Deagreez

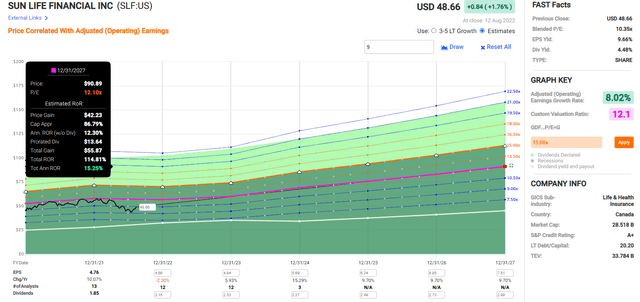

If you’re a bit confused by the market these days, you’re not alone.

Bonds are rallying, which at least makes sense given rising recession risk.

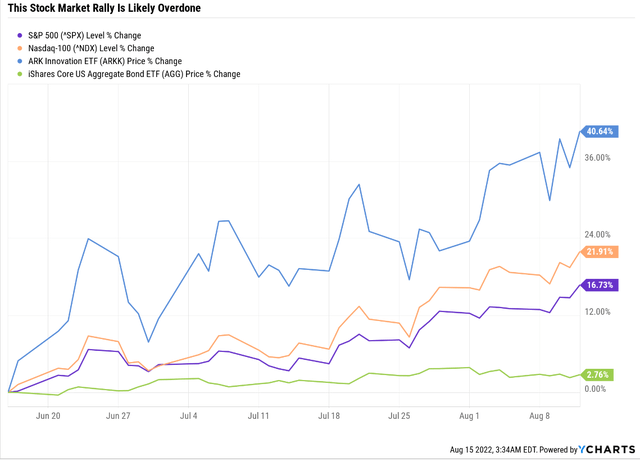

But stocks are up 17% off their June 16th lows with tech up 22% and speculative tech up 41%.

This is based on a “Fed pivot” thesis that no less than six Fed presidents have said is 100% wrong.

Inflation has possibly peaked but might take several years to reach the Fed’s target level. The Fed currently has no plans to stop raising rates in 2022 and no plans to cut them in 2023.

And when it does start cutting rates? The Fed plans to do this over two years and reduce rates to 2.5%, 0.25% higher than rates sit now.

And in the meantime, we have falling earnings estimates and rising recession risk, plus geopolitical uncertainties over the war in Ukraine and a low-risk but potentially high-impact invasion of Taiwan.

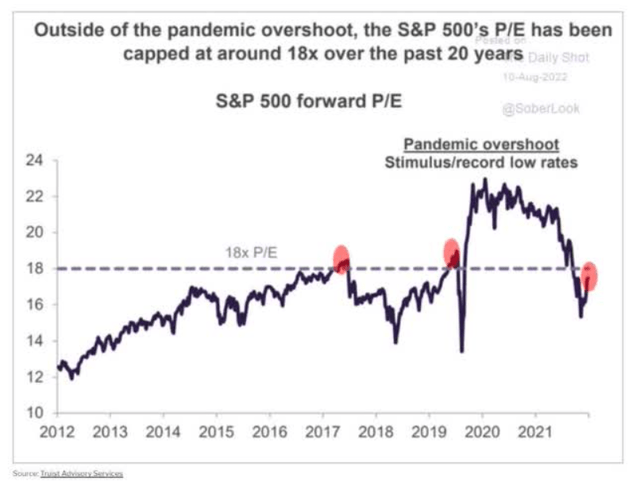

Does any of this sound like an environment in which the S&P 500 might be able to keep growing its P/E above its current 18.2X?

In over 200 years, the stock market has never been able to sustain a forward P/E above 18 for more than a few years. Might this time be different? Of course, but look at all the reasons it’s not likely to be:

- The fed is still tightening

- QT is about to hit 2X the previous record, and the Fed plans to keep sucking out $1.1 trillion from the economy until June 2025

- no Fed pivot in sight

- inflation is still at 40-year highs

- rising recession risks

- falling earnings estimates

Virtually zero fundamentals are backing up the low volume July/August “Fed pivot” rally which is based on a grand market delusion and little else.

