Deagreez

The stock market continues to suffer, and it’s not hard to guess the major reason.

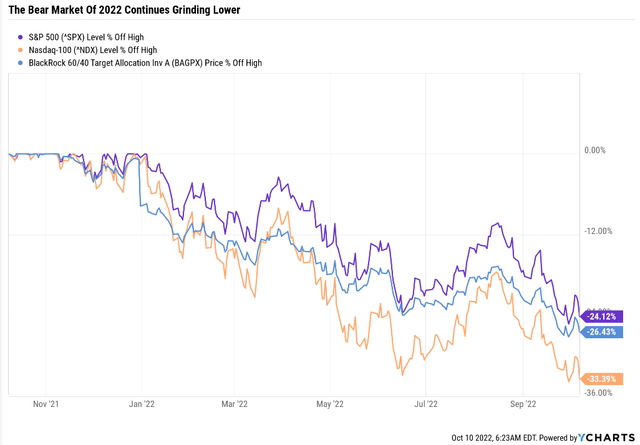

For the first time in US history, the 60/40 is doing worse than the S&P 500, suffering through a 25% bear market (so far).

The reason is simple; the Fed is on the inflation-fighting warpath. We’ve had five bear market rallies so far, all of them driven by “Fed pivot” hopium.

For 40 years, anytime the economy slowed the Fed would step in with rate cuts, dovish forward guidance, and even bond buying (QE). But until inflation is defeated the Fed is being crystal clear that there will be no pivot.

The market is continuing to struggle because investors just can’t bring themselves to believe the Fed has the stomach to keep hiking into economic weakness.

That’s why every single Fed speaker in recent months has been singing from the same hymnal, begging financial markets to believe that they are deadly serious about getting inflation back to 2%.

Minneapolis Fed President Neel Kashkari

Until I see some evidence that underlying inflation has solidly peaked and is hopefully headed back down, I’m not ready to declare a pause. I think we’re quite a ways away from a pause…

“The bar to actually shifting our stance on policy is very high.” ” – Yahoo Finance

President Kashkari was formerly the most dovish Fed member, calling for 2% long-term interest rates and running the economy hotter for longer than anyone. Now he’s 100% dedicated to beating inflation, even if it risks breaking parts of the financial system.

Atlanta Fed President Raphael Bostic

Be assured that I am not advocating a quick turn toward accommodation…

“You no doubt are aware of considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall. I would say: Not so fast.” – Yahoo Finance

President Bostic of the Atlanta Fed has said he wants the Fed to hike 75 basis points not just in November but also in December, to 4.5% by year-end.

Fed Governor Lisa Cook

Restoring price stability likely will require ongoing rate hikes and then keeping policy restrictive for some time until we are confident that inflation is firmly on the path toward our 2 percent goal.”

Cook stated that inflation has been “stubbornly persistent” and that she fully supported front-loading rate hikes at the last three policy meetings.

She added that while lowering inflation will bring some pain, not bringing inflation down would make it harder and more painful to restore price stability in the future.” – Yahoo Finance

Even the most dovish Fed members are now firmly hawkish and are pounding the table about how there is no Fed pivot on the horizon.

San Francisco Fed President Mary Daly

“I don’t see that happening at all,” told Bloomberg Television when asked about the trajectory in futures pricing that suggests rate hikes followed by reductions…

San Francisco Fed President Mary Daly doesn’t see the Fed cutting rates by the end of 2023, according to her comments on Wednesday. Instead, she remained steadfast that the Fed’s interest rate projections, which suggest the Fed will keep interest rates elevated until 2024, still hold true.” – Yahoo Finance

