Khosrork

Warren Buffett is the greatest long-term investor in history, delivering 20% annual returns to Berkshire (BRK.B) investors since 1965.

- a 32,609X return

- 3,433X adjusted for inflation

An award-winning study examining Buffett’s secrets to success found they weren’t a secret.

- 1.7X leverage using low-risk/low-cost financing (insurance float)

- a focus on blue-chip company

- bought at an attractive valuation

- and held for the long-term (often for decades)

While most of us don’t have insurance companies to provide us with free money to invest, buying undervalued blue-chips for the long-term is something we can and should strive to emulate.

- Peter Lynch and Joel Greenblatt also applied similar strategies and became investing legends

Given the success of “the Oracle of Omaha” it’s not surprising that Berkshire’s quarterly 13-F filings are closely tracked to see what Buffett is buying and selling in Berkshire’s portfolio.

The most recent 13-F had some surprises for investors, including Buffett only buying $6.2 billion worth of nine companies in Q2. That’s compared to $40 billion in Q1. Is Buffett’s empire telling him that a recession could potentially cause stocks to fall much lower? Very possibly, but he’s still finding attractive bargains to buy, and today I wanted to share two of my favorite Q2 Buffett buys with you.

These are quality companies with the right combination of safety, quality, growth, and value to potentially deliver Buffett-like returns in the next few years and could be just what your portfolio is looking for in these troubled times.

Ally Financial (ALLY): An Anti-Bubble Financial That Could Almost Triple In 5 Years

Further Reading: More On Ally’s growth prospects, risk profile, and investment thesis.

What Ally Does

Ally Financial Inc is a diversified financial services firm that services automotive dealers and their retail customers. The company operates as a financial holding company and a bank holding company. Its banking subsidiary, Ally Bank, caters to the direct banking market through Internet, mobile, and mail. The company reports four business segments: Automotive Finance operations, Insurance Operations, Mortgage Finance operations, and Corporate Finance operations. – Morningstar

Is Ally the world’s best financial? Not even close. Its loans tend to be riskier, so S&P and Moody’s rate it BBB- stable, implying an 11% 30-year bankruptcy risk. It’s also why the market has historically valued ALLY at 9X earnings.

So why did Buffett buy $777 million worth of ALLY?

Why Buffett Likely Bought $777 Million Worth Of Ally

| Metric | Ally Financial |

| Quality | 70% 9/13 Above-Average |

| Risk Rating | Low |

| DK Master List Quality Ranking (Out Of 500 Companies) | 428 |

| Quality Percentile | 15% |

| Dividend Growth Streak (Years) | 5 |

| Dividend Yield | 3.3% |

| Dividend Safety Score | 78% – Safe |

| Average Recession Dividend Cut Risk | 1.0% |

| Severe Recession Dividend Cut Risk | 2.20% |

| S&P Credit Rating | BBB- Stable |

| 30-Year Bankruptcy Risk | 11.00% |

| Consensus LT Risk-Management Industry Percentile |

63% Above Average-Risk-Management |

| Fair Value | $60.42 |

| Current Price | $36.87 |

| Discount To Fair Value | 39% |

| DK Rating |

Potentially Good Buy |

| PE | 5.3 (anti-bubble) |

| Historical PE Range | 8 to 9 |

| LT Growth Consensus/Management Guidance | 11.4% |

| PEG Ratio | 0.47 |

| 5-year consensus total return potential: | 17% to 23% |

| Base Case 5-year consensus return potential |

20% CAGR (4X S&P 500 consensus) |

| Consensus 12-month total return forecast | 30% |

| Fundamentally Justified 12-Month Return Potential | 67% |

| LT Consensus Total Return Potential | 14.7% CAGR Vs. 10.1% S&P 500 |

| Inflation-Adjusted Consensus LT Return Potential | 12.48% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.24 |

| LT Risk-Adjusted Expected Return | 7.78% |

| LT Risk-And Inflation-Adjusted Return Potential | 5.56% |

| Conservative Years To Double | 12.96 |

(Source: Dividend Kings Zen Research Terminal)

There’s only one reason I think Buffett is buying Ally.

