When shares are this similar, it’s pretty easy to pick the better value.

Monica Click

Get ready for charts, images, and tables because they are better than words. The ratings and outlooks we highlight here come after Scott Kennedy’s weekly updates in the REIT Forum. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

We’ve been getting more active in trading our preferred share positions. Since the market persists in being irrational, we’re taking advantage of opportunities to swap between positions. The objective is to keep enhancing the risk/reward profile. Often this results in jumping back and forth between the same shares while increasing the total number of shares.

For instance, if you started by owning 1,000 shares of NLY-I, traded them for some number of shares of NLY-G, then traded those shares for 1,040 shares of NLY-I, and have a better position. Anyone who doubts that 1,040 shares of NLY-I is less valuable than 1,000 shares of NLY-I is on the wrong website. We strive to be accessible to new investors, but I’m not teaching third grade math. If you’re new to the sector, you might assume this would be impossible, yet we’ve done it many times. The trick is recognizing the right ratio between shares to make the trades. You needed to know how many shares of NLY-G you wanted to get for your 1,000 shares of NLY-I to make that sequence work.

That’s what many of our preferred share articles focus on. We’re identifying opportunities where it makes sense to swap from one share to another. We are not discussing if an investor should be invested or if they should sit in cash. We don’t have room for the discussion. We’re focused on maximizing performance over time, not timing the market. Whether the price of NLY-I went up or down, 1,040 shares is better than 1,000. When someone tells you they can predict the entire market so they don’t need to evaluate fundamentals, ask for their complete trading history. That should be a good time.

Ideas

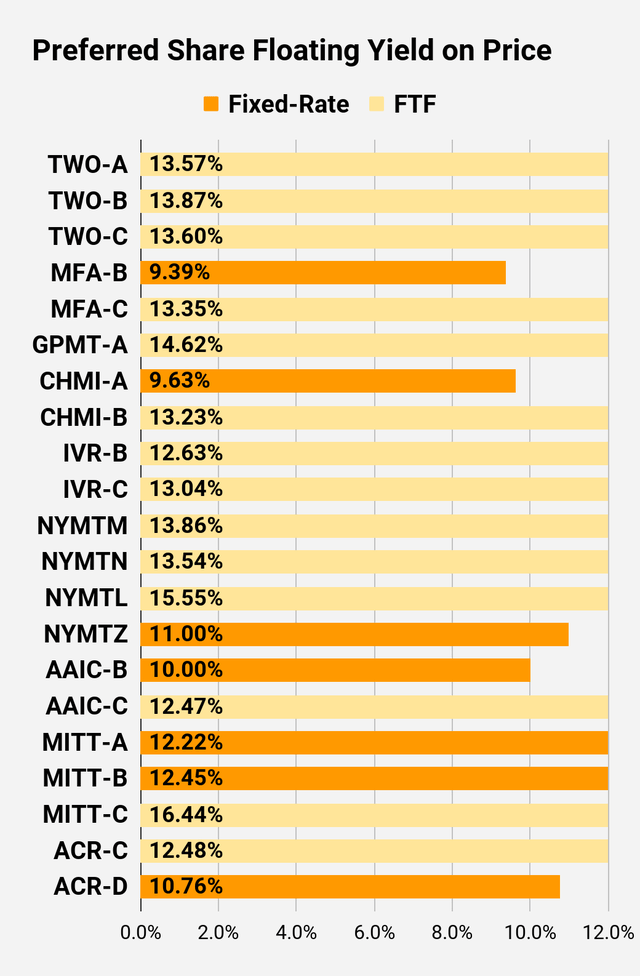

Today we have a disparity in the valuation of NYMTN and NYMTL.

Quick comparison:

- Upside: NYMTN at $19.35 has less upside than NYMTL at $17.52. NYMTL wins. That’s a big edge for potential gains in a market recovery.

- Yield Today: NYMTN’s yield at 10.48% is better than NYMTL’s yield at 9.94%. NYMTN wins. That’s nice, but not enough. You’re talking about 0.5% per year. But only until the fixed rate ends.

- Floating Spread: NYMTN’s floating spread is 5.7%. NYMTL’s floating spread is 6.13%. NYMTL wins. That’s an edge of 0.43%. But it gets better. Sinec NYMTL shares are cheaper, investors get far more of them.

- Floating Yield on Today’s Price: If shares were floating, NYMTN has 13.59%. NYMTL has 15.63%. That’s the bigger spread combined with a lower price. NYMTL wins big.

- Floating Starts: NYMTN starts 10/15/2027. NYTML starts 10/15/2026. NYMTL wins. That huge dividend increase (if rates remain elevated) hits much sooner for NYMTL.

- Fixed-to-Floating Spread: NYMTN’s floating spread of 5.7% comes after an initial rate of 8%. Unless short-term rates are over 2.3%, dividends decrease. NYMTL’s floating spread of 6.13% comes after a initial rate of 6.88%. For NYMTL’s dividend to decrease, short-term rates must be below 0.75%. NYMTL wins by a mile.

Investors who are sitting in NYMTN would be served well by changing their position to NYMTL. If you already own NYMTN, I don’t need to convince you that there is some value in these preferred shares. That’s not the point. I’m showing you which investment is better. This is how to win in the sector. Spot the opportunities to improve the risk/reward profile.

We’ve done this before. In some cases, we’ve seen relative prices swing significantly over the next week. We’re simply alerting investors to the failure in market prices.

Now we’re going to move on to a trade we placed yesterday. Prices swung pretty hard today, so the execution prices we used were better than the closing prices from 11/17/2022. Prices change every day. We’re simply taking advantage of the opportunities produced by those swinging prices.

