Bedrin-Alexander

Welcome to the final edition of my monthly series of 10 Dividend Growth Stocks for 2022!

In this series, I rank a selection of Dividend Radar stocks and present the ten top-ranked stocks for further research and possible investment. Dividend Radar is a weekly automatically generated spreadsheet of dividend growth [DG] stocks with dividend increase streaks of five or more years.

To rank stocks, I use the scoring system of DVK Quality Snapshots, an elegant way to assess the quality of DG stocks. Developed by David Van Knapp, DVK Quality Snapshots employs five widely used quality indicators from independent sources and assigns up to five points per quality indicator for a maximum quality score of 25 points. This month, I used a variation of DVK Quality Snapshots in which I replaced Value Line’s Safety Rank with Value Line’s Price Stability Index.

I apply different screens every month to highlight different aspects of dividend growth investing. This month, I used a new Dividend Quality Grade developed by Portfolio Insight as the primary screen. Specifically, I screened for Dividend Contenders with A+ Dividend Quality Grades. Dividend Contenders are DG stocks with dividend increase streaks of 10-24 years.

I also screened for DG stocks trading at discounted valuations. Only stocks trading below my fair value estimates and risk-adjusted Buy Below prices and whose dividend yield is higher than its 5-year average dividend yield qualified. With these screens, this month’s picks offer great value!

Dividend Quality Grade

I’ve been working with Portfolio Insight to develop a Dividend Quality Grade for dividend stocks. The system evaluates all dividend-paying stocks and assesses the likelihood of a dividend increase in the next 12-month period. It also identifies stocks most at risk of freezing or cutting the dividend. In backtesting the system, we found it accurately predicted a failure to continue dividend increases in more than 98% of cases.

The Dividend Quality Grade is automatically determined from broker-grade data using the same technology platform that delivers Dividend Radar to the investment community every week. Our approach is entirely data-driven and eliminates assumptions or subjective biases about any of the underlying metrics.

The system analyzes 20 different metrics over a 10-year timeframe and establishes a quality range for each metric using data from DG stocks with dividend increase streaks of at least ten years (i.e. the Dividend Champions and Dividend Contenders). The analysis is done per GICS sector, and each stock then receives a score per metric based on where it falls in the corresponding quality range.

Individual metric scores are combined into component scores as follows:

- EPS Performance & Outlook

- Dividend Performance and Outlook

- Revenue Performance & Outlook

- Financial Performance

- Profitability Performance

The component scores are rolled into an overall score per ticker, then ranked based on where they fall by percentile. These rankings determine a stock’s Dividend Quality Grade from A+ to F.

For this article, I used a pre-release version of Dividend Quality Grades to extract Dividend Contenders with A+ (Exceptional) Dividend Quality Grades.

Screening and Ranking

The latest Dividend Radar (dated December 23, 2022) contains 722 stocks. Of these, 350 are Dividend Contenders with dividend increase streaks of 10-24 years. Only 48 Dividend Contenders have A+ Dividend Quality Grades, and only twelve of these stocks are trading at discounted valuations.

Here are this month’s screens:

- Dividend Contenders (Dividend Radar stocks with dividend increase streaks of 10-24 years)

- Stocks with Exceptional Dividend Quality Grades (A+ only)

- Stocks trading below my fair value estimates

- Stocks trading below my risk-adjusted Buy Below prices

- Stocks whose dividend yield is higher than its 5-year average dividend yield.

See below for a description of my fair value estimates and risk-adjusted Buy Below prices.