We’re buying above average quality at below average prices” – Joel Greenblatt

ALLY is trading at 5.5X trough earnings, an anti-bubble valuation that means that as long as the company grows faster than -7% and doesn’t go bankrupt, Buffett is guaranteed to make good returns.

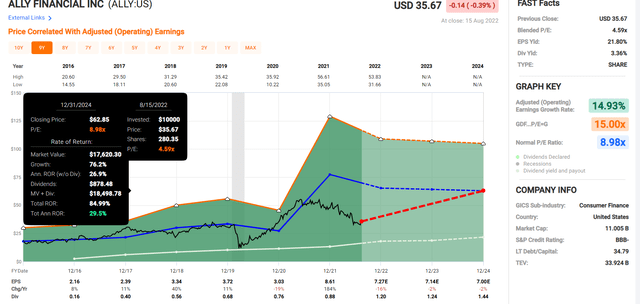

Ally 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Even with slightly negative growth expected in the next few years, courtesy of the 2023 recession, Ally is an anti-bubble stock trading at 5X earnings. It’s priced for -7% growth and analysts expect 11.4% over the long-term once the new economic cycle begins.

And in the meantime, ALLY’s anti-bubble valuation could deliver Buffett-like 30% annular returns through 2024, or about 4X that of the S&P 500.

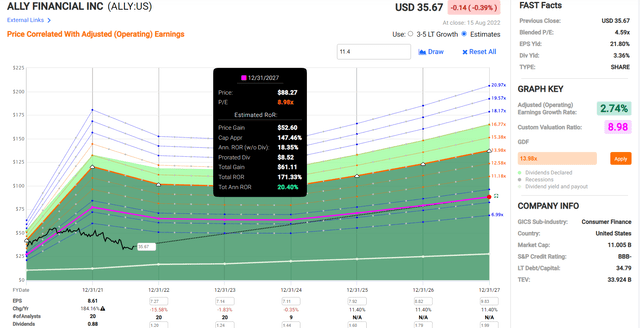

Ally 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

And suppose ALLY grows as expected and returns to its historical market-determined fair value PE of 9. In that case, it could almost triple, delivering Buffett-like 20% annual returns over the next five years.

Now compare that to the S&P 500’s return potential.

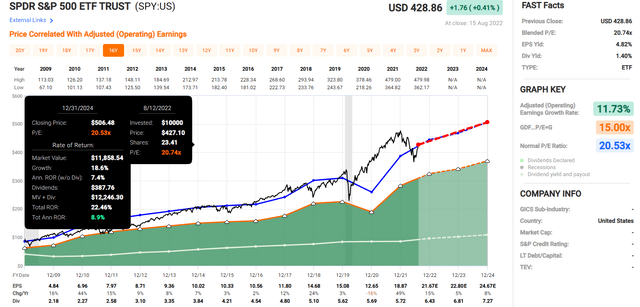

S&P 500 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

The S&P is expected to deliver about 22% returns over the next 2.5 years, approximately 4X less than ALLY.

S&P 500 2027 Consensus Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

| 2027 | 40.78% | 7.08% | 5.31% | 3.03% |

(Source: DK S&P 500 Valuation And Total Return Tool)

It’s also expected to deliver 4X lower returns than ALLY over the next five years.

Are there higher quality anti-bubble stocks trading at 5X earnings? Absolutely.

But I can’t fault Buffett for spending 13% of this quarter’s buying budget on ALLY.

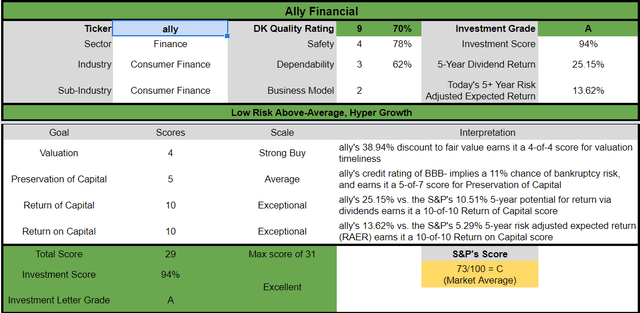

ALLY Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

ALLY is one of Wall Street’s most reasonable and prudent fast-growing high-yield anti-bubble investment options for anyone comfortable with its risk profile.

