malerapaso/E+ via Getty Images

Until recently, it was difficult for income investors and retirees to find high-quality companies offering a dividend yield in excess of 3% or 4%.

But this changed recently as interest rates began to rise and the stock market crashed.

Some dividend-oriented sectors dropped particularly heavily, despite continuing to hike dividends, and as a result, you can now find much greater dividend yields.

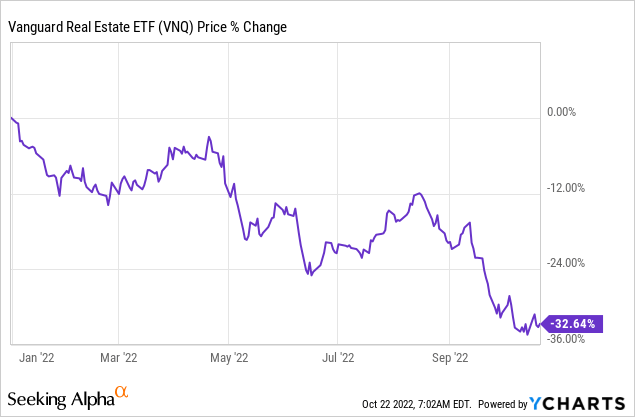

REITs (VNQ) are a perfect example of that. They are down 33% year-to-date even as most REITs kept growing their cash flow and hiking their dividend in 2022:

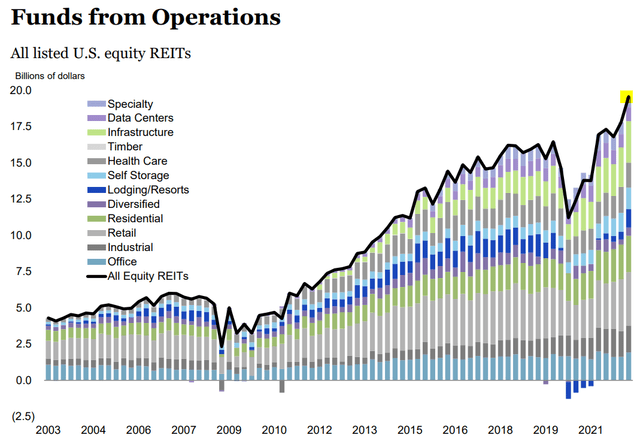

NAREIT

As a result, you now have some very respectable REITs that offer 5%, 6%, or even 7% dividend yields that are not just sustainable but also growing.

REITs are so heavily discounted because the market fears that rising interest rates are going to force REITs to cut dividends as they refinance their debt at materially higher rates.

But here’s the issue:

Most REITs use little debt these days, have long maturities, and most of this debt is fixed rate anyway. Moreover, interest rates are only rising because of inflation, which benefits REITs by growing the replacement value of their real estate and allowing them to charge higher rents.

So yes, it may make sense for a highly leveraged REIT with declining rents to drop in value, but this simply isn’t the case in most cases.

There are many investment grade rated REITs with strong balance sheets that are growing their cash flow at a rapid rate, and despite that, they have dropped heavily and now offer a sustainable and growing 6-7% dividend yield.

I believe that they are ideal investments for income investors and retirees because they do not just offer a high yield, but also offer inflation protection, which is so important in today’s world.

Sure, you could buy a treasury and earn a risk-free 4% yield, but after taxes and inflation, you really end up with ~5% negative real return, which isn’t sustainable for the average retiree.

Below, we highlight 2 REITs that provide high yield, growth, and inflation protection – at a discounted price for retirees:

Simon Property Group (SPG)

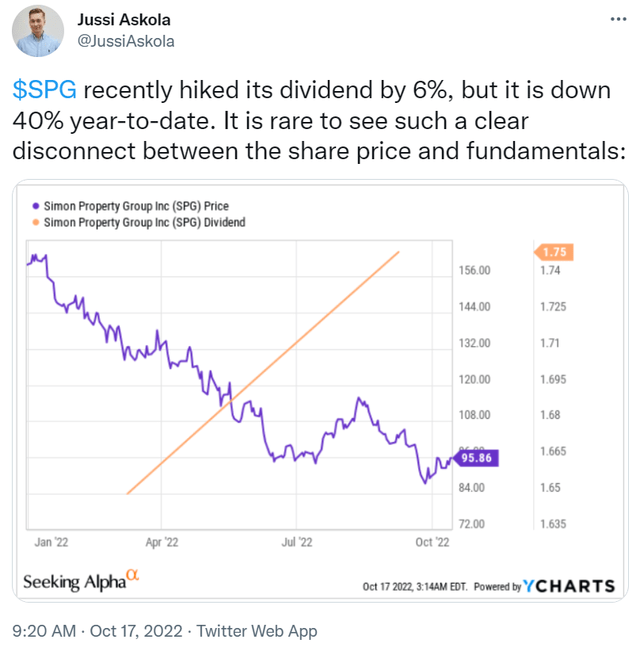

SPG has historically been considered to be a blue chip in the REIT space. That’s because it has one of the best track records of all REITs, a huge scale, a fortress balance sheet, and Class A assets. It is not heavily impacted by rising rates and its cash flow is rising rapidly. The company is doing so well that it recently even hiked its guidance and increased its dividend by 6%:

Twitter Jussi Askola

Why is it down so heavily?