Our Trade

We placed a few trades yesterday and sent a real-time alert to our members. I’m going to share a pair of the swaps from the alert. I’ll be quoting directly from that article, so investors are familiar with the layout for our alerts.

Note: Paragraphs or sentences that start with “note:” have been added to provide additional clarity for the public release.

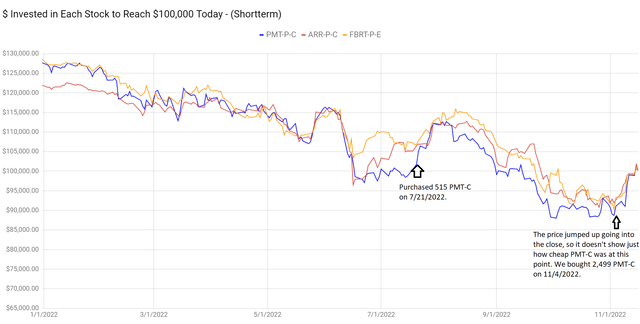

The next trade was moving PMT-C into FBRT-E and ARR-C.

The REIT Forum

We were monitoring the fixed-rate shares and found PMT-C was too cheap relative to other shares at those points. Consequently, we picked up shares. Now that the gap in relative valuations changed, we shifted our positions.

FBRT-E hardly gets any coverage. It usually wasn’t exciting. Since we don’t cover the common shares, we left the rating set to “merger” after the original REIT entered a merger. However, we also kept price targets on the shares and those targets showed FBRT-E falling below peers.

Common shares of FBRT have done very well year-to-date. They’ve delivered a positive total return of about 2.5% on the year. Further, FBRT-E has some of the better coverage metrics among the mortgage REIT preferred shares. Therefore, we decided it would be reasonable to swing into FBRT-E for a while.

Since FBRT-E shares were suffering from poor liquidity, we decided to use ARR-C for the rest of the swap. It gives us another respectable opportunity to capture some outperformance.

There would be nothing wrong with holding onto any of these shares for income. We’re jumping back and forth using some of the lower-risk shares precisely for that reason. We’re comfortable being “stuck” with shares as they offer a compelling yield and a significant discount. Yet if the market remains as inefficient as it has been lately, we would be fine to continue swapping positions.

Account

These trades went through our tax-advantaged accounts. No benefit for a capital loss, but no penalty if we take capital gains later. We may get another opportunity to swap between shares in the future and we like to make those trades without considering any tax consequences.

