Foreword

A reader of August 2019’s version of this high-yield, low priced, dividend dog list called it, “dangerous advice.” Hence, this information is to be used at your own risk.

I have always advised that high dividends portend high risk. Combine that signal with a low-price offer and you have the stuff of legends and horror stories. Especially in light of Y Charts declaration that YCharts allows a dividend yield to persist for 365 days after the most recent reported dividend if a dividend is cut. Therefore, a few line items you see calculated here could be totally inaccurate. (Most of the time Y-Charts withholds forward yield projections when a dividend is cut, however… but not always.)

These 130 October selected stocks reported total annual returns ranging from 3.32% to 451.84%. Any candidates this month showing yields greater than 20% were removed because their dividends are the most likely to be cut or curtailed. I did nothing about Chinese-based high yielders, but China has announced a preference for home-grown investors and could ban Chinese corporations from international stock market listings in the future.

Another caveat holds for Russian listings. With Putin’s war with Europe raging, the price drop in Russian stocks sent yields over 25% and thus off this list since August. Raising the market cap from $100M to $200M, and not listing stocks with negative price returns, kept the list just under 100 last month and kept ARR and AGNC and other regulars off this listing. Nevertheless Mr. Market has slashed prices and here’s the evidence of 130 dividend stocks yielding greater than 10% for October

This October list is at 130 and November will generate a new list. Maybe those missing will recover positive price returns and rejoin the pack. Thus, the healthiest of sickly dogs will collect here.

Happy hunting, and beware of the numbers put up from the top ten by yield on this list of 130. In short, this is risky business. These are Dogs of the Low, not of the Dow. These dogcatcher metrics are set to snag the most unloved and unpopular curs as a contrarian stock selection strategy.

Meanwhile, all but six of the 130 stocks on this list, show dividends from a $1K investment greater than their single share prices. Some investors find this condition to be an invitation to, at least look closer, or maybe, buy.

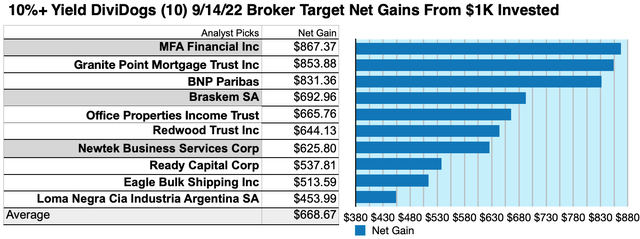

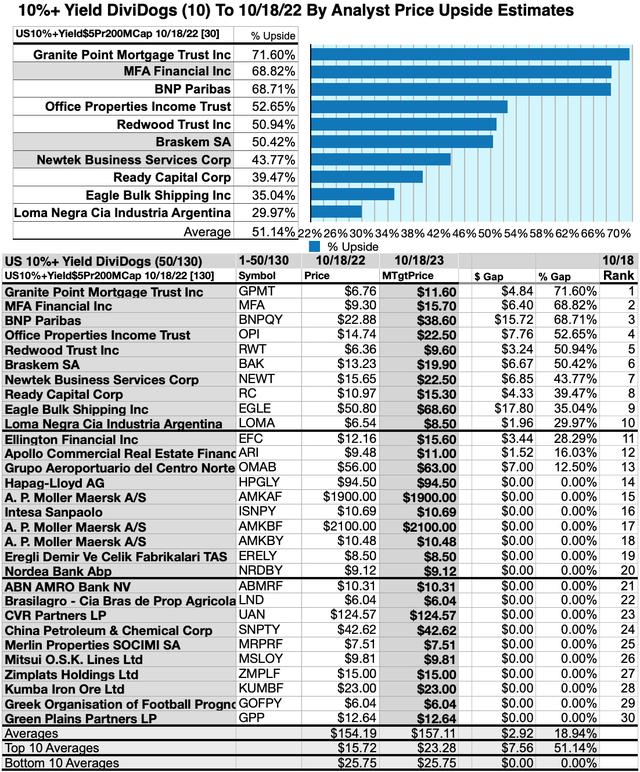

Actionable Conclusions (1-10): Brokers Calculated 45.4% To 86.74% Net Gains For The Top Ten 10%+Yield Stocks As Of October 18, 2023

Three of the ten top-yield 10%+Yield stocks (tinted in the list below) were among the top-ten gainers for the coming year, based on analyst 1-year targets. Thus, this forecast, as graded by Wall St. Brokers, was 30% accurate.