The simple answer is that SPG owns malls and the market hates malls. It fears that malls are going to die due to the rapid growth of Amazon (AMZN), and besides, the rising interest rates are probably hurting its market sentiment even further.

But what the market appears to have missed is that not all malls are created equal.

Some suffer from the growth of e-commerce, but others actually benefit from it. Here’s why:

The growth of e-commerce has caused the lower quality malls to suffer and many have had to close down permanently. This benefits the remaining high-quality malls because it lowers competition and leads to traffic consolidation.

Simon Property Group

Moreover, as the world moves towards an omnichannel world, increasingly many retailers are making the decision of closing shop at lower quality or average malls to instead focus on the very best malls of the nation combined with e-commerce. These stores can then serve as showrooms and return centers, in addition to selling goods and making a profit. It is very synergetic to their e-commerce businesses.

This of course hurts the lower-quality malls, but it greatly benefits the higher-quality ones because all the top retailers of the nation want to be in a limited number of high-quality malls, allowing the mall to hike rents and reinvest in the property to make it even better by diversifying its uses, which increases its moat even further.

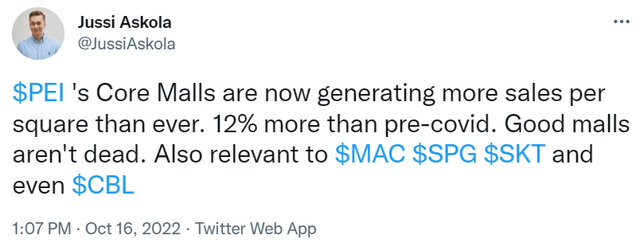

This explains why Class A malls are today generating a lot higher sales than before the pandemic. Even Pennsylvania REIT (PEI), which owns lower quality malls than SPG, is today generating higher sales per square foot than ever. Here is a recent tweet that I posted about it:

Twitter Jussi Askola

SPG does not just own some of the very best malls in the nation, but it also has the largest scale by far, the best management, and the best relationships with retailers, which really goes a long way in this business.

Therefore, unlike the market, we really aren’t worried about the long-term prospects of these properties. On the contrary, we are confident that they will continue to grow cash flow in the long run and become more valuable than ever:

Simon Property Group

The company also has a strong balance sheet with low debt and long maturities.

Despite that, it is now priced at just 8x FFO and it offers a 7.3% dividend yield. The payout ratio is just around 60% and the company has enough retained cash flow to buy back shares, develop new properties, and reinvest in existing ones to grow the dividend further.

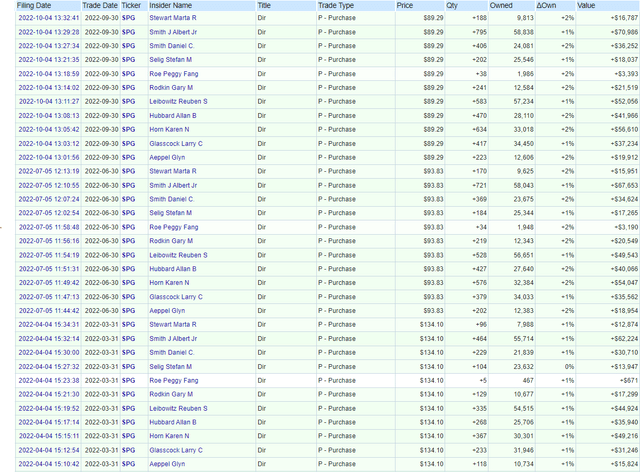

If you buy into the idea that high-quality malls are here to stay, then this is one of the best opportunities in today’s market. The management surely thinks so. They are aggressively buying back shares and insiders are also buying more with their own cash. Here are the insider buys this year alone:

OpenInsider

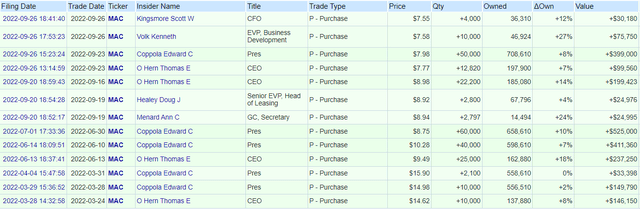

Adding further evidence that SPG is undervalued is the fact its close peer, Macerich (MAC), has also had some large insider purchases in the recent past:

OpenInsider

How many blue-chips can you find that pay a growing 7.3% yield that trade at a steep discount to fair value and have so many insider purchases?

I don’t know many and this is why I am buying SPG.

Essential Properties Realty Trust (EPRT)

Historically, one of the bluest blue-chips in the net lease REIT sector has been STORE Capital (STOR). It was so highly regarded because its business model was different from that of other net lease REITs like Realty Income (O) in a way that allowed it to earn higher yields, grow faster, and all of that – without taking more risk.

Instead of going after the properties occupied by big name, investment grade rated tenants like Walmart (WMT), it would go after middle market, non-rated tenants and get higher cap rates, but also better lease terms. What it would lack in credit quality, it would make up for by structuring better leases with master lease protection, higher rent coverage, access to unit-level profitability, no force majeure clauses, longer leases, and higher rent escalations.

Essential Properties Realty Trust

The business model was simple and led to above-average returns with below-average risk. Not even the pandemic could take it down as it grew its dividend by 3% in 2020 and another 7% in 2021, despite it being the worst possible crisis for the company.

Unfortunately, private equity noticed the opportunity and Blue Owl (OWL) teamed up with GIC to buy it out.

Fortunately, there is another net lease REIT that’s very similar to STOR. It was modeled after it and its leadership even has ties to STOR’s leadership (we covered this topic in detail in a recent interview with EPRT’s management).

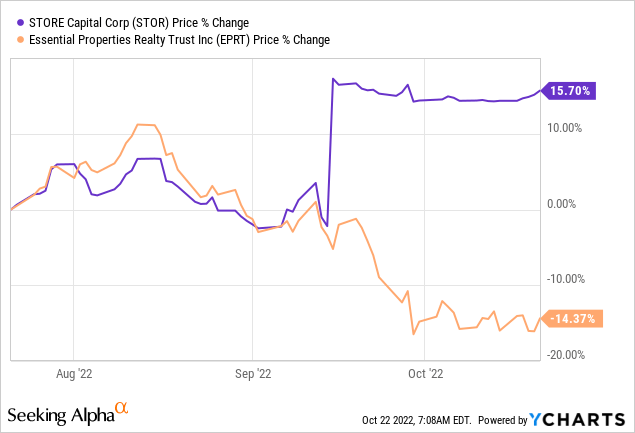

And STOR’s recent acquisition has led to a fantastic opportunity to shift the proceeds from STOR to EPRT at a very opportunistic valuation. This is because STOR rose even as EPRT’s share price collapsed:

EPRT’s poor share price performance may lead you to think that its business is heavily affected by rising interest rates, but that really isn’t the case.

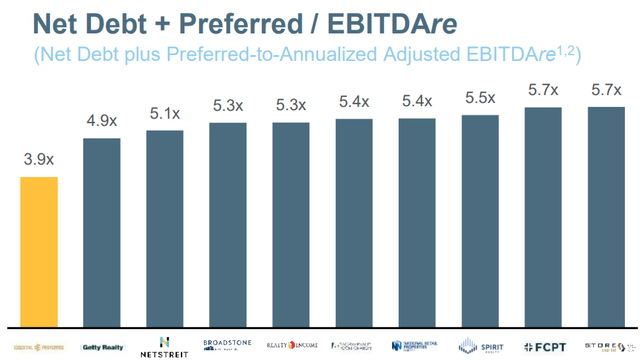

In fact, EPRT is one of the most resilient companies because it has a fortress balance sheet. Its balance sheet is literally the strongest in the net lease sector with a low 33% LTV and lots of liquidity:

Essential Properties Realty Trust

What about the risk of a recession? Again, EPRT is not heavily impacted because it has 10-15 year lease its rents are pre-set for the entire duration of the lease with steady annual escalations. In addition to that, EPRT keeps buying new properties with retained cash flow that it has left after its dividend payment and also by recycling capital by selling properties and buying new ones at higher cap rates.

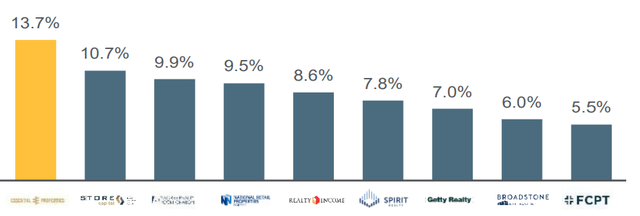

Despite all the uncertainty, EPRT is expected to grow its FFO per share by 13.7% in 2022. That’s one of the fastest growth rates in the whole REIT sector:

Essential Properties Realty Trust

And yet, EPRT is priced at a near 6% dividend yield and just 12x FFO, one of the lowest valuations in the company’s history.

The dividend is well-covered with a low 73% payout ratio and is set for rapid growth in the coming years. This makes it an ideal investment for retirees in my opinion because it pays a safe and growing ~6% dividend yield, and combined with the growth, the company is on a path to generating 12-15% annual total returns.

Bottom Line

REITs are today priced at historically low valuations and offer some of the highest yields in many years. Not just that, they also offer inflation protection, which is particularly important in today’s world.

This is why I think that they are some of the best opportunities in today’s market for income-seeking investors.

Be the first to comment