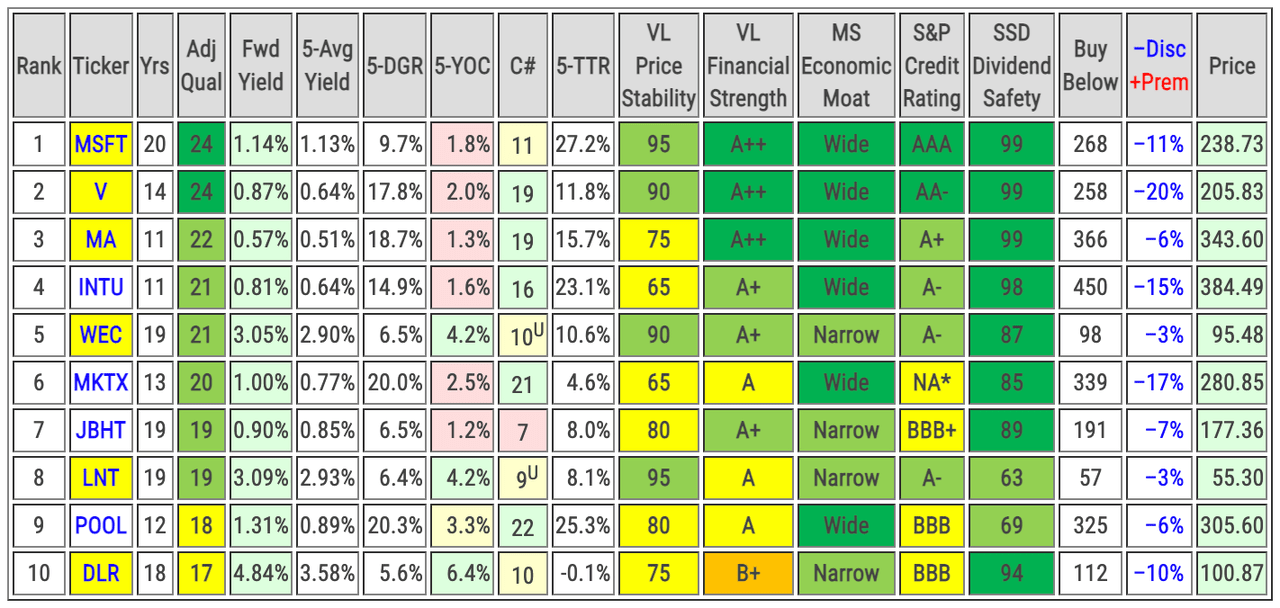

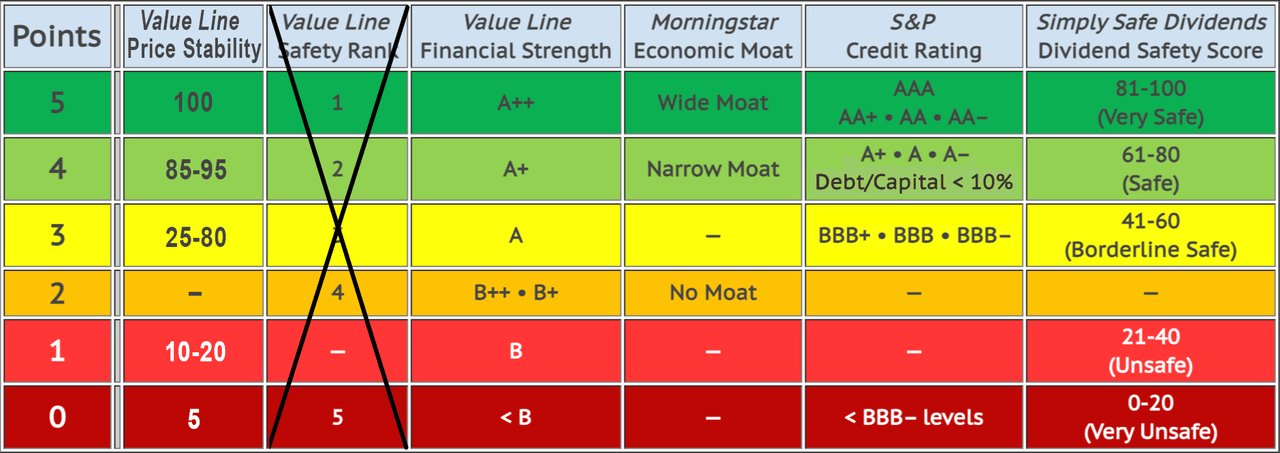

I ranked the twelve candidates that pass all my screens using a variation of DVK Quality Snapshots in which I substituted Value Line’s Price Stability for Value Line’s Safety Rank:

Value Line’s Price Stability is based on a ranking of the standard deviation (a measure of volatility) of weekly percent changes in the price of a company’s stock over the last five years. It is reported on a scale of 100 (highest) to 5 (lowest) in increments of 5.