But that doesn’t mean you can’t find world-class high-yield blue-chips at reasonable or even highly attractive valuations if you know where to look.

Let me show you why Siemens (OTCPK:SIEGY) and Sun Life Financial (SLF) are two A-rated international high-yield blue-chips you can trust in the likely coming recession.

Not just for safe and generous income, but attractive long-term returns that can help you potentially retire in safety and splendor.

Siemens: A World-Beater Industrial Giant

Further Research

26.375% dividend withholding tax. Own in a taxable account to qualify for the tax credit.

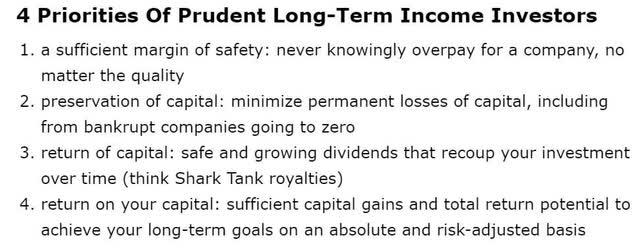

Reasons To Potentially Buy Siemens Today

| Metric | Siemens |

| Quality | 85% 12/13 Super SWAN (Sleep Well At Night) |

| Risk Rating | Low |

| DK Master List Quality Ranking (Out Of 500 Companies) | 159 |

| Quality Percentile | 69% |

| Dividend Growth Streak (Years) | 1 |

| Dividend Yield | 3.9% |

| Dividend Safety Score | 87% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.65% |

| S&P Credit Rating |

A+ Stable |

| 30-Year Bankruptcy Risk | 0.60% |

| Consensus LT Risk-Management Industry Percentile |

82% Very Good Risk-Management |

| Fair Value | $76.52 |

| Current Price | $57.81 |

| Discount To Fair Value | 24% |

| DK Rating |

Potentially Strong Buy |

| PE | 15.8 |

| Cash-Adjusted PE | 11.6 |

| Historical PE Range | 17-18 |

| LT Growth Consensus | 9.80% |

| PEG Ratio | 1.18 |

| 5-year consensus total return potential: | 11% to 18% |

|

Base Case 5-year consensus return potential: |

15% (2.5X the S&P 500 consensus) |

| Consensus 12-month total return forecast | 36% |

| Fundamentally Justified 12-Month Return Potential | 36% |

| LT Consensus Total Return Potential | 13.7% |

| Inflation-Adjusted Consensus LT Return Potential | 11.5% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.0X |

| LT Risk-Adjusted Expected Return | 9.53% |

| LT Risk-And Inflation-Adjusted Return Potential | 7.31% |

| Conservative Years To Double | 9.85 |

(Source: Dividend Kings Research Terminal)

Everything Siemens does is heavily aligned with where it sees the world going for the next 25-75 years.” – Sebastian Wolf

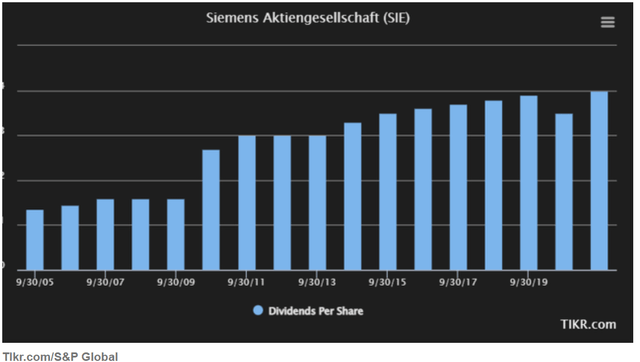

Unlike GE (GE), Siemens has been focused on only its highest margin businesses for many years and has one of the most stable dividend track records in Germany.