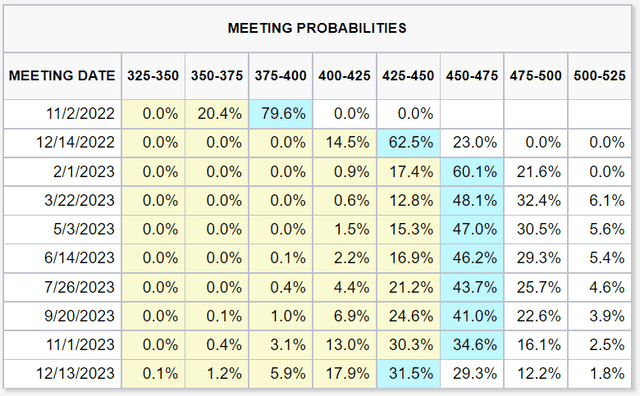

President Daly of the San Francisco Fed is not one to mince words. No rate cuts should be expected in 2023, which the bond market is still pricing in.

Granted the bond market now agrees with such blue-chip economist teams as Bank of America in expecting a cut in December 2023. The Fed? Potentially not until October of 2024.

Fed Governor Christopher Waller

This is not the inflation outcome I am looking for to support a slower pace of rate hikes or a lower terminal policy rate than projected in the September 2022 SEP.”

Fed Governor Christopher Waller said the Fed hasn’t yet made “meaningful progress” on inflation and that he supports continued rate increases, along with ongoing reductions in the Fed’s balance sheet.” – Yahoo Finance

Headline CPI inflation appears to have peaked at 9.1% in June. But the Fed doesn’t care about that; it targets core PCE, which peaked at 5.2% in March, and fell to 4.6% in August, and is now going back up.

The Cleveland Fed thinks the next CPI report will print 8.2% YOY with core inflation up to 6.6% (FactSet consensus 6.7%).

Worse yet, after rising from 4.6% in August to 4.9% in September, the Cleveland Fed thinks the next core PCE report will be +5.1% YOY and then 5.1% in November.

Why should you care about core PCE?

New York Fed President Williams

We need to get interest rates up further and basically get interest rates above where inflation is.”

Speaking at a gathering held in Buffalo on Friday, New York Fed President John Williams said that interest rates need to rise to 4.5% over time.” – Yahoo Finance

Just like Fed Chairman Jerome Powell, President Williams of the New York Fed thinks the Fed has to hike rates until the Fed Funds Rate is above core PCE.

He thinks that COULD mean stopping at 4.5% next year, but if core PCE gets stuck at 5.1%, it means he will likely be voting (along with Powell) to go to 5.25%.

That means a 75 basis point hike in November and potentially another 75 in December (a 23% probability according to the bond market).

Since 1953 the Fed has never stopped hiking until the Fed Funds rate was above core PCE. It almost always leads to a recession, but Cleveland Fed President Mester has recently made it clear that it’s OK with the Fed.

Cleveland Fed’s Mester says U.S. recession won’t stop the central bank from raising rates

At Jackson Hole when asked about Deutsche Bank’s worst-case scenario, the Fed hiking to 6% by July 2023 and then keeping rates there for two years, Mester said if that’s what it takes, she’s willing to vote for it.

The bottom line is that anyone talking about a Fed pivot is speculating and 100% going against what the Fed says is their game plan.

The Fed appears hell-bent on beating inflation at all costs, and it would take some significant deterioration in the economy or credit markets for the Fed to “blink”.

What about the Bank of England “blinking” a few weeks ago and resuming QE temporarily?

That was a very specialized situation that has nothing to do with US financial conditions.

- 90% of UK pension funds (a very specific kind not seen outside of England) were at risk of a margin call and bankruptcy

- because 30-year UK bonds had fallen in value by 50% in a matter of two days

- 5X the volatility of Bitcoin

The Bloomberg consensus is that the UK’s troubles are due to its government’s 400 billion pound stimulus plan (all debt-financed) the equivalent of the US trying to do a $3.5 trillion debt-funded stimulus package right now.

And guess what? The Fed has been doing a QE of sorts.

The Fed broke overnight lending markets in 2018 with its first attempt at QT. So it put in place an infinite overnight repurchase or Repo facility at the NY Fed to ensure financial institutions had all the liquidity their risk-free assets could cover.

