We Are

Dear readers,

For those of you following my articles, you will know I’m a proponent of investing in cheap, or undervalued companies. Most of my articles focus on a company being cheap combined with an upside either from reversion, earnings growth, or a combination of the two.

What you won’t find is me arguing that a company has a great total addressable market, superb growth estimates, and a new product or service that completely, by itself, makes the company investable. That’s not me, and that’s not how I invest.

Value investing as a Portfolio Strategy

Value investing or contrarianism by design means that you need to take a longer, sometimes much longer, perspective than most other types of investors. If you look at an investment and after a week, a month or even a year aren’t satisfied because the company has dropped 20% or more or has cut the dividend and as a result of this, you sell the stock – well, chances are unless this was part of a “fundamental change of risk”-scenario, you might not have been properly prepared for what it means to be a value investor.

As value investors, we seek out stocks that the market is underestimating. We believe that given enough time, (we believe this to be one of the few factors or variables that really matter), a company of fundamental quality will revert to what is either a fair or an overvaluation.

The market does this – it overreacts, both on the negative and on the positive side.

We believe that stock price movements in the short term have a similar correlation to actual company quality or long-term return prospects as ice cream sales have to shark attacks (just kidding, there is actually correlation in this(!), but you get my point). The point is, that the market short-term has very little to do with whether a company is actually quality or not.

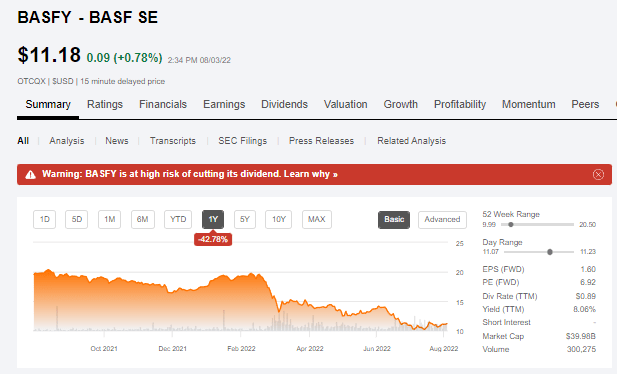

That is why I can invest 4-5% of my net worth into a business like BASF (OTCQX:BASFY), which is currently performing like this on a 1-year basis…

BASF Stock (Seeking Alpha)

…without caring overly much, beyond making sure that I am fully invested to the degree that my diversification and investment rules dictate.

The bottom line is that overreaction is the opportunity.

Overreaction in a negative way is an opportunity to “BUY” a stock.

Overreaction in the opposite direction on the other hand, is usually a good signal to divest or rotate part of, or an entire holding and reinvest that capital into something else.

People do argue against this – and often. Many investors argued that Amazon (AMZN) or Apple (AAPL) would never fall. I remember one investor whose portfolio stake of AAPL had grown to 20%, but he convinced himself not to sell, because “Apple could never fall”. He even bought more – at yields of below a single percent. While Apple is recovering nicely, he actually ended up rotating a part near the bottom due to fear. Amazon is still down 17% for the year.

My point is, don’t get caught in the modality that “Stock X can never fall”. I happen to love Castellum (OTCPK:CWQXF), a Swedish real estate giant. Looking at the pricing history, I rotated my massive 8-9% share of the company at the peaks when the business touched above 240 SEK/share.

Castellum 5-year price history (Google Finance)

Certainly not perfect by any matter – but the point was, I sold at profits of well above 100%, and cut my stake down to 0.5% of total. So I was well-prepared when the crash came, and the company dropped. I loaded back up to 5% at 125-135 SEK/share, and I’m already up close to 9% with dividends. This “cycle” went far quicker than I thought.

I can give more examples. Take a look at Finnish giant Fortum (OTCPK:FOJCF). I bought this utility at below €11.50 back in 2016, came close to selling in 2020, but finally sold my stake at a close-to-record of €26.50/share in very good timing, in hindsight.

Fortum Share Price (Google Finance)

Again, returns over 160% including dividends. The company crashed only a few months after this. Guess what I did when the company dropped to below €10/share? I’m currently up to close to 2% Fortum again, and plan to buy more here.