Execution

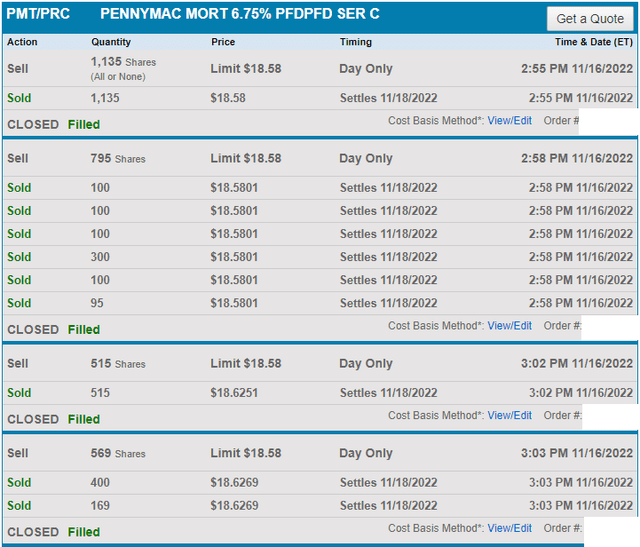

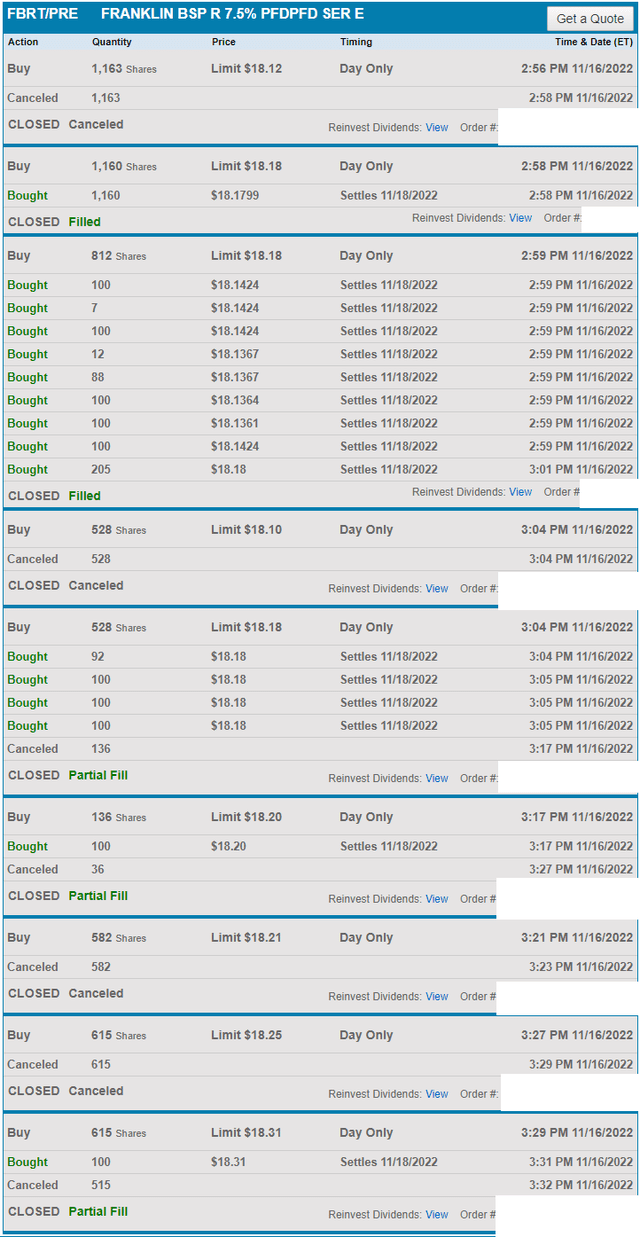

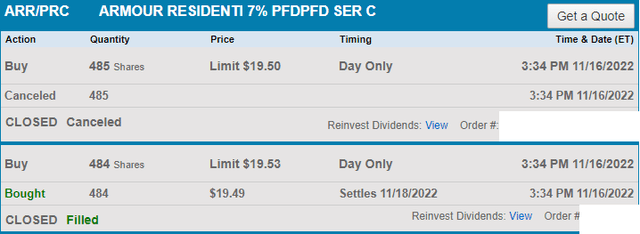

Trades went through Schwab and Fidelity:

Schwab

Schwab

Schwab

Note: The trades that went through Fidelity were part of another swap that we’re not including in this public article. We may add it later. We include screenshots of execution because we’ve found most readers value them. They provide transparency. An analyst who claims they “bought” something could later claim: “We added it to the Google Sheets or we bought it in a practice / imaginary account. That’s the same thing! Stop whining!”

To be extremely clear, it is not the same thing. Our portfolio stands behind our research. By including execution images, we raised the stakes. Anyone who accuses us of not placing a trade after we post an execution image is accusing us of a crime. There is zero misunderstanding with execution images.

As you may notice, I run into liquidity challenges as well. Sometimes I end up needing to cancel orders and adjust the limit prices. It’s a bit of a challenge because I want to get trade alerts posted, which means pushing for a bit faster execution rather than letting an order simply sit there for hours or days.

Returns for Closed Positions

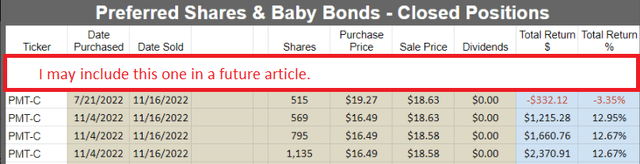

The REIT Forum

Note: I stripped out the other trades as they may go into another article. The goal is to show the trades in PMT.

Most of those purchases worked out very well. The older ones ended up with a small loss while the more recent ones provided exceptional returns.

Since the market has been remarkably irrational over the last several months, we’ve become a bit more active in swapping between preferred shares to optimize returns. It used to be very rare to get these kinds of opportunities, but one nice thing about the increased volatility in the prices is the opportunity to swap between similar shares to capture changes in relative value.

We’re looking for FBRT-E to outperform some peers and will most likely end up swapping it for one of those peers after a change in the relative valuations.

Note: The swing in valuations is already underway as we had a solid pick.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

Let the images begin!