Generally, DVK Quality Snapshots assigns 5 points to the highest ranks and best ratings so that the highest quality stocks would get 5 points per quality indicator for a maximum score of 25 points.

I assigned scores for Price Stability to somewhat match the distribution of scores for Safety Rank, but I elected to penalize the lowest ranks by shifting them down one row in the scoring table.

The 10 Dividend Growth Stocks for December

Here are this month’s ten top-ranked DG stocks in rank order:

The six stocks I own in my DivGro portfolio are highlighted.

| Rank | Company (Ticker) | Sector | Supersector |

| 1 | Microsoft (MSFT) | Information Technology | Sensitive |

| 2 | Visa (V) | Information Technology | Sensitive |

| 3 | Mastercard (MA) | Information Technology | Sensitive |

| 4 | Intuit (INTU) | Information Technology | Sensitive |

| 5 | WEC Energy (WEC) | Utilities | Defensive |

| 6 | MarketAxess (MKTX) | Financials | Cyclical |

| 7 | J.B. Hunt Transport Services (JBHT) | Industrials | Sensitive |

| 8 | Alliant Energy (LNT) | Utilities | Defensive |

| 9 | Pool (POOL) | Consumer Discretionary | Cyclical |

| 10 | Digital Realty (DLR) | Real Estate | Cyclical |

The following company descriptions are my summary of company descriptions sourced from Finviz.

1. Microsoft

Founded in 1975 and based in Redmond, Washington, MSFT is a technology company with worldwide operations. The company’s products include operating systems, cross-device productivity applications, server applications, productivity and business solutions applications, software development tools, video games, and online advertising. MSFT also designs, manufactures, and sells several hardware devices.

2. Visa

Headquartered in San Francisco, California, V operates as a payments technology company worldwide. The company facilitates commerce by transferring value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. V provides its services under the Visa, Visa Electron, Interlink, V PAY, and PLUS brands.

3. Mastercard

MA, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers payment solutions and services under the MasterCard, Maestro, and Cirrus brands. MA was founded in 1966 and is headquartered in Purchase, New York.

4. Intuit

INTU provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in three segments: Small Business & Self-Employed, Consumer, and Strategic Partner. INTU was founded in 1983 and is headquartered in Mountain View, California.

5. WEC Energy

Founded in 1981 and based in Milwaukee, Wisconsin, WEC provides regulated natural gas and electricity; and renewable and nonregulated renewable energy services in the United States. The company operates in six segments: Wisconsin, Illinois, Other States, Electric Transmission, Non-Utility Energy Infrastructure, and Corporate and Other. WEC generates and distributes electricity from coal, natural gas, oil, hydroelectric, wind, solar, and biomass sources.

6. MarketAxess

MKTX, together with its subsidiaries, operates an electronic trading platform that enables fixed-income market participants to trade corporate bonds and other types of fixed-income instruments, offering institutional investor and broker-dealer firms access to global liquidity. MKTX was founded in 2000 and is headquartered in New York, New York.

7. J.B. Hunt Transport Services

JBHT, together with its subsidiaries, provides surface transportation and delivery services in the continental United States, Canada, and Mexico. It operates through four segments: Intermodal, Dedicated Contract Services, Integrated Capacity Solutions, and Truckload. The company also transports or arranges for the transportation of freight. JBHT was founded in 1961 and is headquartered in Lowell, Arkansas.

8. Alliant Energy

LNT operates as a regulated investor-owned public utility holding company. LNT provides electricity and natural gas services to customers in the U.S. Midwest through two subsidiaries, Interstate Power and Light Company and Wisconsin Power and Light Company. LNT was founded in 1917 and is headquartered in Madison, Wisconsin.

9. Pool

Founded in 1993 and headquartered in Covington, Louisiana, POOL distributes swimming pool supplies, equipment, and related leisure products in North America and internationally. POOL offers maintenance products, repair and replacement parts for pool equipment, packaged pool kits, pool equipment and components for new pool construction and the remodeling of existing pools, and irrigation and landscape products.