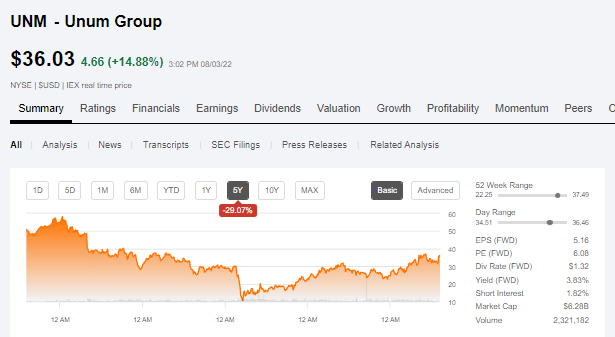

Another example? Take Unum (UNM). You can actually follow my stances on this one here on SA. My heaviest investing in the company began when the stock began trading at levels below $15/share.

UNM Share price (Seeking Alpha)

And when the share price increased over $35-$36? That’s when I sold. I, unfortunately, did not “BUY” back in between the drop and the spike today, but my point stands.

What do all of these companies, and the businesses I do this with, have in common?

A few things.

- They are fundamentally sound (usually IG-rated, with great history & management)

- They have no massive amounts of debt.

- They have a dividend – and one that is well-covered.

- There usually is no logical or acceptable reason for the company in question to be punished to the degree that it is being de-valued.

Understand that I am not saying I do not understand the reasons, or that there is no reason at all for the company to be de-valued. Unum had an issue with its LTC blocks. BASF is facing gas and electricity issues. Fortum is currently in the midst of a Uniper crisis. Castellum was facing one of the biggest real estate issues in Sweden since 2010 (and still is).

The market is saying, usually very similar, that the reason that they’re being punished, is enough to devalue them to such a degree that they’re suddenly equating large amounts of the company’s assets or earnings to being worthless, compared to what things were going on before.

Does this sound logical? Does it sound acceptable?

As value investors, we say “no”.

We fully understand that a recovery could take years. Literally years. I will be the first one to say that I do not think you should invest in BASF – at all – unless you’re willing to take the long perspective. People are acting as though the sky is falling around Ludwigshafen (the company’s largest Verbund site), and as though this sort of action has never happened before.

Newsflash – it’s happened many times.

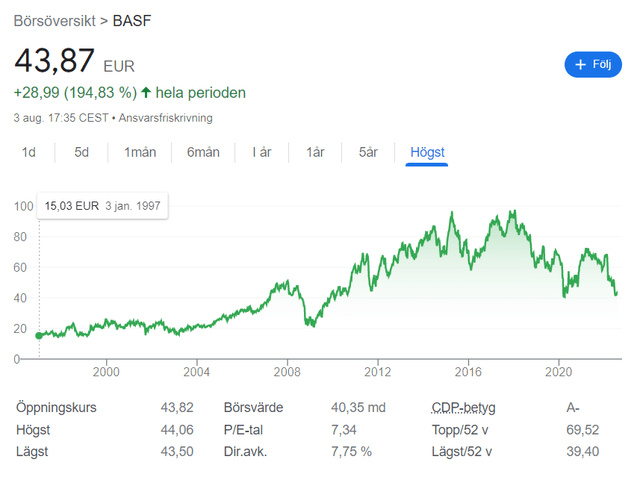

BASF Share price (Google Finance)

Watching the company’s valuation ebbs and flows, you get a feeling of where the market tends to put the company – both its highs and its lows. Understanding this, and understanding that the market overreacts means that you can make money off the highs, and buy at the lows.

This, to me, is the essence of value investing – and this is how I try to allocate my capital over the medium and long term.

I have positions in my portfolio that I expect to be underwater for potentially years before finally delivering the goods. But once those goods are delivered, then we’re talking triple digits. Even high triple digits.

My/others’ failures

However, I wouldn’t be much of an honest investor if I didn’t talk about my failures. They exist, and while they thankfully have been small (No realized loss larger than $2000 in total in the last 7 years), owing much to “luck”, excellent guidance and learning from capable investment professionals, and sticking to my strategy, I nonetheless believe them to be valuable lessons.

1. Equating “any” undervaluation with quality

The term “value investing” has been used too loosely over the last few years, because suddenly investors are claiming that every nanocap stock is somehow a “value” stock. To me, a company needs to have actual value – size, credit, fundamentals – in order to be categorized as such.