- 39% discount vs. 9% market premium = 48% better valuation

- 3.5% safe yield vs. 1.6% yield (more than 2X higher)

- 40% better consensus long-term return potential

- 2.5X better risk-adjusted expected returns over the next five years

- 2.5X higher consensus dividends over the next five years

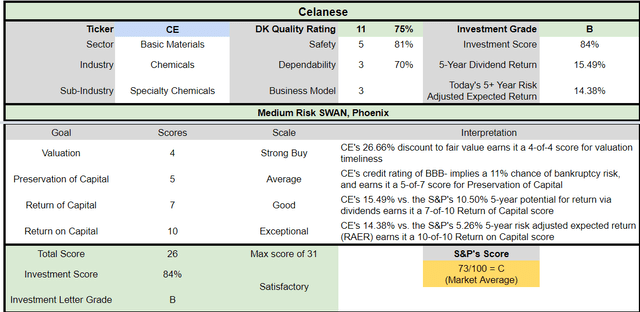

Celanese (CE): A Classic Buffett-Style “Fat Pitch” Anti-Bubble Bargain

Further Reading: More On CE’s growth prospects, risk profile, and investment thesis.

What Celanese Does

Celanese is the world’s largest producer of acetic acid and its chemical derivatives, including vinyl acetate monomer and emulsions. These products are used in the company’s specialized end products or sold externally… The company plans to expand acetic acid production capacity at Clear Lake by roughly 50%, which should benefit segment margins thanks to lower unit production costs relative to other geographies.

The engineered materials, or EM, segment (45%) produces specialty polymers for a wide variety of end markets. Celanese is investing in the expansion of this business through acquisition. The company completed the acquisition of Santoprene in late 2021 and announced plans to acquire the majority of DuPont’s mobility and materials portfolio in a deal that should close by the end of 2022. Both deals add complementary products to Celanese’s existing portfolio. After the DuPont acquisition closes, the EM segment will generate the majority of revenue. – Morningstar

CE is a classic example of a blue-chip you’ve never heard of but is right up Buffett’s ally. A boring but beautiful company that helps the world keep turning.

Investment Thesis Summary

Celanese should benefit from automakers lightweighting vehicles, or replacing small metal pieces with lighter plastic pieces. Celanese should also see growth from increasing electric vehicle and hybrid adoption, as the company will sell multiple components specific to these powertrains. By 2030, we forecast two thirds of all new global auto sales will be EVs or hybrids. – Morningstar

Why did Buffett buy 1.27 million shares of CE worth about $150 million? Because it’s a great deep value way to profit from secular economic growth and the rise of EVs.

Why Buffett Likely Bought $150 Million Worth Of Celanese

| Metric | Celanese |

| Quality | 75% 11/13 SWAN (Sleep Well At Night) |

| Risk Rating | Medium |

| DK Master List Quality Ranking (Out Of 500 Companies) | 352 |

| Quality Percentile | 30% |

| Dividend Growth Streak (Years) | 11 |

| Dividend Yield | 2.3% |

| Dividend Safety Score | 81% – Very Safe |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 2.0% |

| Fitch Credit Rating | BBB- |

| 30-Year Bankruptcy Risk | 11.00% |

| Consensus LT Risk-Management Industry Percentile |

50% Average Risk-Management |

| Fair Value | $161.10 |

| Current Price | $118.11 |

| Discount To Fair Value | 27% |

| DK Rating |

Potentially Strong Buy |

| PE | 7.3 |

| Cash-Adjusted PE |

5.8 (Anti-Bubble) |

| Historical PE Range | 11.5 to 12.5 |

| LT Growth Consensus/Management Guidance | 8.6% |

| PEG Ratio | 0.85 |

| 5-year consensus total return potential: | 13% to 25% |

| Base Case 5-year consensus return potential |

22% CAGR (4.5X S&P 500 consensus) |

| Consensus 12-month total return forecast | 27% |

| Fundamentally Justified 12-Month Return Potential | 39% |

| LT Consensus Total Return Potential | 10.9% Vs. 10.1% S&P 500 |

| Inflation-Adjusted Consensus LT Return Potential | 8.68% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.30 |

| LT Risk-Adjusted Expected Return | 5.41% |

| LT Risk-And Inflation-Adjusted Return Potential | 3.19% |

| Conservative Years To Double | 22.59 |

(Source: Dividend Kings Zen Research Terminal)

CE isn’t doesn’t win any quality contests, but it is crazy, stupid, cheap.