In recent months the Fed’s repo positions have grown to almost $2.4 trillion.

- if every institutional US bondholder in the world demanded cash in exchange for bonds at the same time the NY Fed has the authority to print tens of trillions and buy those bonds

In other words, we’re not going to see a 50% to 66% crash in US bonds like we saw in the UK. If the Fed “breaks something” in the credit markets it already has the infinite QE capacity to prevent another financial crisis.

There is no reason the Fed has to blink, and the Fed is committed to not blinking but “finishing the job” and beating the worst inflation in 41 years.

- everyone at the Fed is channeling Paul Volcker

- recession is better than stagflation hell is the Fed’s mantra

- there is no pivot coming, and if we did get one it’s not actually bullish for stocks

That light at the end of the tunnel you see about interest rates is actually an oncoming freight train” – Mike Wilson, Morgan Stanley Chief Investment Officer

If the Fed did have to pivot quickly, it means economic and credit market chaos is breaking out worldwide, beyond what even an infinite repo facility can handle.

- economic and credit market chaos are hardly bullish for stocks in the short-term

Why You Should Still Be Buying Blue-Chip Bargains Today

I’m often asked in bear markets like this, “why are you recommending buying anything if stocks will keep falling?

- the market’s don’t bottom because bad news stops (not in 2020, 2009, 2002, or 1991)

- they bottom when all the bad news is priced in

- You will NEVER be able to tell when it’s the “real” start of a new bear market and just another bear market rally

- stocks never fall 20+% for no reason, there is always a reason to be scared

- if you don’t want to buy stocks at -25% you’ll like the idea even less at -35% or -40%

- because the news will be bleaker and investor sentiment even worse

Permabear doomsday prophets like Burry, Hussman, and Kiyosaki sound smart in a bear market. In fact, they can sound like geniuses.

Anyone telling you to buy blue-chip bargains sounds like a fool, but guess who is proven the real genius over time?

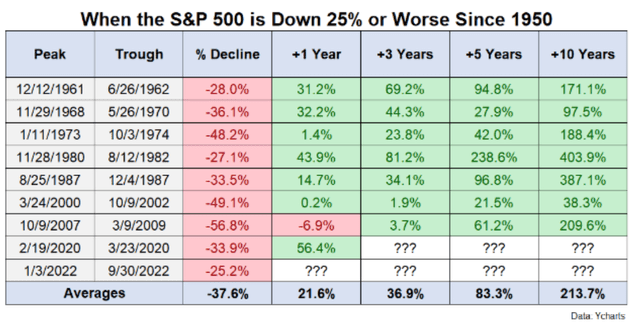

Buying the market when stocks are down 25% doesn’t mean you always catch the bottom. In fact, stocks usually bottom at -35% to -40% in recessionary bear markets.

But guess what? They don’t always do. How many long-term buy-and-hold investors have ever regretted buying the market when its down 25%? Probably none.

The average 12-month return from the first time the S&P hits -25% since 1950 is a 22% gain. The average gain after a decade? More than 3X.

Am I bearish in the short-term? Yes, the data says stocks are LIKELY to fall lower before we hit the final bottom.

Does that mean I’m selling everything I own and waiting to buy back in at the bottom? Heck no!

I’m fully invested to the tune of over $2 million in all my accounts.