My by-far biggest failures center around being coaxed or drawn in investing in smaller-cap stocks with the promise of “value”, not doing enough due diligence myself, only to find that what I thought was a value stock was actually a small-cap player with incredible customer concentration – and now 2 of their customers are bankrupt, and I’m down 60% or more with no real hope of recovery in any sort of humane timeframe.

Be careful when someone tells you a small company, or smaller-cap equity is a “value play” or a “value stock”. If it doesn’t have the size, credit rating or relevance in its sector, you might be investing in a company that lacks some of the safety that comes with scale, which is one advantage I’ve started to treasure highly over the past few years.

2. Missing out because of pre-conceived notions

I was not happy that I had invested significant capital in oil stocks last year – and I allowed myself to be convinced by the naysayers on energy that oil stocks were too volatile and too fundamentally incompatible with future energy policy to ever make great investments (with certain exceptions).

I was completely wrong. The price I paid for this realization was exiting my investments with barely any profit, and missing out on superb oil stock growth by investing when crude futures were being priced at negative dollar amounts.

I should have known better because I didn’t allow myself to be pulled into tech/growth investing at sky-high valuations. But I forgot the reverse rule, which is that these companies, and the best of them, were incredibly appealing. I should have opened my wallet and put down 70-90% of what I had at the time.

When someone tells you “The entire sector is uninvestable”, and when it isn’t a highly specialized sector that’s quite likely to become obsolete, such as a company making the spokes for wheels used in horse-drawn carriages back in the 1920s, I’d be extremely careful about listening to such broad strokes.

3. “This will change everything”

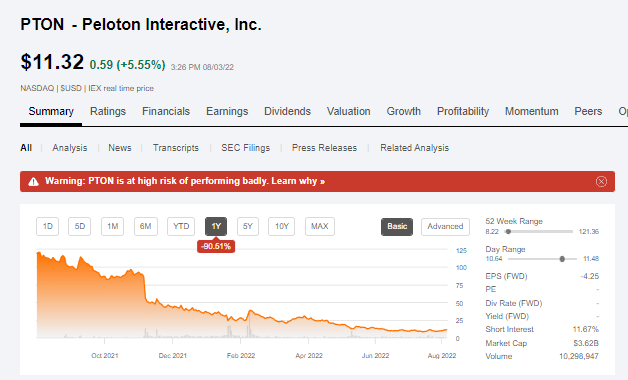

The opposite of this is equally dangerous – someone convincing you that this news is the only way things will be done in the future. We have an example close to hand – work and do things from home. We had respected analysts actually telling us that the future of all work is to work from home (with some exceptions) and that things will mostly be done from home.

This led to companies like Peloton (PTON), where analysts literally argued that a company screwing the equivalent of an iPad to an exercise bike and selling a subscription service (apparently meaning that all gyms which were cheaper, were a thing of the past) meant the company should be valued at a 200-300x theoretical P/E – which it never was because PTON has never actually made a single dollar of annual GAAP profit, and is currently forecasted to see an impressive adjusted EPS decline of 784%, down to negative $5.7/share.

Companies or investors that claim they will change everything, do not infrequently end up like this.

PTON Valuation (Seeking Alpha)

Now, this is not a failure I’ve personally faced – but it’s one that I very commonly hear about as we exit this overvalued tech bubble.

2 Contrarian/Value stocks

A good way of finding what I view as a contrarian, or a value stock, is to look at what everyone is currently saying will “never go anywhere”, or what everyone is hating on.

Currently, that is Europe and many European stocks.

The reasons for it are incredibly clear – and even valid to some extent. Ukraine, electricity prices and the prospect of winter, as well as a worsening gas situation, isn’t an easy thing to get past.

But it’s also led to a massive, EU-wide valuation decline for quality stocks that I view as one of the best investment opportunities of the decade.

When I invest, my goal is nothing less than a 100%+ RoR. I want that 100%+ in less than 3-5 years, if possible, and I want to be able to consider that upside to be realistic.

With that in mind, here are two stocks that, to my mind, fulfill this. These are not “the best” – but they’re great examples.

