing down anytime soon. Meanwhile, interest rates remain stuck near historic lows. This leaves retirees and other income investors desperately searching for low-risk, high-yield opportunities that can help them preserve their purchasing power.

While these opportunities are increasingly rare, with careful analysis and diligent searching, they can still be found and purchased for attractive prices. In this article, we will discuss two of the best high yield, low risk, and inflation resistant opportunities out there today.

#1. W. P. Carey (NYSE:WPC)

WPC – our sole REIT investment at High Yield Investor at the moment – is a blue chip triple net lease REIT that invests in a well-diversified portfolio of high quality properties in North America and Europe.

As of the end of 2021, WPC’s portfolio spanned 1,304 properties, with rental revenue split ~63% in the U.S., ~35% in Europe, and ~2% in other locations.

Meanwhile, half of its rental revenue comes from Industrial and Warehouse properties, 20% from office properties (many of whose tenants are investment grade, including governments), 18% specialty ecommerce resistant retail, 5% self-storage, and 8% other.

The vast majority of its properties have been acquired via sale-leasebacks that typically involve multi-decade lease terms along with annual rent escalations. What sets WPC apart from most of its peers (aside from its overwhelming focus on industrial and warehouse properties as opposed to retail and office that is more common in triple net lease REITs), is that the vast majority of its rent escalations are actually linked to inflation.

This makes it a highly compelling income investment because it offers the bond-like cash flow stability that comes with high quality, diversified, and well-managed triple net lease real estate while at the same time providing some inflation protection. As a result, investors can count on stable income from the quarterly dividend checks while also sleeping well with the assurance that a high inflation environment will lead to increases to those rent checks as well.

Another big advantage of investing in WPC over rental properties, for example, is that it only has a G&A cost of 6.2% (and shrinking as it continues to scale). In contrast, most property management companies charge an 8% property management fee. This makes WPC a more efficient vessel for investing in real estate, while its broad diversification, investment grade balance sheet, and access to cheap capital and attractive deal flow give it a much better risk-reward profile than the typical individual real estate investor.

In addition to its numerous inherent strengths, WPC is experiencing accelerating inorganic growth, which is combining with the inflationary tailwind for its rent escalators to create powerful growth momentum for the company.

Full-year AFFO/share grew by 6.1% year-over-year in 2021, which is particularly impressive given that they issued a substantial amount of equity during the year inflation escalators really will not flowing through to the bottom line until 2022 and 2023. This growth came from the fact that the company acquired ~$2 billion in new properties over the course of 2021 and management expects 2022 to see a similarly robust acquisition pipeline. This is meaningful growth given that the total enterprise value of the company is just $22 billion.

Last, but not least, the valuation appears quite reasonable as well. The company’s EV/EBITDA ratio is 17.75x which is below its 3-year average of 18.65x. Meanwhile, its price to AFFO ratio is 15.39x, which is in-line with its 3-year average of 15.31x. However, given that WPC has finally exited the asset management business and is now a pure-play triple net lease that is also increasingly focused on lower-risk industrial and warehouse properties, while also experiencing accelerating growth due to its strong growth pipeline and inflation-linked rent escalators, we believe that it deserves to see some multiple expansion. All told, combining a mid single digit AFFO/share CAGR for the foreseeable future with likely multiple expansion and a 5.3% dividend yield makes for a very attractive risk-reward profile.

#2. Enterprise Products Partners (NYSE:EPD)

EPD is arguably the finest energy midstream infrastructure business in the world. It owns one of the best asset portfolios that has proven to generate very consistently strong returns on invested capital and distributable cash flow through all sorts of energy and macroeconomic cycles. This is largely due to the fact that:

- It owns a very well diversified portfolio that also benefits from economies of scale (earning it a “wide moat” rating from Morningstar)

- The vast majority of its cash flows are immune to commodity price swings and are tied to fixed-fee contracts

- Roughly 80% of its customers are investment grade caliber

- It has some of the lowest leverage levels and highest liquidity levels in the industry, giving it a BBB+ credit rating from S&P

Even better, it is a great inflation hedge, as 100% of its pipeline revenues are linked to inflation. This should give investors great confidence in its ability to not only continuing to pay out its very attractive 7.4% yielding distribution, but to continue growing it moving forward. In fact, the distribution is already very well covered with 1.7x distributable cash flow coverage and management just hiked the quarterly payout by 3.3%.

Similar to WPC, the business is also enjoying strong momentum in its fundamentals. The company continues to invest in a pretty substantial pipeline of growth projects ($1.5 billion in CapEx is slated for 2022) and its recent acquisition of Navitas Midstream will give it even more opportunities to invest at very attractive risk-adjusted return levels. Management stated in the wake of the deal that it will be generating ~14% distributable cash flow yields on invested capital based on the midpoint of the estimated per unit accretion range and the cost of the acquisition. On top of that, it expects to be able to invest in additional even more attractive growth projects as it seeks to further expand the Navitas system and unlock synergies with EPD’s existing system.

Last, but not least, EPD remains quite reasonably priced and offers investors an attractive total return proposition. Its EV/EBITDA ratio is 9.63x, which is below its 3-year average of 9.97x and its price to DCF ratio is 8.18x. By way of comparison, fellow BBB+ rated midstream businesses Magellan Midstream Partners (MMP) and Enbridge (ENB) trade at EV/EBITDA ratios of 11.29x and 13.10x respectively, and price to DCF ratios of 9.63x and 8.65x, respectively.

EPD is likely to generate a 3-5% annualized DCF per unit growth rate in the coming years due to a combination of growth investments, inflationary increases to existing pipeline contracts, and opportunistic unit repurchases (somewhat offset by unit based compensation and existing pipeline contract roll-offs). When combining the 7.4% distribution yield, solid growth, and likely multiple expansion, generating double-digit annualized returns is highly likely from here. Given the low risk business model and balance sheet, EPD is arguably the safest undervalued high yield stock today.

Investor Takeaway

Both WPC and EPD are dream retiree stocks given their wonderful combination of high current yield, inflation-linked cash flows, rock-solid balance sheets and asset portfolios, proven management teams, solid growth potential, and lengthy track records of growing their quarterly payouts that will soon put them both in the Dividend Aristocrat category.

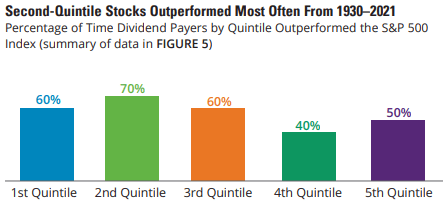

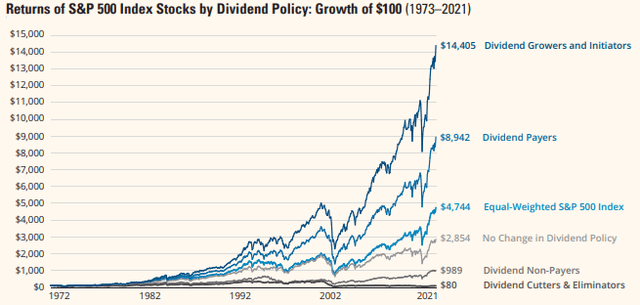

Given that past history has proven that high yield stocks and dividend growth stocks have both crushed the market:

High Yield Stocks Outperform (Hartford Funds) Dividend Stocks Outperform (Hartford Funds)

We think that both of these opportunities would make excellent additions to any portfolio looking for inflation-resistant income, safety, and attractive long-term returns.

Be the first to comment