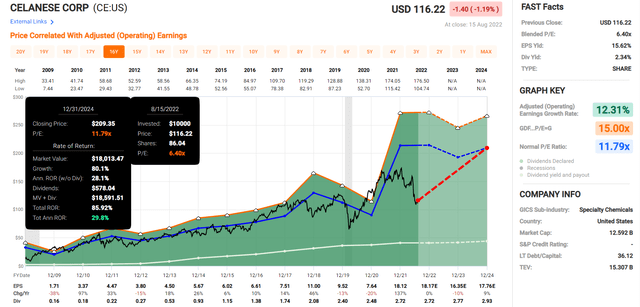

CE 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

CE is 27% undervalued (Morningstar estimates 30%) that if could nearly double by the end of 2024 if it grows as expected and returns to its historical PE of about 12.

That’s a potential 30% annular return from the world leader in these kinds of petrochemicals.

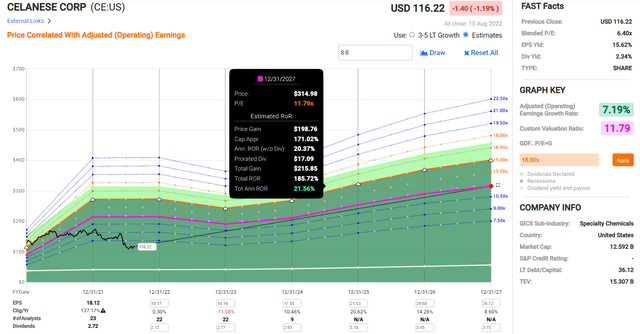

CE 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If CE grows as analysts expect through 2027, it could nearly triple, delivering slightly better returns than ALLY. This is a truly Buffett-like 22% annual total return potential.

- 4.5X more than the S&P 500

CE Investment Decision Score

DK Dividend Kings Automated Investment Decision Tool

CE is one of Wall Street’s most reasonable and prudent anti-bubble investment options for anyone comfortable with its risk profile.

- 27% discount vs. 9% market premium = 36% better valuation

- 2.1% safe yield vs. 1.6% yield

- 10% better consensus long-term return potential

- 3X better risk-adjusted expected returns over the next five years

- 50% higher consensus dividends over the next five years

I personally would have bought other blue-chips over Celanese, but I can’t fault Buffett’s logic with this one either.

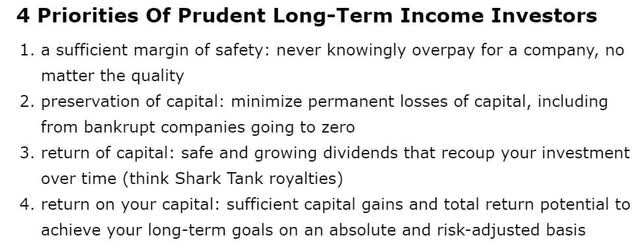

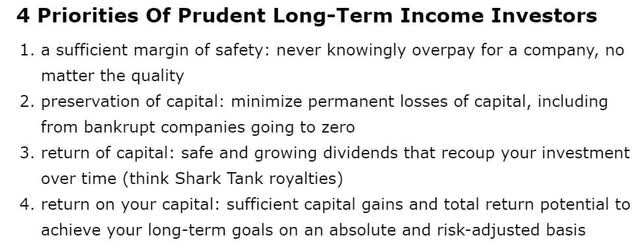

Bottom Line: These 2 Buffett-Buys Are Potentially Worth Emulating In Your Portfolio

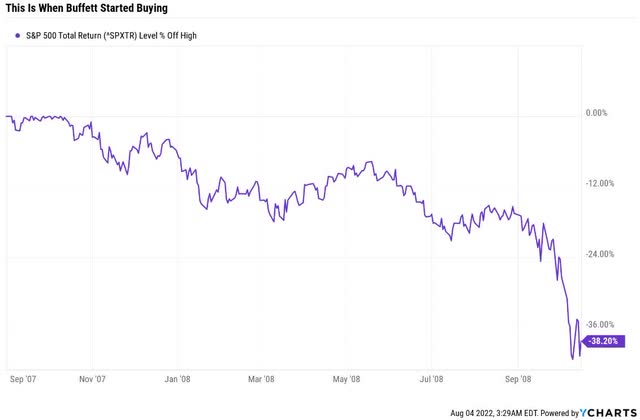

I’m not saying Buffett is infallible; no one is, not even the greatest investor of all time. And Buffett is certainly no market timer.

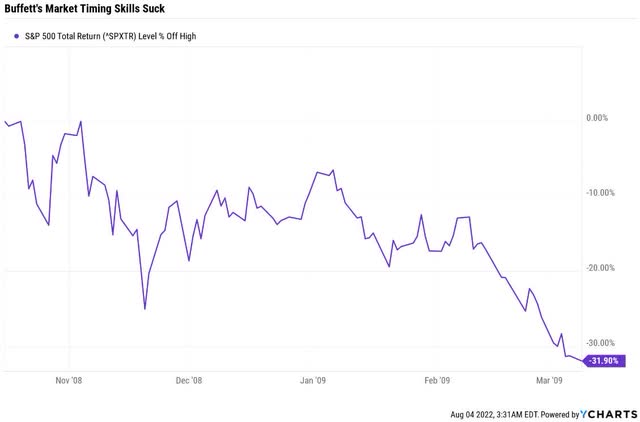

In October 2008, Buffett bought billions in stocks and told investors to “Buy American: I Am.” And then the market fell another 31%, and he just kept on buying.

Buffett has never cared about looking right in the short-term.

If you’re not willing to own a stock for 10 years, don’t even think about owning it for 10 minutes. – Warren Buffett

He cares about the long-term because, in the long-term, fundamentals are 33X as powerful as luck.

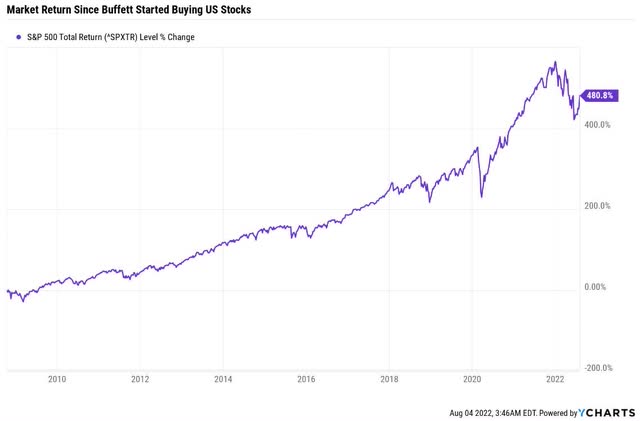

Stocks fell 30% after Buffett told us to buy with both hands. Can you even see that decline in the chart? If you buy quality companies during a bear market, even if you miss the bottom by several months, 10 years later, you’ll feel like you bought the bottom. You’ll feel like a stock market genius.

Ally Financial and Celanese aren’t Buffett’s favorite companies; they represent relatively small portions of Berkshire’s portfolios. And while the $823 million that BRK invested into ALLY and CE is a lot by our standards, it’s couch-cushion money for Buffett’s company.

But whether you’re investing $823 or $823 million, the principles of “above-average quality for below-average prices” are the same.

My best guess is that Berkshire bought ALLY and CE for their anti-bubble valuations, with the potential to double in 2.5 years and triple in five years.

I don’t always agree with Buffett, and I can think of superior quality companies trading at similar or even more attractive valuations.

But if you want to take a long-term ride with the Oracle of Omaha, ALLY and CE represent classic Buffett-style “fat pitches.” Ones you can still safely buy with the market blasting ever closer to new record highs.

Be the first to comment