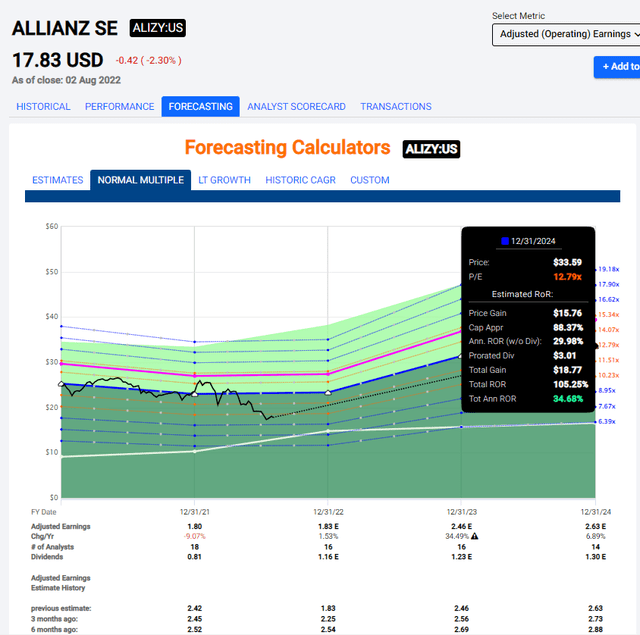

1. Allianz (OTCPK:ALIZY)

Allianz published 1Q22 numbers back in May. This was before the serious, deep part of the crash really began. The core of the message is that revenues on a group-wide basis were up 6.2%, and segment-specific revenues saw increases across the board – in P&C, Life/Health, and the asset management arm. The company still saw some internal growth and delivered good profit, even if shareholder net income was down due to provisions for Structured Alpha products in the US.

However, Allianz remains at high group solvency of very close to 200%, which comfortably supports the company’s generous dividends. The company continues to expect a capital generation net of tax and a dividend of around 10% in 2022, supporting a strong upside for the business.

On an individual basis, results and trends are more encouraging. The P&C operations came in at very strong levels, seeing strong internal growth across almost the entire board of geographies where the company is active. Furthermore, the company managed to push rate changes in terms of renewals of up to 11-12% in some cases for Global lines, with averages of around 3.5-4%.

All of this means, for the valuation, that I view the company as extremely undervalued on the basis of its current share price. Looking at the embedded-based valuation of Allianz and considering a WACC of 8.9% and a risk-free rate of 3.5% to reflect the increased interest rate as well as a now-increased 4%+ cost of debt, we still get a share-based embedded value of €235/share for the native. Again, no matter how you slice this one, this company is trading below where it should be trading.

This makes it a value play – and an AA-rated, 6%+ yielding one. The largest insurance company on the planet.

The upside is no less than 100%+ until 2024, and I view this as realistic. Until then, your dividend is well-covered, and investing today, I believe you have significant upside.

Allianz Upside (F.A.S.T graphs)

So, Allianz is the first company we look at here.

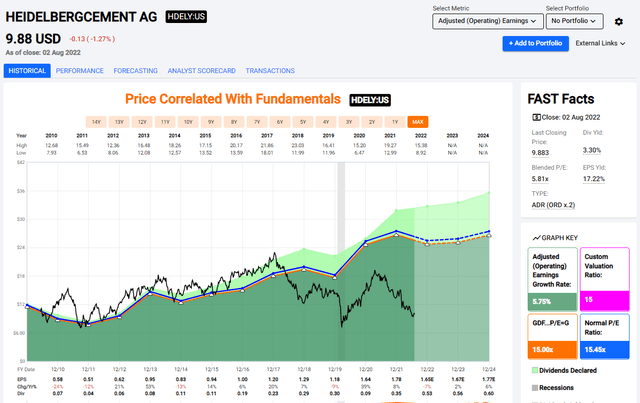

2. HeidelbergCement (OTCPK:HDELY)

One of the world’s largest cement and concrete companies is trading as though the world does not need concrete or cement any longer and currently is around 5.8x P/E.

HeidelbergCement Valuation (F.A.S.T graphs)

Let me reiterate that I welcome drops such as this, and valuation situations like this, for their ability to deliver exactly the triple-digit alpha I want, while enabling me to get it by investing in investment-graded market leaders with superb yields.

It’s easy to understand why the market doesn’t especially like HeidelbergCement at this particular time – again, value investing is not about not understanding what the market is seeing.

What isn’t as easy to understand, at least not for me, is how anyone could believe that this company should trade at close to 5-6X P/E when it’s active in one of the most significant infrastructure segments available.