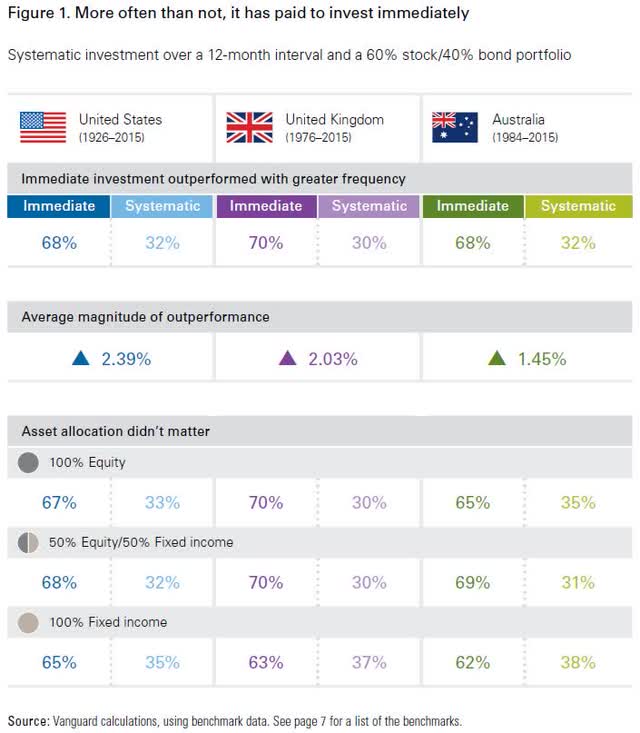

160 years of market data from three countries shows that being 100% invested at all times is the optimal strategy 70% of the time.

- delivering 2.4% CAGR better annual returns

- 2X more money over 30 years

- in bear markets, being fully invested is the optimal strategy 85% to 90% of the time

Don’t try to buy at the bottom and sell at the top. This can’t be done – except by liars.” – Bernard Baruch

And guess what? Other than no one ringing a bell at the market tops or bottoms, don’t forget that individual blue-chips bottom at different times.

- MO bottomed in early December 2008 at a very safe 15% yield

- and was up 9% by the time the market bottomed on March 9th, 2009

- AMZN bottomed early January 2002, 10 months before the S&P did

- and was up 60% by the time the S&P stopped falling

That’s why I keep buying and recommending blue-chip bargains during every market downturn.

And that’s why today I wanted to highlight why Medical Properties Trust (MPW) and Medifast (MED) are two speculative high-yield blue-chip bargains that you need to see to believe.

- 2.5% OR LESS max risk cap recommendations

Medical Properties Trust: The Ultimate “Greedy When Others Are Fearful” REIT Bargain

Further Reading

MPW has soared to an 11.4% yield thanks to its 2nd largest bear market in history.

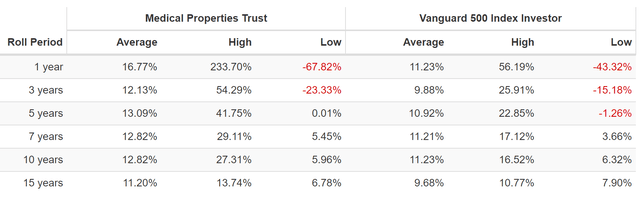

MPW Rolling Returns Since 2005

The last time MPW was this undervalued, it delivered 27% annual returns for the next decade.

- 11.2X total return in 10 years

Why does the market hate MPW right now?

Not surprisingly bad news, including a short report from Hedgeye that calls into question whether Steward Healthcare (28% of revenue for MPW) can pay its rent.

Steward has struggled with profitability since private equity created it back in 2010. As a private company, investors have no financial data besides what it’s chosen to disclose and no data since 2020.

2022 is a tough year for hospitals, largely due to high wage pressures driven by inflation and the ongoing Pandemic.

- Medicare and Medicaid reimbursement operate on a 1 to 2-year lag

MPW reports that its largest tenant (Steward) has 2.8X rental coverage in the most recent quarter, meaning 36% of operating cash flow is going to MPW rent.

Steward tried to sell five hospitals earlier this year to HCA, and the FTC blocked that deal. The market, having no data to go off, is imagining the worst, including Steward potentially going bankrupt.

Why is MPW’s yield so high? Because MPW’s bond covenants require it not to exceed a 95% normalized AFFO payout ratio.

If Steward were to go bankrupt MPW would get its hospitals back and then have to re-lease them, which would take time.