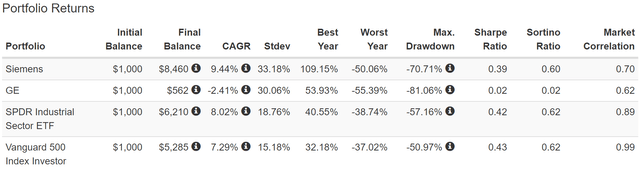

How You Can Tell Siemens Is A World-Class Company: Historical Returns Since 1999

(Source: Portfolio Visualizer)

For 23 years, Siemens has delivered not just market-beating returns but sector-beating returns and has crushed GE.

(Source: Portfolio Visualizer)

SIEGY’s average one-year return is almost 2X better than the S&P 500’s, and its average 15-year return is 27% better.

What’s the probability of a below-average quality company outperforming its peers and the US market for 23 years? Approximately 8%.

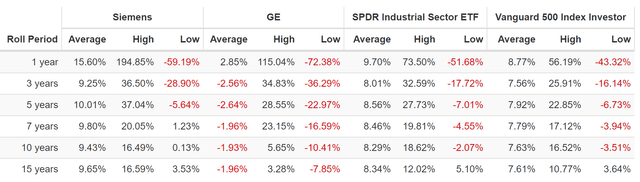

Siemens 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If Siemens grows as expected through late 2024 and returns to historical market-determined fair value, it could deliver 60% total returns of a Buffett-like 25% CAGR.

- compared to 10% CAGR for the S&P 500

- Buffett-like return potential from a world-beater blue-chip bargain hiding in plain sight

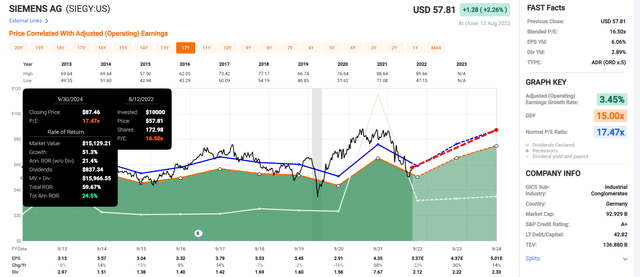

Siemens 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

SIEGY has the potential to double your money in five years, delivering 2.5X higher returns than the S&P 500 and total returns of 15% CAGR.

- Its average one-year total return since 1999.

Siemens Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

SIEGY is as close to a perfect industrial dividend investment as exists on Wall Street for anyone comfortable with its risk profile.

- 25% discount vs. 8% market premium = 33% better valuation

- 3.9% yield vs. 1.6% yield (2.5X higher and much safer)

- 35% better consensus long-term return potential

- 2X better risk-adjusted expected return over the next five years

- 2.5X higher consensus dividends over the next five years

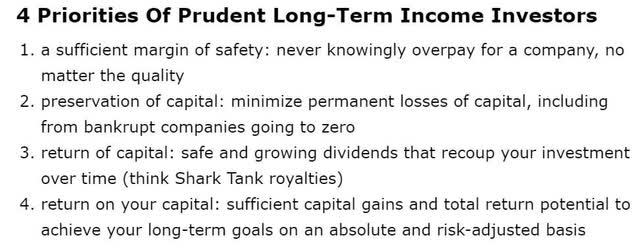

Sun Life Financial: 22 Years Without A Dividend Cut Even In The Great Recession

Further Research

15.0% dividend withholding tax. Own in a retirement account to avoid the withholding.

In taxable accounts, you can recoup the withholding with tax credits though it can require some paperwork.

Investment Thesis Summary

Following the 2008-09 financial crisis, Sun Life made several positive changes to its business operations, most notably selling its lagging U.S. life insurance and annuities business. Sun Life’s medium-term objectives include underlying EPS growth of 8%-10%, underlying returns on equity of 12%-14%, and a dividend payout rate of 40%-50%.