As I mentioned in some of my base articles, HeidelbergCement is one of the largest building materials companies on earth – period. After completing the M&A of Italcementi, it became the largest aggregate producer for construction aggregates at the time and is now one of the world’s largest producers of building materials.

It works in 60 countries with 67,000 employees working at over 3,000 production sites, operating over 135 plants with an annual capacity of over 175 million tonnes. Additionally, the company has over 1,500 ready-mix sites and over 600 quarries where aggregate is sourced.

If you recall my base article on the company, the results for 2021 were absolutely stellar. HeidelbergCement saw a near-double digit sales revenue increase, a 6% EBITDA increase, and above all, a successful across-the-board price hike increase and fixed cost management that preserved the company’s operating margins and profit – despite the aforementioned, sub-par asset quality in context to competitors.

We do need to discount the company at this juncture to reflect some of the headwinds, but the way the market is going into it at this time is bordering on ridiculous.

None of the negatives will significantly make HeidelbergCement an unappealing investment. What’s changed is that the continued trajectory for the 2025E targets has been broken – and it seems doubtful that all of the company’s targets will be realized, if things continue along this line. As a small note, a sale of business activities in US west will color EPS with non-recurring sales gains of close to €500M.

HeidelbergCement is all about the road to normalization – and the market’s view of how long this will take. I come to a mixed PT of around €82/share here based on a mixed DCF/NAV/forecast and peer perspective, which is above the S&P Global share price. For the native ticker, the average share price from 19 analysts is now down to below the €70/share level, with the high at around €85/share, compared to a 2021E high of around €102/share. The analysts believe this company has a long way to reversion, and indeed that might be the case.

My bullish case is based on the, in my opinion, conservative assumption that earnings aren’t going anywhere. While we might see a small drop down to around €8/share for the native in EPS, this would come to around a 9-10% EPS drop, but still higher than any time before.

My view of this target change is that the company’s 20 following analysts are overreacting, and failing to recognize the potential of this investment. On a 10-year basis, the company’s trough has been around €30-€40, and highs of €92.

HeidelbergCement is also a company I successfully bought and rotated. I successfully invested in HeidelbergCement between 2014 and sold in late 2017, making a return in the triple digits.

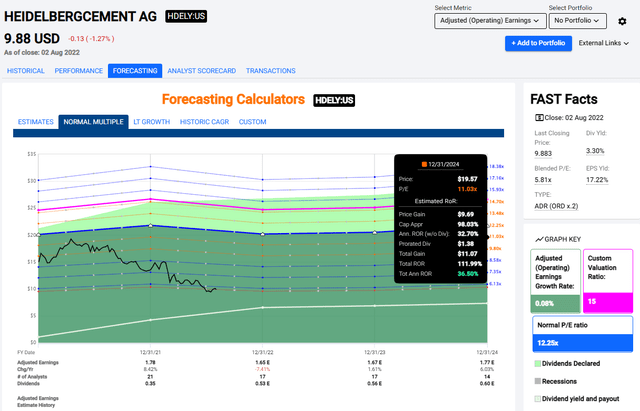

My intention is to do the exact same thing again – like a value investor. The upside is triple digits here, even on a forward 11x P/E.

HeidelbergCement Upside (HeidelbergCement IR)

That is the second pick for this article.

Wrapping up

As a contrarian investor, I often times feel as though I am shouting to an unheeding crowd of people. This is not to claim that my approach is “the” approach for everyone, because it very clearly is not.

However, many investors ask me a question that basically contains the following essence.

“How can I invest in great companies and get good returns while also staying safe in any/most market situation/s?”

Well, to me, value investing is the answer.

Why?

- You’re sure to invest in great companies if you focus on fundamentals, quality, leverage, dividends, and management.

- You’re bound to invest in a long-term historical good position if you heed valuation logic and focus on the company being “cheap”.

- Your returns, even during a negative market situation, are somewhat cushioned by dividends.

- Your capital, even in a downturn, is never really in “danger” – because what really is the risk a company like Coca-Cola (KO), Allianz or some of the other companies really go down?

- Now add diversification where none of your stellar companies has more than 3-5% of your portfolio.

The net result of these five steps, to me, is a portfolio or an investment style that’s tailored to almost any market situation I can think of.

It is what allows me to stay the course in any market situation we’ve encountered for the past 5-10 years.

Does it sound interesting?

Then maybe this has some value to you.

Be the first to comment