If Steward demands a rent cut of 25% or more, then MPW’s payout ratio would hit or exceed its bond covenant limit.

We could lower the rating if:

S&P Global Ratings-adjusted debt to EBITDA increases to above 9.5x for a sustained period, or if debt to undepreciated capital rises above 65%, perhaps because of debt-financed acquisitions;

Tenants face industry-related pressure that considerably weakens rent coverage, or if any large tenant files for bankruptcy protection; or

The company materially increases its concentration on its top tenants.” – S&P

S&P rates MPW BB+ stable, the highest level of junk bond rating, and last affirmed this rating in August of 2022.

Suppose MPW’s leverage, elevated after $16 billion in acquisitions over the last decade, becomes elevated due to Steward filing Ch 11 and or demanding a rental decrease. In that case, MPW could be forced by both bond covenants and S&P to cut its dividend.

However, as things stand now, MPW’s leverage of 7.2X is headed in the right direction, and it has $1.14 billion in liquidity with no major debt maturities that are likely to give it trouble.

MPW management says that after talking with all its tenants, including Steward, every single one of them expects cash flows to improve in 2023, giving it confidence its AFFO and dividend will remain sustainable.

- analysts expect a slow but steady dividend growth through at least 2026

Reasons To Consider Buying Some MPW Today

| Metric | Medical Properties Trust |

| Quality | 86% 12/13 Speculative Blue-Chip Quality REIT |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 164 |

| Quality Percentile | 68% |

| Dividend Growth Streak (Years) | 9 years |

| Dividend Yield | 11.40% |

| Dividend Safety Score | 86% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.75% |

| S&P Credit Rating | BB+ Stable |

| 30-Year Bankruptcy Risk | 14.00% |

| Consensus LT Risk-Management Industry Percentile |

32% below-average |

| Fair Value | $21.48 |

| Current Price | $10.14 |

| Discount To Fair Value | 53% |

| DK Rating |

Potentially Ultra-Value Buy |

| P/FFO | 5.5 |

| Growth Priced In | -6.0% |

| Historical P/FFO | 12 to 13 |

| LT Growth Consensus/Management Guidance | 5.4% |

| 5-year consensus total return potential |

21% to 24% CAGR |

| Base Case 5-year consensus return potential |

23% CAGR (4X the S&P 500) |

| Consensus 12-month total return forecast | 88% |

| Fundamentally Justified 12-Month Return Potential | 123% |

| LT Consensus Total Return Potential | 16.8% |

| Inflation-Adjusted Consensus LT Return Potential | 14.5% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.88 |

| LT Risk-Adjusted Expected Return | 10.11% |

| LT Risk-And Inflation-Adjusted Return Potential | 7.82% |

| Conservative Years To Double | 9.20 |

(Source: Dividend Kings Zen Research Terminal)

MPW is trading at just 5.5X FFO, pricing in -6% growth, and analysts actually expect, with all its Steward challenges, 5.4% long-term growth.

How many REITs can realistically beat the Nasdaq over the long term? Anti-bubble MPW likely can if you buy a prudently sized position today.

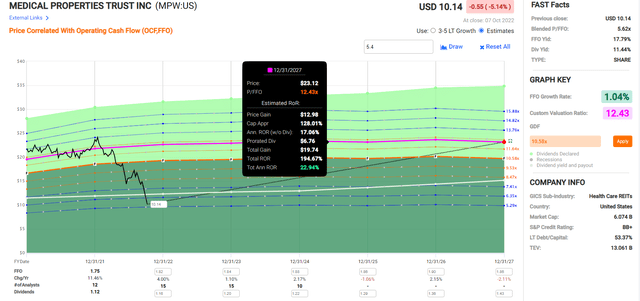

MPW 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

The Steward overhang is expected to cause slow growth in the years ahead, but not a collapse in fundamentals.

If MPW grows as expected and returns to its historical market-determined fair value of 12.4X FFO, investors could see 52% annual returns for the next two years.

