AUDINDesign/iStock via Getty Images

Investment Thesis

In my last article on the Global X Nasdaq 100 Covered Call & Growth ETF (NASDAQ:QYLG), I discussed how this ETF was an excellent way for investors to gain exposure to the power of long-term compounding while earning a greater dividend yield than on the index. While my view on this ETF hasn’t changed, I believe the macro outlook is now more bearish for US equities than 7 months ago. Despite great corporate earnings and record-high margins, valuations remain high at a turning point in monetary policy. Personally, I feel that inflation is stickier than expected and will have a negative influence on margins and earnings.

How Well Did QYLG Perform Since My Last Article

As a reminder, QYLG implements a covered call strategy, where the Fund acquires Nasdaq-100 Index stocks and sells call options on roughly half of the portfolio. You can read more about how the covered call strategy works here.

As a result of this strategy, QYLG enables half of the portfolio to grow over time, while the other half is being used to produce periodic cash dividends. In my last article on QYLG, I concluded that this strategy was superior to the NASDAQ 100 Covered Call ETF (QYLD) which writes calls on 100% of the portfolio. Given the recent pullback, I think it is interesting to review the investment thesis.

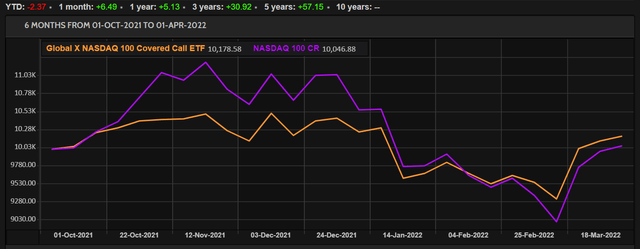

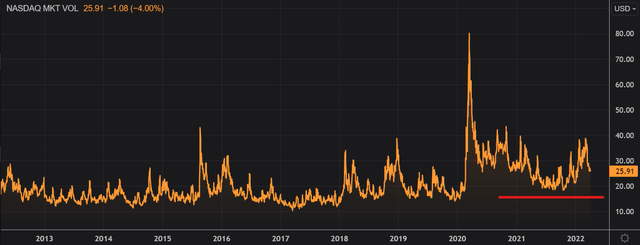

I have compared below QYLG’s price performance against the Invesco QQQ ETF (NYSEARCA:QQQ), which tracks the NASDAQ 100 index, and QYLD over the last 7 months to assess which one was a better investment. Over that period and excluding dividends, QQQ outperformed both QYLD and QYLG. It is interesting to note that both covered calls strategies delivered very similar price returns, with QYLD (purple line) slightly outperforming QYLG (yellow line). Most of the outperformance was realized during the decline in the NASDAQ 100 that started in late 2021 when QYLD showed to be more resilient.

However, if we account for the reinvested dividends, it is interesting to see that QYLG actually outperformed the NASDAQ 100, which shows the power of compounding. If you would have invested $10,000 into QYLG back in late September 2021 and reinvested the monthly dividends, you would now be pretty much flat.

At the same time, we can see that buying and reinvesting dividends in QYLD was a better strategy over the last 6 months and outperformed QYLG by ~0.6%. In my opinion, this shows that QYLD is a better choice during a market downturn given the fact that it sells covered calls on the entire portfolio, and the premium earned on the calls compensates in a small proportion for the negative performance of the stocks. However, I still believe that over the long term, QYLG will outperform QYLD.

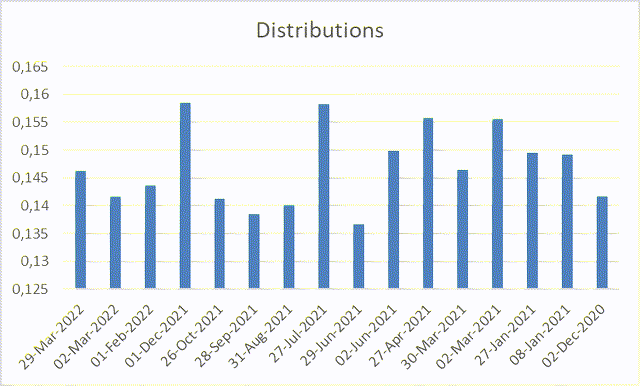

If we take a look at dividends, it is interesting to note that they were pretty stable since inception. The average monthly dividend payment is $0.147 per share, which translates into a $1.8 payment per share per year. At the current price of $29.6 per share, this means that QYLG has a ~6% gross dividend yield.

In my previous article on QYLG, there were a number of questions on whether this investment is tax-efficient or not. While I’m no tax expert, it is definitely an important factor that you should take into consideration if you live in a country with a high dividend tax rate. In this particular case, I believe that investing in QYLG could turn out to be less rewarding as a large chunk of the income from dividends will go towards the government.

Another important aspect of this particular investment is the relationship between the implied volatility on the NASDAQ 100 and the dividend amount. As we can see below, some of the worst months in terms of the dividend amount were in mid-2021, when implied volatility was relatively low compared to the previous 12 months. As volatility started to pick up in the second half of 2021, we can notice an increase in dividends during that period. Implied volatility is now higher than pre-COVID-19 and I believe it will likely remain elevated in the coming months, which is a positive factor for QYLG shareholders.

Market Outlook

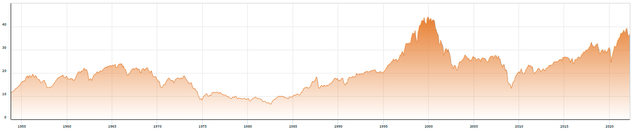

I believe understanding the macro picture is key before investing in QYLG. If we look at US equities, we are still near a record high cyclically adjusted price-to-earnings ratio, which I believe adds some risk to the bullish thesis.