10. Digital Realty

DLR is a real estate investment trust that owns, acquires, develops, and operates data centers. The company provides data center and colocations solutions to domestic and international tenants, including companies providing financial and information technology services. The company was founded in 2004 and is headquartered in San Francisco.

Please note that the top ten DG stocks are candidates for further analysis, not recommendations.

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates:

|

|

Color-coding

|

Created by the author from a personal spreadsheet

I use a survey approach to estimate fair value [FV], collecting fair value estimates and price targets from several online sources such as Morningstar, Finbox, and Portfolio Insight. Additionally, I estimate fair value using each stock’s five-year average dividend yield. With up to 11 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

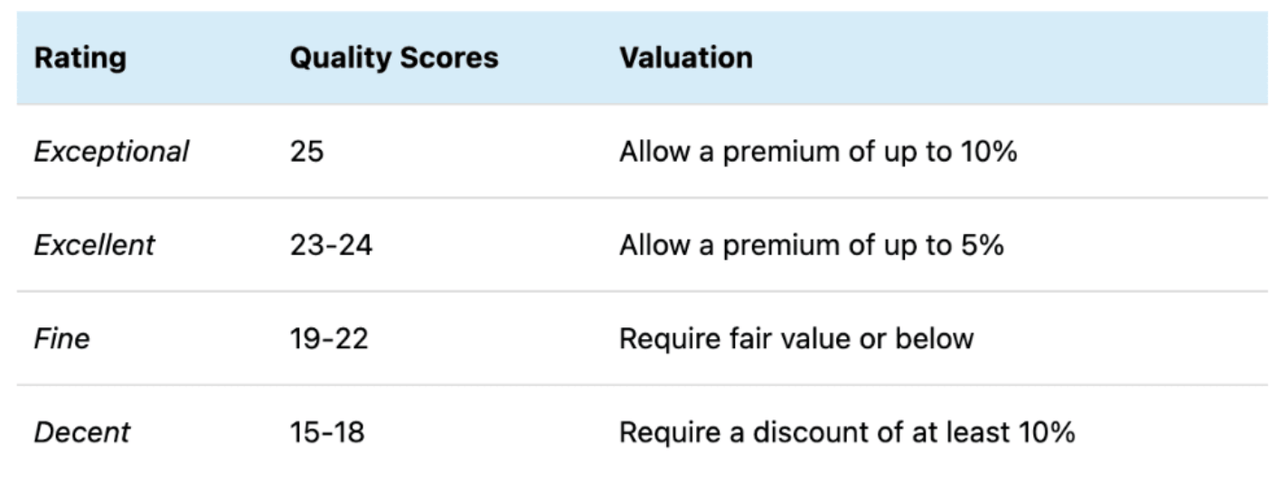

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

Created by the author

My Buy Below prices recognize that the highest-quality stocks rarely trade at discounted valuations. As a dividend growth investor with a long-term investment horizon, I’m more interested in owning quality stocks than getting a bargain on lower-quality stocks.