MPW 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

MPW is barely expected to grow through 2027 as it works its way out of its Steward concentration issues. But it’s over 50% undervalued, so even 1% growth could drive a 3X return or 23% annually.

- Buffett-like return potential

- 4X more than the S&P 500 consensus

MPW Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

MPW is a potentially good ultra-yield anti-bubble speculative dividend blue-chip opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 54% discount to fair value Vs. 9% S&P = 46% better valuation

- 11.4% safe (but speculative) yield vs. 1.9% S&P (6X higher than the market)

- 60% higher annual long-term return potential

- 2X higher risk-adjusted expected returns

- 5X the consensus 5-year income

Medifast: Ultra-Yield Today And Potentially Buffett-Like Returns For Years To Come

Further Reading

Medifast runs the Optavia brand, which provides weight management services, specialized diets, and weight plans while also providing personal weight coaches to customers under the Optavia Coach program.” – Seeking Alpha

It’s a wildly volatile hyper-growth dividend stock that began paying a dividend six years ago and has raised it every year since then and at an impressive 68% annual rate.

We’re not immune to issues in the wider macroeconomic environment, and like many consumer-focused businesses, we’ve seen the impact of inflation on customer retention and consumer sentiment, which will cause slower-than-anticipated growth in the second half,” said MED CEO Dan Chard in the earnings report.

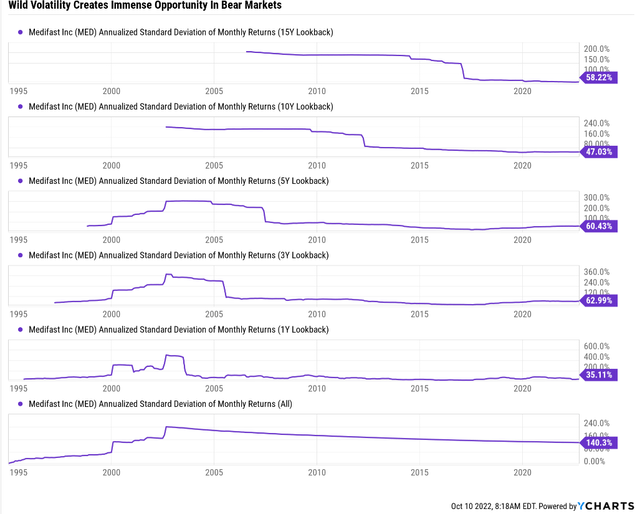

MED is a speculative blue-chip and not a SWAN. It’s dealing with some growth headwinds right now, resulting in a gut-wrenching crash. One that is nothing new for long-term investors.

It’s one of the most volatile companies on Wall Street, and that creates the kind of incredible opportunities we have now.

Medifast Rolling Returns Since 1994

Medifast is a hyper-growth speculative company that has richly rewarded investors over the decades who can tolerate its wild, crypto-like swings.

That includes 15-year returns as strong as 43% annually from its bear market bottoms and mind-blowing 70% annual returns over 10 years.

- 214X 15-year return

- 202X 10-year return

Trading At Pandemic And Great Recession-Like Valuations

(Source: FAST Graphs, FactSet)

MED is trading at under 9X forward earnings, even after its downward guidance revision, and 6.3X cash-adjusted earnings.

- 6.3X cash-adjusted earnings for a company growing at 20% per year

- 0.31 PEG = hyper-growth at a wonderful price

A safe (though speculative) 5.7% yield AND 20% long-term growth? That’s 26% long-term total return potential, even if MED’s PE never recovers to its historical 19.5 to 23X (PEG close to 1 is what the market values it at).