Dividends from $1000 invested in the highest-yielding stocks and the median of analyst-estimated one-year target prices, as reported by YCharts, created the 2022-23 data points for the following estimates. (Note: one-year target prices from lone analysts were not applied.) Ten estimated profit-generating trades to October 18, 2023 were:

MFA Financial Inc (MFA) was projected to net $867.37 based on dividends, plus the median of target estimates from 6 analysts less broker fees. The Beta number showed this estimate subject to risk/volatility 75% over the market as a whole.

Granite Point Mortgage Trust Inc (GPMT) netted $853.88 based on dividends plus the median of target estimates from 4 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 48% over the market as a whole.

BNP Paribas (OTCQX:BNPQY) was projected to net $831.36, based on dividends plus the median of target estimates from 2 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 45% over the market as a whole.

Braskem SA (BAK) was projected to net $692.96 based on dividends plus the median of target estimates from 8 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 67% over the market as a whole.

Office Properties Income Trust (OPI) was projected to net $665.76, based on dividends plus the median of target estimates from 4 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 20% over the market as a whole.

Redwood Trust Inc (RWT) was projected to net $644.13 based on dividends plus the median of target estimates from 9 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 18% over the market as a whole.

Newtek Business Services Corp (NEWT) was projected to net $625.80, based on dividends plus the median of target estimates from 2 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 19% greater than the market as a whole.

Ready Capital Corp (RC) was projected to net $537.81, on dividends plus the median of target estimates from 7 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 19% greater than the market as a whole.

Eagle Bulk Shipping Inc (EGLE) was projected to net $513.59, based on dividends plus the median of target estimates from 8 brokers, less broker fees. The Beta number showed this estimate subject to risk/volatility 31% greater than the market as a whole.

Loma Negra Cia Industria Argentina SA (LOMA) was projected to net $453.99, based on dividends plus the median of prices estimated by 6 analysts, less broker fees. A Beta number was not available for LOMA.

The average net-gain in dividend and price was estimated to be 66.87% on $10k invested as $1k in each of these ten stocks. This gain estimate was subject to average risk/volatility 17% greater than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends; (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