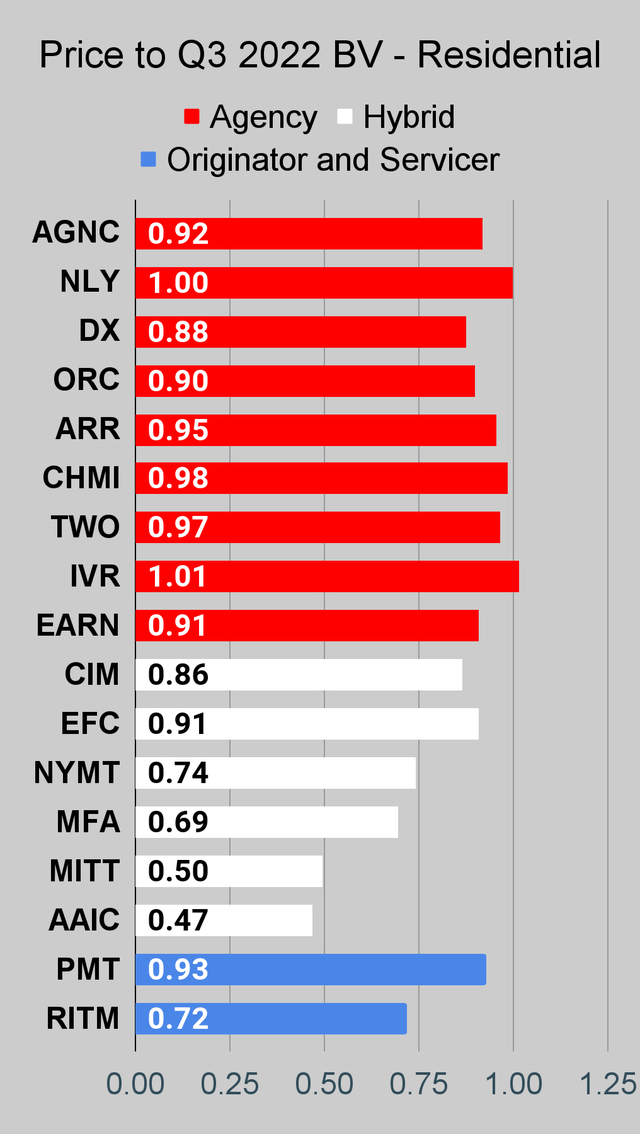

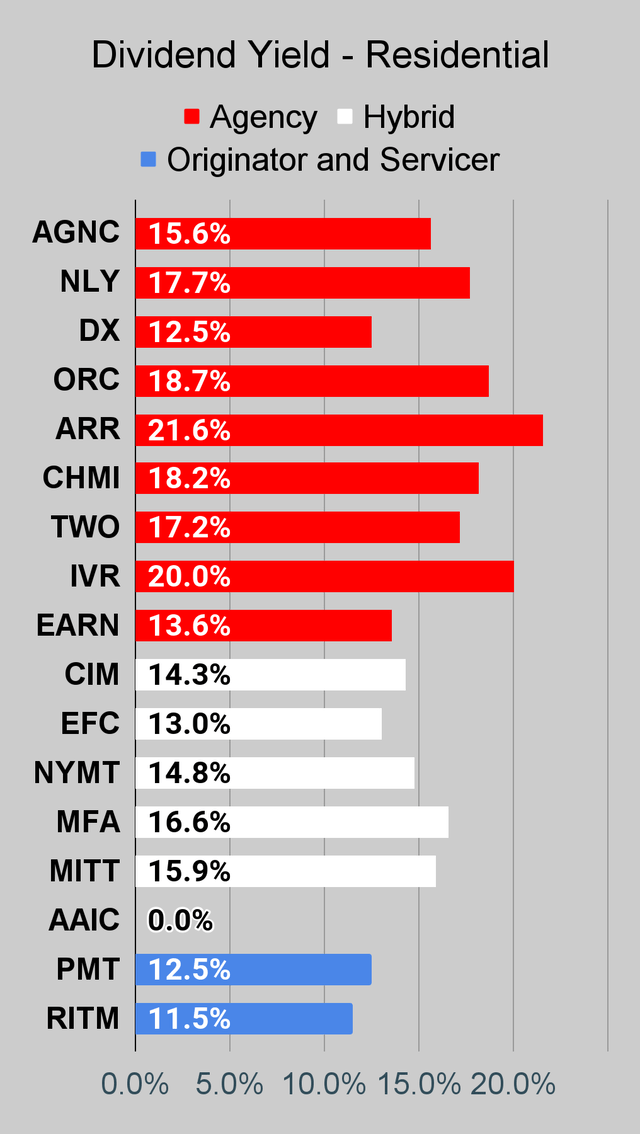

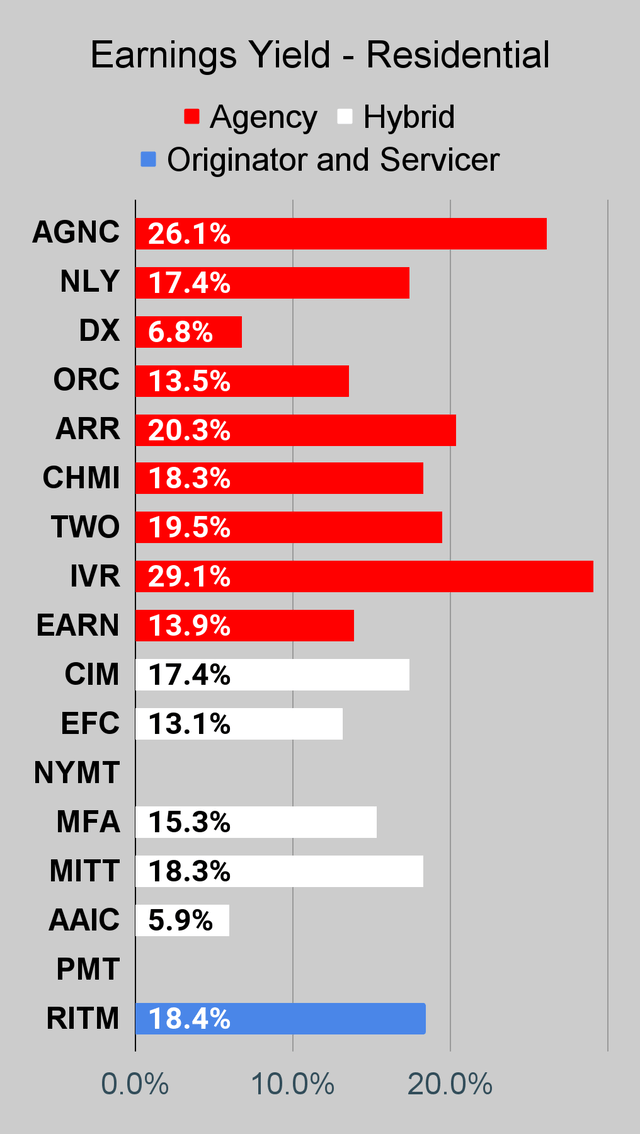

Residential Mortgage REIT Charts

Note: The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It’s available in our service, but those estimates are not included in the charts below. PMT and NYMT are not showing an earnings yield metric as neither REIT provides a quarterly “Core EPS” metric.