Commentary

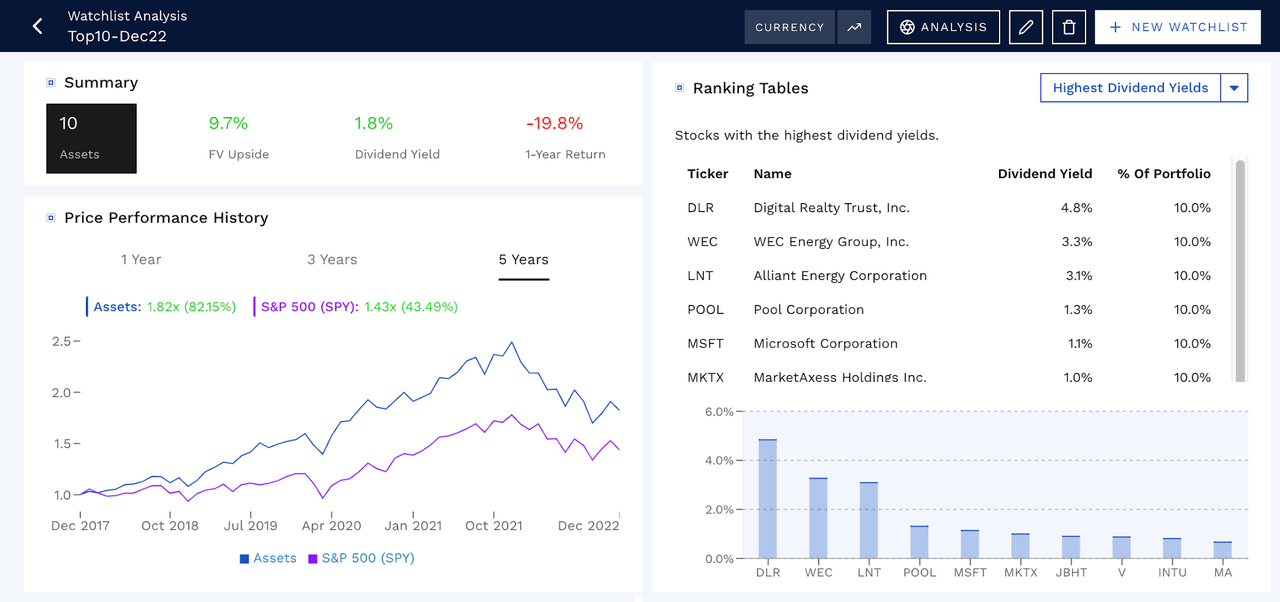

Here’s a comparative analysis of an equal-weighted portfolio of this month’s top ten DG stocks, courtesy of Finbox.com:

Finbox.com

From a price-performance perspective, the portfolio would have outperformed the S&P 500 (as represented by the SPDR S&P 500 Trust ETF (SPY)) over the last five years, returning 82% versus SPY’s 43%.

The stocks offer a wide variety of yields, with DLR the highest at 4.84% to MA the lowest at 0.57%.

DLR, WEC, and LNT are suitable for income-oriented investors.

POOL (20.3%) and MKTX (20.0%) have the highest 5-year dividend growth rates and are strong candidates for growth-oriented investors. Other candidates with double-digit 5-DGRs are MA, V, and INTU.