Reasons To Potentially Buy Medifast Today

| Metric | Medifast |

| Quality | 74% 10/13 Speculative Blue-Chip Quality Company |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 393 |

| Quality Percentile | 22% |

| Dividend Growth Streak (Years) | 6 years |

| Dividend Yield | 5.70% |

| Dividend Safety Score | 80% |

| Average Recession Dividend Cut Risk | 1.0% |

| Severe Recession Dividend Cut Risk | 2.10% |

| S&P Credit Rating |

Effective BBB stable |

| 30-Year Bankruptcy Risk | 7.50% |

| Consensus LT Risk-Management Industry Percentile |

31% below-average |

| Fair Value | $251.20 |

| Current Price | $114.35 |

| Discount To Fair Value | 54% |

| DK Rating |

Potentially Ultra-Value Buy |

| PE | 8.8 |

| Cash-Adjusted PE | 6.3 |

| Growth Priced In | -4.4% |

| Historical PE | 19.5 to 23 |

| LT Growth Consensus/Management Guidance | 20.0% |

| PEG Ratio | 0.32 |

| 5-year consensus total return potential |

27% to 47% CAGR |

| Base Case 5-year consensus return potential |

37% CAGR (9X the S&P 500) |

| Consensus 12-month total return forecast | 93% |

| Fundamentally Justified 12-Month Return Potential | 126% |

| LT Consensus Total Return Potential | 25.7% |

| Inflation-Adjusted Consensus LT Return Potential | 23.4% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 8.19 |

| LT Risk-Adjusted Expected Return | 16.64% |

| LT Risk-And Inflation-Adjusted Return Potential | 14.35% |

| Conservative Years To Double | 5.02 |

(Source: Dividend Kings Zen Research Terminal)

MED is trading at 6.3X cash-adjusted earnings, pricing in -4.4% CAGR growth but actually growing at 20%.

- 27% to 47% CAGR 5-year consensus total return potential range

It’s so undervalued that analysts think it will almost double in the next year, and a 126% total return within 12 months would be fundamentally justified.

MED 2023 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If MED grows as expected and returns to its historical market-determined fair value of 19.3X earnings, investors could double their money in a year.

MED 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

MED is expected to recover from its bad year and could potentially deliver more than a 5X return over the next five years.

- Buffett-like return potential of 37% CAGR

- 9X more than the S&P 500 consensus

MED Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

MED is a potentially excellent speculative hyper-growth dividend blue-chip opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 54% discount to fair value Vs. 9% S&P = 46% better valuation

- 5.7% very safe yield vs. 1.9% S&P (3X higher)

- 160% higher annual long-term return potential

- 3X higher risk-adjusted expected returns

- 4X the consensus 5-year income

Bottom Line: Buy Blue-Chip Bargains Today, And You Might Feel Like A Stock Market Genius In 5+ Years

98% of market timers fail. Why?

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

This is why I don’t bother to time the markets, call bottoms or try to score quick gains. In the short term, Wall Street is a crap shoot. In the long-term, it’s fundamentals-driven destiny.

Sleep well at night blue-chip bargains are all around us and offer potentially amazing investment opportunities.

MPW and MED are NOT sleep well at night blue-chips, but speculative blue-chips that not everyone will be comfortable owning.

But if you are and use prudent risk management (2.5% OR LESS max risk cap recommendation), then they offer exceptional bear market bargain opportunities that need to be seen to be believed.

- over 50% undervalued

- almost 12% sustainable (for now) yield for MPW and 5.7% for MED

- 5.4% long-term growth for MPW and 20% CAGR for MED

- P/cash flow or PE’s of 6 or less

- anti-bubble speculative blue-chip bargains pricing in -4% growth but actually growing much faster

Both of these high-speculative blue-chips face short-term challenges that, if they can be overcome (and the best available data we have says they can), I think could triple or better in the next five years.

In fact, anyone brave enough to buy today, at the best valuations in years, could be in for Buffett-like returns, not just for the next five years, but potentially for years or even decades to come.

For anyone comfortable with their risk profiles, MPW and MED are two speculative ultra-yield blue-chips well worth considering as deep-value long-term investments.

Be the first to comment