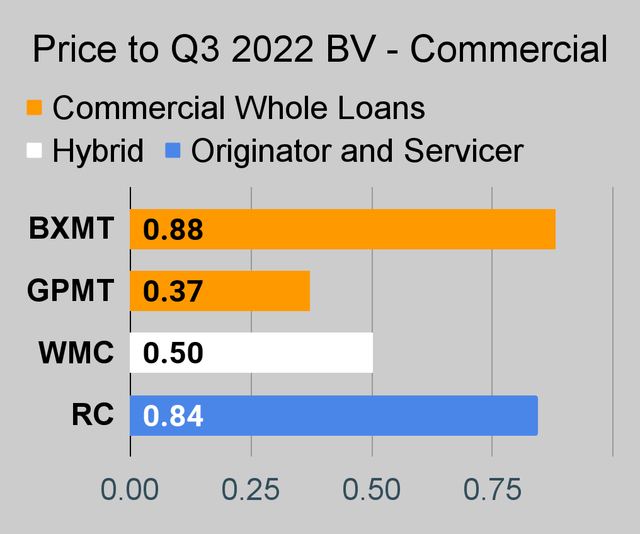

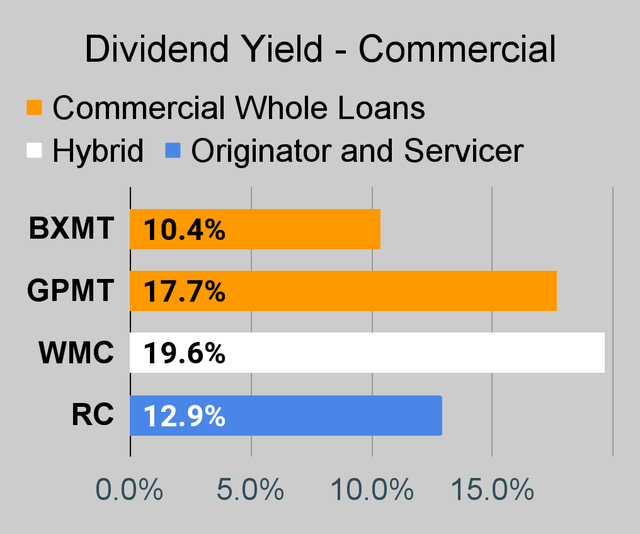

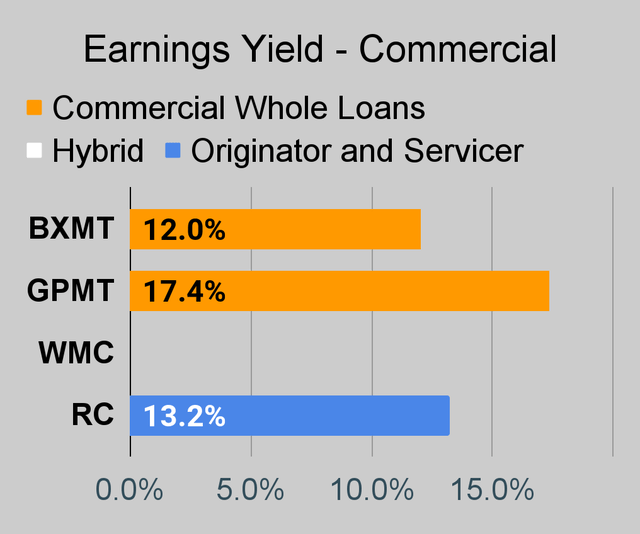

Commercial Mortgage REIT Charts

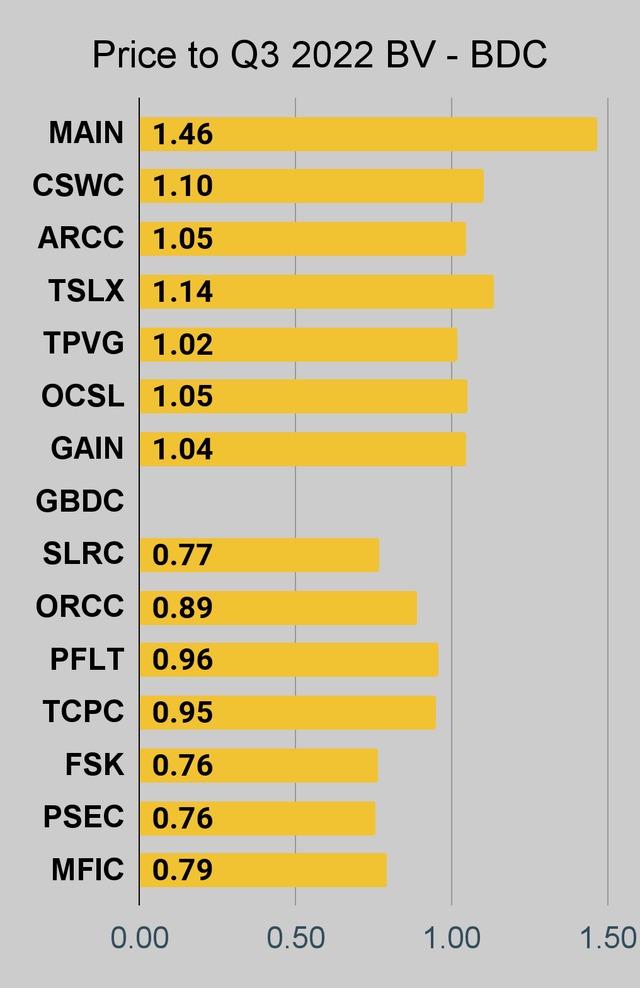

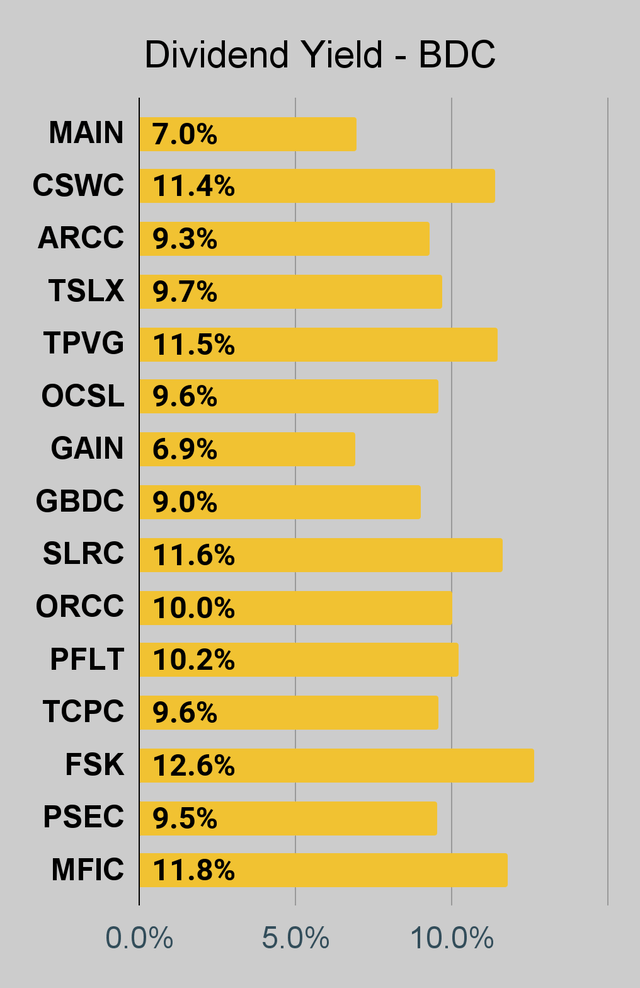

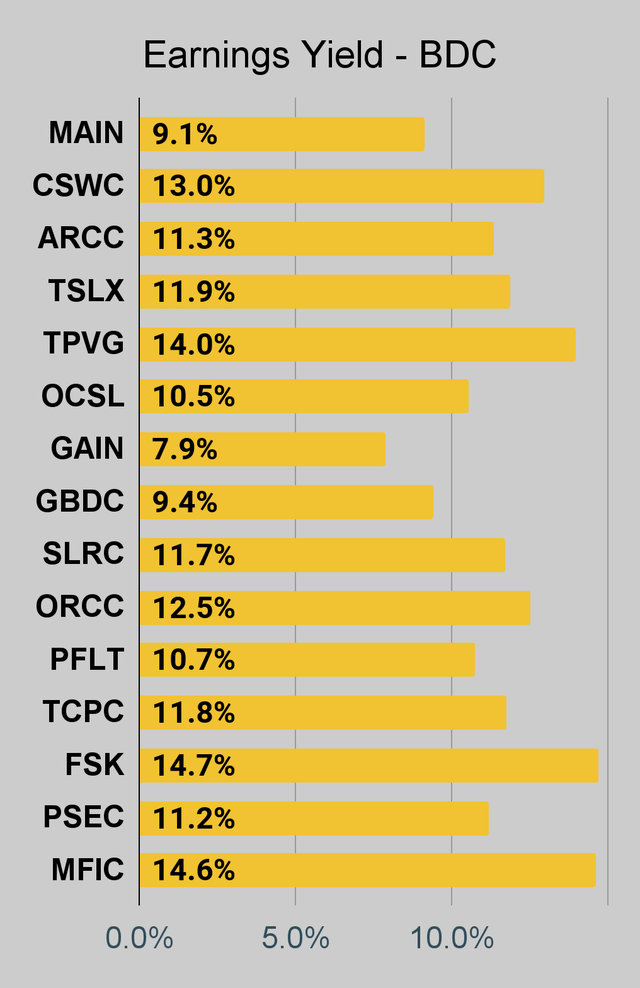

BDC Charts

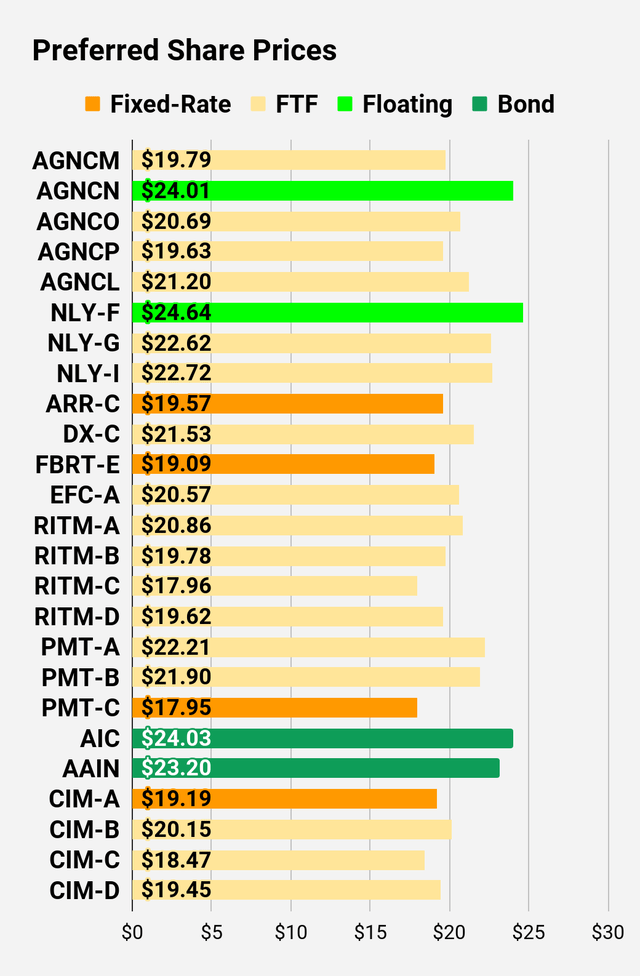

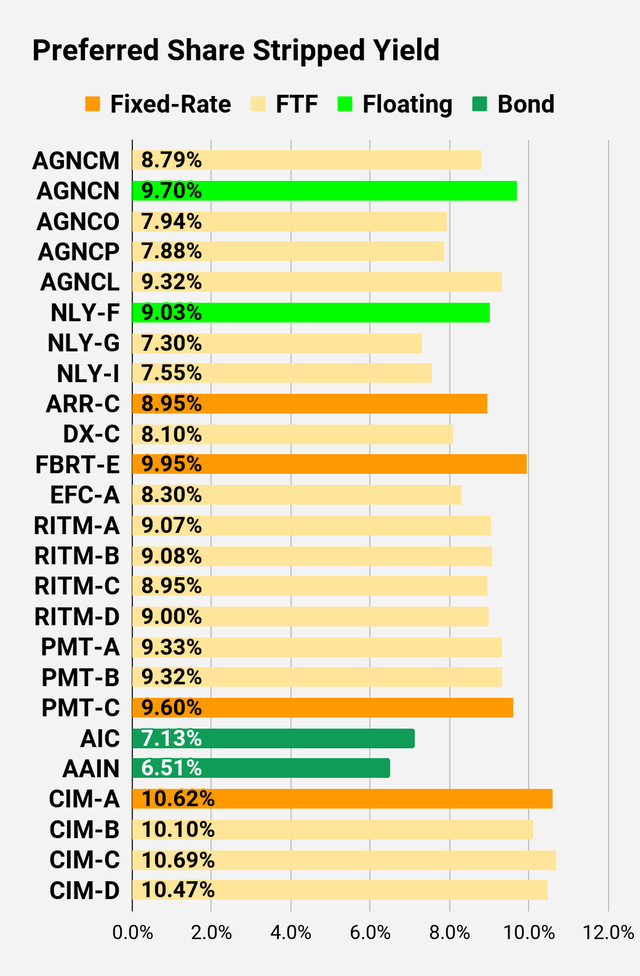

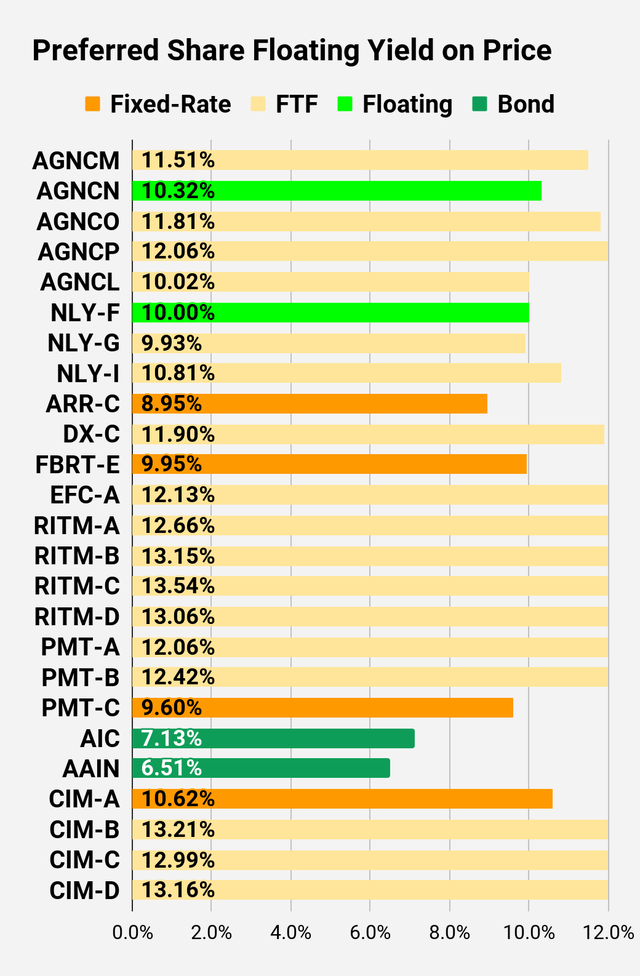

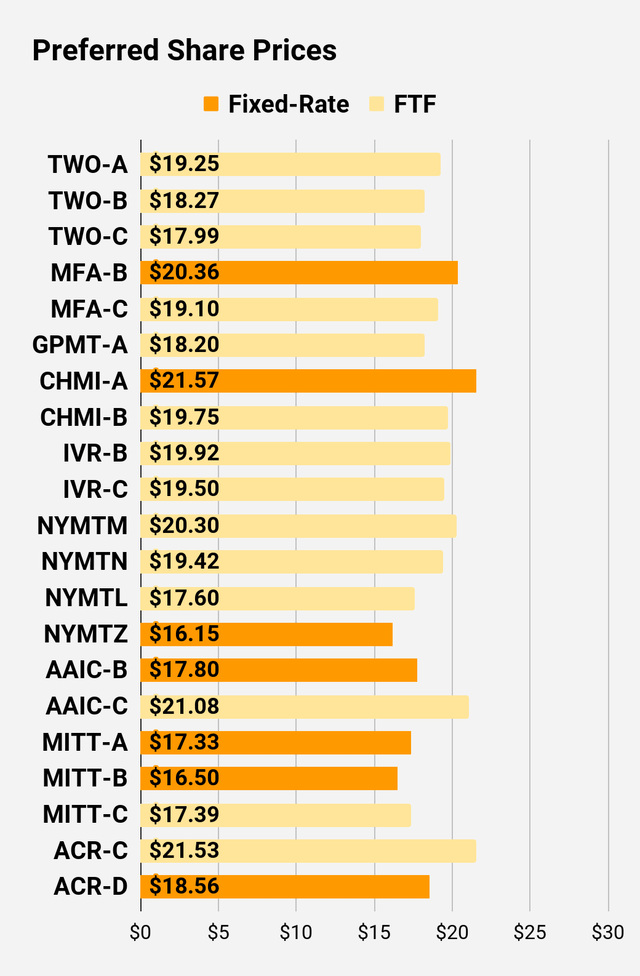

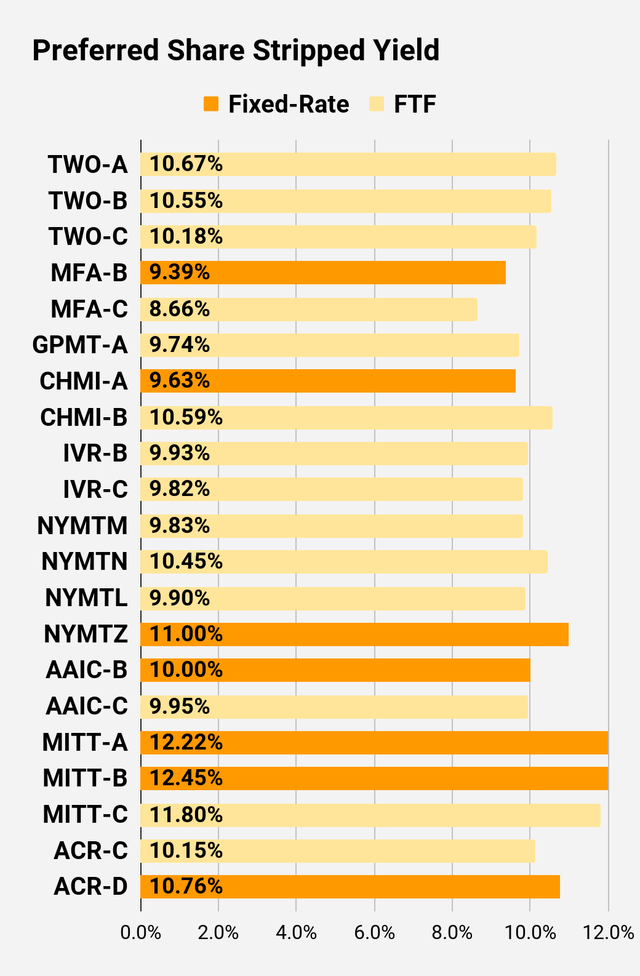

Preferred Share Charts

I changed the coloring a bit. We needed to adjust to include that the first fixed-to-floating shares have transitioned over to floating rates. When a share is already floating, the stripped yield may be different than the “Floating Yield on Price” due to changes in interest rates. For instance, NLY-F already has a floating rate. However, the rate is only reset once per three months. The stripped yield is calculated using the upcoming projected