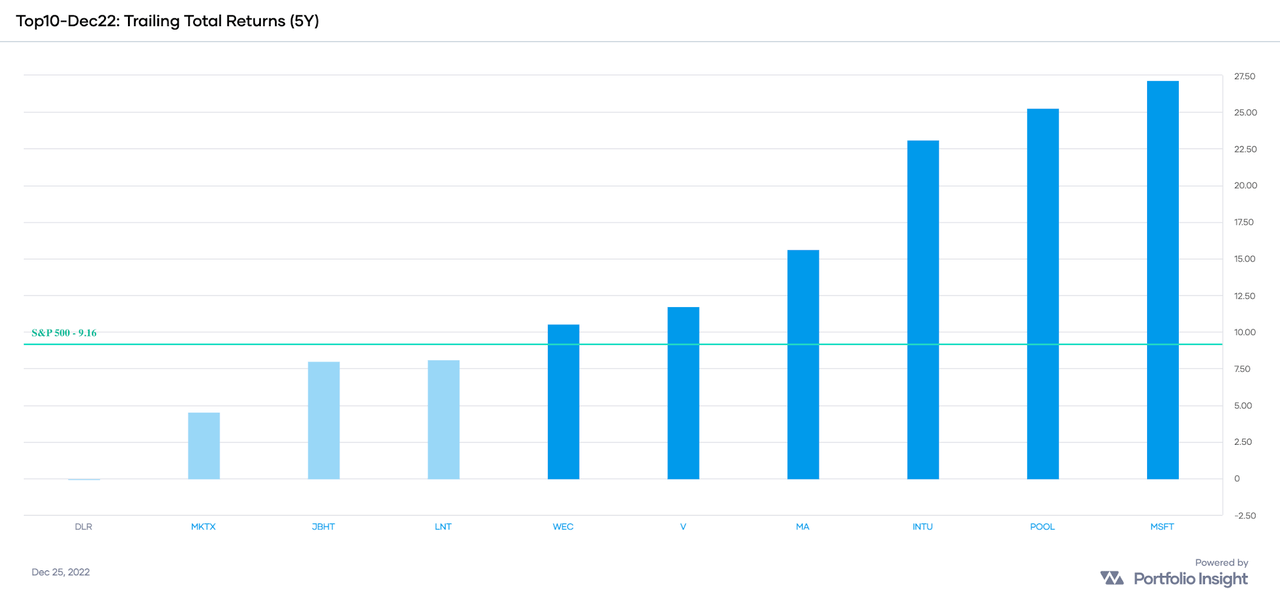

MSFT, POOL, and INTU have the highest 5-year TTRs and, along with MA, V, and WEC, are the stocks in this month’s list that have outperformed SPY over the trailing 5-year period:

Portfolio Insight

As for valuations, V (-20%) and MKTX (-17%) are discounted most relative to my Buy Below prices and are strong candidates for value investors.

None of the stocks I don’t own interest me, mainly because they have low yields. For younger investors with a long time horizon, INTU and POOL could be interesting candidates, though I’d consider MSFT first due to its superior quality score.

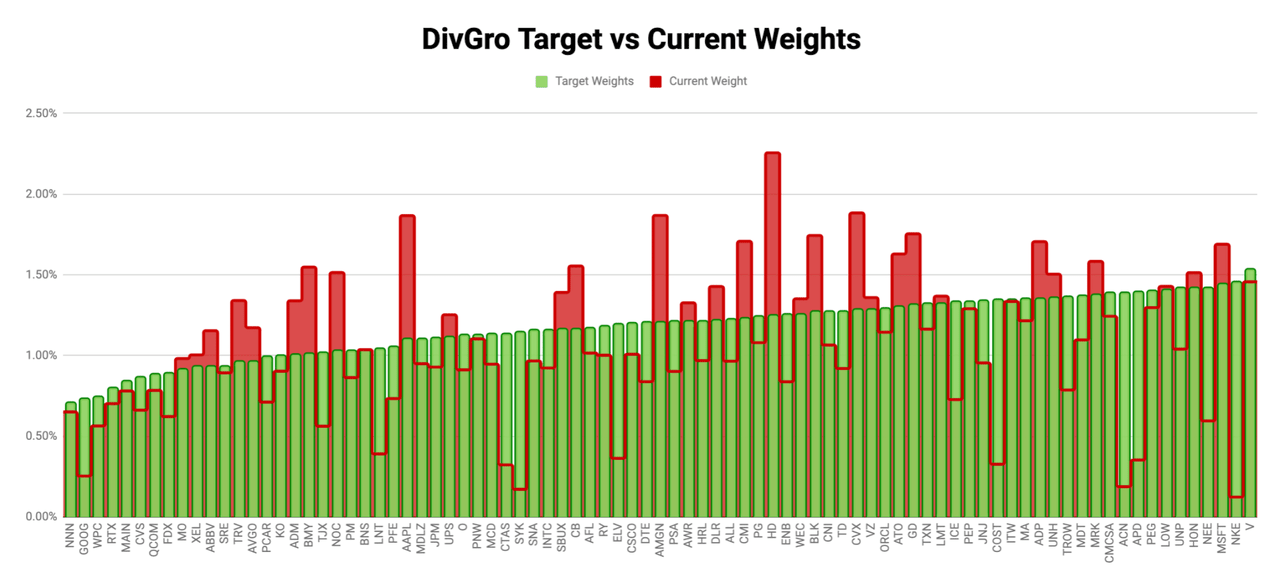

I use a dynamic and flexible system to determine target weights for my DivGro portfolio. Here is a chart showing the current and target weights of dividend-paying stocks in DivGro:

Created by the Author

Of this month’s candidate stocks in my portfolio, only LNT (recently added) is well below my target weight. Based on the current price, I’d need to add 165 shares to match my target weight. V and MA are slightly underweight, and I’d need to buy 5 shares of each stock to match my target weights.