Canada and the United States continue to have several demographic trends working in favor of insurers, especially with wealth- and asset-management businesses, as an aging population increasingly looks to manage its savings. However, growth areas remain fiercely competitive, and life insurance will remain structurally difficult, making it hard for Sun Life to maintain any excess returns. Sun Life is also focused on expanding its operations in Asia, though we’re skeptical of this initiative ultimately providing significant value, given the subpar returns on equity so far.” – Morningstar

Reasons To Potentially Buy Sun Life Today

| Metric | Sun Life |

| Quality | 80% 10/13 Blue-Chip |

| Risk Rating | Very Low |

| DK Master List Quality Ranking (Out Of 500 Companies) | 275 |

| Quality Percentile | 46% |

| Dividend Growth Streak (Years) |

1 (22 Years Without A Dividend Cut) |

| Dividend Yield | 4.5% |

| Dividend Safety Score | 85% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.85% |

| S&P Credit Rating | A+ Stable |

| 30-Year Bankruptcy Risk | 0.60% |

| Consensus LT Risk-Management Industry Percentile |

89% Very Good Risk-Management, Bordering On Exceptional |

| Fair Value | $55.56 |

| Current Price | $47.85 |

| Discount To Fair Value | 14% |

| DK Rating |

Potentially Reasonable Buy |

| PE | 10.2 |

| Historical PE Range | 11.5 to 12 |

| LT Growth Consensus/Management Guidance | 9% |

| PEG Ratio | 1.13 |

| 5-year consensus total return potential: | 13% to 18% |

|

Base Case 5-year consensus return potential |

15.3% (2.5X the S&P consensus) |

| Consensus 12-month total return forecast | 16% |

| Fundamentally Justified 12-Month Return Potential | 21% |

| LT Consensus Total Return Potential | 13.5% |

| Inflation-Adjusted Consensus LT Return Potential | 11.28% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.91 |

| LT Risk-Adjusted Expected Return | 7.85% |

| LT Risk-And Inflation-Adjusted Return Potential | 5.63% |

| Conservative Years To Double | 12.79 |

(Source: Dividend Kings Research Terminal)

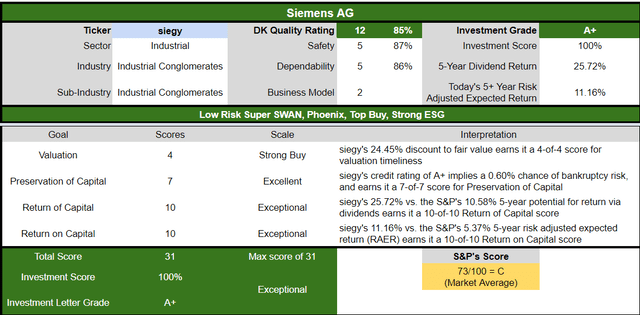

Sun Life 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If Sun Life grows as expected through 2024 and returns to historical market-determined fair value, it could deliver 54% total returns of a Buffett-like 20% CAGR.

- compared to 10% CAGR for the S&P 500

- Buffett-like return potential from a world-beater blue-chip bargain hiding in plain sight

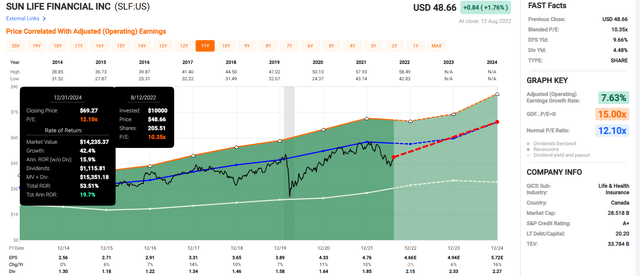

Sun Life 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

SLF can potentially more than double your money in five years, delivering 2.5X higher returns than the S&P 500 and total returns of 15% CAGR.