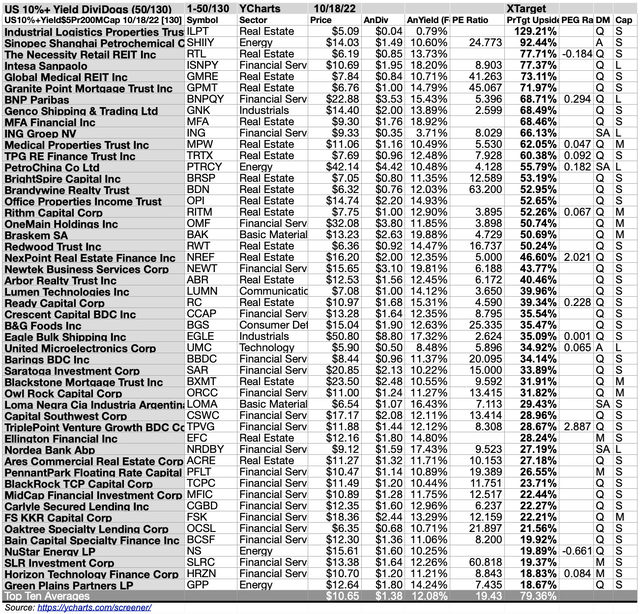

50/130 Broker Price Target Up/Dn-sides

50/99 10%+Yield Top-Dogs By Yield

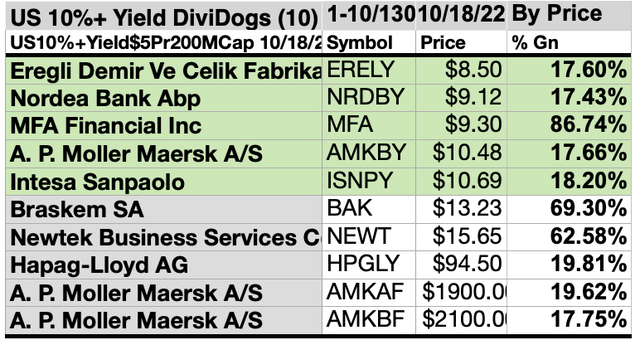

Actionable Conclusions (11-20) Top Ten 10%+Yield October Stock Yields Ranged 17.43%-19.88%

Top ten 10%+Yield dogs selected 10/18/22 by yield represented four of eleven Morningstar sectors.

First place was earned by the first of two basic materials stocks, Braskem SA [1]. The other materials, member placed ninth, Eregli Demir Ve Celik Fabrikalari TAS (OTCPK:ERELY).

Four Industrials sectorstocks in the top ten placed second, fourth, seventh, and eighth: Hapag-Lloyd AG (OTCPK:HPGLY), A. P. Moller Maersk A/S (OTCPK:AMKAF) [4], A. P. Moller Maersk A/S (OTCPK:AMKBF) [7], and A. P. Moller Maersk A/S (OTCPK:AMKBY) [8].

Then third place went to the top of three financial services members, Newtek Business Services Corp [3], while the other financials placed sixth and tenth, Intesa Sanpaolo (OTCPK:ISNPY) [6], and Nordea Bank Apb (OTCPK:NRDBY) [10].

Finally, fifth place was occupied by the lone real estate representative, MFA Financial Inc [5], to complete the 10%+Yield top ten for October, 2022-23.

Actionable Conclusions: (21-30) Ten 10%+Yield Stocks Showed 29.97% To 71.6% Upsides To October 18, 2023 and (31) No Down-siders

To quantify top yield rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig out bargains.

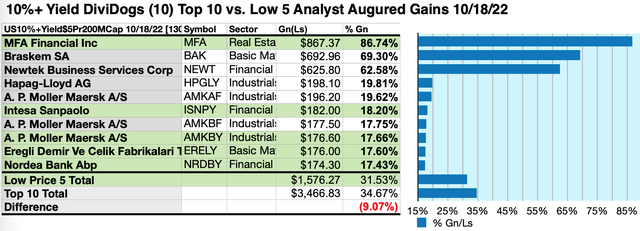

Analysts Estimated A 9.07% Disadvantage For 5 Highest Yield, Lowest Priced, Of Ten 10%+Yield Dogs To October 18, 2023