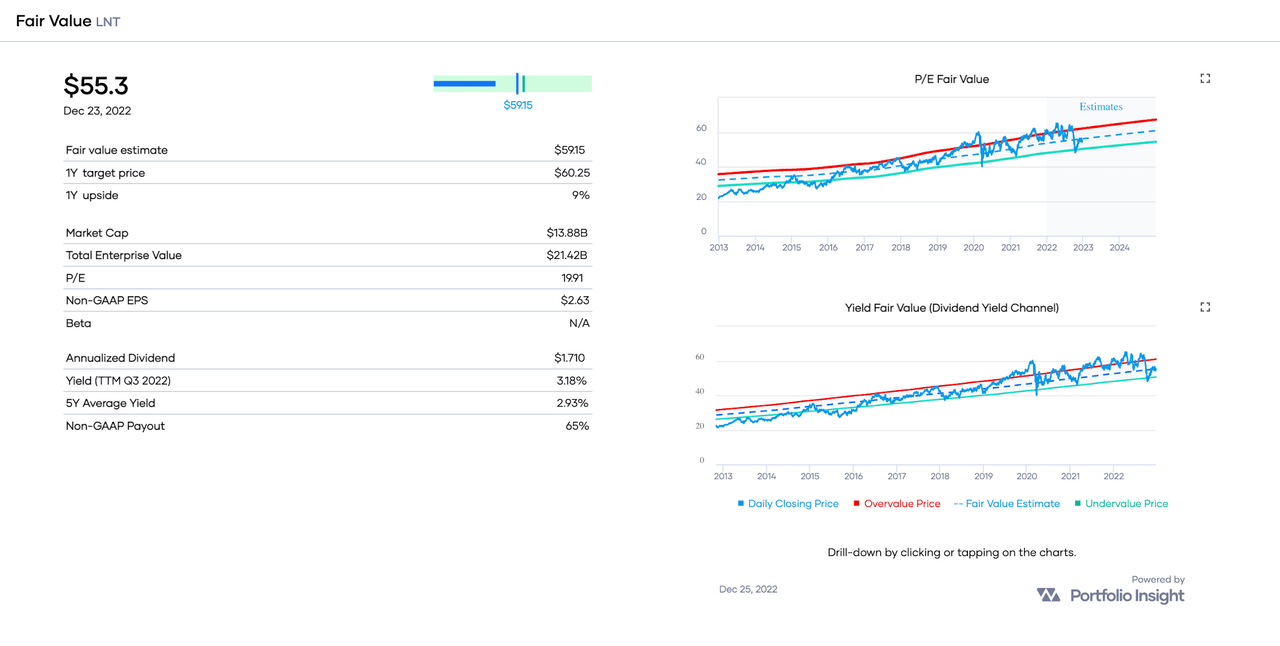

Portfolio Insight

According to Portfolio Insight, LNT has a 1-year upside of 9%.

With a Non-GAAP payout ratio of 65%, which is low for Utilities, LNT has plenty of room to continue paying and raising its dividend. LNT’s dividend is deemed Safe with a Dividend Safety Score of 63, according to Simply Safe Dividends.

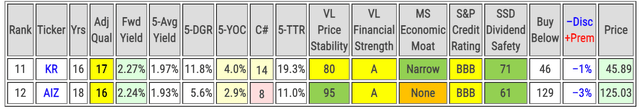

Bonus Section

I mentioned that only twelve stocks passed all my screens this month. Here are the two stocks that ranked lowest based on their quality scores:

Created by the author from a personal spreadsheet

| Rank | Company (Ticker) | Sector | Supersector |

| 11 | Kroger (KR) | Consumer Staples | Defensive |

| 12 | Assurant (AIZ) | Financials | Cyclical |

Concluding Remarks

In this article, I ranked a selection of Dividend Radar stocks using a variation of DVK Quality Snapshots. This month, I used Value Line’s Price Stability instead of Value Line’s Safety Rank. I introduced Portfolio Insight’s Dividend Quality Grade and screened the Dividend Contenders for stocks with Exceptional (A+) Dividend Quality Grades. I used additional screens to find DG stocks trading at discounted valuations.

As always, I encourage readers to do their due diligence before buying any stocks I cover.

Thanks for reading, and I wish all my readers a festive holiday season and a very happy and prosperous new year!

Be the first to comment