frender/iStock via Getty Images

Co-produced with Treading Softly

I am no stranger to not being part of the “cool club”. Some of you might be having flashbacks to high school and the “in” crowd. High school is a land of labels.

We like to pride ourselves in thinking that, as older adults, we no longer pander to such cliquish mentalities. However, the opposite seems to be true. Cliques become larger and more defined as we age. We associate more willingly with those we agree with and have other commonalities. Social media makes it easy to find communities of people worldwide that share our views and beliefs. Often, these groups can operate as echo chambers.

There are “in” and “out” stocks in the market all the time. People will rush into stocks that are doing well and are popular, then rush away when they aren’t. Everyone loves to poke fun at the “Reddit” crowd, buying and selling “meme” stocks.

Yet, it is no different than a pattern I’ve seen my whole life. Wall Street is hardly immune to causing irrational price movements because “everyone knows” this or that. Savings and loan associations, the dot-com bust, CMO squared, Wall Street has come up with its share of foolish ideas that very large institutional investors piled into with both fists.

On the other side, the market has frequently sold off perfectly sound companies. When prices drop and move swiftly towards “bear market” territory for any single company or fund, it’s important to look deeper and see what is happening. The famous quote of buying when there is blood in the street comes to mind.

Being a high-yield investor often means being a contrarian investor by buying out-of-favor securities. Yields get high when the price is low relative to the dividend. Prices get low because a lot of people are selling. The big question is whether they are selling for a good reason or selling because that is what is currently fashionable.

This requires plenty of research and due diligence, as you must determine why something is crashing. You must evaluate fundamental risks and determine how accurate the perceived risk is.

Today, I want to highlight two oversold funds. These funds offer excellent dividend income from down and out securities. These funds invest in sectors that are experiencing oversold conditions, and we are avid buyers of those types of situations.

Pick #1: THQ – Yield 6%

When the market starts selling, it can be quite indiscriminate. Investors just panic and press the “SELL” button. At HDO, we love those investors, they provide us opportunities to buy income at cheaper prices, secured by fundamentally sound companies in strong sectors.

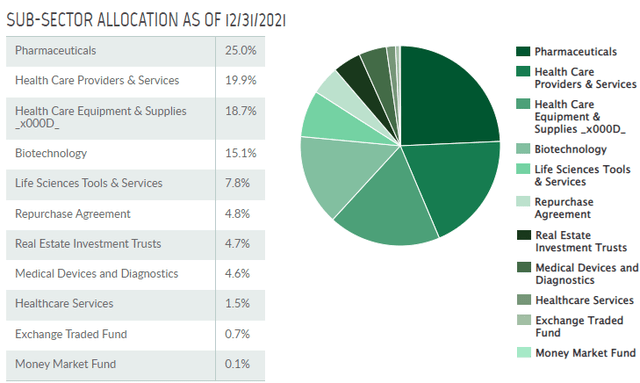

One example is Tekla Healthcare Opportunities Fund (THQ). THQ has exposure to all things healthcare such as pharmaceuticals, providers, equipment, biotech, life sciences, and more.

Tekla Healthcare Opportunities Fund (THQ)

When you go to the doctor, companies that THQ invests in are likely responsible for everything you see from the personal protection equipment, the medical tools, the medication you’re prescribed, possibly even the building you are in.

It’s a harsh reality of life that the longer you live, the more doctors you know by sight. THQ has a US-centric portfolio, and the population of the U.S. is aging. The Baby Boomer generation is the largest and wealthiest generation in history and is spending a considerable portion of that wealth on healthcare – an amount that is likely to continue increasing for decades.

With the recent pullback, THQ is now trading at a 7% discount to NAV, a fairly significant discount for a CEF that has been averaging a discount of 2% or less. This makes it a great time to pick up some shares to benefit from the secular tailwinds in the healthcare sector.

Note: Tekla World Healthcare Fund (THW) is a sister fund with very similar holdings and a yield of over 9.2% which is trading at a small 1% premium to NAV. On a total return basis, we still favor THQ, however, for investors who are willing to sacrifice a little total return for a higher dividend, THW is a good alternative that can be swapped for THQ.

Pick #2: JPS – Yield 7.4%

Fixed-income is a sector that has sold off in anticipation of interest rate hikes. This creates an opportunity to buy high-quality fixed income at an attractive price. We can take advantage of the sell-off to grow our income.

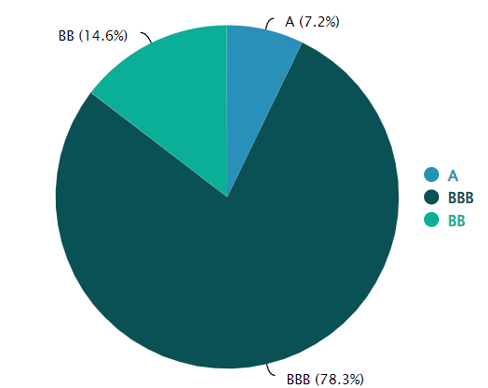

Nuveen Preferred & Income Securities Fund (JPS) is a CEF that invests in high-quality fixed-income. JPS is trading at an 8% discount to NAV, its steepest discount since May 2020. JPS invests in low-risk securities – over 85% of its holdings are investment-grade or better.

Nuveen

JPS primarily invests in institutional preferred shares and convertible bonds. Their largest sectors are major banks and insurance companies, which combined account for over two-thirds of their holdings. The holdings are high-quality, defensive investments that are likely to continue paying their coupon through most economic conditions.

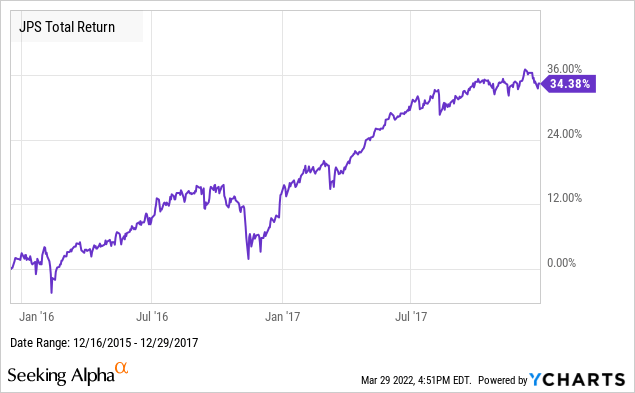

Many investors have the knee-jerk reaction that Fed rate hikes are automatically bad for fixed-income. Thus, the reality is often very different, here is how JPS performed from the Fed’s hike in December 2015 through December 2017, a period where rates went from 0% to 1.5% with 6 hikes:

Clearly, rising rates are not the end of the world for fixed-income that some would have you believe. Take advantage of those who have not learned from history, and snap up high-quality investments when they go on sale!

Shutterstock

Conclusion

THQ and JPS are currently not in the cool kids club. Investors are selling off their shares in search of greener pastures, and we are happy to take those shares off their hands. Healthcare and Fixed Income are two areas in the market that will provide us with excellent income for the years and decades to come. In time, the market will run around its circle and come back to these high-quality funds.

When you have a limited supply of capital to invest, buying securities on sale will allow you to see the most income possible from your starting position. Today, these two funds allow you to boost your income and see outperformance on the horizon as others rush back when these sectors are “cool” again.

Let’s ditch the high school mentality. We’re saving or planning for retirement, for goodness sake! My retirement is paid for in dividends, and they keep on raining in. If I get those dividends on sale from others who decide to follow the crowd instead of deciding for themselves, so be it.

In the end, the choice is yours. You get to decide. That’s the beauty of being an adult. That’s the beauty of income investing.

Be the first to comment