dividend payment and the “Floating Yield on Price” is based on where the dividend would be if the rate reset today. In my opinion, for these shares the “Floating Yield on Price” is clearly the more important metric.

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

Preferred Share Data

Beyond the charts, we’re also providing our readers with access to several other metrics for the preferred shares.

After testing out a series on preferred shares, we decided to try merging it into the series on common shares. After all, we are still talking about positions in mortgage REITs. We don’t have any desire to cover preferred shares without cumulative dividends, so any preferred shares you see in our column will have cumulative dividends. You can verify that by using Quantum Online. We’ve included the links in the table below.

To better organize the table, we needed to abbreviate column names as follows:

- Price = Recent Share Price – Shown in Charts

- BoF = Bond or FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield – Shown in Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield on Price – Shown in Charts

- NCD = Next Call Date (the soonest shares could be called)

- Note: For all FTF issues, the floating rate would start on NCD.

- WCC = Worst Cash to Call (lowest net cash return possible from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our goal is to maximize total returns. We achieve those most effectively by including “trading” strategies. We regularly trade positions in the mortgage REIT common shares and BDCs because:

- Prices are inefficient.

- Long term, share prices generally revolve around book value.

- Short term, price-to-book ratios can deviate materially.

- Book value isn’t the only step in analysis, but it is the cornerstone.

We also allocate to preferred shares and equity REITs. We encourage buy-and-hold investors to consider using more preferred shares and equity REITs.