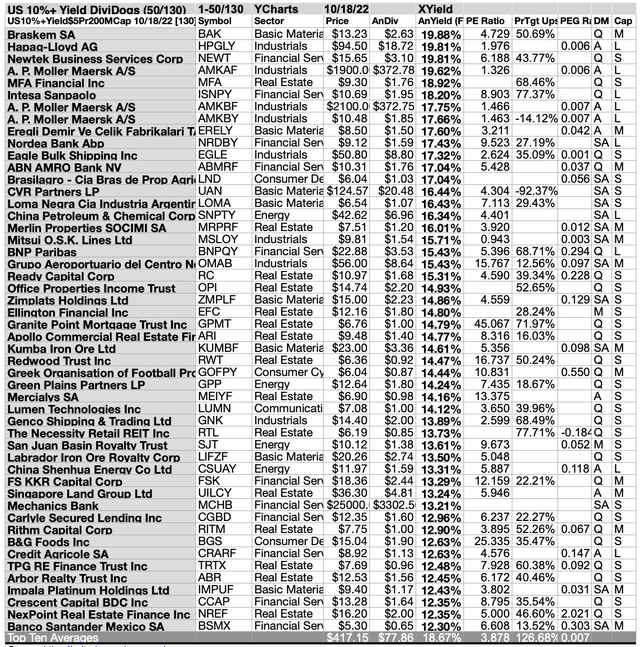

Ten top 10%+Yield dogs were culled by yield for this October update. Yield (dividend/price) results verified by Yahoo Finance did the ranking.

As noted above, top ten 10%+Yield dogs selected 10/18/22 showing the highest dividend yields represented four of eleven sectors in the Morningstar scheme.

Actionable Conclusions: Analysts Estimated 5 Lowest-Priced Of Top Ten Highest-Yield 10%+Yield Dogs (31) Delivering 31.53% Vs. (32) 42.57% Net Gains From All Ten By October 18, 2023

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten 10%+Yield dogs collection was predicted by analyst 1-year targets to deliver 9.07% LESS net gain than $5,000 invested as $.5k in all ten. The third lowest priced, MFA Financial Inc was projected by analysts to deliver the best net gain of 86.74%.

The five lowest-priced top 10%+Yield stocks as of October 18 were: Eregli Demir Cia Celik Fabrikalari TAS; Nordia Bank App; MFA Financial Inc; A.P. Moeller Maersk A/S (BY); Intesa Sanpaolo, with prices ranging from $8.50 to $10.69

Five higher-priced >10%Yield dogs from September 14 were: Braskem SA; Newtek Business Services Corp; Hapag-Lloyd AG; A.P. Moeller Maersk A/S (AF); A.P. Moeller Maersk A/S (BF), whose prices ranged from $13.23 to $2100.00.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

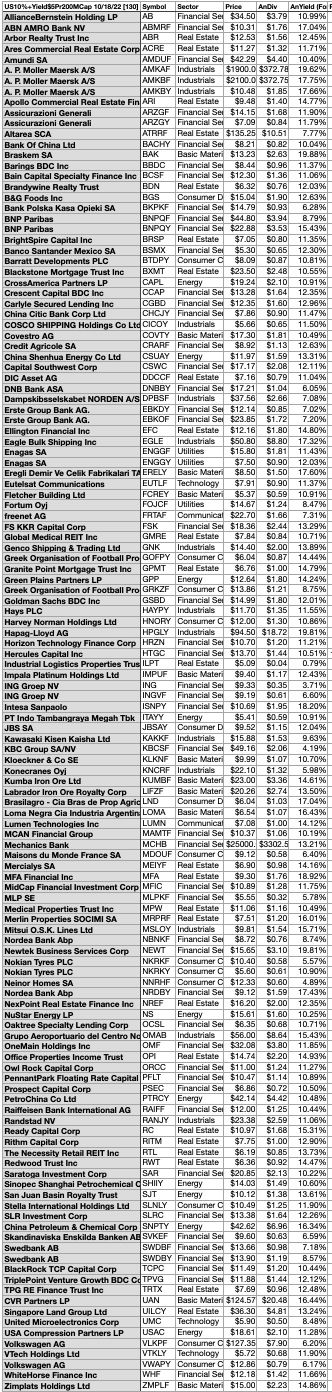

Below is the listing (alphabetically by ticker symbol), of all 130 of the 10%+Yield stocks from YCharts as of 10/18/22.

130 10%+Yield Dogs For October

Source: YCharts

Note: 95 of the 99 stocks on this list show dividends from a $1K investment greater than their single share prices. Some investors find this condition to be an invitation to buy or, at least, look closer.

Stocks listed above were suggested only as possible reference points for your 10%Yield-Priced dividend dog purchase or sale research process. These were not recommendations.

iridi

Be the first to comment