S&P 500 Shiller PE Ratio – NASDAQ

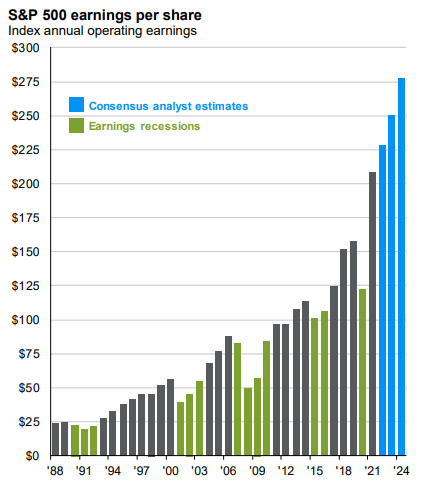

At the same time, future earnings expectations have never been that high as analysts are very bullish and they aren’t forecasting any pullback in profits over the next 3 years. I personally believe there is a lot of uncertainty in the market at the moment given the war in Ukraine and the high level of inflation which makes forecasting future profits quite difficult.

JPM Q2 2022 Guide to the Markets

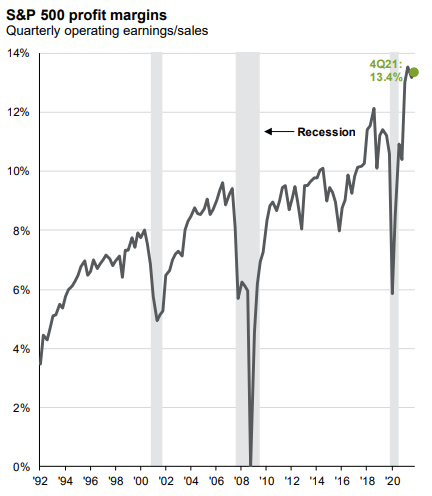

At the same time, US equities have posted record profit margins. Profit margins tripled in the last 30 years on the back of low inflation and low-interest rates. As we now have higher inflation and we are entering a hiking cycle, I personally believe margins will decrease over the next month, putting pressure on earnings.

JPM Q2 2022 Guide to the Markets

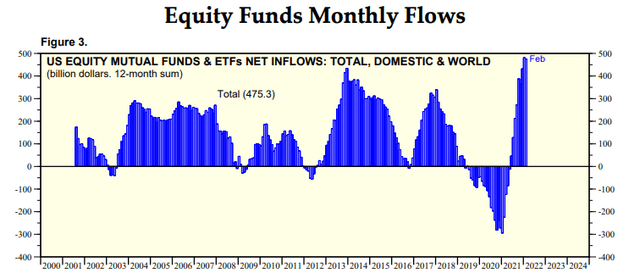

However, investors remain optimistic about the future of US equities. If we look at the net inflows into U.S. equity mutual funds and ETFs, it has reached a record high in February 2022. The best opportunities are generally available when no one wants to invest and when outflows dominate inflows.

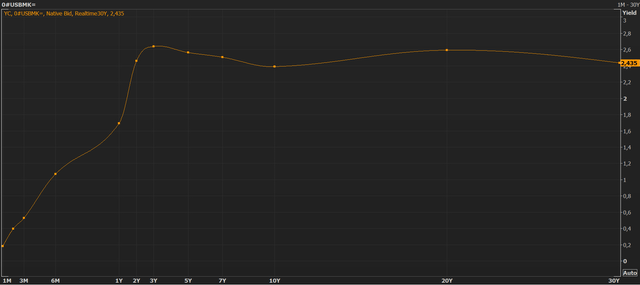

Another red flag can be found in the credit market where the yield curve has inverted recently. When long-term interest rates fall below short-term interest rates, investors expect short-term rates to fall in the future, often as a result of poor economic performance. Such an inversion has been a pretty accurate recession signal.

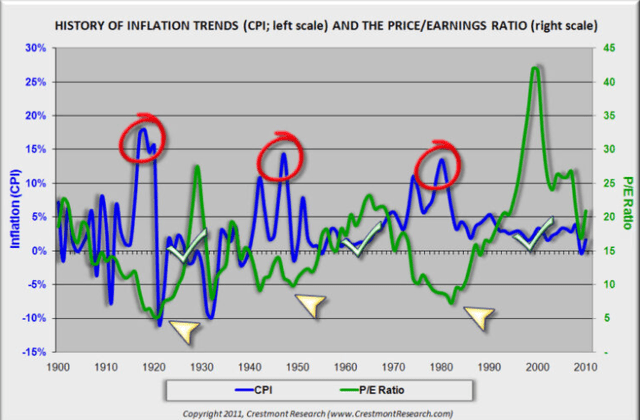

Lastly, inflation is likely to do more damage than it is expected to valuations across the board. Inflation has historically been negatively correlated to PE ratios. In other words, when the CPI is hot, PE multiples tend to suffer and vice versa.

Key Takeaways

QYLG employs a covered call strategy, which entails acquiring Nasdaq-100 Index stocks and selling call options on around half of the portfolio’s value. This technique has delivered a steady stream of dividends to shareholders since inception and benefitted from the higher post-COVID-19 volatility. That said, there are a number of red flags in the macro outlook that would make me think twice before buying QYLG. Valuations are still high despite excellent corporate earnings and record-high margins. I personally believe that inflation is likely to negatively impact margins going forward and as a result, it will put pressure on profits and ultimately on valuations. In my opinion, the historical negative correlation between inflation and PE ratios will prove once to be accurate, which is bearish for QYLG.

Be the first to comment