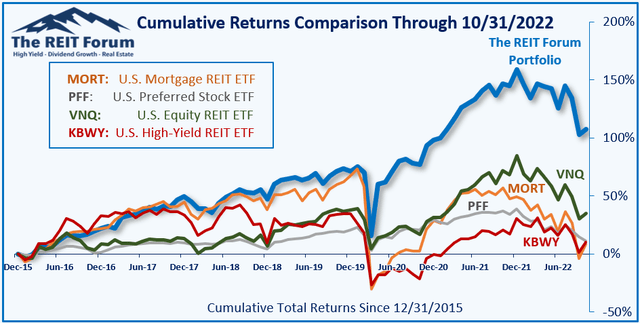

Performance

We compare our performance against four ETFs that investors might use for exposure to our sectors:

The REIT Forum

The four ETFs we use for comparison are:

|

Ticker |

Exposure |

|

One of the largest mortgage REIT ETFs |

|

|

One of the largest preferred share ETFs |

|

|

Largest equity REIT ETF |

|

|

The high-yield equity REIT ETF. Yes, it has been dreadful. |

When investors think it isn’t possible to earn solid returns in preferred shares or mortgage REITs, we politely disagree. The sector has plenty of opportunities, but investors still need to be wary of the risks. We can’t simply reach for yield and hope for the best. When it comes to common shares, we need to be even more vigilant to protect our principal by regularly watching prices and updating estimates for book value and price targets.

Ratings:

Bullish on preferred shares: NYMTL, PMT-C, ARR-C, FBRT-E

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment