JamesBrey

Recession Fear Is On the Rise

Talks of a 100 basis point hike not seen in more than three decades have surfaced, and Canada’s Central Bank made the surprise 1% move last week, raising further concerns. While sky-high inflation needs to be tamed, a hike of this magnitude could push the U.S. economy into recession.

The Consumer Price Index (CPI) jumped 9.1% in June, and many investors are turning to high-yielding dividend stocks to battle portfolio losses. We have two high-yield dividend stocks with Strong Buy ratings. They are fundamentally strong with solid earnings projections, yield above 5%, and can make for an excellent investment to the rescue.

2 Dividend Stocks with High Yields to Invest In

I’ve said it before. Not all dividend stocks are created equal. Since yield is a payout relative to share price, which does not always mean the company is in great financial shape, when picking high-yield stocks, investors must dig deeper into its fundamentals. These two stocks have strong financials and great overall fundamentals that complement their high yields to stand the test of time.

1. LyondellBasell Industries (NYSE:LYB)

-

Market Capitalization: $27.71B

-

Quant Rating: Strong Buy

-

Dividend Safety Grade: B+

-

Forward Dividend Yield: 5.62%

A unique materials company that produces commodity chemicals, LyondellBasell Industries (LYB) is one of the largest global plastic, chemicals, and refiner, offering agricultural solutions, recycling, and advanced packaging. Involved in producing and packaging essentials like food, hygiene, healthcare, and consumer staples, LYB has a 70-year legacy of innovation and product technologies using chemicals and high-performance plastic compounds.

With recent pullbacks in energy (XLE -7% over the last month), the attractiveness of chemical companies that both refine oil and offer agricultural chemicals is in high demand. LYB’s diverse offerings position the stock well against the downturn we’re experiencing. Considered a stock ‘most immune to big earnings misses and beats,’ LYB comes at an attractive price with solid momentum.

LYB Stock Valuation & Momentum

LyondellBasell Industries is trading at an extreme discount. Following the commodity rally in April and May that sent the markets to the moon, LYB stock experienced a decline like most commodities amid the expectation that through aggressive monetary policy, the Fed would raise rates so fast that it would cause demand to fall off a cliff. As the markets attempted to anticipate a diminished need, according to basic supply demand, fear brought prices back to reality. But LYB has remained a strong buy and is currently trading near 52-week lows.

LYB Stock Valuation Grade (Seeking Alpha Premium)

Year-to-date, the stock is only down 2.89%. As we look at Lyondell’s quarterly price performance, which is outperforming its sector median peers, not only does LYB have a B+ valuation grade, its forward P/E ratio of 4.88x is trading nearly 60% below its sector peers. The forward PEG ratio of 0.29x is a -74.48% difference to the sector, which indicates that this stock is undervalued. This stock is rated a strong buy with solid momentum and a strong outlook based on quantitative grades and earnings. Let’s dive into its growth and profitability.

LYB Stock Growth & Profitability

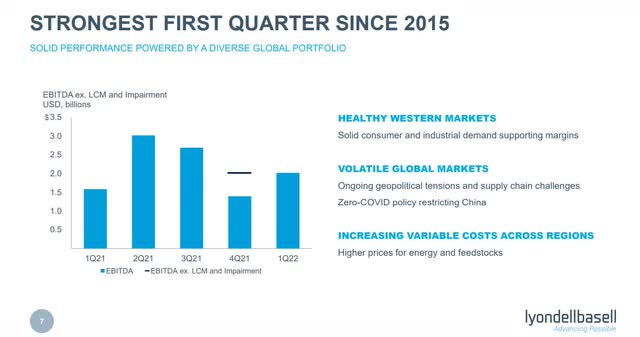

Presenting its strongest quarters since 2015, LYB generated $8.6B from operating activities, including an 88% cash conversion ratio, providing the firm 26.9% free operation cash flow yield.

LYB Q1 2022 EBITDA (LYB Q1 2022 Investor Presentation)

The executive team is applying LYB’s cash into growth investment, debt reduction, and growing its dividend. Following stellar Q1 results, LyondellBasell offered a special dividend at $5.20 and raised its quarterly $1.13 share by 5.3%.

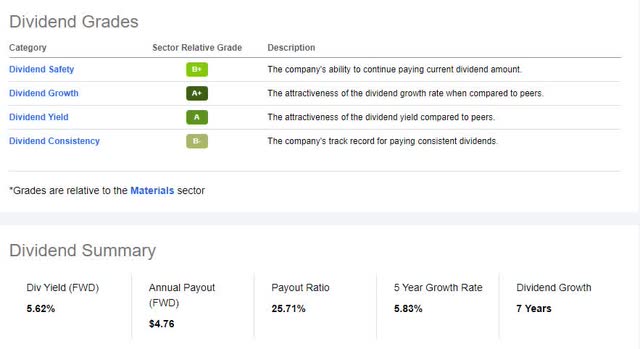

LYB Dividend Scorecard (Seeking Alpha Premium)

In addition to a 5.62% forward dividend yield, LYB’s overall dividend grades are attractive, which is the focus of this article. Investors want high-yielding stocks in the current environment that showcase dividend safety. With ten years of consecutive dividend payouts, an A+ grade for dividend growth, and a B+ dividend safety grade, LYB has strong liquidity and guidance for 2022. Thus, as Kenneth Lane, LyondellBasell CEO, said during the Q1 Earnings Call:

“We remain committed to prudent capital allocation. With robust cash generation, we plan to continue rewarding shareholders through a growing dividend and share repurchases. We are consistent in our commitment to an investment-grade balance sheet and remain highly disciplined in our consideration of organic and inorganic growth investments.

The coming months are exciting times for LyondellBasell. Our businesses are generating resilient results despite volatile economic conditions. We are laying the groundwork for new, more sustainable business models that are likely to reshape value chains across our industry.”

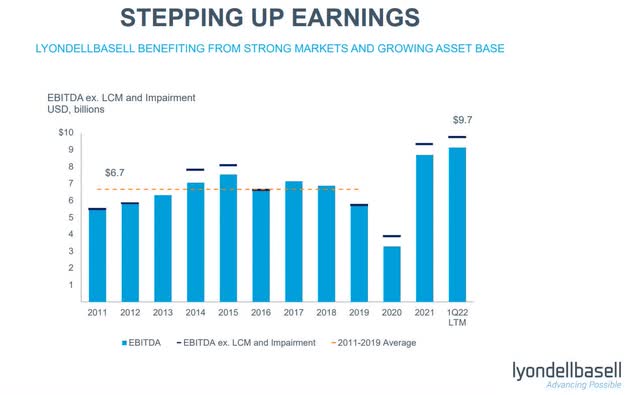

LYB Q1 2022 Earnings (LYB Q1 Investor Presentation)

Capitalizing on high demand post-pandemic and pricing competition in the energy and feedstock categories, LyondellBasell has stepped up its earnings, increasing its EBITDA and showcasing a Q1 EPS of $4.00 beat by $0.45 and revenue of $13.16B beat by $500.50M, resulting in 16 analyst FY1 UP revisions over the last 90 days. LYB improved its incident rate by 40% this year with a focus on safety improvements. In addition, the company’s goal of reducing emissions by 30% by 2030 is a significant driver in the push for sustainability. After signing two U.S. renewable energy power deals in Texas for an estimated 628K MWh/year of clean power, Lyondell is looking to be a dividend investment for the future. Historically, commodity chemical stocks have been good inflation fighters. Here is a Quant ranked list of Seeking Alpha Top Commodity Chemicals Stocks.

2. Dow Inc. (NYSE:DOW)

-

Market Capitalization: $36.08B

-

Quant Rating: Strong Buy

-

Dividend Safety Grade: B-

-

Forward Dividend Yield: 5.65%

Dow Inc. (DOW) is another top commodity chemical company taking advantage of the current environment and competitive pricing. DOW is a leader in innovative and sustainable packaging solutions. A spinoff of popular DuPont (DD), formerly the world’s largest chemical company in terms of sales, DuPont was known for its chemical creations like Kevlar, Teflon, Mylar, and Lycra.

As concerns surrounding the Fed’s decision on monetary policy increased fears about decreasing demand and spiking fuel and commodity prices, Piper Sandler downgraded DOW and LYB. In addition, investor fears prompting a slide in their share prices. Similar to LYB, the stock reached highs in April and May. But given the stock is trading near 52-week lows, it maintains a strong buy rating. It has excellent fundamentals, and I believe this stock is an optimal pick, especially at its current valuation.

DOW Stock Valuation Grade

Trading just over $50 per share and down 11% YTD, DOW comes at a great price. With a forward P/E ratio of 6.54x and a forward PEG of 0.19x, the stock is -42.96% and -82.85%, respectively.

DOW Stock Valuation Grade (Seeking Alpha Premium)

These figures indicate that the stock is severely discounted, with a current momentum grade of B- showcasing its quarterly outperformance of the sector median, now may be an excellent opportunity to add this stock to a portfolio.

DOW Growth & Profitability Grade

As the war in Ukraine and the effects of Russian gas and other imports affects industries and nations, many companies will feel the impact of cuts into profit margins. At the same time, U.S.-based DOW stands to benefit and has seen an increase in revenue of 22%.

“Dow has an ample supply of affordable natural gas to power its American operations available. The price of natural gas in North America has every chance of remaining low relative to European prices for the foreseeable future, and the odds of outright disruptions are arguably low. Dow is therefore a buy,” writes Seeking Alpha Contributor Zoltan Ban.

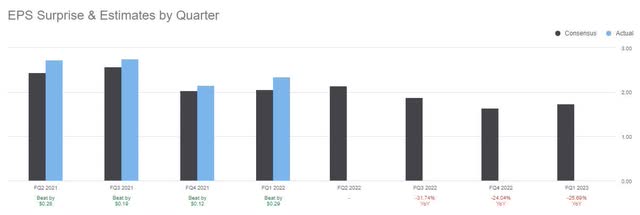

DOW Stock EPS (Seeking Alpha Premium )

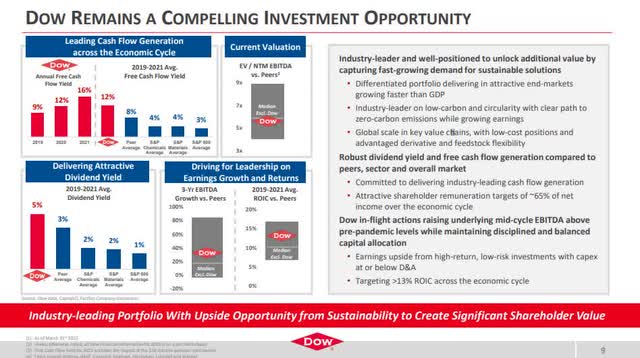

While DOW plans to release updated earnings this week, it recently presented at the Bernstein 38th Strategic Decisions Conference, citing that DOW remains well-positioned to deliver long-term value for its shareholders, which is showcased in its most recent earnings and dividend announcements.

DOW Q1 Dividend and Cash Flow Figures (DOW Q1 Investor Presentation)

DOW Inc. presented excellent financial results for Q1 2022. With an EPS of $2.34 that beat by $0.29 and revenue of $15.26 that beat by 28.46%, DOW’s top- and bottom-line growth resulted in net sales of $15.28B, $2.4B in operating EBIT, and $1.3B free cash flow. These substantial figures allowed DOW to return $1.1B to shareholdings, which includes $513M in dividends and $600M in share repurchases.

DOW Inc. has a 5.65% dividend yield and solid dividend scorecard. Given the company’s attractive dividend growth, yield, and dividend safety grades, the stock’s announcement of a new $3B buyback program paves the way for this to be an extremely attractive high-yield stock. This company maintains stellar performance and momentum, with room to grow. As Howard Ungerleider, President & CEO stated,

“Despite elevated inflation, consumer spending continues to grow, and balance sheets remain healthy with household debt service levels at some of the lowest levels in the last 30 years…We continue to monitor dynamics impacting the operating environment, including geopolitical activity, inflation, COVID, and the pace in which global supply chain constraints are easing. Our talented team and advantaged operating model continued to position us well to navigate these impacts by leveraging our global footprint, scale, and differentiated portfolio, combined with our cost-advantaged and suture feedstock and derivative flexibility.”

Investors want their stocks to make them money, and LYB and DOW are proving to be stocks that showcase their strong upside potential, possessing high yields and excess cash flow. Consider both for a portfolio. In addition to identifying Commodity Chemicals to combat inflation, many material stocks are also incredibly defiant during periods of high inflation. Here is a quant-ranked list of our Top Materials Stocks.

Conclusion

Capital preservation or off-setting inflation is what many investors want in this environment. When stock markets rise or fall, buying high-yield dividend stocks offers investors an option where their investment should be able to thrive in both environments without sacrificing quality or growth.

LYB and DOW are win-wins for value and growth investors. Not only do they both offer forward dividend yields of +5%, both possess solid growth outlooks, are undervalued, and should provide investors a steady income stream in this highly volatile market. In addition to solid dividend safety grades, each has significant cash for operations coupled with growth and profitability to ensure shareholders that these stocks’ dividend payout should remain consistent.

Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions. Check out the Dividend Grades on your favorite stocks and evaluate them using our tools to help you make tactical investment decisions that ensure you stick with strong dividend income that stands to increase over time. In this volatile environment, consider using Seeking Alpha’s ‘Ratings Screener’ tool to help you achieve diversification into desired sectors you like, including energy or commodities, or we also offer Top Dividend Stocks.

Be the first to comment