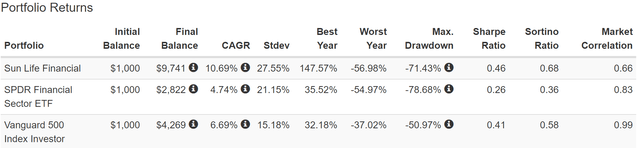

How You Can Tell Sun Life Is A World-Class Company: Historical Returns Since 2000

(Source: Portfolio Visualizer Premium)

SLF rose like a Phoenix from the Great Recession crash (with no dividend cuts) and delivered 66% better annual returns than the S&P 500 and 2.5X better annual returns than the US financial sector.

(Source: Portfolio Visualizer Premium)

Management’s long-term total return guidance of 13.5% CAGR is similar to the 12% average annual returns it’s delivered for the past 22 years, which includes three recessions, three market crashes, and five bear markets.

Sun Life Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

SLF is one of the most reasonable and prudent high-yield blue-chip opportunities for anyone comfortable with its risk profile.

- 14% discount vs. 8% market premium = 22% better valuation

- 4.5% yield vs. 1.6% yield (3X higher and much safer)

- 35% better consensus long-term return potential

- 2X better risk-adjusted expected return over the next five years

- 3X higher consensus dividends over the next five years

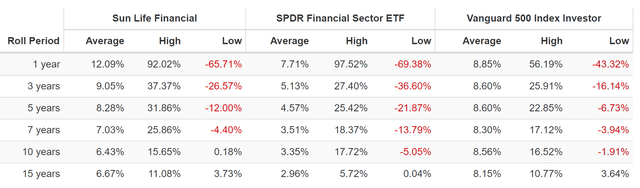

Bottom Line: Siemens And Sun Life Are Two Great High-Yield Blue-Chip Bargains Just Begging To Be Bought

Does the recent US market rally make sense? Only if you’re a technically focused trader trying to score some quick gains.

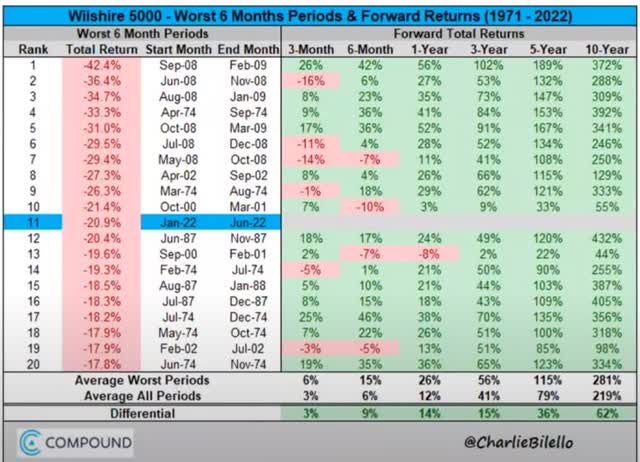

Is the market likely to hit new lows in the coming months? The fundamentals and market history say yes, we potentially have about 29% more to fall before the final bottom.

Does that mean that now is the time to sell everything, go to cash, and wait for “the dust to settle”? Absolutely not.

After an 18+% decline over 6 months, the US market is one of the best long-term wealth compounders you can possibly own. Only once since 1971 has the market failed to deliver positive returns in the next year.

And not once in 51 years, after a grisly shellacking as we’ve seen in the first half of this year, have stocks failed to deliver positive returns in the next 3+ years.

The wrong questions to ask are “will the Fed pivot soon?” and “what will the market do over the next year?”

The right questions to ask are “what will stocks likely do in the next 3+ years?” And “what high-yield blue-chip bargains can I buy today that are likely to do even better in the next decade?”

Siemens and Sun Life are two of the best high-yield blue-chip bargains you can buy today, offering a potent combination of safety and quality first and prudent valuation and sound risk management always.

These are A-rated 3.9% to 4.5% yielding companies have proven they can deliver dependable income and market and sector beating returns.

And in the next few years, they literally offer Buffett-like return potential for anyone who is comfortable owning them as part of a diversified and prudently risk-managed portfolio.

It’s always and forever a market of stocks, not a stock market, and if the US market is going crazy, there are world-class alternatives available overseas if you know where to look.

Be the first to comment